Introduction

Background of the study

Mergers and acquisitions (M&A) have been considered very instrumental factors as far as the shape of business activities in any economy is concerned. The mergers and acquisition phenomenon has been rampant in the United States of America but is now common in most parts of the world (Jean-Claude & Siham 2013).

For example, there have been cases of mergers and acquisition in the European market that has characterized lack of activity across the borders of Europe and domestically following the effect of the recession experienced between 1980 and 1981 that led to the passage of the deregulation law within the financial services sector, as well as the availability of new markets and financial instruments.

Consequently, the effects of this recession and the development of markets that initially did not exist catalyzed a merger wave in Europe. Several studies have been conducted that focus on the emergence of mergers and acquisitions in the world and have shown that all continents have fallen victim of this phenomenon (Chuang 2014). The increased rate of mergers and acquisition is attributable greatly to the technological changes witnessed all over the world (Deshpande, Svetina & Zhu 2012).

Also, mergers and acquisitions are becoming more complex due to the introduction of deregulation laws and the acceleration of the innovation process within the financial sector (Dutta, Saadi & Zhu 2013). On the other hand, there is a growing demand to ensure that shareholders have value in their respective firms, and this significantly influences mergers and acquisition. According to a study carried out by Conn, Cosh and Hughes (2005), the primary objective of mergers and acquisitions is to create shareholder value. Nevertheless, according to past trends, it is more likely that most mergers and acquisitions occur within national borders.

The decision to enter into a merger or even be engaged in an acquisition is very important as far as the performance and success of firms are concerned (Fu, Lin & Officer 2013). Mergers and acquisitions have been used by corporations as a gateway to the expansion of ownership boundaries, while in other cases, corporations enjoy more benefits through the separation of public ownership whereby different business segments are involved (Kiliç 2011; Kohli & Mann 2012).

Theoretically, it is considered that mergers and acquisition lead to the creation of synergies, cutting of costs, expansion of operations, as well as a considerable gain of economies of scale (Jo, Byun & Lee 2011). Also, most investors consider M&A as a pathway to more market power. According to proponents of mergers and acquisitions, firms can enjoy high revenue in comparison to the price premiums they incur (Cartwright & Schoenberg 2006).

Despite this, there are cases whereby mergers and acquisitions have adverse effects, especially whereby there are flaws and associated inefficiencies. Although numerous studies have been conducted to ascertain the returns following a merger, mixed result exists with some scholars and researchers asserting that acquisition is associated with abnormal returns. The lack of consensus, in this case, is an indication that there is a need for more research to shed light on the effects of mergers and acquisition as far as the performance of corporations is concerned.

Mergers and acquisition have significant effects on the performance of the structure and general operations of the affected firms (Amernic & Craig 2006). Over the years, there has been a considerable evolution of the existing literature on M&A, which has led to the proposition of a few theories to explain the concept of mergers and association.

Nevertheless, most of the existing literature, as well as the understanding of the effects of mergers and acquisition, is aligned to scenarios in developed markets like in the case of Canada, United Kingdom and the United States (Eckbo & Thorburn 2009; Bhagat, Malhotra & Zhu 2011). For a long time, the effects of mergers and acquisition in the case of emerging markets have been neglected until lately.

For example, there have been a lot of concerns to understand the degree of impact of mergers and acquisitions in developing economies such as China following the realization that emerging markets have an enormous contribution to the economy of the world (Lau, Proimos & Wright 2008). In recent years, China has witnessed a growth in the number of listed companies. Nevertheless, the corporate control market is growing at a slow rate (Callahan, Gabriel & Smith 2008). Mergers and acquisitions activity in China was commenced in 1993 following the China Bao’an (SZ)-Shanghai Yan Zhong Industrial (SH) deal.

This study seeks to provide in-depth details on the effects of mergers and acquisition on the shareholders’ wealth and the performance of corporations through a case study of Chinese listed firms between 2003 and 2013.

Statement of the problem

Over the past decades, China has experienced a high number of mergers and acquisition despite the state of corporate control in the country. For example, China recorded a 20% growth rate in mergers and acquisition in 2008, with trends showing potential for more growth in recent years (Muehlfeld, Weitzel & van Witteloostuijn 2011). Developments in China have shown that the country has a high potential for growth to the extent of becoming a world leader in the future (Lübbers 2008).

If such potentials are realized, the capital markets will have a significant influence on corporate control activities as well as in the world economy. Nowadays, the global marketplace is dominated by Chinese enterprises, implying that the effects of Chinese mergers and acquisitions are felt globally. Also, state-owned enterprises are dominant in China as opposed in the cases of developed countries (Leeth & Rody 2004). For this reason, it is more likely that the operations of state-owned enterprises are tied closely to the government’s economic policies, which adversely affects the growth of mergers and acquisition in the country.

The government of China has set up platforms that facilitate outbound and inbound acquisitions leading to the maximization of the scale of operations by state-owned enterprises, as well as an improvement in the performance of management and allocation of resources (Lin, Wang & Chen 2009). Such a platform opens ways for more mergers and acquisition in the future. On the other hand, the mergers and acquisitions market in China is domestic even though there are high numbers of transactions occurring across the borders (Louis 2004).

In most of these cases, state-owned enterprises act as the acquirers with their target being on private firms. For this reason, there is an increased level of government’s control within the capital market in China (Okafor, Ofoegbu & Ohwovoriole 2011). Therefore, there is need for detailed research as far as the corporate control market of China is concerned for providing more insights on whether or not mergers and acquisitions affect shareholders’ wealth and the performance of corporations.

Objectives of the study

The primary objective of this study is entire to find out the effects of mergers and acquisitions on the shareholders’ wealth and the performance of corporations. However, the study also has various specific objectives including:

- To find out whether mergers and acquisitions are likely to lead to value creation for shareholders of the affected firms.

- To find out the factors, which influence the wealth of shareholders as well as the performance of the acquirer in the case of an acquisition.

- To find out the comparison between mergers and acquisition in developing and developed countries.

Research questions

The use of research questions in any study has been considered to be an appropriate approach through which researchers can effectively cover the phenomenon under study because they act as guidelines. In the case of the current study, several research questions are used to ensure that all necessary areas are covered as far as the concept of mergers and acquisition in Chinese listed companies is concerned. Therefore, the study has the following research questions:

- Is there a significant relationship between mergers and acquisitions and the creation of value for shareholders of the affected firms?

- What are some of the factors which influence the wealth of shareholders as well as the performance of the acquirer in the case of an acquisition?

- How do mergers and acquisitions compare in developing and developed countries?

Dissertation outline

Having provided the background of the study on the effect of shareholders’ wealth and the performance of corporations following mergers and acquisitions, statement of the problem, research objectives and research questions, the rest of the paper is divided into various sections. The next chapter, literature review provides an in-depth analysis of the study phenomenon for a chance to provide more details on the impacts of mergers and acquisitions on the shareholders’ wealth and performance of affected corporations. This is achieved through an investigation of related literature.

Chapter three provides the research design and methodology adopted for the study. This section provides the various techniques used to collect and analyze data on mergers and acquisitions in Chinese listed companies, and sampling methods used to arrive at the sample size adopted. Also, this section provides information on the market performance of acquiring firms (shareholder wealth effect), as well as the measures of operating performance (long-term corporation performance, 3 years after a merger and acquisition has occurred).

Chapter four provides the results and findings from the study, while chapter five offers a summary of the entire study, discussion of findings, as well as conclusions.

Literature review

Theories on Mergers and Acquisitions

Numerous studies on mergers and acquisitions have been conducted in most of the world’s developed markets. According to the findings of these studies, mergers and acquisitions are used to catalyze the restructuring and integration of industries within a given market.

