Industry Analysis

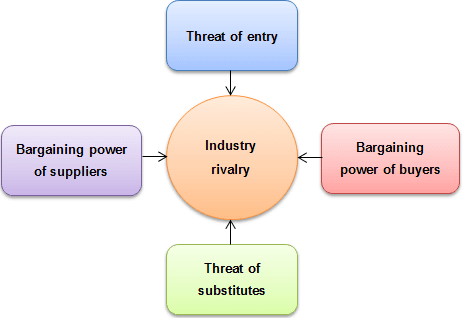

The amusement park industry has emerged as a crucial pillar of the hospitality and tourism industries. These facilities offer various attractions such as games, rides, and other entertainment. Although initially targeting children, the industry has grown and now offers products that meet the needs of family members of all ages. These parks can be found around the globe; for example, Ocean Park is a leading amusement park in Hong Kong (Fodor’s Travel Guides 56), and Motiongate Amusement Park in Dubai offers similar services in the United Arab Emirates (Schulte-Peevers and Walker 112). Analyzing the industry wherein the two firms operate in their respective countries can be instructive, using the Porter’s Five Forces model shown in figure 1 below.

The threat of new entrants is an issue that a firm should be prepared to encounter in the market. Motiongate Amusement Park in Dubai faces a greater threat of new entrants than Ocean Park Amusement Park in Hong Kong. While the government of the United Arab Emirates has liberalized its market to attract foreign investors, Hong Kong’s policies favor local firms at the expense of foreign companies (Wong 78). The language barrier is another factor making it easier for foreign firms to enter the local market in Dubai than in Hong Kong. Only 46% of Hong Kong residents can communicate effectively in English, while in Dubai, over 85% of the population can speak English (Oxford Business Group 171).

The threat of substitute products is another major concern in any industry. Motiongate Amusement Park in Dubai faces a greater threat of substitute products than Ocean Park Amusement Park in Hong Kong. According to Al Faris and Soto, Dubai is currently among the top tourist destinations in the world (112). Tourists who travel to visit various amenities such as the world’s tallest building, the world’s largest man-made island, and other attractions must balance their time well, making it impossible to spend copious time at an amusement park. On the other hand, amusement parks in Hong Kong mostly attract locals (Wong 78), who come as a family to have fun and are not in a hurry to visit other sites within a short period.

Buyers’ bargaining power has a direct impact on profitability. Motiongate Amusement Park in Dubai enjoys stronger bargaining power over its buyers than Ocean Park in Hong Kong. Most customers who visit amusement parks in Dubai are tourists who are willing to pay high prices for entertainment (Oxford Business Group 95). On the other hand, amusement parks in Hong Kong attract locals who are more likely to negotiate for low prices as an incentive to use the services. Belton argues that local customers often know about alternative products and will always demand lower prices than foreigners might (97).

The bargaining power of suppliers is another factor identified in this model. Suppliers in Hong Kong have low bargaining power in the market because of their number and the fact that most of the products they supply are available locally (Woo 54). As a result, Ocean Park Hong Kong can negotiate with its suppliers for low prices because various alternatives are available. On the other hand, some of the items and machines used in Dubai’s amusement parks are imported from China, Europe, and North America (Belton 58), limiting the ability of local firms in this industry to bargain for favorable products because they are not manufactured locally.

Finally, the model looks at industry rivalry as a factor that must be considered when analyzing a given industry. The competitive rivalry in Dubai’s amusement park industry is by far more intense than that in Hong Kong. Ocean Park’s main rivals in the market are Hong Kong Disneyland and Tomorrowland (Goodstadt 63). On the other hand, Motiongate Amusement Park has to deal with numerous rivals such as IMG Worlds of Adventure, Bollywood Parks Dubai, Legoland Dubai, Columbia Pictures, AquaFun, Six Flags Dubai Parks and Resorts, Dinosaur Park, and Wild Wadi Waterpark, among others (Oxford Business Group 171). The stiff competition in Dubai can be attributed to the high number of visitors who come to the city regularly as tourists and business travelers. Survival in such a highly competitive market depends on the ability of an individual firm to understand customer needs and deliver quality products that meet these needs.

Factors That Contribute to the Differences

While Motiongate Amusement Park in Dubai and Ocean Park Amusement Park in Hong Kong may operate in the same industry, their location in different countries means that they face different challenges and opportunities in the market. According to Belton (64), when analyzing firms operating in the same industry but in different countries, the CAGE (cultural, administrative, geographic, and economic) framework, shown in table 1 below, can help in explaining the different forces facing these firms.

Table 1: CAGE Framework.

Cultural Differences

The cultural environment in Dubai significantly differs from that in Hong Kong. According to Schulte-Peevers and Walker, the local language in Dubai is Arabic, while that in Hong Kong is Mandarin (80). In Dubai, over 75% of the residents are economic migrants, making English the most common language (Oxford Business Group 79). The fact that a significant majority of the population speaks English gives Motiongate Amusement Park a competitive advantage over Ocean Park Amusement Park in Hong Kong. This means that international tourists from North America and most parts of Europe can visit the park without facing a language barrier. In contrast, only 46% of Hong Kong residents can communicate effectively in English, a disadvantage when it comes to attracting foreign customers.

