NBAD: Company Description and Market Analysis

The National Bank of Abu Dhabi (NBAD) is ranked first among the largest banks in Abu Dhabi and second in the United Arab Emirates (UAE). It is located in the 1 NBAD Tower, is defined as a corporation (particularly, a joint-stock company), and is owned by the Abu Dhabi Investment Council (ADIC). Particularly, the organization is run by HH Sheikh Mohammed Bin Zayed Al Nahyan, the crown prince of Abu Dhabi (National Bank of Abu Dhabi 2017a).

NBAD was founded in 1968, when it became the first bank of Abu Dhabi and started expanding rapidly, gaining an increasingly large influence. NBAD complies with the principles of Shariah and, therefore, includes several crucial restrictions to the banking operations, riba (i.e., the collection of interest) being the key one (Abdul-Rahman 2014). The company names customer satisfaction and meeting the needs of the target population as its core mission: “Our mission is to put our customers first by motivating, educating and inspiring them to achieve their goals at each stage of their lives” (National Bank of Abu Dhabi 2017a, para. 6).

Seeing that a rather strong emphasis has been placed on the issue of education, it can be assumed that the firm pursues innovation as one of its goals. However, the said intention is implied rather than explicit since the company does not have an innovation management team. Therefore, NBAD should pay closer attention to the issue of innovation, promoting change as the foundation for success.

NBAD operates in the UAE and global financial markets (market share: 8.2% (National Bank of Abu Dhabi 2017)) and offers an array of services, including risk management, hedging, cash management, investment services, e-commerce-related options, etc. (National Bank of Abu Dhabi 2017b). NBAD employs 10,849 people (‘National Bank of Abu Dhabi’ 2017) and has reached the turnover of AED 15,455,336.70 (‘First Abu Dhabi Bank (NBAD)’ 2017).

Despite the impressive score, the firm has a range of competitors, including the Emirates NBD, the Abu Dhabi Commercial Bank, the First Gulf Bank, etc. (‘Revealed: top 10 banks in the UAE’ 2017). The company’s strategic decisions are made by the Senior Management team.

Innovation Framework, Policies, and Strategies

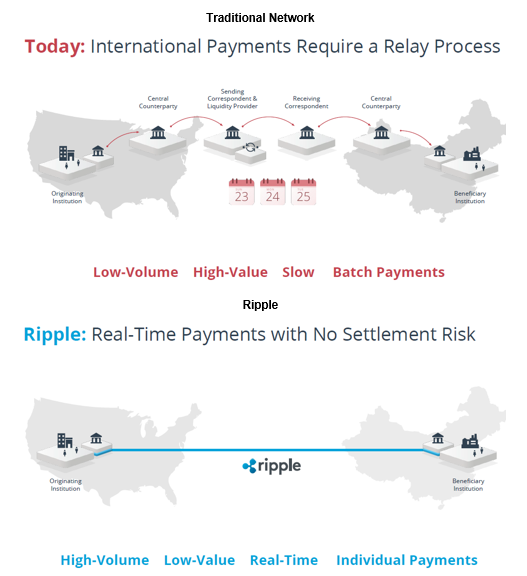

Although NBAD does not spell out its intention to encourage innovation in the context of its environment, it would be wrong to claim that NBAD refuses from using the subject matter as the tool for improving its services and communication. Quite on the contrary, innovation-based strategies are used actively by NBAD. For instance, the unique payment infrastructure that the company uses can be deemed as a huge step in the right direction. Particularly, the Blockchain technology utilized by NBAD allowed creating an entirely new and significantly improved channel for financial transactions carried out by the company’s customers.

The channel creates prerequisites for making the transaction process nearly transparent, with major stages becoming completely visible to the parties involved. As a result, not only does the company offer its clients financial security but it also helps create the framework in which possible errors and issues can be identified at the earliest stages of their development and, thus, prevented or managed successfully (National Bank of Abu Dhabi 2017c).

Named Ripple, the innovation used by NBAD allows attaining high levels of customer satisfaction since the transaction process is improved and simplified significantly because of it. The framework aligns with the company’s mission and corporate philosophy, which revolve around the concept of customer satisfaction and meeting the target population’s needs in a manner as efficient and expeditious as possible.

Furthermore, the focus on quality improvement, which Ripple sets for the organization, can be deemed as essential to the overall progress of the firm. The commercialization of the blockchain that Ripple provides triggers an immediate growth of the company. Furthermore, the innovative tool creates premises for the protection of customers’ rights, particularly, the security and non-disclosure of their data.