For this reason, such activities are instrumental in championing for changes in the performance of firms within a given market. M&As are very important in any market; a factor that has increased the interests of researchers to explore deeply the subject of corporate finance from various perspectives. As such, researchers have been more fascinated by empirical studies as well as theoretical models in corporate finance.

Several theories try to offer an in-depth explanation of the concept of mergers and acquisitions (Powell & Stark 2005). However, these theories are divided into either value-maximization theories or the non-value maximization category.

In the case of the value-maximization, the theories explain the motives of mergers and acquisitions strategy that is similar to investment decisions whereby investors expect an increase in the cash flows of their investments in the future (Rahman & Lambkin 2015). On the other hand, the non-value maximization category comprises of theories that consider the interest of the managers of an acquiring firm, whereby the self-interests of the managers affect the acquisition decisions.

Generally, theories about mergers and acquisitions have shown that there is more benefit to the acquired firms than to the acquiring firms as far as the returns of the shareholders are concerned (Ryu 2010). According to the synergy motive, the occurrence of any takeover is based on the benefit of combined value since the combining resources for two companies are better when compared to the resources of a single firm.

Theoretically, firms engage in mergers and acquisitions to gain a larger market value (Seo 2008). Various explanations have been given regarding the benefits of mergers and acquisitions as portrayed by the synergy motive of M&As. These explanations include the collusive synergy, the financial synergy and the operational synergy.

According to the agency theory, because managers under non-value maximization category focus on their self-interests, it is more likely that the decisions they make are aimed using the resources of the concerned firm at the expense of the shareholders (Sharma & Raat 2016; Walker 2006). As such, they end up destroying the value of shareholders instead of creating it.

However, based on the agency motivation, a corporate control hypothesis has been postulated that suggests that it is possible for managers under the control of any firm in which they have not invested any wealth to come up with resolutions aimed at the maximization of shareholders’ market value (Wan & Wong 2009). This is attributable to the fact that decisions by managers who are shareholders in a given firm can be diverted by self-interests as opposed to sticking to the existing shareholders’ interests.

Another theory on mergers and acquisition is the free cash flow theory that was postulated by Jensen in 1986 and emphasizes on the ability of mergers and acquisitions to destroy the value of shareholders as opposed to its maximization. The rationale of this theory’s argument is that there is a high possibility of managers who have large cash flow that is free to participate in projects that are not profitable to the firm in the long-run.

For this reason, mergers and acquisitions activities involving such firms are likely to lead to low or negative returns to the affected firms (Moeller & Schlingemann 2004). According to the hubris hypothesis, the combined returns for merged firms is always zero or insignificant. As such, it important for firms to be careful when evaluating target firms for takeovers to avoid making mistakes that would lead to zero returns in the long run. If such cases occur, the shareholders of the acquiring companies experience negative gains which offset the positive gains of the acquired firms.

It can be seen that the hubris hypotheses offers a credible background to explain the non-positive returns by mergers and acquisitions. First, the hypothesis postulates that it is likely for managers to overestimate a target firm’s market value presently if they are driven by the urge to provide much to the target firm. On the other hand, the hypothesis’ implication is that the wrong decisions by managers of acquiring firms lead to zero returns for the merged firms (Moeller, Schlingemann & Stulz 2005).

Thus, basing the argument on the provisions of this hypothesis, it suffices that mergers and acquisitions only lead to the transfer of value to a target firm from a bidder in cases where such M&A are misguided. Such a scenario implies that acquiring firms get lower returns in a situation whereby the projected gain for the target firm is high.

An overview of the evidence on the worldwide mergers and acquisitions cases

Most of the existing literature about the performance of mergers and acquisitions in terms of finances emphasizes on the percentage of returns that firms get within the merger announcement period (Mulherin & Boone 2009). Moreover, most of the studies that have been carried out focus on developed markets such as the U.K and U.S. Globalization has had a lot of impact on the operations of corporations. This is attributable to the fact that globalization is considered to be a process that cannot be avoided as it entails integrating global cultural, political and economic systems (Powell & Stark 2005).

For this reason, globalization has been considered to have an enormous effect on the emergence of mergers and acquisitions, especially in cross border scenarios. On the other hand, the occurrence of mergers and acquisitions can be described as globalization’s attributes and consequences, which have reverse reinforcement effect (Schwert 2006). For more than thirty years, the popularity of mergers and acquisitions has increased in the aspects of corporate development. For example, more than thirty thousand complete acquisitions were recorded in 2004 all over the world.

However, on a general view, theories on mergers and acquisitions can be viewed from two perspectives including value destruction and value maximization. In the case of value maximization, the motivation behind M&A revolves around synergetic gain through combining two companies while the value destruction category comprises of deals whose motivation is based on agency considerations (Sudarsanam & Mahate 2003).

In this case, the interests of managers have a significant effect on the directionality of the mergers and acquisitions activities, especially where the motive is to destroy the value of shareholders (Van-Schaik, Steenbeek & Mahlerplein 2004). According to extant evidence and theories, shareholders in any firms targeted for M&A are likely to benefit. Despite this, the shareholders of the acquirer firm do not benefit from corporate control.

There are numerous cases of mergers and acquisitions all over the world. For example, a review of the state of mergers and acquisitions in Europe reveals that a large amount of money has been used in M&A as evident in 1997 whereby six hundred thousand M&A deals were recorded as completed.

The occurrence of mergers and acquisitions is attributable to several reasons including the need to increase the value of affected firms through creating avenues for large economies of scale and reducing the cost of operations by putting several firms under single ownership (Awolusi 2012). Also, through mergers and acquisitions, firms can expand their markets thereby enjoying various benefits such as tax savings due to favourable domestic regulations.

Recent studies have shown that there is mixed empirical evidence regarding the impact of wealth on the acquiring firms (Billett, King & Mauer 2010). For example, several scholars and researchers have investigated the wealth effects in the case of U.S markets and found out that shareholder returns are either positive or zero (Masulis, Wang & Xie 2007; Faccio, McConnell & Stolin 2006). On the other hand, a few other researchers found out that the shareholder returns are negatively abnormal especially during the date of the announcement.

In the case of the UK’s market, several studies have provided negative returns on shareholder wealth effects while others have recorded positive shareholder returns during announcement dates (Croci & Petmezas 2010; Cao, Tang & Yuan 2013).

However, examining the wealth effects and shareholder returns during the announcement date, various researchers have shown that there is a high probability that the shareholders of the affected companies do not earn any abnormal returns. In support of this, Bruner (2002) compared the results from 130 studies based on the period between 1971 and 2001 and concluded that bidders at the announcement date of mergers and acquisitions earn zero returns.

Nevertheless, the shareholder returns are different for developed markets such as Canada. Unlike in the case of U.S, shareholders earn positive abnormal returns in Japan, Canada and other developed European markets (Faccio, McConnell & Stolin 2006). While there are numerous studies on mergers and acquisitions about developed markets, the case is different for developing markets.

Zhu and Malhotra (2008) in their study investigating the case of international mergers and acquisitions in developing economies found out that there is a high possibility of shareholders earning positive returns in the short run following a merger and acquisition activity. Martynova and Renneboog (2008) asserted that long term evaluation of the shareholder returns is not likely to provide reliable results due to errors in the methodology adopted.

An examination of the wealth effects of mergers and acquisitions for two years after M&A announcement has been made has revealed zero to insignificant returns in the case of M&A targeting a public firm (Charlety, Fagart & Souam 2008). However, the returns are significantly negative whenever a private target is involved.

