Executive Summary

Sony is going to start a new business in Saudi Arabia as a part of its brand expansion. However, the purpose of this paper is to discuss the background of the company, internal strengths and weaknesses, external opportunities and threats of the new projects of Sony and Michael Porter’s Five Generic Strategies and environmental situation analysis.

Introduction

Sony Corporation was formed in 1946 with center of operations in Japan and this company is the world’s largest media conglomerate, one of the biggest manufacturers of the electronics items and worldwide top 20 semiconductors leader of sales, which generates revenue by more than ¥7,214.0 billion.

Moreover, Sony uses complicated organizational structure in order to control the functions of its outlets and according to the structure, Howard Stringer is the chairperson, CEO, and head of company amongst delegate business decision-making officials of Sony, whilst Ryoji-Chubachi is the vice-chairman, Kazuo-Hirai is the administrative deputy-president, etc.

Company Background

Before starting a new telecommunication business in Saudi Arabia, it is important for Sony to focus on its current position and background to help the concerned strategy makers to designate the way in which it would be best for the company to accomplish its new business project. In order to do so, it is necessary to consider its financial position, product lines, competitive forces, as well as the performance of Sony in stock market.

It is arguable that the firm has categorized into seven major production departments, as the main manufactured items of the firm comprises auditory, video, TV, ICT devices, electrical apparatuses, and semi conductors; the following table shows the five years financial overview generated by each of the production departments of the firm for a better understanding of its financial background –

Table 1: Financial Overview of Sony Corporation.

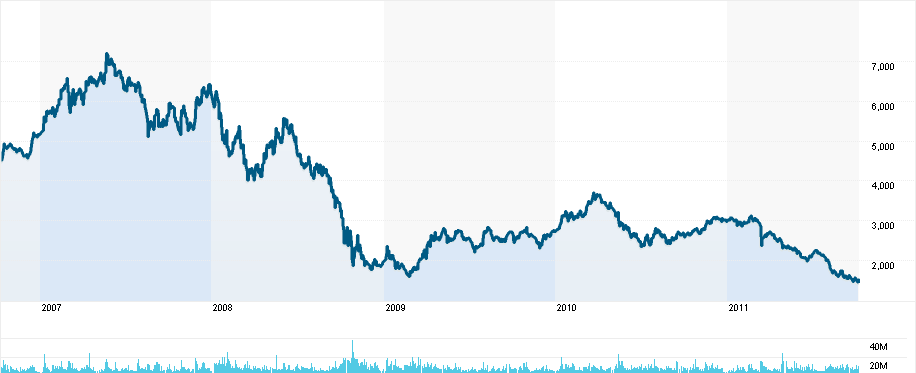

As shown in the figure below, the business has suffered awfully during the global financial crisis due to the reason that the demand fell tremendously. Although the business possesses a strong financial background as discussed above, this crisis put a great adverse impact over the company.

However, although the business started recovering from the very beginning of 2010, the recent creeping inflation, and the slight presence of recession that started from September 2011, has again caused a sudden drop on the share prices of the business, which is going below gradually –

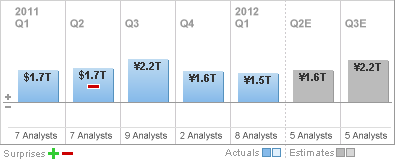

According to Bloomberg Businessweek (2011), Sony Corporation disclosed its estimated first quarter report in September 2011 and the graph below shows that the quarterly turnovers are not as impressive as it was supposed to be owing to the size and business structure of Sony as the expected quarterly revenues are $1.5 trillion, which prepared by the eight analysts.

However, these turnovers are quite lower than the last financial year by about 5.4 percent, which means that the new stroke of the recession has already started to hit the firm’s revenues once again like 2008 –

The Mission and Vision of Sony Corporation

Dogruer, Ferzly, and Nguyen (2001) argues that the company’s mission is to build up a broad-range of innovative-products and multimedia services that can assure consumers’ access to let them enjoy digital entertainment by making sure synergy between segments within the group; so, Sony’s aim is to create new worlds of entertainment continuously that can be present on variously assorted arenas.

