Introduction

LVMH is a multinational firm that is headquartered in Paris (Thompson, Strickland, Gamble, and Gao, 509). It was started in 1987 after the merger of two firms. The company has about 60 subsidiaries that specialize in the management of its prestigious brands (Okonkwo 287; Thompson et al. 509). This paper focuses on highlighting LVMH’s past and current corporate diversification strategy. It provides information about the firm’s portfolio of businesses and analyzes the impact of diversification strategy on the company’s shareholder value. Finally, the paper concentrates on providing recommendations with regard to improving shareholder value.

LVMH’s past and current corporate diversification strategy

It is evident that the multinational company focuses on a corporate strategy that is based on business diversification. The current diversification approach is different from the one applied in the past because the previous one was characterized by fewer brands (Okonkwo 287). However, in the current competitive world, the firm has adopted a variety of high-quality products that would enable it to achieve more market shares and competitive advantage (Thompson et al. 515).

The business is exemplified by a variety of ‘star’ brands, which are important for achieving excellent sales in different global markets. The following are some of the top brands of the company: Hennessy, Krug, Fendi, Kenzo, Dior, Marc Jacobs, Chaumet, Bulgari, and Sephora (Thompson et al. 517). The brands enable LVMH to attain corporate advantage and strategy because they are specifically manufactured for particular customers in the markets. Thus, they record very impressive sales.

The following are the main segments of the firm:

- Wines & spirits

- Selective retailing

- Perfumes & cosmetics

- Watches & jewelry

- Fashion & leather goods

- Other businesses & eliminations

The management adopts specific business strategies in each of these segments. With regard to the watches and jewelry segment, products are designed with a view to reflecting the needs of the upscale sector of the industry. The strategy that is implemented for the perfumes and cosmetics products is based on the use of unique chemicals and other ingredients that are combined to result in unique and innovative goods.

The selective retailing segment concentrates on the identification of unique market niches for excellent sales. The other businesses and eliminations unit have media, art auction, and e-commerce products. The strategy used in the segment is based on the identification of market opportunities. The wines and spirits unit adopts the strategy of producing wines and spirits, which focus on quality. The fashion and leather goods unit uses the strategy of hiring and utilizing talented and creative designers (Thompson et al. 518).

Quality uniqueness is a common strategic approach that is used in the management of all business areas of the organization. Synergy is evident in a number of fragrance and cosmetics brands, which are being developed using common laboratories (Thompson et al. 516).

LVMH’s portfolio of businesses

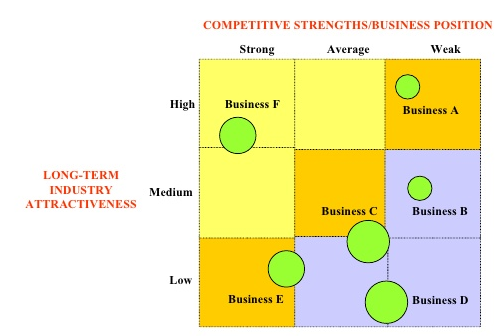

With regard to LVMH’s diversified businesses, it would be important to use the 9-cell attractiveness/strength matrix to know the positions of the business areas of the company.

The businesses are used to represent the following segments:

- Wines & spirits- business F

- Selective retailing- business A

- Perfumes & cosmetics- C

- Watches & jewelry- business B

- Fashion & leather goods- business E

- Other businesses & eliminations – business D

The relative business positions of each business are as follows:

- Wines and spirits- strong

- Selective retailing- weak

- Perfumes & cosmetics- average

- Watches & jewelry- weak

- Fashion & leather goods- strong

- Other businesses & eliminations – average

The following are the business fit and synergies of each business

- Wines & spirits- high

- Selective retailing- low

- Perfumes & cosmetics- medium

- Watches & jewelry- low

- Fashion & leather goods- high

- Other businesses and eliminations – medium

The following pairs of businesses contribute to LVMH’s common competencies:

- Wines & spirits and fashion & leather goods

- Selective retailing and watches & jewelry

- Other businesses and perfumes & cosmetics

It is important to note that the results that are contained in the 9-cell attractiveness/strength matrix do not change from the case study to 2012/2013.

Impact of diversification strategy on LVMH’s shareholder value

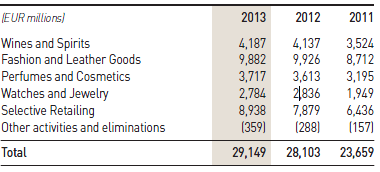

The financial features and relative performance of each of LVMH’s six major business segments are shown in exhibit 1, which presents revenue information. Based on the information, the following businesses can be termed as being the cash hogs of LVMH:

- Other businesses & eliminations

- Watches & jewelry

- Perfumes & cosmetics

On the other hand, the following can be described as being the cash cows of the multinational business establishment:

- Wines & spirits

- Fashion &leather goods

- Selective retailing

The management of the firm should focus on milking, investing in, and divesting the following businesses:

- Wines & spirits

- Fashion & leather goods

- Selective retailing

The decision to focus on the above three business segments could be because they are characterized by a steady trend of excellent sales. The trend is constant in 1999 and 2012/2013 (LVMH par. 2; Thompson et al. 509). It is important to note that business enterprises focus on implementing the activities that could bring the most benefits. Thus, LVMH should concentrate on investing more funds in the three businesses so that it can achieve more markets and excellent revenues in the future.