It is also important to review the progress of firms after an acquisition activity. Several studies have been carried out to assess the performance of acquiring firms several years after a successful acquisition (Chen & Zheng 2014). However, the studies are based on different measures and benchmarks implying that the evidence provided inconclusive when comparing developing and developed markets.

The fact that different markets have different accounting policies is very instrumental in the difference in the overall information collected about the performance of firms operating in different markets. For example, evaluation of the long-term performance of acquiring firms in the U.S market based on their cash flow shows that the firms do not improve their performance (DeYoung, Evanoff & Molyneux 2009). Based on this assertion, it can be concluded that the acquisitions in the U.S market in the long-run are not based on maximizing the value of shareholders and thus no evidence of improvement in performance.

Similarly, a review of the UK market shows that acquiring firms do not improve in terms of performance when assessed in the long-term. Despite this, several studies provide evidence of improvement in performance based on acquisitions dating in the eighties (Conn, Cosh & Hughes 2005). Unlike in the case of developed markets, studies focusing on various developing economies have shown significant improvement in the performance of acquiring firms as evident in the study conducted by Rahman and Limmack (2004) on 1988-1992 Malaysian acquisitions.

Additionally, Ramakrishnan (2008) reported significant improvement amongst Indian mergers between 1993 and 2005. In the case of European mergers and acquisitions, Martynova and Renneboog (2008) found out acquiring firms experience positive returns averagely. However, the shareholder returns in the case of French firms are insignificantly positive. On the other hand, mergers and acquisitions in Japan lead to positive abnormal returns during the post-acquisition period.

An overview of the evidence on the Chinese mergers and acquisitions cases

Over the past two decades, the literature on Chinese financial activities has become popular following the country’s rapid economic growth. Such popularity can be attributed to the increased need to gain more understanding of the mergers and activities undergoing in the country (Nogata, Uchida & Goto 2011). There have been notable developments in China with one of them being the continuous search for market-oriented changes to ensure that Chinese firms have a competitive edge over other countries’ firms whenever compared over a global scale (Petmezas 2009).

As such, the changes in the market and economic policies are aimed at encouraging the participation of Chinese firms in cross-border investments as opposed to concentrating in inward foreign investments that take place within the borders of the country. Resultantly, there has been a high rate of entry into cross-border activities among Chinese firms; a move that has led to various successful mergers and acquisition across the borders of China. For example, a review of the period between January 2000 and December 2004 shows that there were successful twenty-seven outward merger and acquisition deals in China.

However, according to anecdotal evidence, there is a high possibility that the number of outward merger and acquisition deals that were completed within this period were more than twenty-seven (Rhodes–Kropf, Robinson & Viswanathan 2005). This is attributable to the fact that some of the deals involved companies that were not listed with the stock markets of China, implying that it was hard to get the right information about them.

As noted from above, merger and acquisition activities differ significantly according to how a market is developed. The implication is that mergers and acquisitions that involve companies from countries with developed economies are more probable to enjoy monopoly as well as other internationalization benefits in comparison to the companies from countries that are still undergoing development (Schiereck, Sigl-Grüb & Unverhau 2009).

As such, companies from developed companies have a form of motivation that pushes them towards the exploitation of own resources, while companies in developing markets engage in meagre and acquisition activities as a way to benefit from resources from another market (Shimizu, Hitt & Pisano 2004). For this reason, it suffices that mergers and acquisitions deals that occur comprising of companies from developing markets as in the case of China are based on the need for resources and other intangible assets from the companies they are agreeing to merge with.

Most firms in China use mergers and acquisitions as the pathway through which they can achieve improved performance by boosting their core competencies as well as filling the strategic gap (Von-Eije & Wiegerinck 2010). Despite the high cost of M&A, firms benefit from expanded knowledge as well as the organization’s competitive advantage.

However, there are limited studies that focus on China’s corporate control market as compared to the case in developed markets such the U.S. There are high numbers of cross-border merger and acquisition deals in China, implying that most of the studies on corporate control market in China focus on issues of cross-border mergers and acquisitions (Bi & Wang 2014). Empirical evidence shows that most of the Chinese listed companies; especially state-owned enterprises are focusing on engaging in acquisitions across the borders.

Boateng, Qian and Tianle (2008) provide a comprehensive review and evidence of Chinese mergers and acquisition whereby the study analyzes several Chinese cross-border mergers and acquisitions that took place between 2000 and 2004. In this study, the researcher was interested in finding out how Chinese firms performed in the short-term after successful mergers and acquisitions.

As such, Boateng, Qian and Tianle (2008) examined the abnormal returns of the 27 Chinese companies sample and found out that all the acquiring firms in China benefit from cross-border mergers and acquisitions in that such M&A are known for value creation. In another study, Wen (2004) examines the various reasons for Chinese mergers and acquisitions, as well as whether or not such deals are effective in the long-run. In this study, Walker (2006) analyzed the relationship that exists between the valuation, performance, earnings management and the governance of acquiring firms, and found out that mergers and acquisitions in China focus on the realization of hubris or agency motives.

A study carried out by Chi, Sun and Young (2009) focused on the examination of the features of mergers and acquisitions in China as well as their overall performance with special focus on deals that occurred between 1998 and 2003. According to the findings of this study, it was evident that acquiring firms are likely to benefit from positive abnormal returns before and after a merger and acquisition deal is announced (Chi, Sun & Young 2009).

However, the same firms experience insignificant abnormal returns after six months of acquisition. On the other hand, a review of the performance of firms investigated in this study revealed that various factors affect the performance of acquiring firms (Cummins & Weiss 2010). Such factors include cash bids, cross-provinces mergers and acquisitions, and political factors. Based on the findings of this study, it can be concluded that the fundamentals of acquiring firms in China do not increase as a result of mergers and acquisitions especially in the short-run.

Several studies in China have been conducted that examine the operating performance of Chinese acquiring firms in the long-term (Frederik & Hong 2014). Despite this, most of the studies vary in terms of results and findings. For example, some studies have found out that the performance of acquiring firms change over a certain period, whereby it is more likely that there will be improved performance during the first and second years of acquisition but a decrease in performance would be expected in the following years (Sung, Kiyoung & Doseong 2013).

On the other hand, Walker (2006) concluded that acquiring firms experience decrease in their operating performance upon acquisition over a long period. Boateng and Bi (2013) carried out a study on the characteristics of acquirers in the context of the Chinese market using 1370 M&A that was completed between 1998 and 2008 and assessed their returns.

After analysis of the returns for between one and three years, the Boateng and Bi (2013) found out that most Chinese acquiring firms record abnormal returns between 14.29% and 121% due the pre-acquisition period. On the other hand, the findings of the study showed that there is no difference in the performance of the acquiring firms after an acquisition has been made.

Chinese capital market

Overview of the capital market of China

China’s economy is experiencing tremendous growth over recent years. Such growth has placed the country at a position such that China has become a key player in the rebalancing of global finances (Matthew, Tao & David 2004). The emerging markets, China included, have a significant role to play in the economy of the world (Dodoo & Han 2015). For example, according to recent trends, emerging markets account for more than 35% of the global gross domestic product. Despite this, such markets are only accountable for 7% of the total number of foreign investments in the entire world (Ghosh & Peltier 2009).

As such, it can be considered that the growth of emerging markets is set towards growth through a financial landscape that has changed conditions (Fich, Nguyen & Officer 2009). China has become a key player in the shifting post-crisis financial era. However, the capital market of the country requires a few reforms if China is to get established as a major player in global finance. For such objectives to be achieved, there is a need for deep and well-developed domestic financial markets in the country, as well as an increase in the number of returns that households, corporations and the government earn (Nitin 2015).