According to Sony Corporation (2011), the company’s vision is to generate thrillingly new-fangled digital pursuit experiences for customers by bringing collectively forward-looking products with generation of latest contents and services; the main focus is to strengthen Sony’s much repeated electronics business and preserve market leadership in high profile areas such as TVs, digital imaging, home video equipment, and transportable audio.

Sony’s visions connect the entire firm; it aims to experience the ecstasy of progressing by applying technology for assistance of community, endorse education of science amongst people, reconstruct Japan, and to raise the country’s traditions through vibrant scientific and manufacturing actions, direct all workers in every segment along trails that escort to pioneering and exciting ways to enhance the world.

Moreover, as Sony’s new vision is to start a new business in Saudi Arabia concerning telecommunication services, it would start to focus on developing the networking of the country by expending more on the research and development department in order to bring up new technologies that Saudi Arabians have never ever experienced before.

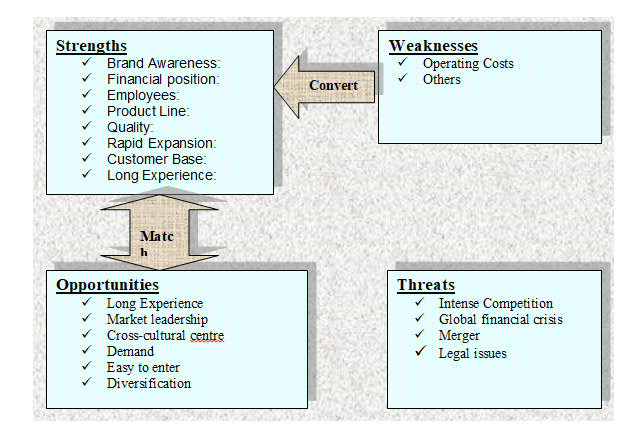

SWOT Analysis of Sony’s New Business

Strengths

Brand Awareness: Sony’s brand image has great influence on the global customers, which always help this company to diversify product line and expand its business in new marketplace.

Employees: This Company has more than 168,200 employees who are working with team spirit to face any challenge in the competitive market and to increase loyal customer base in global market. However, the experience of the workforce would assist the management of Sony to introduce telecommunication services in Saudi Arabia.

Financial position: according to 2010 income statements, it generated consolidated-sales and operating income of ¥7,181,300m, which indicates this Company has enough financial capabilities to establish telecommunication network in Saudi Arabia; however, the subsequent table shows the financial capabilities of SONY –

Table 2: Financial information of Sony.

Technology: This is one of the most important factors for Sony, as the company needs to upgrade product line and services considering market demand as well as competitors’ product range. However, the marketers of new business plan would like to capture the Saudi market by offering different value added telecommunication services and strong strategic network of vendors by developing technology; so, they would invest large amount for technological advancement to ensure the best telecommunication services.

Quality: Sony provides highest efforts on quality products and it has considered an icon for high quality products, so, the customers of global market are highly satisfied with this brand, for example, Sony television and other electronics successfully captured about 22% shares of the European market in 2009 and retail sales revenue from such electronics products were approximately £10.0 bn.

Rapid Expansion: According to the annual report 2010 of this company, Sony experienced huge success in case of global expansion because of quality, price of the products, marketing strategies, human resource plan, strong leadership, and so on. Thus, business expansion and new product developments are the key strategies of Sony that inspire the company to offer telecommunication services in the Saudi Arabia as this country provides some facilities to the foreign companies to enter this market.

Corporate Governance: the Board members of Sony maintain corporate governance system with high degree of compliance with general norms of corporate practice and pay care to the local legislation, follow Companies Act 2006 and the guidance of the recommendations of the reports and so on.

Corporate Social Responsibility (CSR): In addition, the CSR practices of the company would help the company operate its telecommunication services in KSA as it has a significant level of budgetary involvement for development of CSR policy and practice.

Customer Base: However, the strong base of loyal customers has turned as competitive advantage of the company and the existing customer base is gradually increasing, which would be core competence in Saudi market in order to develop its telecommunication services.

