Abstract

As the national debt continues to increase exponentially, the government is grappling with the challenge by formulating new laws and policies to alleviate the alarming trends of national debt.

Increased borrowing by the treasury, massive retirement of baby boomers, and deficit spending are some of the factors that have caused a considerable increase in the national debt.

Literature review has confirmed that, mandatory social programs, such as Medicare and Social Security, are vital factors that contribute considerably to increase in the national debt.

In this case, the Social Security causes the greatest increase in the national debt because of massive retirement of baby boomers who are the principal beneficiaries.

Furthermore, literature review affirms that, deficit spending by the government contributes to an increase in the national debt. Thus, deficit spending has compelled the government to borrow more funds that are necessary for it to meet its obligations.

A survey conducted has shown that, borrowing, deficit spending, and massive retirement of baby boomers are the three main factors that cause the national debt to increase exponentially.

Data collected from the Treasury effectively illustrated that, bonds, notes, and bills have been increasing proportional to the national debit meaning that, they have causal relationships. In essence, borrowing of funds to cater for deficits have been responsible for the alarming increase in the national debt.

Analysis of secondary data obtained from CBO demonstrated that, deficit spending has been increasing for the last 10 years due to the Congress’ efforts to increase the deficit limit. Ultimately, analysis of data collected from the Social Security has indicated that millions of baby boomers, which are retiring annually, are to blame for the increasing national debt.

Introduction

The national debt is growing at an alarming rate, and this trend predisposes the United States to a financial crisis. According to Elmendorf (2011), under the current laws and policies, budget deficits will continue to increase indefinitely and is predictable that, after a period of ten years, the deficits will be over $17 trillion (p.1).

Increasing national debt, coupled with globalization forces, is posing serious financial crisis to the United States. Therefore, it is imperative that economists should conduct research to determine what causes national debt to increase exponentially and give robust recommendations to alleviate the ever-surging budget deficit.

The Statement of the Problem

The research purpose is to establish whether high levels of deficit spending, continuous borrowing of money and retirement of baby boomers are factors that contribute to the national debt to grow at an alarming rate.

Results of the research are critical, as they will provide ways of alleviating the debt that has continuously increased for the past decades, and is likely to increase if there are no effective interventions.

The sub-problems

1. To investigate whether the national debt is growing due to high levels of deficit spending, as demonstrated by President Obama Pay as You Go Act to control government spending in the Congress.

2. To evaluate if the national debt is growing because the federal government continues to borrow money from foreign countries by selling treasury bills, notes and bonds.

3. To establish whether national debt is growing because many baby boomers are starting to retire, as the government budget on social security account for more than three quarters of the budget.

The hypotheses of the study

- The first hypothesis is that high levels of deficit spending have no direct influence on increased growth of the national debt.

- The second hypothesis is that, increased federal government borrowing from foreign countries has negative effect on the national debt.

- The third hypothesis is that high rate of retirement and baby boomers increase social security expenditure of the federal government and increase the national debt.

The delimitations of the study

- The study will not examine the effectiveness of Pay as You Go Act to control government spending in the Congress.

- The study will not examine the previous levels sales of notes, treasury bills, and bonds for every foreign country.

- The study will not determine the federal government decision to borrow from foreign countries and sale of the bills and bonds.

- The study will be limited to levels of levels of deficit spending, the continuous borrowing of money, and the expenditure on social security.

The assumptions of the study

The first assumption is that, more deficit spending is needed because the Congress is continually increasing the debt ceiling, depending on economic conditions of the United States.

The second assumption is that the federal government will continue to borrow money from foreign countries by selling treasury bills, notes, and bonds. All these assumptions are perceived to have no effect on the outcomes study.

The importance of the study

The consequences of the high levels of deficit spending, the continuous borrowing of money, high expenditure on social security are little known by many people. More than three quarters of the government budget go to social security.

The study is critical because it will give an insight into why the national debt has continuously grown for decades, despite several interventions put in place by the government with a view of suggesting probable solution.

Literature Review

Since the purpose of the research is to establish if treasury borrowing, deficit spending, and massive retirement of baby boomers are responsible for exponential increase in national debt, literature review examines how these have factors have influence national debt.

Literature review attempts to enhance basis of study and gives bearing to the course of research relative to research hypotheses and objectives.