Numerous barriers affect investments by individuals and corporations in China (Gu & Reed 2016). As such, the removal of such barriers can be a suitable approach towards well-developed capital market and the creation of avenues for growth (Han 2014). Also, there is a need for the country to build trust with international investors as a way to attract foreign investments.

The capital control regime in China is very extensive although the country has been selectively restricting such control. For example, there are cases whereby the capital inflows, as well as the outflows, have been let loose (Joshi & Desai 2010). Despite this, the capital account in the country can be considered to have become highly open.

The government of China has established several structures, which are aimed at ensuring that there is control in the capital market (Li 2016). The establishment of such plans has led to the generation of numerous financial openness “benefits that touch of the development of both international and domestic financial portfolios while at the same time ensuring that there is free movement of capital in the country”.

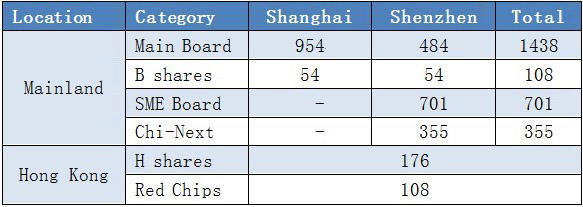

The capital market of China dates back in the nineties when its creation was based on the re-establishment of the Shenzhen Stock Exchange and the Shanghai Stock Exchange (Li & Jiang 2014). These two stock exchanges have remained to be key players in the capital market of China to date. However, several futures exchanges were introduced into the market, which includes the Zhengzhou Commodity Exchange, Shanghai Future Exchange, and the Dalian Commodity Exchange. Additionally, one financial futures exchange was also established. On the other hand, the Chinese emerging market trades in commodity futures, warrants, investment funds, securities, bonds, and stocks.

The capital market in China is young. Despite this, the market has experienced rapid growth over the last two decades (Massa, Ferreira & Matos 2010). For example, the regulatory system in China has improved while participants in the market have gained a lot of experience and continue to be active. This can be evident from recent reports such as in the case of 2007 whereby more than 1500 companies had over 2200 trillion shares and participated in various stock exchanges of China more than it was in the previous years (Rani, Yadav & Jain 2015). Following such increase in the participation in the Chinese capital market in 2007, the total market capitalization was $4.33 trillion putting China in position three when compared to the stock market of other countries of the world.

The enactment of rules and regulations that govern the capital market practices in China is the responsibility of the China Securities Regulatory Commission (CSRC). This regulatory body was introduced in 1992 and offers regulation to the securities markets of China (Masulis & Swan 2009). Over time, the China Securities Regulatory Commission has experienced an expansion in its functions (Resti & Siciliano 2009). This can be attributed to the numerous reforms that have been carried out within the capital market of China, which have strengthened and clarified the functions of the CSRC.

The primary responsibilities of the CSRC revolve around direct leadership in matters concerning the securities market through the establishment of a central system that can supervise the securities markets of China effectively (Restrepo 2010). A centralized system has been very instrumental in developing the capital market of China in that it formulates the right standards and policies to govern the operations and the participants of the market (Mutaitina 2006). Initially, China was under a planned economy with the participants of the market being mainly state-owned enterprises (Rizvi 2016).

However, with time the economy changed from the planned system to a market-oriented economy, which has been very significant in the development of China’s financial portfolio. The change in the Chinese economic system has been possible through numerous reforms, which have yielded various results (Rani &Yadav 2012). To begin with, it has become possible for managers to work towards growth and profit following the authorization of the state-owned enterprises to do that.

The reforms of the capital markets led to the separation of the management and ownership of companies to ensure that the responsibility of a firm’s profits and loss is left to the managers (Selmier 2013). Such decisions allow the managers to work extra hard to ensure that the operations of their firms are aimed at making profits. The rationale behind such a decision is that the managers are required to account to the shareholders of the concerned company in case of loss or profit (Tauseef & Mohammed 2008).

Also, more reforms have set grounds for the transformation of firms whose scale of operation is large into modern corporations. For example, during the third phase of the market reforms, various state-owned enterprises in China made to the list of Chinese Stock Exchanges (Tham 2011). Nevertheless, the government of China has active and majority control of the state-owned enterprises that are listed in the stock exchanges of China.

The stock market of China has various characteristics that are distinct such as the classification of the common stocks in the country into the H-shares, B-shares and A-shares (Verma & Sharma 2015). Often the A and B shares are common in the stock exchange markets of Shenzhen and Shanghai. The major form of currency used in the A-shares trade is the Chinese currency, and according to the market rules, the A-shares are only availed to investors domestically (Tingley, Xu & Milner 2015). The B-shares, on the other hand, are available for trade among domestic and foreign domestic investors and in the form of foreign or domestic currencies. The last class of stocks, the H-shares, is available within the stock exchange market of Hong Kong whereby any global investor is allowed to trade.

Recent studies on the performance of capital markets as well as the operations of corporations have revealed that the structure of the market is very important in the overall success of participants in the concerned market (Wen 2004; Zhu 2016). In the case of China, the country’s capital market has a very distinct share ownership structure.

This structure which is based on share segmentation, allows firms to enjoy several shares’ categories including the state-owned shares, legal person shares, as well as the A/B-shares. Corporations hold legal person shares, while the state holds state-owned shares and individuals hold the A and B-shares (Manuel, Carvalho & Martinho 2012). The capital market reforms have significantly led to a reduction of the number of shares that are cannot be traded among listed companies in the stock exchanges of China.

It suffices that the trend of reforms alongside the growth of the economy of China has been very instrumental in the promotion of the introduction of the capital market in China. The government has also been very active in ensuring that the market develops. Such efforts have seen the expansion of the market, optimization of the market’s function and structure as well as the improvement of the construction of the market’s system. Even though the capital market of China has not yet acquired an international standard, trends show that with time the market will achieve such standards.

Developmental phases of the capital market of China

A review of the history of China in terms of economy and stock market reveals that the developments that have been witnessed in the country are subject to the economic reforms in the country. Following such reforms, the economy has been liberated and it is now undergoing a tremendous evolution and increase in the demand for such types of markets. The growth and development of the capital market of China have passed through several phases to get to the position it is nowadays.

The first phase was between 1978 and 1992 during which the country experience full-scale economic reforms. This phase set the grounds for the development of the capital market of China as well as the introduction of Chinese enterprises. The second phase occurred within the period 1993-1998, which according to Wen (2004), was “the development of the CSRC to ensure effective regulation of securities markets and various activities within the capital market”.

This phase entailed the integration of a supervision regime with the already introduced capital market. The third phase of the development of the capital market of China can be examined from 1998 onwards, which saw the establishment of the securities law, which provided additional strength and formality to the capital market of China. Besides, various reforms were also introduced to ensure that the market further developed.

Overview of China’s stock market

A review of the economy of the world shows that the global marketplace is dominated by Chinese enterprises, implying that the effects of Chinese mergers and acquisitions are felt globally. Also, state-owned enterprises are dominant in China as opposed in the cases of developed countries. For this reason, it is more likely that the operations of state-owned enterprises are tied closely to the government’s economic policies, which adversely affects the growth of mergers and acquisition in the country (Čiegis & Andriuškevičius 2013).

The government of China has been instrumental in the growth of the stock market of China. For example, the government of China has set up platforms that facilitate outbound and inbound acquisitions leading to the maximization of the scale of operations by state-owned enterprises, as well as an improvement in the performance of management and allocation of resources (Halabi, Colombage & Hellings 2008). Such a platform opens ways for more mergers and acquisition in the future.