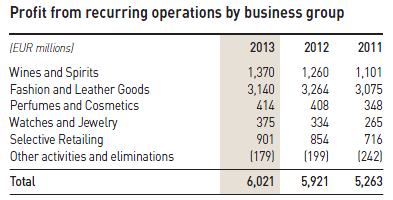

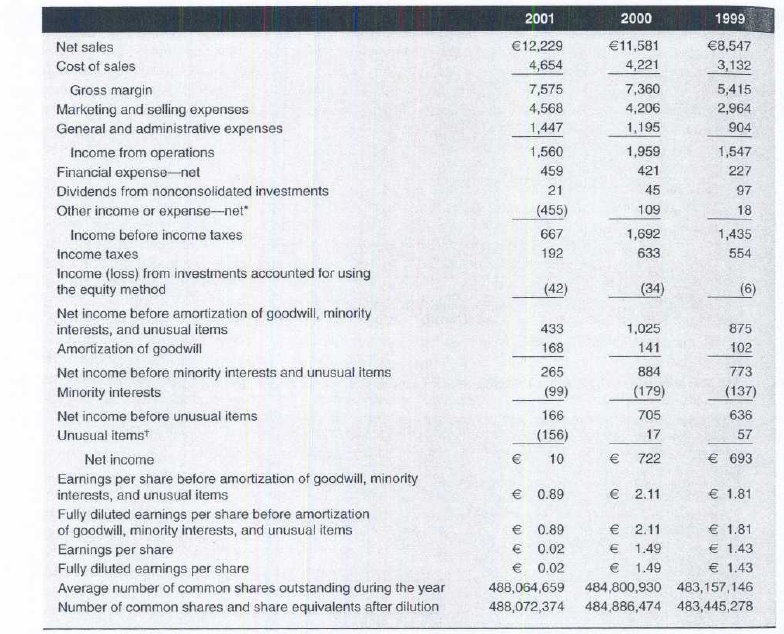

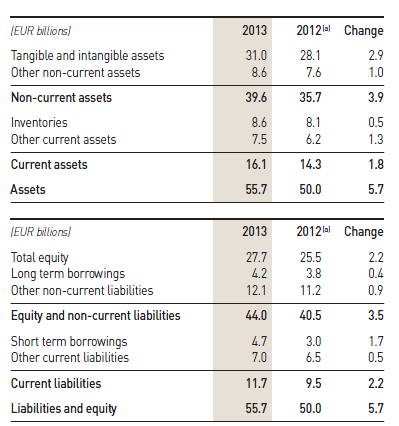

Overall, it is evident that LVMH’s financial performance and that of business segments have improved from 1999-2001 to 2012. It is worth noting that, although the costs of doing business have increased, the revenues have also increased in a significant manner. The improvements are shown in exhibits 2, 3, and 4.

The diversification adopted by the firm has improved shareholder value. The conclusion is based on the analysis of Porter’s three essential tests (Kaplan and Norton 45). First, the attractiveness test shows that LVMH has directed its investments toward actual attractiveness industries. The cost of entry test indicates that the cost that is associated with the entry is not focused on all profits in the future. In addition, the better-off test shows that the firm has established synergy in its business segments. Overall, shareholders should be pleased because two key financial ratios show that they would reap more from their investments. These are dividend per share and shareholder equity ratios (Kaplan and Norton 98).

Conclusion and recommendations to improve shareholder value

Other activities & eliminations and watches & jewelry segments have destroyed shareholder value. In comparison with other segments, it appears that the two areas of business are incurring a relatively high amount of costs for operations. This has the net effect of reducing the expected profits. The recent/proposed acquisitions have the potential to increase the level of competition of the firm. If they would lead to the achievement of improved revenues and net profits, then shareholders would benefit by receiving better dividends. Three important lessons can be adopted from LVMH. First, business diversification is important in attaining improved revenues and better shareholder value. Second, strategic approaches are essential in the identification of markets that are characterized by huge potential. Third, synergy is a key component in business establishments that have many business segments.

Exhibits

Works Cited

Kaplan, Robert, and David Norton. The execution premium: linking strategy to operations for competitive advantage. Cambridge, MA: Harvard Business Press, 2008. Print.

LVMH. 2014.Reports. 2014. Web.

Okonkwo, Uché. “The luxury brand strategy challenge.” Journal of brand management 16.5 (2009): 287-289. Print.

Thompson, Arthur , Alonzo Strickland, John Gamble, and Zeng’an Gao. Crafting and executing strategy: The quest for competitive advantage: Concepts and cases. Vol. 18. New York, NY: McGraw-Hill/Irwin, 2012. Print.