Thus, extensive background information forms the basis of establishing factors that cause national debt to increase. To give a comprehensive view of how borrowing, deficit spending, and retirement of baby boomers influence national debt, literature review explores theoretical, related, and current studies.

Theoretical Studies

According to the dynamic economy theory that elucidates taxation, public spending, and debt, the Congress has responsibility of formulating policies and laws that are essential in management of funds by government. According to the theory, government utilizes budget deficits and surpluses to cushion taxpayers from a rapid increase in tax rates.

Thus, government will operate on deficits when expenditure is exceptionally high and conversely operate on surpluses when expenditure is low.

According to Battaglini and Coate (2007), while proponents assert that the theory restricts politicians from borrowing and spending money inappropriately, opponents argue that, the theory hinders the government from raising taxes when adjusting to spending and revenue shocks (p.25).

Hence, the theory protects citizens from incurring extra tax burden that the government may impose due to budget deficits.

Moreover, dynamic economic theory enables politicians to make appropriate legislations to adjust to changing economic conditions due to local or global factors. Effective legislations are going to guide policy makers in weighing and balancing expenditure and income.

Since the government is more inclined to spending than saving, the theory restricts government from making unnecessary expenditure that may lead to borrowing, and subsequently increase the national debt.

The United States government is experiencing exponential increase in national debt because, policies and laws allow the Congress to recommend borrowing of money, to alleviate budget deficits and enhance smooth provision of essential services in health care system and Social Security.

Battaglini and Coate (2007) assert that, the government can spend more for the interests of public good in times of natural disasters or war (p.2). Therefore, war on terrorism, coupled with disasters such as hurricanes have cost the United States billions of dollars, which add to the national debt.

Usually, the debt of a government increases when it borrows from public finance to run its day-to-day activities, or when it issues money to government accounts such as Medicare and Social Security.

Since economic conditions of the United States have been fluctuating, the government has been operating under intermittent circumstances of surplus and deficits. While budget deficits increase the national debt, budget surpluses decrease the national debt; hence, surpluses help in alleviating the exponential increase, in the national debt.

In times of deficits, treasury may decide to increase the national debt, but the Congress has set statutory limit to restrict haphazard increase in national debt. According to Austin (2008), statutory debt limit gives the Congress powers to regulate federal accounts in accordance with the constitutional mandate of controlling spending (p.5).

Thus, controlling expenditure is one of the ways of mitigating increase in national debt.

Related Studies

Federal Reserve

When a government is operating under deficit, it approaches treasury and borrows money in terms of securities such as bills, notes, and saving bonds. After a given period when securities mature, government has to repay them plus appropriate interests. Usually, bills mature within a year and notes mature within two to ten years while bonds mature after a period of ten years.

Hence, these securities have enabled the United States’ government to operate under deficit budget. Rosen (1994) argues that, factors that increase the national debt are social programs such as Medicare and Social Security programs as well as national defense (p.8).

Although national debt seems to have been increasing with time, the United States has a larger economy that can accommodate and withstand colossal debt.

National debt does not indicate economic capacity of a nation, but rather GDP is a significant parameter. Hence, high GDP of the United States has enabled her to cope with increasing national debt that seems to be crippling economic growth in the face of global recession.

Social Security

Baby boomers consume significant part of Social Security funds; hence, they affect the national debt negatively. According to Nuchler and Sodor (2010), out of over 50 million beneficiaries of the Social Security, retired workers consist of about 64% (p.1).

Projections show that Social Security beneficiaries are increasing gradually due to demographic changes, particularly due to massive retirement of baby boomers.

In late 20th century, beneficiaries of Social Security have been below 30 million, but at the beginning of 21st century, the figure tremendously increased due to massive retirement of baby boomers.

The retirement of baby boomers heralds a phase where there are drastic changes in demography, hence causing significant impact on not only Social Security but also government budget.

National debt is increasing because fiscal policy does not effectively limit the Congress and executive from making unnecessary deficit spending or borrowing.

According to Burman, Rohaly, and Rosenberg (2010), the United States is experiencing serious fiscal challenges because of massive borrowing of funds to stimulate economic growth and finance mandatory programs such as Targeted Asset Relief Program (p.4).

Since national debt is increasing more exponential than economic growth, the United States is thus heading to an economic crisis. In 2009, treasury borrowed about 3 trillion, which formed about 10% of GDP, and increase the national debt to form 50% of GDP, the highest ever since Second World War.