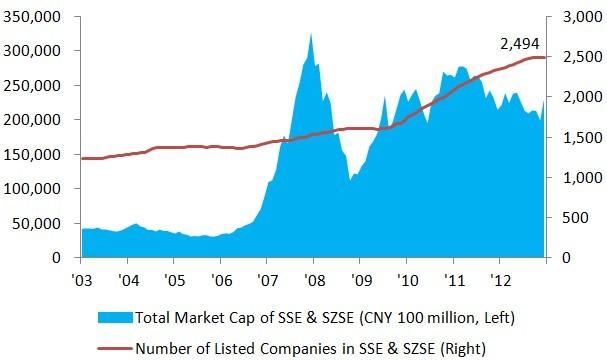

On the other hand, the mergers and acquisitions market in China is domestic even though there are high numbers of transactions occurring across the borders. As pointed out earlier, the stock market of China has tremendously developed. For example, the country had more than 2600 companies listed in the stock exchanges of China by 2012, which brought out more than 200 million investor accounts. Such a high number of firms in the list of China’s stock exchange led to an improvement value of China’s capital market. The figure below shows the state of the Stock Exchange of Shenzhen and Shanghai in terms of listed companies and total market capitalization between 2003 and 2012.

As evident from the figure above, China has been experiencing an increase in the number of listed companies from 2003 to 2012. Resultantly, the total market capitalization in the country has seemed to increase and get concentrated with an increase in the number of listed companies in the stock exchange of Shanghai and Shenzhen.

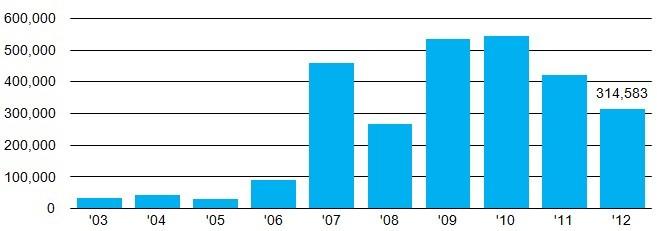

On the other hand, a review of the turnover returns of the stock market in China shows an improvement from 2003 to 2007. However, the share turnover decreased in 2008, which can be attributed to the global financial crisis of 2007/08. Nevertheless, the returns improved thereafter following various reforms and adjustments within the market to ensure that the stock markets recovered quickly from the crisis’s shocks (Jory & Ngo 2011). The figure below summarizes the state of China’s stock market through the example of the Shenzhen Stock Exchange and Shanghai Stock Exchange between 2003 and 2012.

Overview of the Bond market of China

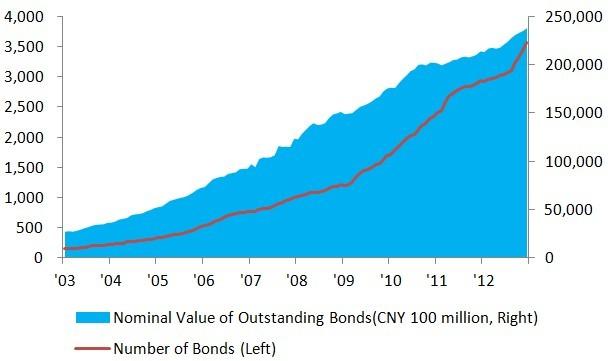

The bond market of China has had various challenges dating back in 1981 following the resumption of the treasury bonds issuance (Kumar, Kuo & Ramchand 2008). Over the past ten years, the bond market of China has experienced tremendous growth in the number of bonds and the balance volume. For example, in the previous years, the bond market recorded more than 20 trillion CNY in terms of total bond balance. At the same time, the bonds’ number was more than 3500 in the same year. The figure below offers a summary of the number of bonds as well as the bond balance within the bond market of China between 2003 and 2012.

There has been an improvement in the bond market of China in terms of bond numbers as well as the balance of bonds as evident in the figure above. However, various innovate markets have been introduced in the bond market of China during the past decade which has contributed immensely to the growth of the bond market. Some of these products include the Small and Medium Enterprises private debt, asset-backed securities, convertible bonds, and corporate bonds.

Structure of the capital market of China

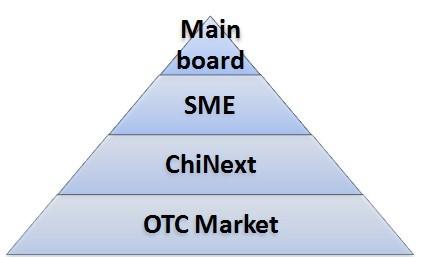

The structure of any capital market plays a significant role in the success of the market’s activities (Li, Carline & Farag 2007). In China, the capital market follows a multi-level structure. This type of structure is very important as far as the construction of the capital market of China is concerned. Such a structure ensures “growth and strengthening on the primary board, acceleration of SME board’s development as well as the success of the ChiNext stock market’s construction, before active exploration of the OTC market construction”. The capital market of China has significantly improved as a result of an effective structure. The figure shown below offers a summary of the multi-level capital structure of China.

The capital market of China comprises of various participants including agencies, listed companies and investors. Over the past decades, there has been a year by year increase in the number of investors thereby leading to an increase in the market participation. As such, the capital market of China has been very instrumental in the management of wealth for investors and shareholders.

Listed companies also play a significant part in the development and success of the capital market (Ma, Pagán & Soydemir 2012). In China, there has been an increase in the number of companies listed in various stock exchange markets, which has led to a subsequent increase in the market capitalization. Nowadays, the stock exchanges of China hold more than 2300 companies. The figure below offers an overview of the number of listed companies in the Stock Exchange markets of Shenzhen and Shanghai.

The other group of participants in the capital market of China is the intermediary agencies. This group has experienced various changes in the recent years in terms of total assets, net capital and number of customer transactions.

A comparison of the capital market of China and other countries

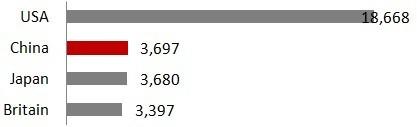

The size of China’s capital market has grown significantly in comparison to other global markets. Presently, it is considered to be one of the largest developing securities market (Manasakis 2009). For example, a comparative analysis of the global securities market carried out in 2012 ranked the capital market of China the second. Additionally, the market has recorded a rapid increase in the number of listings over recent years. The figure below shows the 2012 rankings of global capital markets in terms of market value.

According to the figure above, China’s capital market compares significantly with Japan’s and Britain’s capital market in terms of market value. During the same year, China had a value of share trading of $4,968 billion, second after USA’s $23,227 billion, and above Japan’s $3,606 billion.

Testable hypotheses

In the analysis of the concept of the shareholders’ wealth effect as a result of mergers and acquisitions, the study will involve several hypotheses. First, in the case of the current study, the development of the hypothesis focuses on the existence of shareholders’ wealth effect as a result of mergers and acquisitions. As such, to achieve the objectives of the study, it would be important to examine how the capital market of China is structured in terms of ownership.

Notably from above, majority of the participants in the Chinese capital market are the state-owned enterprises whose control comes from the state alongside other legal person corporations. The implication of the dominance of the state-owned enterprises within the capital market of China is that the number of public targets for acquisition is few because most of the listed firms are owned by the state (Schiereck, Sigl-Grüb & Unverhau 2009). Also, most of the mergers and acquisitions that take place in China are likely to involve cash because the government wishes to control the interests of all its enterprises.

According to the empirical literature, it is evident that shareholders of acquiring firms enjoy abnormal positive returns, especially if the focus on private firms (Tsagkanos 2010). This shows that the wealth of shareholders is significantly affected by mergers and acquisitions activities. However, most of the existing literature focuses on developed markets. In the case of this study, the focus will be whether mergers and acquisitions of Chinese firms affect the wealth of shareholders.