The main religion in Dubai, especially among the citizens of the United Arab Emirates, is Islam, while that in Hong Kong is Buddhism. While religious beliefs and practices have no significant impact on the competitiveness of firms in this industry, they define the dress code and commonly available types of food. However, Dubai has become a socially liberal city because of its high number of foreigners. In Hong Kong, over 92% of the population is Chinese, while in Dubai, 75% of the residents are foreigners. Dubai’s diversity thus gives it a competitive advantage in attracting foreign visitors.

Administrative Differences

Administrative differences also have an impact on the ability of a firm to achieve success in the market. As shown in the framework above, China has no colonial ties, offering both an advantage and a disadvantage. This factor is advantageous in terms of freedom in defining trade policies. On the other hand, it is a disadvantage because the country has lost economic ties that could be critical in promoting international trade. In comparison, the colonial ties in the UAE are minimal. In Hong Kong, copyright laws are not strongly enforced, which is a disadvantage for firms with strong brands because their products can be counterfeited. The UAE, in contrast, has strong laws to protect copyrighted material. The political class in Dubai often tries to avoid significant control of most industries to promote growth, benefiting local firms. The government of China, on the other hand, often tries to control the industries operating in Hong Kong (Wong 29), even though such measures may be counterproductive.

Geographic Differences

A company’s location plays a major role in its ability to achieve growth. Dubai, as a global entry route to markets in the Middle East and Africa from Europe, North America, and Asia, is strategic in comparison to Hong Kong, giving the local firms in this city a competitive edge over those in Hong Kong (Goodstadt 56). However, the extreme temperatures in Dubai are disadvantageous to the local firms because tourists from Europe and North America can only visit during specific periods when temperatures are manageable. The climatic conditions in Hong Kong are more favorable to tourism than those in Dubai.

Economic Differences

The Gross Domestic Product (DGP) of Hong Kong is significantly higher than that of Dubai, which means that the purchasing power of the locals in this city is equally high (Goodstadt 51). This gives Hong Kong firms a competitive edge over their rivals in Dubai. However, Dubai’s infrastructure has been modernized to help facilitate the movement of people and access to different amenities. Although both countries have modernized their infrastructure, the UAE has spent more in this sector over the past decade (Oxford Business Group 172). In Hong Kong, most firms rely on local human resources and locally manufactured goods. In comparison, Dubai relies on third-country nationals, and some of the products used there are manufactured in China. In this context, Hong Kong firms have a competitive advantage over those in Dubai.

Competitive Issues

Motiongate Amusement Park and Ocean Park Amusement Park face different competitive issues in their respective markets. As discussed above, although the two firms are operating in the same industry, they face different challenges and opportunities because of the differences between the countries where they are located. Other than the socio-cultural forces discussed above, resources in the home market and the companies’ core competencies also define their competitiveness in the market.

Resources in the Home Market

Improved infrastructure is a resource that both companies enjoy in their respective home markets. Dubai and Hong Kong have some of the most advanced road and rail transport systems in the world. These resources are not portable, but they can be replicated in other countries. Dubai International Airport is one of the busiest in the world (Oxford Business Group 127). Hong Kong may need to improve its major airports to match Dubai’s facilities. In Hong Kong, Ocean Park enjoys a large pool of talented employees. This resource is portable; for example, many Chinese have moved from Hong Kong and Mainland China to Dubai in search of better employment opportunities.

Company’s Core Competencies

The ability of a firm to succeed in the market goes beyond the advantages that the market offers. Its core competencies define its ability to compete favorably with market rivals. Motiongate Amusement Park in Dubai has emerged as a family destination, offering a wide range of products that meet the varying needs of its customers. This competitive strategy focuses on attracting clients that visit the city as a family. The firm’s products are age-specific and depend on various demographical factors. Ocean Park Amusement Park, on the other hand, is pursuing a different strategy by making it possible for visitors to see marine mammals and other wild animals in addition to various beautiful amenities, a strategy aimed to attract a wide range of people who may be seeking different forms of entertainment.

The two firms are focused on offering unique products as a way of achieving competitiveness in the market. For Dubai’s Motiongate Amusement Park to operate in Hong Kong, it would need to redefine its pricing strategy. Most of the clients in Hong Kong are price-sensitive, but this is not the case in Dubai where the park is currently serving wealthy visitors from various parts of the world. If it were operating in Hong Kong, Motiongate would also be required to redefine its organizational culture in line with the socio-economic and economic factors in Hong Kong. Its current employment strategy, which emphasizes hiring third-country nationals, would also have to change, and the firm would need to hire Chinese-speaking employees to overcome language and socio-cultural barriers.

Works Cited

Al Faris, Abdulrazak, and Raimundo Soto. The Economy of Dubai. Oxford University Press, 2016.

Belton, Pádraig. Competitive Strategy: Creating and Sustaining Superior Performance. Routledge, 2017.

Fodor’s Travel Guides. Fodor’s Hong Kong 25 Best: With a Side Trip to Macau. Fodor’s Travel, 2015.

Goodstadt, Leo F. Poverty in the Midst of Affluence: How Hong Kong Mismanaged Its Prosperity. HKU Press, 2014.

Oxford Business Group. The Report: Dubai 2016. Oxford Business Group, 2016.

Schulte-Peevers, Andrea, and Jenny Walker. Dubai & Abu Dhabi. 8th ed., Lonely Planet, 2015.

Wong, Yue C. Fixing Inequality in Hong Kong. Hong Kong HKU Press, 2017.

Woo, Henry K. Growth without Inequality: Reinventing Capitalism. Routledge, 2017.