Roubini and Sester (2004) argue that, trend of borrowing exhibited by the United States is not lucrative because it is economically unsustainable in the long run (p.9). Thus, poor fiscal policies are to blame for skyrocketing national debt that is threatening economic stability of the United States.

Increasing national budget reduces the ability of the United States economy to cope with global challenges of the economy such as recession.

In 2009, budget deficit was approximately 10% of GDP, which was the highest ever because of global recession of economy. Economic experts have attributed increasing budget deficit to poor policies and laws that govern fiscal responsibility of government.

Labonte (2010) asserts that, rising life expectancy, retirement of baby boomers and increasing health care costs are factors that are responsible for exponential increase in budget deficits (p.1).

Projections show that Social Security benefits are going to increase from current 4.8% of GDP to 6% of GDP by 2035, and health care costs are going to increase from current 5.3% of GDP to approximately 10% of GDP by 2035.

Increase in budget deficits is going to increase exponentially until when all baby boomers retire, and alleviate budgetary allocation to Social Security benefits.

Projections indicate that current fiscal policy of the United States is unsustainable because of skyrocketing health care costs and Social Security benefits. To cope with the challenge of increasing national debt, the government needs to increase taxes and reduce expenditures.

Adjustment of taxes in advance will significantly alleviate the budget deficits and increase national savings because, it gives individuals ample time to brace themselves for hard economic challenges, by inculcating saving behavior.

Through national savings, government can reduce its national debt by repaying it, buying treasury securities, and boosting businesses.

Labonte (2010) argues that, small adjustment in Social Security benefits such as calculating benefits based on inflation rather than wage growth rate will save the government a terrific deal of money (p.13).

Thus, adjustment of retirement benefits is essential to alleviate the impact of massive retirement of baby boomers, for they cause annual upsurge of budget deficits that have made the United States have a large national debt.

Current Studies

The increasing national debt signals an impending financial crisis, which may cripple the United States’ economy if appropriate policies and laws are not in place to reverse the alarming trends of the budget deficit.

It is predictable that, by the year 2020, the rising health care costs, and population aging will place an extra burden on the budget that is already running on deficits.

Such prediction has triggered the United States’ government to formulate new policies and laws, which are critical in curbing the increasing budget deficits and the overall national debt.

According to the Congressional Budget Office (CBO), so long as there are no appropriate changes in current laws and policies, there will be persistence of imbalance between spending and revenues because health care costs are increasing while baby boomers begin to tap their federal benefits.

Elmendorf (2011) argues that, CBO projections show that budget deficits will increase from current 10% of GDP to about 16% of GDP in the next 25 years because of increased spending on mandatory health care programs and Social Security (p.3).

Thus, since baby boomers form a significant part of the population, it is plausible that their benefits cost a whopping deal of budget, and thus significantly influence budget deficit.

Given that, mandatory health care programs and Social Security benefits are factors that increase the budget deficit and subsequently increase the national debt via borrowing; these factors need review to alleviate their impact on the national budget.

Medicare and Social Security are mandatory programs that take a significant amount of the national budget, thus causing an increase in the budget deficit annually.

According to Elmendorf (2011), to reduce spending on Social Security, the government needs to use a new measure of inflation because it will significantly decrease mandatory spending by approximately $6 billion by 2016 and $billion by 2021 (p.56).

A new measure of inflation is going to correct overstatement of the inflation rate, and thus save billions that will alleviate national debt.

Economic experts argue that, the United States is yet to face dire financial crisis, since national debt has doubled within a short period of 8 years. Increasing the rate of the national budget is quite alarming because, it depicts impending economic crisis that is likely to strike within a short period of years to come.

Clemmitt (2008) argues that, the Bush administration caused larger annual budget deficits, and restricted government from implementing critical policies and laws to avert financial crisis (p.938).

Currently, budget deficits and global economic crisis is making the United States susceptible to catastrophic economic crisis. Thus, increasing national budget is posing serious economic threat to sustainable growth of the United States’ economy.

Major economic challenges that most countries are grappling with are regulation of revenues and expenditure, and increasing Gross Domestic Product (GDP) as a means of promoting sustainable economic growth.

The current president, Barrack Obama, has an absolute responsibility of ensuring that new policies and laws are in place to mitigate the increasing trends of the budget deficits, which have perplexed the Congress.