Weakness

Operating costs: Under the pressure of adverse economic position, the risk of high operating costs can be one of the major weak points for Sony’s new business while business expansion in the foreign country is a costly process.

Others: the external environment of the business, pricing, and availability of products and services for all sorts of customers, relatively small budget for promotional activities, and expatriates management are the weak points to operate Saudi Market.

Opportunities

Long Experience: Sony has long experience to continue its journey with remarkable footprint in the market, as this company was established in 1946 and become market leader of electronic market in EU zone.

Market leadership: At the same time, Sony is also popular to the customers of Asian Countries and it has enough financial capabilities to expand its market with new products and it has the opportunity to be the market leader within the target period; thus, it would be able to capture a significant part of market share of Saudi Telecommunication industry.

Cross-cultural centre: As a large multinational company, this company has opportunity to increase its brand awareness in Saudi market by adopting effective strategies, using capital more efficiently, and providing special facilities to the expatriates.

Demand: Telecommunication is a prospective sector of Saudi Arabia as numbers of subscribers of both local and foreign telecommunication companies are rapidly increasing here, for instance, Etihad Etisalat Company (Mobily) attracted more than 17.0 million subscribers within six months of its operation.

Easy to enter: Saudi Arabia is now member of World Tread Organization, which gives the opportunity to the multinationals to enter this market easily by applying any entry mode strategies, such as, joint venture or partnership; therefore, Sony has scope to joint venture with any renowned telecommunication company like Saudi Telecom Company (STC).

Diversification: According to the annual report 2010 of Sony Corporation, it is highly diversified company and it diversified its products both vertically and horizontally; consequently, new business project of Sony has scope to increase integrate profits within very short period.

Threats

Competitors: The existence of strong competitors in this market are one of the main threats for Sony Corporation while the competitors offer networking, internet and telecommunication services at lower price and use effective strategies considering their local culture. However, Saudi Telecom Company (STC), Arabian Internet & Communication Services, and Etihad Etisalat Company (Mobily) are the market leaders, those offer landlines, mobile phone, and internet service and so on.

Global Financial Crisis: It has huge financial risks to invest large fund in economic downturn and unstable market; therefore, the Board of Directors of Sony may not pass the investment plan, which would design to introduce telecommunication service in Saudi Arabia.

Merger: Merger with foreign companies may also subject of financial risks and it can destroy the image and originality of the product line of the parent company; therefore, it can fail to capture expected market share due to high competition and cultural gap.

Legal issues: Multinational companies are not interested to operate their business in Saudi Market due to frequent change of regulation and strict Islamic law, as it increases the costs to mitigate legal claims.

In addition, multinational companies like Coca-cola, Starbucks, and Sony Corporation pointed out that it is difficult for the company to practice their key values and corporate codes in KSA, for instance, Coca-cola experienced problem to promote products, Starbucks complained against the strict law for women and Sony ensured equal opportunities for all but here it is not possible to practice.

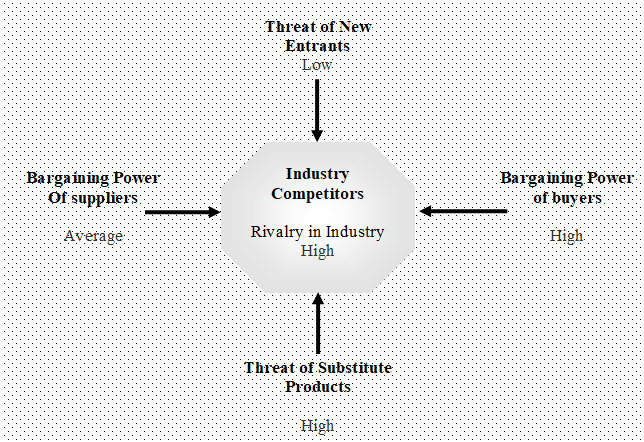

Porter’s Five Forces or Micro Environment Analysis of Sony

Threat of New Entrants: Threat of New Entrants is very low because of large investment required to enter telecommunication industry and it is difficult for any company to follow the rules and regulations of Saudi Arabia at initial stage. However, well-established multinational companies enter this prospective market by using several entry route strategies, such as they apply Joint Venture strategy to share competitive advantage and resources of other company;

Bargaining Power of Customers: This power is relatively high in Saudi telecommunication sector as the customers are highly concern about the price of the products along with the quality of the telecommunication service; therefore, most of the Telecommunication service providers in Saudi Arabia try to offer quality service at low price.