Secondly, the objectives of the study revolve around finding out how firms behave in terms of their performance following mergers and acquisitions. As pointed out earlier, the majority of the participants of mergers and acquisitions involve takeovers by state-owned enterprises. Additionally, it was noted that the performance of acquiring firms vary with time.

In this case, the study hypothesizes that acquiring firms enjoy positive abnormal returns whenever non-state-owned enterprises are involved, and abnormal returns that are non-negative for acquisitions that involve stock, while for cash transactions, the returns are hypothesized to be abnormally positive. As such, the primary focus of this study is to examine how the performance and operations of firms change upon M&A, and whether such changes affect the wealth of shareholders.

Chapter conclusion

The literature review chapter has extensively covered various aspects of mergers and acquisitions as well as the capital market of China. According to the objectives of the study, various studies were reviewed to provide more insights into the phenomenon under study. For example, the chapter examined the various studies to ascertain evidence of mergers and acquisitions activities of the world and specifically in the case of China.

It was evident that there is extensive literature on mergers and acquisitions in developed economies but limited in the case of developing markets such as China. Nevertheless, a few studies provided the necessary evidence of the growth and development in China’s economy and capital market, as well as the emergence of cross-border mergers and acquisitions.

An in-depth analysis of the findings of various studies revealed that mergers and acquisitions are driven by various motives including the need to destroy or maximize the value of shareholders in the involved firms. On the other hand, the chapter reviewed the background of China’s capital market and found out that its development has undergone three phases between 1978 and 1992 (full-scale economic reforms), between 1993 and 1998, (development of the CSRC) and from 1998 onwards, (the establishment of the securities law). Overly, the chapter has been extensively covering most aspects of the study phenomenon.

Research Design and Methodology

Introduction

Creswell (2009) noted that the success of any research depends extensively on the study design and methodology adopted. The study design refers to the outline that research follows in the execution of objectives of the concerned study as far as the collection and analysis of the necessary data are concerned. Researchers can use a variety of study designs depending on the scope and objectives of any given study. On the other hand, a research methodology entails the procedures and techniques that a researcher adopts to gather the required information for any given study.

The research design and methodology chapter for the study provides a discussion on the plan, techniques and procedures followed in the examination of the shareholders’ wealth effect and the performance of firms following a merger or an acquisition. As such, the chapter outlines the research designs, the population used for the study, the methods of collecting and analyzing information on shareholders’ wealth effect and corporation performance. Also, the chapter covers aspects of sampling techniques used to achieve the size of the sample used.

Study design

The primary focus of this study is to explore the concept of Chinese capital market concerning mergers and acquisitions to find first whether or not there exists shareholder wealth effect and secondly, whether the occurrence of mergers and acquisitions affects the performance of the affected corporations in the long run. As such, a lot of emphases will be given on the existing literature to explore what is already known about Chinese mergers and acquisitions and the operations of corporations following such activities.

Additionally, the study will make use of quantitative data concerning the shareholder wealth effect and the performance of acquiring firms after M&As. To achieve the objectives of this research, the study was comprehensive and applied the descriptive research design. The use of the descriptive research design in any study is considered appropriate especially in the provision of answers to adopted research questions (Neumann 2007). In the case of this study, several research questions were adopted and thus the descriptive design was chosen to ensure that all the research questions were answered accordingly.

Besides, the descriptive design of the study is suitable for this study due to its ability to index variables and well as providing suitable grounds for the collection of reliable data that can be used in making conclusions about a given study phenomenon. There is a need to ascertain the effects of mergers and acquisitions on the performance of acquiring firms, as well as on the shareholders’ wealth.

For this reason, the descriptive study was adopted to offer tangible evidence regarding the effects of mergers and acquisitions. On the other hand, a second research design, the cross-sectional design will be used in this study as a complementary design to the descriptive research design. This is attributable to the fact that the descriptive research design relies entirely on instrumentation and measures, which are subject to errors. As such, the use of the cross-sectional research design for this study would ensure the realization of valid and credible information that can be used for comprehensive conclusions.

Target Population

A study’s target population entails the total number of subjects and/or objects used in a study to provide the necessary information that can be used in explaining a societal problem or scenario under study. In the case of the current study, the focus is on the mergers and acquisitions in China and the effects such activities have on the performance of corporations and the wealth of shareholders. China is a large country with one of the highest population in the world. Through its capital market is young, the country has very many listed companies in various Stock Exchanges.

As such, the study would require a large amount of data for the credibility of the results and findings. For this reason, the study targets the entire capital market of China, with a specific interest in the companies that have undergone successful M&As. There are three stock exchanges markets in China, which include the Hong Kong Stock Exchange, the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

These will form the primary sources of the required information for this study. Creswell (2009) pointed out that the selection of the population to target in a study largely depends on the scope of the study and the phenomenon under study. Thus, the target population in the study is the listed companies in China that have completed M&A deals.

Sampling Design

A sample refers to a section of the targeted population in a study and is used to represent the entire target population. Thus, to achieve a highly representative sample, Kothari (2005) noted that the appropriate sampling techniques ought to be used. This is attributable to the fact that a sample should bear all the characteristics of the people or units forming the target population.

Sampling frame

The sampling frame refers to the working population in any given study. In the case of the current study, the sampling frame is the listed companies that have either merged with other firms. However, the exclusion criteria for the sampling frame focuses on a few factors. For any company to be considered for inclusion in the sample, it ought to be listed publicly in China’s capital market. Secondly, the date of announcing the M&A should lie anywhere around January 1st 2003 and December 31st 2013.

Lastly, the merger and acquisition deals to be studied should be in the list of successful M&A deals. Several target populations are excluded such as those that do not qualify the exclusion criteria. For example, there are M&A deals that were successful but the announcement date of the deals does not lie between January 1st 2003 and December 31st 2013. Also, various deals were successful but they are not listed in China’s stock exchanges. Such deals will be excluded from the sample.

Study’s sampling techniques

A sampling technique refers to the procedures that a researcher uses to arrive at the sample size to be used for any given study. Several sampling techniques can be used in any study. However, the choice of a given technique depends on the scope of data and sample needed (Mitchell & Jolly 2010). The convenient sampling procedure is applied in this study.

The choice of this method is based on the need to have an inclusive, sample given that the scope of the study focuses on a large capital market that has numerous listed companies. As such, the convenient sampling technique is suitable for this study since it allows all the companies a chance of being used in the sample. Additionally, this method of sampling is effective in that it is flexible especially in terms of time, distance and finances. The sample selected through this sampling method is often convenient as it avoids all forms of restrictions as the researcher makes decisions on what data sources to use.

Sample Size

The size of a sample to be used in any study varies from small to large depending on the required data, availability of resources to use in the study, as well as the aim of the study. This study aims to explore various aspects of mergers and acquisitions in the context of Chinese capital market to establish the effects that such activities have on the wealth of shareholders as well as on the performance of acquiring firms in the long-run. As such, the sample size should comprise of units that in the collection of valuable information to achieve the aim and objectives of the study. The size of the sample used in a study matter especially in the determination of research’s level of precision and accuracy. In the process of obtaining the sample size for this study, the following formula will be used:

n=N/

Whereby, e and N represent stand for the degree of freedom and target population respectively.

Data collection

As noted earlier, the primary aim of this research is to provide more insights into the effects of mergers and acquisitions on the performance of acquiring firms as well as on the wealth of shareholders. For such objectives to be achieved there is a need for data collection methods that would lead to the collection of valuable data to draw comprehensive inferences.

Various research questions have been adopted to ensure that all the objectives of the study are met. Secondary sources such as journals and online databases that have information on Chinese mergers and acquisitions form the main sources of data for the study. However, a lot of emphasis in the study is given on the market performance of acquiring firms and the measures of operating performance of the firms.