As shown on the figure below, the system removes intermediaries from the transaction process, making the latter much safer in terms of data disclosure and, understandably enough, considerably faster. Thus, settlement risks are reduced to a considerable degree.

On the one hand, the system that NBAD has deployed as its innovative practice in managing customers’ needs is rather basic. Indeed, the concept of simplifying the framework of financial transactions in the context of the banking process is hardly new (Xv & Meng 2015). However, there are several characteristics of the framework that make it stand out of the range of similar choices made by rival organizations.

First and most obvious, it performs the task of conducting transactions in the environment of the global financial market in a much safer and more efficient way than any other system currently deployed. The identified concept belongs to the disruptive innovation ilk and, therefore, aligns with the Theory of Disruptive Innovations (TDI) proposed by Clayton M. Christensen (Sultan 2014).

To be more accurate, it helps simplify the process of tending to the customers’ needs, making it more comfortable for the target population and, thus, becoming easily distinguishable from the services that competitors have to offer. Put differently, the emphasis is placed on the enhancement of the product quality rather than rebranding the services to change the target population’s perception thereof. Additionally, the approach suggests that simplicity should be preferred to complexity, which also meets the primary tenets of TDI (Gemici & Alpkan 2015).

Much to NBAD’s credit, even though the company does not make innovations its essential goal, it does its best to sustain the change and make sure that it should be supported and commercialized. It should be noted that the use of the disruptive innovation concept, which NBAD is currently adopting, does not suggest that a sustained innovation should be incorporated into the framework as well.

Indeed, by definition, the concepts of disruptive innovation and a sustained one do not necessarily go hand in hand together. Particularly, in contrast to a disruptive innovation, which is supposed to spark from the concept that is new to the market, the principles of a sustained innovation are deeply rooted in the corporate philosophy and values. Therefore, a sustained innovation implies that the innovative solutions delivered by an organization should be the product of its values. However, it could be argued that the current shift toward applying the Ripple framework to the firm’s transactions is, in fact, the effect of promoting the key corporate values actively.

Indeed, as stressed above, NBAD has been striving to produce the framework that will allow meeting customers’ needs most efficiently so that customer satisfaction levels could increase consistently. Therefore, the innovative approach to conducting financial transactions can be deemed as a result of reinforcing corporate values. Furthermore, the firm has been exploring opportunities to sustain the change by enhancing the importance of teamwork and customer satisfaction.

The focus on increasing customer loyalty levels, which can be considered the primary goal of NBAD, is also the focal point of the innovative approach that the organization has adopted by incorporating the Ripple technology into its framework. Therefore, the organization has been sustaining and developing innovation by promoting key corporate values and enhancing the significance of customer satisfaction. In other words, the approach allows for successful value capture, at the same time complying with the national innovation policies (Dentchev et al. 2016).

Moreover, the fact that fewer transactions are carried out, and fewer parties are involved helps reduce the negative environmental effects (Saad, Su, Marsh & Wu 2015). Consequently, the innovative approach used by NBAD meets the current standards for green innovation and the environmental policies of the UAE, reducing the levels of pollution and environmental damage to a considerable extent with its recent Green Bond approach (Ali, Abbas & Mazin 2017; National Bank of Abu Dhabi 2017d).

Recommendations

As stressed above, the current mission and vision of NBAD do not seem to focus on the issue of innovation extensively. One might argue that the identified characteristic of the organization is a significant flaw in its design. However, the fact that innovation remains an important part of the company’s design even though it is not mentioned directly in the mission and vision statements shows that NBAD’s operations are rooted deeply in the concept of innovation.

In other words, the phenomenon is an intrinsic element of the firm’s functioning, and the two cannot be separated from each other. The said approach toward developing innovation (i.e., incorporating it into the very design of the organization and allowing innovations to evolve and grow together with the firm) is what truly fascinates me.

Furthermore, NBAD is pushing the envelope of supporting and managing innovation since it incorporates the latest technological tools to make sure that the suggested innovative solutions should be in consistently working conditions. The use of the latest IT solutions creates a completely secure environment for the customers, therefore, addressing one of the most topical issues on the global agenda, i.e., the safety of customers’ data (e.g., the use of CyberSource (CyberSource Corporation 2017)).

