Introduction

The purpose of this essay is to describe the background of OfficeMax, Inc., financial statements, organizational structure, industry overview, and overall performance of this company.

Company and Industry Description

OfficeMax is a diversified company and the pioneer of retail office products industry, which serves the pubic and private sector for the office supplies, paper, print, document services, and technological solution with high integrity, accountability, and corporate social responsibility through 29,000 associates all over the USA; in addition, it establishes several subsidiaries with 1,000 stores in the US and Mexico (OMX, Inc. 1).

The performance of the office-supply retail industry is very significant to the manufacturers as they directly linked with the quick unstable demand, while the sector generated profit of US$ 151.5 million with sales revenue US$ 7.6 billion in 2011, but the industry has been suffering from a declining profit from 2.6% to 2.0% during 2006 to 2011 (IBISWorld 4).

History of firm

OfficeMax started its journey in 1931 in the name of Boise Cascade Corporation; in 2003, it acquired OfficeMax, Inc. that provided the company to double its office products supply chain in the US market and the company bannered as OfficeMax; at the same time, it registered in NYSE and established headquarter in Naperville, Illinois (OMX, Inc. 1).

In 2004, the company diversified its business from manufacturing to independent office products distribution channels for different technology based office supplies; in 2006, it brought remarkable changes at the management and shifted headquarters with strategic plan that rescued the company from the serious impact of global financial crisis and the company introduced five-year growth plan in 2010.

Ownership and Stockholders of Company

ZACKS (6) pointed out that OfficeMax Inc. has already listed company in the New York Stock Exchange, and it has aligned with 94% Institutional Ownership, 1 % Insider Ownership with US$ 696 million of market capitalization and 87 millions of outstanding shares while its Mexican outlets operated through 51% joint venture.

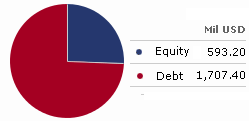

The debt equity scenario of the company is as follows

The current equity owners of the company is as –

Morningstar, Inc. (1) reported that the stockholders of the OfficeMax are Franklin Balance Sheet Investment Fund, Thornburg Value, CREF Stock, and Fidelity Value and so on while Countryman (1) pointed out that the share of the company is significantly undervalued and they think to break-up or realize their full investment, such threatening trend of investors have generated huge challenges.

Financial Condition: Past, Present, Trends

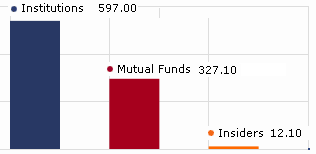

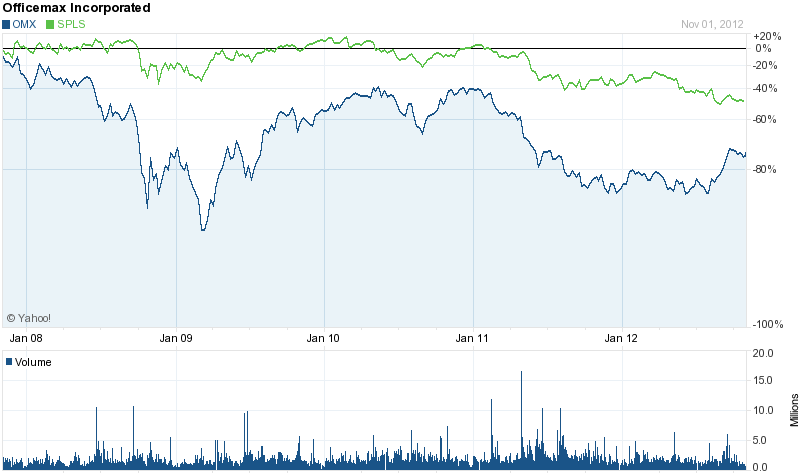

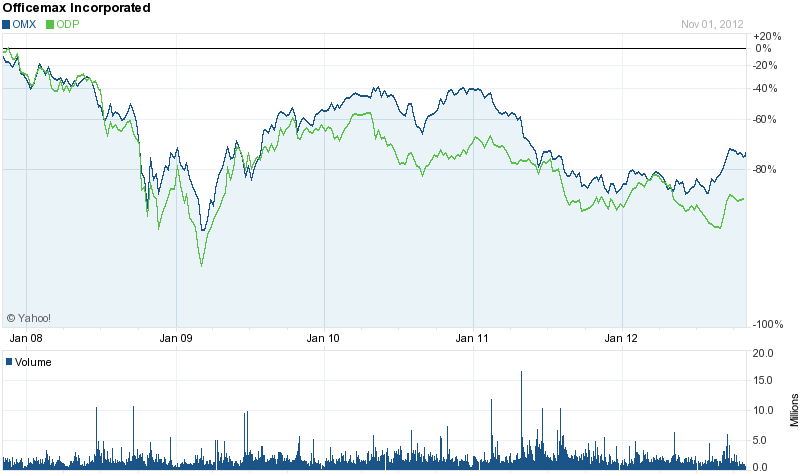

According to the Yahoo Finance (1), share price of OfficeMax experienced extreme growth in the stock market at the initial stage, and the share price of this company decreased in 2008 and it was below $2 at that time though the position developed steadily; however, the following figure shows the historical stock price of OfficeMax for three stock exchanges –

Table 1: Key financial variables of OfficeMax. Source: Self generated from O’Malley (14).