Data, Results and Findings

Characteristics of M&A deals, 2003-2013

Based on the methodology and research design highlighted above, the study focuses on specific mergers and acquisitions listed in the Chinese stock exchange markets. According to the proposed methodology, secondary sources of data such as journals and online databases are used in the collection of the required data. In this case, online databases containing information on mergers and acquisitions in China such as the SDC Database are used. As such, the necessary information about the M&A deals is collected including data about the status of the deals, effective and announcement data among other fine details.

As outlined previously, this study focuses entirely on the impacts of mergers and acquisitions on the acquiring firms’ performance as well as on the shareholders. For this reason, it is important to examine the characteristics of firms in terms of their operations, performance and returns within the pre-acquisition period and post-acquisition period.

Since numerous mergers and acquisitions deals match the selection and inclusion criteria for the study, firms that have a stake of below 50% in the targeted companies are excluded. However, to reduce the challenge of dealing with large sample size, the study targets 100 deals that match the inclusion and exclusion criteria stated in the previous chapter. Using convenient sampling and the formula n=N/ , the sample size for the study is calculated as follows where n is the sample size, N, the target population and e the degree of freedom (0.05).

n=100/ (1+100 (0.052))

n=100/1.25

n=80

Characteristics of M&A deals, 2003-2013

Table 1: Characteristics of M&A deals, 2003-2013.

The table above provides a summary of the characteristics of the mergers and acquisitions deals sampled. According to the data on the table, it is evident that there is a growth in the number of mergers and acquisitions in China. This is based on the fact that 20% and 80% of the mergers and acquisitions occurred in 2003-2007, and 2008 -2013 respectively, accounting for 60% increase in the percentage of M&A deals between 2003 and 2013.

Secondly, the table above shows that the number of cash transactions is high when compared to deals involving other forms of payment such as stock only, or cash and stock. The empirical literature on Chinese mergers and acquisitions found out that the majority of China’s M&A deals are carried out by firms owned and controlled by the state (Yong 2010). Expectedly, the section of the status of ownership shows that majority of the acquirers (90%) are state-owned enterprises.

On the other hand, the analysis of the number of cross border and domestic deals showed that between 2003 and 2007, there were more domestic mergers and acquisitions than cross-border ones. However, the number of cross-border M&A deals exceeded the domestic ones in the following years, which can be attributed to the existence of successful reforms within the capital market of China.

The last section of the table above highlights the characteristics of the sampled deals in terms of the target firms. Notably from the literature review, most of M&As in China target the private sector with nearly no target on the public or state-owned enterprises. This is attributable to the fact that most of the listed companies in China are state-owned. The sample shows that majority of the target are subsidiary firms, joint venture firms, or private firms.

Market performance of acquiring firms (shareholder wealth effect)

The first hypothesis of this study is based on the examination of the existence of shareholder wealth effect. As such, the study will use the sampled units to examine the market performance of acquiring firms to establish whether or not mergers and acquisitions affect the wealth of shareholders. The study adopts the standard event study methodology in the measurement of the shareholders’ wealth effect. The Cumulative Abnormal Return, often abbreviated as CAR is used in the computation of the number of returns that a given firms during the announcement period of M&A deal.

To achieve credible results, the calculation of the cumulative abnormal return is carried out over several event windows after the date of the announcement. However, there are cases when information of mergers and acquisition is available to the public before the announcement date. During such cases, manipulation of stock prices can be done thereby providing the wrong returns. As such, to take care of such case, it is always advisable to calculate the cumulative abnormal returns based on several days before the announced date (often considered -1, since 0 is taken as the announcement date).

In the case of this study, the study is based on the market portfolio of the value-weighted index as recorded by either the Shenzhen stock exchange or even in the Shanghai stock exchange. Additionally, it is important to examine the buy-and-hold abnormal returns (BHARs) of the sampled firms in the long-run based on the value-weighted index of the Shenzhen or Shanghai stock exchange. The use of matched-firm benchmarks or even the calendar time approach is not appropriate for this study due to cases of data limitations.

The calculation of the cumulative abnormal returns in the short-run is based on the day-to-day abnormal returns for the acquirers’ firms. In this case, the market model is used as the benchmark model and is calculated as follows:

Rit = αi+ßiRmt + eit;

In this equation, the daily return realized for any given stock i, on a given day, t. The value-weighted market return for each day is represented as Rmt for day t. The value eit, is considered to be the error term accounting for any computational errors that might occur. Based on the above formula, it follows that the abnormal return for any given stock i can be calculated as follows;

ARit = Rit – (αi+ßiRmt), whereby (αi+ßiRmt) represents the number of normal returns expected from the given stock i, for any specific day t which can be represented as E (Rit) implying that the above equation changes to;

ARit = Rit – E (Rit)

Thus, the cumulative abnormal returns (CAR) for any firm can be calculated as a summation of the total abnormal returns over a specified number of days (t), implying that;

CARit =∑ARit

Over the long-term, the abnormal stock returns are measured based on BHAR. The difference in the calculation of BHAR and CAR is that the measurement of the BHAR is based on the differences between returns of a benchmark portfolio investment and a buy-and-hold investment.

Measures of operating performance (long-term corporation performance) (3 years after M&A)

The examination of the operating performance of various corporations within the sampled units can be a suitable way to establish whether mergers and acquisitions activities affect the performance of acquiring firms in the long-run. Therefore, the investigation of the operating performance, in this case, will be evaluated for three years for comprehensive inferences.

Several financial tools can be used in the measurement of the operating performance of firms. Nevertheless, a suitable approach is the investigation of the growth of the given firms in terms of sales as well as their profitability. Some of the indicators of company’s growth in sales and profitability include profit margin, the return on equity (ROE) as well as the return on asset (ROA), and are discussed below in the context of this study’s objectives.

The first ratio is the Return on Equity (ROE), which is an expression of the total net income that a company gains from the total number of invested shareholders’ equity and is expressed as follows;

Secondly, the Return on Assets (ROA) is used in explaining the potential of a firm’s asset to cater for the debts of the company’s debts by examining the earnings of the concerned firm over its total assets’ value

The other financial ratio of interest, in this case, is the profit margin, which is significant in explaining the profitability of a given firm by examining its net income in comparison to collected revenue.

On the other hand, for more comprehensive results especially considering that the generation of cash flow in a frim can be reflected through a firm’s growth, the study examines the growth of the firm. This is done to ascertain the performance of the firms concerning the objectives of the study. As such, the growth in sales is expressed as a percentage of the difference in sales as shown below:

Whereby, the sales in year two reflect the sales in the current year, while year 1’s sales reflect the sales of the previous year. According to the empirical literature, the structure of capital in any given market significantly affects the performance of firms especially in developing markets such as China and Canada (Eckbo & Thorburn 2009). For this reason, the objectives of the study can be effectively met if the debt capacity of the firms is examined to find out the actual performance of the concerned firms. This can be done through the calculation of the leverage ratio, which acts as a reflection of the debt capacity of a given firm. The leverage ratio is calculated as follows:

Market performance analysis

To effectively analyze the performance of various firms in the sample, the Ordinary Least Square method is used. It is a type of regression model and it is adopted to help in the analysis of how various cumulative abnormal returns and, deal characteristics leverage changes and the performance of firms before acquisition relate. In this study, the calculation of the cumulative abnormal returns is done concerning several days prior and several days after the announcement date. As such, the dependent variables for this study are set at CAR (-1, +1) within three days and CAR (-2, +2).

