Introduction

The main objective of this report is to analyze the business environment of Louis Vuitton Moet Hennessy, in addition to conducting a market audit. The purpose of the report is to analyse the structure and performance of LVMH. The report shall also provide a brief overview of LVMH. In addition, the company’s SBUs, PESTLE analysis, SWOT analysis, Porter’s 5 Forces, and McKinsey 7S Matrix, shall also be conducted.

Overview of the LVMH

LVMH was formed in 1987 when Moet Hennessy merged with Louis Vuitton (Rugman 2005). The French based company operates in different parts of the world and it has over 100,000 employees (LVMH n.d). The company’s largest market share is in the US (26%), followed by Europe (18%), France (16%), and Japan (15%). Latin America and Asia account for 25% of the company’s market share (Rugman 2005).

LVMH enjoys global presence, and this has enabled the company to diversify its market risk. For example, LVMH managed to withstand major financial crises such as the 1998 Asian crisis and the 2007 global financial recession.

Some of the company’s famous brands include Chadon, Moet, Givenchy, Dom Perignon, and Christian Dior (Rugman 2005). Currently, the LVMH enjoys a 15% of the global luxury goods market share. This is a very competitive market with an estimated annual growth rate of10% (Rugman 2005). Some of LVMH’s major competitors include Bulgari, Richemont, and Gucci.

To remain competitive in the market, the company has mainly focused on shared synergies and costs across its dimensional value chain. In the last three financial quarters of 2012, LVMH has recorded an estimated €19.9 billion in revenue. This represents a 22% increase in revenue, compared with the same period last year (LVMH 2012).

Strategic Business Units (SBU) LVMH

LVMH operates under five SBUs namely, perfumes and cosmetics, fashion and leather goods, watches and jewelry, wines and spirits, and selective retailing (Reuters 2012). The table below is an illustration of LVMH’s SBUs

PESTEL Analysis

Porters 5 force

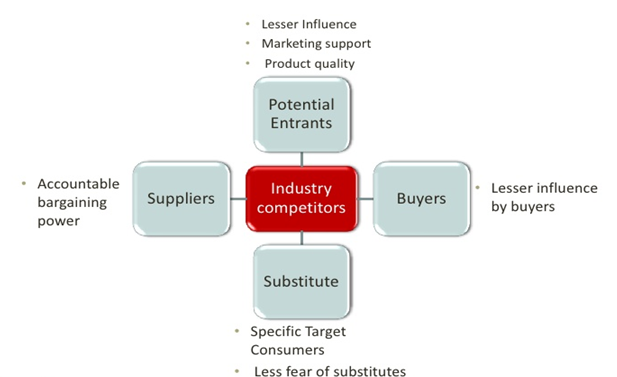

The diagram below is an illustration of Porter’s 5 forces with regard to LVMH as demonstrated by Prads (2010).

LVMH faces competition from new entrants and existing competitors such as Gucci and Bulgari (Rugman 2005). The presence of close substitutes due to cheap products and imitations threatens its operations (Pradas 2008). As the market leader, the company’s supplier bargaining power is high.

The company is a market leader and this is its competitive advantage as well. As such, buyers have little influence on the prices of the company’s products (Nagasawa 2008). The luxury industry is competitive and new entrants must have enough capital. Therefore, potential entrants have less influence on the market.

Opportunities and Threat

Internal Environment

McKinsey’s 7S matrix

Structure: The organization is divided in five units. Each of these units makes its own decisions (Rugman & Girod 2003)

Strategy: Creativity and technological innovations are the major business strategies adopted by the company (LVMH n.d). The company operates under high competitive pricing strategies supported by focused differentiation.

Systems: LVMH has integrated its IT operations such as online marketing and distribution.

Skills: LVMH’s core competences include training employees and skills development so as to enhance quality service and products (Pradas 2008).

Style: LVMH uses transformational leadership which promotes innovation and creativity (LVMH n.d).

Staff: LVMH has 100,000 well trained staff (LVMH n.d). Employee diversification helps to bring cultural diversity in the workplace.

Shared values: LVMH is committed to a sustainable environment and developing a culture of biodiversity conservation (Arnault n.d).

Marketing mix

Marketing mix employed by LVMH entails the 4ps namely, price, place/distribution, promotion, and products.

Price: Prices of LVM products are extremely high compared to those of its competitors. For example, Louis Vuition handbags are highly priced which prohibit bargains (Nagasawa 2008). The company has adopted seven pricing principles which are prohibit exorbitant pricing, bargain sales, price changes, odd pricing, prestige pricing , and “Louis Vuitton Products are Money” bargains (Nagasawa 2008, p.44).

Product: LVMH products are of high quality and are designed through creativity and technological innovations (Nagasawa 2008).

Promotion: LVMH uses advertisements to promote its products worldwide. For instance, the company sets aside 11% of its sales for advertising (Rugman & Girod 2003). It also endorses celebrities such as Madonna and Jennifer Lopez to promote its products (Rawat 2010). LVMH does not give discounts as part of product promotion (Rawat 2010).

Place/distribution: LVMH products are available in over 3000 retail stores owned by the company. The company has a broad and vertically integrated distribution channels which increases efficiency and effectiveness (Nagasawa 2008).

Strengths and Weakness

Swot Analysis

Corporate Analysis

The table below is an illustration of LVMH performance between 2011 and 2012 as provided in LVMH (2012a).

Wines and spirits recorded a 12 percent revenue growth due to a rise in sales and demand for champagne. Leather and fashion has organic revenue growth of 8 percent, perfume and cosmetics have revenue growth of 8 percent which has been as a result of increased growth for Christian Dior (LVMPH 2012). The business units of LMH have led to increase in its revenues.

USB SWOT Analysis/ Fashion and Leather Goods

Conclusion

LVMH is a key player in the luxury industry with a global market share of 15%. Its major sales come from foreign markets such as Asia, Latin America, China, Malaysia, and Japan. The LVMH group operates under five SBUs namely perfumes and cosmetics, fashion and leather goods, watches and jewelry, wines and spirits, and selective retailing.

Its major strengths include a strong brand that is recognized worldwide and technological innovations. In addition, the company has adopted creativity and technological innovations as part of its strategic plans. The major competitors are Bulgari, Richemont and Gucci. In the third quarter, LVMH has revenue of €19.9 billion which was a 22% increase.

References List

Arnault, B., LVMH and the environment. Web.

LVMH, Group mission and values. Web.

LVMH 2012, Excellent first half for LVMH. Web.

LVMH 2012a, LVMH: 22% increase in revenue for the first nine months of 2012. Web.

Nagasawa, S. 2008, Marketing principles of Louis Vuitton: The strongest brand strategy: Waseda Business & Economic studies, no.44, pp. 41-54.

Pradas, A. 2010, LVMH case evaluation. Web.

Rawat, K. P. 2010, Louis Vuitton. Web.

Reuters 2012, LVMH Moet Hennessy Louis Vuitton SA (LVMH.PA). Web.

Roberts, A. 2012, ‘LVMH skips European austerity raising prices for Chinese’, Bloomberg, 2 May, pp.1.

Rugman, A. & Girod, S. 2003, ‘Retail multinationals and globalization: The evidence is regional’, European Management Journal, vol. 21, no. 1, pp. 24–37.

Rugman, A. M. 2005, The regional multinationals MNEs and “global” strategic management. Cambridge, Cambridge University Press.

Solca, L. & Wing, M. 2009, LVMH: King of the luxury jungle, Bernstein Research, pp. 1-188.