In view of increasing national debt, Obama is in a dilemma whether to use tax and revenues or borrow more money to bolster and stimulate economic growth. According to Clemmitt (2008), when a government operates in deficit mode and depends on borrowing, it will increase interest rates of treasury securities that it offers (p.941).

High interest rate on treasury securities will scare private businesspersons from borrowing, which subsequently slows down economic growth. Therefore, for the government to operate effectively, it has to borrow more money to cater for deficiency in the national budget, hence, causing exponential increase in the national budget.

From 1950s to 2008, budget deficit has been increasing gradually from 0.7% of GDP to current 4.3% of GDP. According to Conetta and Knight (2010), budgetary allocation of funds to Social Security, Medicaid and Medicare increased significantly by 55.9% while defense expenditure decreased by 3.8% (p.4).

This means that baby boomers have caused Social Security benefits to increase tremendously. Hence, baby boomers are not only causing demographic changes in the United States, but also economic changes because they have considerable impact on Social Security.

Moreover, exponential increase in interest payments implies that current economic crisis coupled with retirement of baby boomers is going to increase the national debt because Social Security benefits will increase proportionately.

Hence, it is predictable that increasing national debt is an economic burden that is going to elicit serious political contention regarding expenditure, Social Security benefits and borrowing of money.

Methodology

The Research Purpose

The purpose of the research is to establish if the high levels of deficit spending, the continuous borrowing of money, and the retirements of baby boomers are factors that contribute to the national debt grow at an alarming rate.

To achieve this purpose, the research conducted a survey by collecting secondary data from Treasury, Social Security, and Congress Budget Office (CBO).

Quantitative research is appropriate because the research objective is to ascertain the extent to which deficit spending, borrowing of money and retirement of baby boomers influence national budget.

Treasury, Social Security, and CBO provide firsthand data that is relevant for research since they have all records regarding borrowing, spending and retirement of baby boomers. Therefore, collection of secondary data provides a robust data that is critical for understanding how borrowing, retirement, and spending contribute to the national debt.

Procedure for Data Collection

The research entailed collection of secondary data from CBO, Treasury, and Social Security. To ascertain if the national debt is growing because of deficit spending as illustrated by Pay as You Go Act to control government spending by the Congress, the research collected secondary data from CBO, which provide how the Congress recommends deficit spending to enable government pursue its obligations in spite of deficit budget.

The researchers examined how the Congress has been regulating the deficit spending for the last 10 years, and collected relevant figures for statistical analysis to establish if the deficit spending forms a significant part of the national debt.

Moreover, since Treasury is responsible for borrowing funds, researchers examined trends of issuing securities and collected relevant data for further statistical analysis.

Researchers collected Treasury data of issuing securities such as bonds, notes, and bills, to give a comprehensive view of how borrowing of money may have considerably contributed to increasing national debt.

Regarding the massive retirement of baby boomers, researchers explored the Social Security records and obtained appropriate data, which shows the number of baby boomers retiring and their respective benefits. Trends of retiring for the last 10 years depict whether baby boomers have been increasing exponentially or have been relatively constant over time.

Sampling of Data

To ascertain how borrowing, deficit spending, and retirement of baby boomers influence national debt, the research conducted a survey that involved collection of secondary data from CBO, Treasury, and Social Security.

Secondary data is relevant because it is easily accessible and robust for statistical analysis of national debt trends for a given period. Secondary data from CBO provide appropriate data that show how the Congress recommends deficit spending to enable government run its activities.

Since the Congress has powers to limit spending on the part of government, CBO has robust data that reflect the extent of deficit spending.

Treasury provides secondary data regarding borrowing of money using bills, notes, and bonds that the government issues to raise deficient funds to enable it to conduct its obligations. Trends and extent of issuing bonds, notes, and bills reflect how Treasury by treasury contributes to the national debt by borrowing.

Ultimately, secondary data from Social Security provide significant information regarding the number of baby boomers retiring and amount of money that they get as benefits.

Hence, secondary data from Social Security is particularly valuable because retirement of baby boomers has caused a considerable increase in national debt as government give significant portion of its budget to Social Security.

Data Analysis

To determine whether borrowing, deficit spending and massive retirement of baby boomers are considerably responsible for the increase in national debt, the research analyzed collected data using Statistical Package for Social Sciences (SPSS).

The researchers analyzed secondary data collected differentially to determine whether each one of the hypothesized factors contributes to an exponential increase in national debit.