As a result, the switching off costs become too low to purchase the products of another company while the purchasing power of the Saudi Arabian customers are too high, therefore, the concept of customer loyalty is totally absent in the telecommunication industry of KSA. However, figure four shows Porter’s five forces

Bargaining Power of Suppliers: According to the report of telecommunication service providers in Saudi Arabia, the bargaining power of the suppliers is moderately high. However, technological support providers, machinery suppliers, and other raw material suppliers are the key suppliers in the telecommunication industry; therefore, Sony needs to maintain good relationship with the suppliers by imputing flexible provisions in the agreement and clearing dues on time.

Threat of Substitutes: At present, the bargaining power of substitute products is too high in telecommunication industry, for instance, the customer can contact using e-mail service and can talk using Yahoo messengers, Google messengers, skype and so on. As a result, the importance of telephone for communication has reduced slowly, but this company can experience lose if the customers become more familiar with the services of substitute products.

Competitive Rivalry: The competition among existing companies is extremely high as market leader of Saudi Telecommunication industry was losing market share due to high competitive market and new entrants; however, the following tables show the Financial Overview of STC and Mobily to compare the position of an old and a new company in this industry.

Table 3: Financial Overview of STC.

Table 4: Financial Overview of Mobily.

Porter’s Generic Strategies for Sony’s New Telecommunications Business

In order to start a new telecommunication business in Saudi Arabia, it is essential for Sony Corporation to identify a suitable strategy through which it would be able to compete more aggressively in the extensive rivalry on the telecommunication sector of Saudi Arabia.

The following table shows three generic strategies introduced by Michael Porter, which would help the firm’s strategy makers to decide which one of these would suit the firm best to inaugurate the new business and bring about success at the very beginning of penetrating the market. The explanations of the generic strategies are given below to help the firm in making the decision about the choice of the initial market entry strategy-

Table 5: Porter’s Generic Strategies for New Telecommunications Business.

In cost leadership, Sony will have to become the lowest cost producer in telecommunications business industry; the sources of cost advantage would vary depending on the structure of the industry in KSA; this may include pursuit of economies of scale, proprietary-technology, preferential-access to raw-materials and other factors; a low cost producer must find and exploit all sources of cost advantage.

If Sony can attain and prolong general cost leadership, then it will be an above-average player in its industry, provided it can command prices at or near the industry-average; with this strategy, the objective is to become the lowest-cost manufacturer in the industry; many (perhaps all) market fragments in the industry are supplied with the importance placed to minimize costs.

If the attained selling charge is at least alike (or close to) the average of the market, then the cheapest manufacturer would get pleasure from the best profits; however, this strategy is frequently connected with all-encompassing companies offering “standard” items with comparatively small differentiations that are absolutely satisfactory to the majority of consumers; moreover, this strategy further increases market share.

In differentiation strategy, firms try to be idiosyncratic in the market for several characteristics that have extensively appreciated by buyers; they choose features that many purchasers distinguish as noteworthy, and so exclusively position the business to meet those needs; additionally, they are rewarded for its uniqueness with a premium price; however, clear reasons to prefer the product should be present. This strategy comprises choosing one or more principles used by buyers in a market – and then positioning the business exceptionally to meet those criteria; it is usually allied with indicting a premium price for the item habitually to mirror the superior production costs and additional value-added features provided for the consumers; differentiation more than covers the additional production costs.

Focus strategy rests on the alternative of contracted competitive scope within an industry, as the focuser selects a section or group of segments in the market and tailors its strategy to serving them to the segregation of others; the focus strategy has two alternatives – cost and differentiation focus; in cost focus firm seeks cost advantage in its target segment.