Furthermore, the innovations are supported by each other; for instance, the use of the Ripple system is viewed as an integral part of the framework termed as the “Bank in a Box” and used to make the process of accessing the relevant data and carrying out the necessary transactions easy for all customers (Global Intelligence for the CIO 2017). The implementation of the innovations is carried out by promoting cooperation among the staff members and deploying the latest IT tools so that the said services could become available to all customers.

At present, NBAD has been quite successful in promoting innovations. That being said, there are several aspects of its performance that the firm may need to improve to gain even more weight in the global market. Particularly, the change in the organizational values and philosophy by placing a heavier emphasis on the importance of innovation should be viewed as a necessity. Moreover, NBAD should consider the idea of reconsidering its current approach to resources management. Particularly, the principles of sustainability and cost-efficacy should be promoted as the means of improving the firm’s performance.

By investing in the professional growth of the staff members, the company will be able to build a team of competent staff members who will contribute extensively to the further progress of the organization. As a result, the foundation for consistent development can be built. The enhancement of lifelong learning among the employees must become a necessity, and the company must support the employees’ professional growth by offering them courses for increasing the level of their competence and proficiency in the designated areas. As a result, the rapid growth of the organization is expected since NBAD will develop an impressive competitive advantage (i.e., its human resources).

The analysis of the NBAD’s performance and innovative approaches that it adopts has shown that a company needs to develop innovativeness as its essential asset. The incorporation of the latest technologies and the promotion of learning and professional growth among the staff members are some of the opportunities that a company can explore in the global market. By evaluating its assets and weaknesses, an organization will be able to identify the path for its further development and gain the weight that it needs to become valued by the target customers.

Reference List

Abdul-Rahman, Y 2014, The art of Islamic finance and banking: tools and techniques for community-based banking, John Wiley & Sons, Inc., Hoboken, NJ.

Ali, AA, Abbas, K & Mazin, M 2017, ‘Developing a comprehensive taxi strategy for Dubai based on system analysis & structured assessment’, Journal of Transportation Technologies, vol. 7, no. 3, pp. 261-278.

Alison, I 2016, ‘Seven banks kick-off Ripple’s blockchain network including Santander, UBS and UniCredit – “90 more in the pipeline”’, International Business Times. Web.

CyberSource Corporation 2017, National Bank of Abu Dhabi selects CyberSource for secure and streamlined online payment solutions for clients. Web.

Dentchev, N, Baumgartner, R, Dieleman, H, Johannsdottir, L, Jonker, J, Nyberg, T, Rauter, R, Rosano, M, Snihur, Y, Tang, X, & Hoof, BV 2016, ‘Embracing the variety of sustainable business models: social entrepreneurship, corporate intrapreneurship, creativity, innovation, and other approaches to sustainability challenges’, Journal of Cleaner Production, vol. 113, no. 1, pp. 1-4. Web.

‘First Abu Dhabi Bank (NBAD)’ 2017, Mubasher. Web.

Gemici, E & Alpkan, L 2015, ‘Disruptive innovation theory in light of practical implications’, Proceedings of the 2nd Global Conference on Engineering and Technology Management, Chicago, IL, pp. 127-131.

Global Intelligence for the CIO 2017, NBAD: the secret to rapid expansion of IT globally. Web.

National Bank of Abu Dhabi 2017a, About First Abu Dhabi Bank. Web.

National Bank of Abu Dhabi 2017b, Financial markets. Web.

‘National Bank of Abu Dhabi’ 2017, Forbes. Web.

National Bank of Abu Dhabi 2017c, NBAD becomes the 1st bank in MENA to go live on blockchain for real time cross border payments with Ripple. Web.

National Bank of Abu Dhabi 2017d, NBAD launches first Green Bond in the Middle East. Web.

National Bank of Abu Dhabi 2017e, NBAD reports 4Q / FY 2016 results. Web.

‘Revealed: top 10 banks in the UAE’, Gulf Business. Web.

Saad, A, Su, T, Marsh, P & Wu, Z 2015, ‘Investigating environmental management and quality management issues in the Libyan food industry’, British Journal of Economics, Management & Trade, vol. 9, no. 3, pp. 1-16.

Sultan, N 2014, ‘Cloud and moocs: the servitization of it and education’, Review of Enterprise and Management Studies, vol. 1, o. 2, pp. 1-15.

Xv, L & Meng, X 2015, ‘Interference in and ecological strategies to mobile financial services developed by commercial banks’, Open Journal of Social Sciences, vol. 3, no. 1, pp. 194-201.