Given that the first hypothesis states that high levels of deficit spending do not influence the growth of national debt directly, the research examined trends of deficit spending for the last 10 years as they occur in CBO records, and analyzed their variability over this period.

To prove the second hypothesis, which states that increased borrowing by the federal government impact negatively on the national debt, the research analyzed Treasury records that show trends of issuing bonds, notes and bills.

Analysis of data to depict trends of borrowing is essential in deriving relationship between national debt and borrowing within a period of 10 years, 2001 to 2011.

To test a third hypothesis that states that massive retirement of baby boomers has contributed to increase in national debt, the research analyzed data collected from Social Security by determining the number of baby boomers retired and amount of money they receive from government annually. Overall, the research conducted a comparative analysis of the three factors to ascertain their consistency with national debt.

Findings

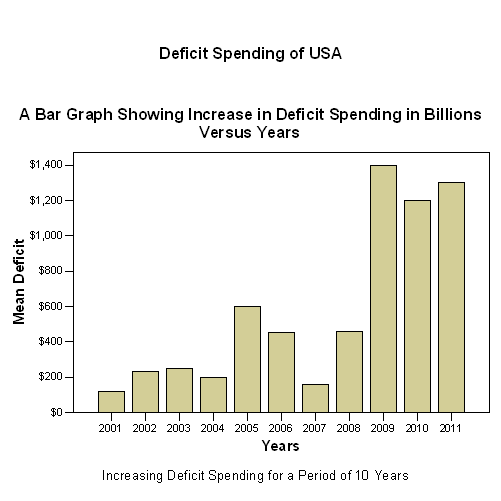

Analysis of secondary data obtained from CBO showed that trends of deficit spending are consistent with trends of national debt for the last 10 years. The correlation between the deficit spending with the national debt means that, the deficit spending increases the national debt.

Given that the Congress has the mandate to regulate deficit spending, in 2009 when there was global economic recession, the government increased its deficit spending that reached over $1400 billion from about $250 billion in 2008.

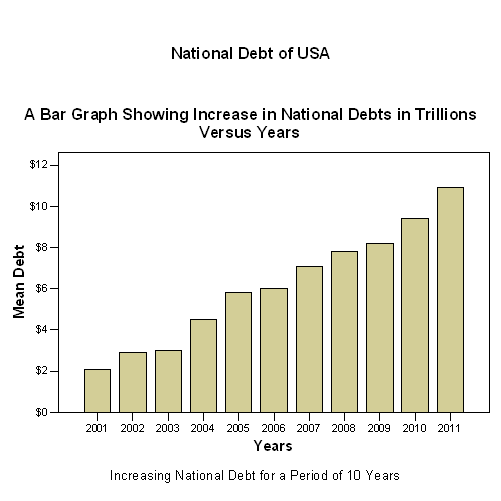

Hence, concomitant increase of national debt and deficit spending implies that they have causal relationships. In a bar graph illustration, (see Graph 1); national debt has been increasing for the last 10 years that the research examined.

The bar graph shows that the national debt has been increasing for the last 10 years and is consistent with deficit spending depicted in a graph (see Graph 2). Critical analysis of deficit spending shows that it relates with trends of national debt. Hence, it is reasonable to state that deficit spending contributed significantly to the national debt in the last 10 years.

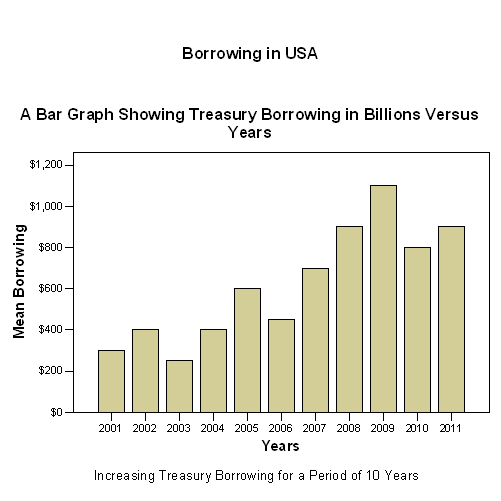

Bar Graph (see Graph 3) depicts trends in borrowing by Treasury using bonds, notes, and bills. Comparatively, the trend is consistent with that of national debt, meaning that borrowing has been cumulatively contributing to increase in national debt in previous 10 years.