Here, a business seeks a lower cost advantage just in or on a little number of market sections; moreover, the manufactured goods would be fundamental – possibly a comparable item for consumption to the higher priced and attributed market leader, but satisfactory to adequate customers; such items for consumptions are often called “me too” items; this often exploits differences in cost-behavior.

Conversely, through differentiation focus, firms create differentiation in their intended fragment; both alternates of the focus strategy rest on dissimilarities amid a focuser’s intended fragments and other sections in the market; intended fragments should either possess purchasers with atypical needs or else production and delivery system that best serves the intended fragment should differ from that of other industry segments.

Differentiation focus exploits the special needs of buyers in certain niche segments, where a firm creates competitive advantage through demarcation within the niche or section; however, some possible troubles exist with the niche approach; for example, small, dedicated niches could depart in the long-term.

Best Fitting Strategy for Sony’s New Telecommunication Business

As discussed above, in cost leadership, producers offer goods, which are very common or similar to those of the rivals’; therefore, they try to charge lower prices to compete in the market. Moreover, little or no distinction has noticed in the items for sale those are offered by the cost leader and its competitors. In addition, being a successful cost leader is only possible when the production costs of the items has kept substantially lower than the other players in the market; besides, it is also important for the firm to ensure that it operates in economies of scale.

It is significant to note that like most of the other products and services that Sony offers, its new telecommunications business would be differentiated as well, possessing a rage of different features that other telecommunication businesses in Saudi Arabia cannot afford with the outdated technological instruments.

In this context because of using the latest technological tools and hi- tech amenities that are specially designed by the research and development team of the company, where massive expenditures were carried out owing to facilitate innovative idea regarding ICT and telecommunications, it is quite natural for the firm that it cannot put its production costs at very lower level. This indicates that because of very costly production process and highly differentiated services that possess a wide variety of new features which any other Saudi Arabian telecom firm may not offer so easily, cost leadership is not at a suitable generic strategy for Sony’s new business.

On the other hand, it is notable to argue that Sony always aim its products and services to mass people, and it always perceives the idea that its innovation is not for any particular group or ethnic origin, rather, for the entire humanity on the planet. Owing to this vision of the corporation, it is usual that the new telecom business that it is commencing would not necessarily be for any niche in the market, but for all the Saudi Arabians who would love to take the opportunity from this awesome technological advancement of ICT and telecommunications.

For this rationale, the “focus” strategy will also not be the best generic tactic for this business to follow. Under this circumstance because of high production costs, extreme differentiations, and much consideration given to mass consumer base, it would be best for the company to go for differentiation strategy to start its new telecom business.

Assessment of the Differentiation Strategy in Unpredictable Environment

Differentiation strategy is not only the most suitable tactic for Sony to enter the telecom sector, but rather, a sustained differentiation would mean that under unpredictable environment, the sales of its telecom services would not get lower. Unpredictable environment may include declining demand that results from falling purchasing power of the customer and recession.

If the recent creeping-inflation throughout the globe together with the slight presence of recession that started from September 2011 may cause a massive fall of demand in the future, therefore, highly differentiated services mean, the service would turn out to be a necessity for people, where falling purchasing power would have little impact because of the “inelasticity” that it offers.

Conclusion

As discussed throughout the paper, it is prospective for Sony to start a new business in KSA. However, the decision makers should consider all sides of this investment, together with risks, weaknesses, and the strategic fits before starting the business.

Reference List

Bloomberg Businessweek (2011). Earnings & Estimates Summary – SONY CORP-SPONSORED ADR (SNE). Web.

Bloomberg Businessweek (2011). Sony Corp-Sponsored ADR (SNE: New York). Web.

Dogruer, B., Ferzly, M., & Nguyen, H. (2001). Report on Sony Corporation. Web.

Mobily (2010) Consolidated Financial Statements and Auditors’ Report for the Year Ended December 31, 2010. Web.

Reuters (2011). Sony Corp (6758.T). Web.

Sony Corporation (2010) Annual Report 2010 of Sony Corporation. Web.

Sony Corporation (2011). Company Profile. Web.

STC (2010) Consolidated Financial Statements for the Year Ended December 31, 2010. Web.