According to the previous discussion above on measures of the operating performance of firms, variables that indicate the performance of firms in terms of profitability and sales growth are used. As such, the study analyzes the pre-return on assets, pre-return on equity, pre-profit margin as well as pre-sales growth to ascertain the performance of firms before acquisition activity. Also, the effects of profit margin, the return on equity, the return on assets on the abnormal returns of the firms are noted.

Dummy variables are appropriate in this study as control variables. As such, the study adopts variables that have a close relation to the deal variables used. For example, in a case whereby the target firm and its acquirer share an industry, the study will adopt a same-industry dummy variable that is equal to 1 or 0. Secondly, whereby the acquiring firm is state-owned (SOE), the appropriate dummy variable for such a firm is SOE is equal to 1, or otherwise, 0. The same trend is followed for payments, and border or domestic M&As.

Empirical results and findings

Wealth effect of shareholders (short-term)

This section of the dissertation provides the stock price data analysis based on the standard event methodology to ascertain the effect of announcing mergers and acquisition on the value of acquirers firms within the Chinese market. As noted earlier, the dependent variables used in this study are CAR (-1, +1), and CAR (-2, +2), whereby the announcement day is represented by 0.

Using various event windows such as (-5,-2), (-2,0), (-1,0), (0,), (0,+l), (-1,+I), (-2,+2), (+2,+5), (-5,+5), (-10,+10), (-42,-1), (0,+ 126), (-42,+ 126), the cumulative abnormal returns are calculated based on 42 days before the announcement dates of mergers and acquisitions and 12 days after the announcement date in order to take care of any leaked information.

The mean CARs following the announcement of a merger and acquisition deal are significantly similar to zero. For example, the analysis of the CAR within 2-5 days after M&A is announced gives a mean of -0.69%, while the CAR after six months is -2.52%. On the contrary, the mean CARs when the event window ranges from 3 to 5 days are 0.67% and 0.74%.

Statistically, the mean is significant and positive. From these results and the findings from the review of literature, it can be concluded that there is a high potential that before the announcement date of M&As, acquirer experience a significantly large part of run-up over a short period before day 0. This is based on the fact that the gains in returns are significantly small when CAR means are calculated over the event window of (-42,-1).

Generally, and according to empirical results, it can be seen that the mergers and acquisitions in China result to significant positive Cumulative Abnormal Returns around day 0 of M&A and that the shareholders do not experience any loss in their wealth until six months of the takeover. The implication from this assertion is that mergers and acquisitions are beneficial to shareholders of acquiring firms in the short run.

These results are in line with some previous studies’ findings such as in the case of Chi, Sun and Young (2009), as well as evidence from other countries like Japan. Despite this, the findings of this study contrast with evidence on wealth effects in developed markets especially in the West. As such, it is important to ascertain the robustness of the above findings concerning firm-specific characteristics and deal-specific features. In this case, the interest is on the form of payment, the status of ownership and types of deals.

In the analysis of the various categories of firm-specific characteristics and deal-specific features of mergers and acquisitions, it is an event that firms within China’s capital market whose acquisition target is joint-ventures are likely to experience abnormal returns. As such, the analysis records cumulative abnormal returns that are significantly positive for the case of bidder’s and their target’s industry readiness.

Such results reflect CAR within more than six months and between 2-1 before day 0. Also, consistent results are found over the 3-days, 5-days and 21-days window, whereby the mean cumulative abnormal returns are statistically significant. The implication from this finding is that joint ventures mergers and acquisitions deals lead to a positive reaction within the market.

Secondly, when assessing the impact of cash transactions on the cumulative abnormal returns, the study finds that there is a significant effect on the wealth of shareholders whenever cash is used as the form of payment during M&As. Such finding aligns with findings from various studies. The use of cash in such transactions indicates that there are possible returns for shareholders of the acquiring firm especially days before the announcement day and shortly after (at most two days) announcement.

Contrary, when firms use a stock exchange as the form of payment during a merger and acquisitions deal, the shareholders suffer from negative mean CAR especially on day 0. According to the analysis, the CAR is -0.45%. Additionally, firms are also likely to experience such cumulative returns over event windows of (+2, +5), (-5, +5), as well as for (-10, +10).

Such cumulative abnormal returns are statistically significant, while windows of (-42, -1) and (-5, -2) provide insignificant cumulative abnormal returns. Despite this, there is a lot of difference whenever stocks are used as a form of payment for windows s (-2,0), (-1,0), (0,1), (-1,+I), (-2,+2), (0,126), and (-42,126) as these lead to positive cumulative abnormal returns that are statistically significant.

The attitude of the bidder, whether friendly or hostile, affects the shareholders’ wealth. Results on the analysis of such effect show that a friendly merger and acquisition deal leads to significantly positive returns. However, where the deal is neutral, the shareholders of the affected companies experience no returns.

Analysis of the effect of cross-border mergers on the wealth of shareholders shows that the shareholders do not experience any significant abnormal returns over the pre-acquisition period, 21-day period, 11-day window, 5-day window or even the 3-day window. Therefore, according to the sample used, it suffices that cross-border deals are no different in that mergers and acquisitions that involve cross-border firms only receive normal returns.

Despite this, there exists an indistinguishable performance of the market in cases involving cross-border deals. According to Boateng, Qian and Tianle (2008), the expectations of many firms prospecting for cross-border mergers and acquisitions is that they will lead to value creation for the Chinese firms.

The reasoning behind the normal rate for cross-border deals is that there is a high potential for a loss during the early stages of acquisitions, which explains why most investors consider the unavailability of any significant relationship between the merger and acquisition event and the performance of the resultant firm in the future. In the case of recent cross-border mergers and acquisitions, political factors have a significant effect which explains the normal rate of returns for shareholders. The implication is that most of the deals are not aimed at the maximization of the wealth of shareholders but its destruction.

On the other hand, domestic mergers and acquisitions have a positive reaction from firms. The results in this category show that the mean cumulative abnormal returns in the case of M&A deals involving domestic firms are significantly positive.

The literature shows that domestic takeovers are favourable in China, as the firms have the potential to grow as well as acquire larger economies of scale through capitalizing on the weaknesses of the acquired firms as well as the integration of operations of the merged firms. A suitable example of a successful domestic takeover is the case of TCL, a company that has successfully acquired and boosted the performance of firms labelled as non-performers.

Even though there is high growth in cross-border mergers and acquisitions in China, evidence shows that most of the deals do not turn out as expected in the long run. This, according to Boateng, Qian and Tianle (2008), is attributable to the setting of high expectations without evaluating the conditions in the market. As such, there are numerous challenges when it comes to cross-border mergers and acquisitions in China. This aligns with the study’s findings that still China is developing its cross-border mergers and acquisitions.

It was important, based on the objectives of the study, to examine the effect of the status of the acquiring firms on the market. As such, the study carried out an analysis of such effects focusing on mergers and acquisitions involving state-owned firms against the non-state owned ones. According to the results of the short-term analysis of the shareholders’ wealth for both case, it is evident that shareholders of mergers and acquisitions involving state-owned enterprises experience positive stock returns within the announcement of mergers and acquisitions.

More specifically, based on the sampled units, the cumulative abnormal returns are significantly positive 1 day, and over 2 days before the announcement date. On the contrary, mergers and acquisitions involving firms that are not owned by the state experience a normal rate of returns. Investigating the form of acquisitions, it becomes evident that acquiring firms in any mergers and acquisitions deal experience positive abnormal returns.

From the foregoing analysis of the wealth effects of shareholders over a short term in the event of M&A, it is evident that a positive announcement effect exists concerning the abnormal stock returns. The implication is that the occurrence of any takeover increases the wealth of the acquiring firms’ shareholders in the short run. This aligns with previous studies’ findings, which indicate that M&A is used as a means of maximizing the value of a given investment especially for the shareholders of the acquirer firm.