Usually, when government experiences deficit in its budget, it order Treasury to issue more bills, bonds, and notes to obtain more funds. Thus, borrowing by Treasury is a significant factor that increases the national debt in spite of debt limit because the Congress has been continually increasing the debt ceiling.

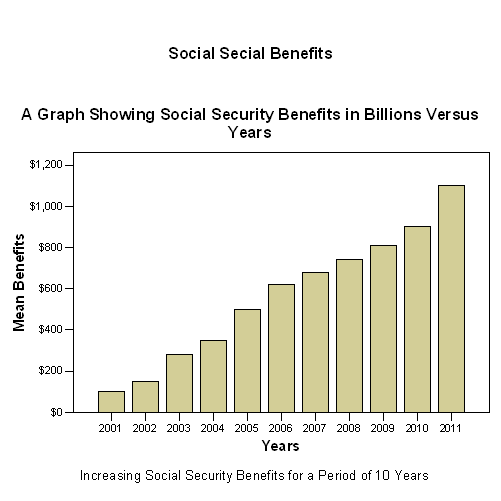

Analysis of Social Security benefits show that they are increasing exponentially, (see Graph 4). Increasing trends of Social Security benefits imply that demographic changes have contributed to a significant increase in benefits.

Specifically, baby boomers have caused drastic increase in benefits in 2011 because they form over half of beneficiaries in Social Security. Thus, research affirmed that baby boomers are responsible for drastic increase in national debt because Social Security borrows funds from government to compensate for increasing beneficiaries.

Implications of the Findings

Research findings are consistent with earlier studies, which have proved that extensive borrowing, massive retirement of baby boomers and deficit spending are factors that have caused exponential increase in national debt for decades.

Since national debt has been increasing, the research established that the government has been concomitantly increasing its borrowing rates to enable it to perform its obligations.

Trends of borrowings have been consistent with an increase in national debt, which implies that borrowing is a factor that significantly determines trends of national debt. According to Austin (2008), increasing national debt has compelled the Congress to formulate laws and policies, which empower it to regulate deficits and surpluses in the budget by borrowing (p.12).

Hence, currently, the Congress has a constitutional mandate of ensuring that the government does not spend too much money than it generates to avert impending economic crisis due effects of increased national debt. Excessive spending predisposes government to rely on borrowing, which is unhealthy for economic growth.

Moreover, the research findings did indicate that, the massive retirement of baby boomers demands significant part of Social Security funds; hence, the government has to contribute extra money from its annual budget to cater for the increasing benefits.

Research established that the national debt has been increasing proportionately as Social Security benefits. According to Nuchler and Sodor (2010), about 30 million baby boomers are beneficiaries of the Social Security, and they form about 64% of total beneficiaries (p.1).

Hence, high numbers of baby boomers who are beginning to retire are to blame for skyrocketing benefits and national debt. Furthermore, government also is responsible for increasing national debt because of deficit spending.

The research findings showed that, increasing national debt correlates with deficit spending, meaning that, the government continues to spend more funds in spite of operating in deficit.

Therefore, to alleviate increasing national debt, government needs to formulate stringent policies and laws that will effectively enhance regulation of deficit spending, borrowing, and massive retirement of baby boomers.

Conclusion

The research findings have effectively demonstrated that deficit spending, extensive borrowing, and massive retirement of baby boomers are significant factors that have been increasing national debt.

The research findings have rejected the first hypothesis, which states that high levels of deficit spending have no direct influence on the national debt because deficit spending increases concomitantly as the national debt.

Regarding the second hypothesis, the research findings revealed that Treasury borrowing increases the national debt, hence acceptance of the hypothesis.

Likewise, the research findings accepted the second hypothesis, which states that the massive retirement of baby boomers has increased Social Security expenditure, hence national debt.

In view of these findings, further research is necessary to determine the extent to which each factor contributes to the national debt and ways on how government can alleviate exponential increase of national debt.

Thus, to reverse trends of increasing national debt, government needs to formulate policies and laws that target borrowing, deficit spending, and retirement of baby boomers.

References

Austin, A. (2008). The Debt Limit: History and Recent Increases. Congressional Research Service, 1-20.

In the article, Austin examines the history of federal debt in terms of evolution and its regulation mechanism. He examines the historical evolution of national debt and how the Congress gained constitutional mandate of regulating government expenditure.

Austin asserts that statutory limit empowers the Congress to regulate budget, hence determine the amount of deficits and surpluses of budget.

Battaglini, M., & Coate, S. (2007). A Dynamic Theory of Public Spending, Taxation and Debt. Department of Economics; Princeton University, 1-58.

The article examines how dynamic economy theory influences how the government spends tax and manages debt. In the article, Battaglini and Coate assert that, politics play a central role in determining taxation and expenditure of national income.

Thus, they recommend that appropriate policies need to be in place to deter politicians from making unnecessary expenditure, taxation, and borrowing of money.

Burman, C., Rohaly, J., & Rosenberg, J. (2010). Catastrophic Failure. Urban Institute, Tax Policy Center, 1-37.

The authors are arguing that the United States fiscal policy is exceptionally poor since it allows national debt to continue indefinitely. Government through executive and Congress can change debt limit depending on prevailing economic conditions.

They assert that increasing national debt is posing catastrophic economic repercussions that the United States may find it difficult to manage. In conclusion, they caution that citizens need to brace themselves for tough economic times caused by increasing national debt.

Clemmitt, M. (2008). The National Debt. Congressional Quarterly Researcher, 18(40), 937-960.

In the article, Clemmitt is asserting that the greatest threat to the United States is not terrorism but fiscal responsibility of government.

Clemmitt is blaming the government by having poor policies and laws that allow it to spend more money that it can generate, hence, causing exponential increase in the national budget.

Clemmitt concurs that cumulative federal budget deficits and skyrocketing Social Security and health care costs are causing national budget to increase exponentially.

Conetta, C., & Knight, C. (2010). The President’s Dilemma Deficits, Debt, and US Defense Spending. Project on Defense Alternatives, Commonwealth Institute, 1-8.

Conetta and Knight examine how deficits, debts and spending have become central to president Barrack Obama’s policies in managing exponential increase in national debt and budget deficit.

They site that although expenditure on defense has decreased considerably, they agree that Social Security benefits and health care costs have increased significantly, hence causing unprecedented increase in national debt.

Elmendorf, D. (2011). Reducing the Deficit: Spending and Revenue Options. Congressional Budget Office, 1-240.

Elmendorf is a director of Congressional Budget Office, which is responsible for advising federal lawmakers regarding implications of policies and laws on budget. The article, Reducing the Deficit: Spending and Revenue

Options, focused on ways in which Congress can make significant amendments in laws and policies to alleviate budget deficit through spending and revenue options. The article indicates that mandatory spending options on health care programs and Social Security benefits need adjustments to reduce the budget deficit.

Labonte, M. (2010). The Economic Implications of the Long-Term Federal Budget Outlook. Congressional Research Service, 1-31.

Labonte argues that the national debt is going to increase because of unsustainable fiscal policy of the United States. He argues that, effective fiscal policy needs to look into mandatory spending on health care programs and Social Security benefits, and make relevant adjustments to enhance sustainability.

The article also indicates that baby boomers have caused unprecedented increase in Social Security benefits and significantly increased national debt.

Nuchler, N., & Sodor, G. (2010). Social Security: The Trust Fund. Congressional Research Service, 1-19.

Nuchler and Sodor are describing how Social Security obtains funds, and serves its beneficiaries who have increased with time, now totaling over 50 million. In the article, they explain how government interacts with Social Security in ensuring that its beneficiaries receive their benefits in due course and improve their welfare in society.

They also assert that the government has an obligation of investing in Social Security by borrowing money from public and treasury.

Rosen, D. (1994). Understanding the Federal Debt and Deficit. Federal Reserve Bank, 1-23.

In the article, Rosen extensively explores how debt and deficit occurs in a government by attempting to answer crucial questions that relate to the national debt. Rosen explains how governments are managing the challenge of the budget deficit by issuing securities such as notes, bonds, and bills to enable it run its activities.

Eventually, he explains how Congress participates in regulation of national debt by assessing proposed budget to regulate spending.

Roubini, N., & Sester, B. (2004). The US as a Net Debtor: The Sustainability of The US External Imbalances. Global Economic Governance Programme, 1-65.

Roubini and Sester examine how national debt influences trading capacity of the United States in world trade. They argue that increasing national debt is going to weaken the United States’ economy and trading capacity.

Hence, Roubini and Sester are predicting that, the trade deficit, which is a consequence of national debt, is going to reduce GDP.