O’Malley (20) pointed out that the performance of this company deteriorated from the fiscal 2000 and the earning per share declined as well; however, the present performance of the company is satisfactory, but it must have to consider global financial crisis to hold stable position in the future.

Analysis of financial statements and performance

The operating costs of this company had not increased significantly, but the net income fluctuated dramatically, for instance, net income attributable to OfficeMax was $34.894 million, $71.155 million and $ 0.667 million for 2011, 2010 and 2009 accordingly; the following tables show key financial statistics and operating expenses for OfficeMax –

Table 2: Key Financial Variables of OfficeMax. Source: self-generated from OfficeMax (74-78) and Yahoo Finance (1).

Table 3: Total operating expenses of OfficeMax. Source: Self generated from OfficeMax (78) and OMX, Inc. (1).

Performance and Soundness in Comparison to Industry/ Competitors

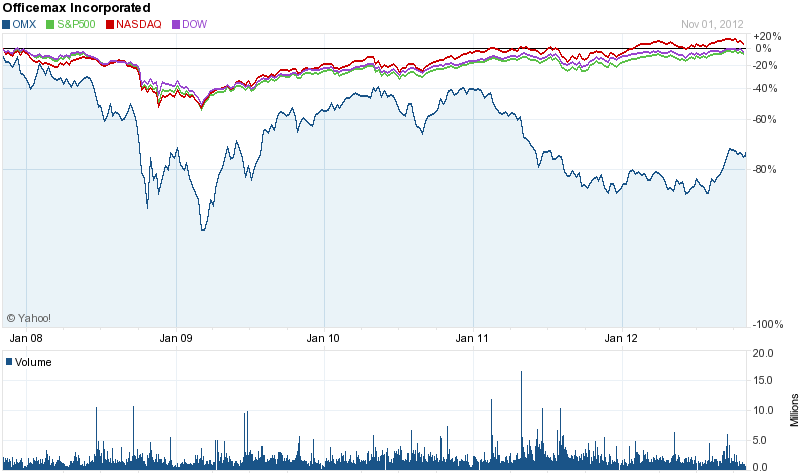

The presence of strong competitors in office-supply retail industry is one of the main threats for OfficeMax while the market position of the competitors is outstanding and it has both direct and indirect competitors those offer similar services, for example, local and international office goods markets are extremely and increasingly competitive (Yahoo Finance and OfficeMax 35).

According to the figure 2, the performance of this company was not enough sound considering the performance of the competitors because it generated about $40 million profits in 2011 while Office Depot earned approximately $80.95 million and Staples, Inc. generated more than $917 million; however, the following figure demonstrates direct competitor comparison among the major competitors –

Many small companies are offering similar products and many others are trying to produce innovative products using modern technology, which can change the customer behavior and increase market demand; moreover, the existing large companies are not the only threatening aspect for OfficeMax, but prospective new entrants can also cause of competitive challenges in the free market economy.

Industry Type: Manufacturing/ Service

In 2010, Sales revenue from manufacturing was US$ 3,634.2 million and from retailing US$ 3,515.8 million while the consolidated sales revenue was US$ 7,150.0, this data illustrated that the contribution of Manufacturing was 51% and the rest 49% earning from retailing; thus, the company has both attributes of manufacturing and service; at the same time, it is labor intensive (OMX, Inc. 6).

Organization and Structure

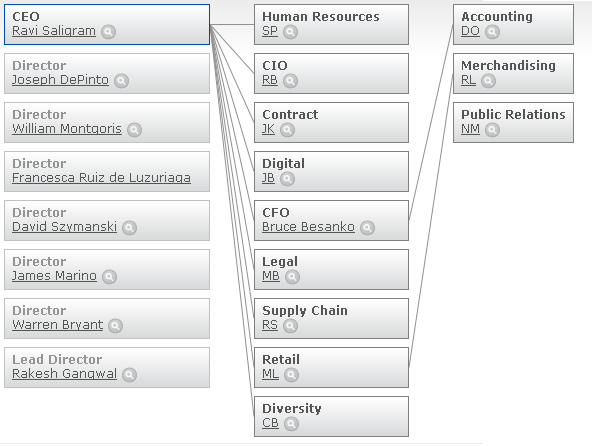

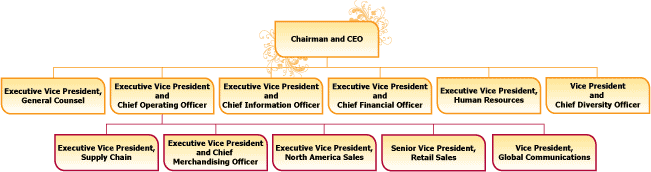

The Chief Executive Officer named Ravichandra Saligram is responsible to control all departments; in addition, the vice-president and Chief Diversity Officer are accountable to maintain the OfficeMax Diversity Council to prepare various reports and improve operational performance by implementing strategic plan.

Diversification

The company is extremely diversified company, for instance, it has retail segment, contract section and so on –

Centralization

The top management and board members are responsible to exercise decision-making power, which demonstrates that OfficeMax is following centralized organizational structure (Barney & Hesterley 135).

Compensation Policies

According to the annual report 2011 of OfficeMax, Executive Vice-President Steve Parsons is responsible for all aspects related with compensation and benefits; however, compensation committee designs salary structure for the employees, directors and other board members.

On the other hand, OfficeMax (1) reported that salary of the directors is competitive, non-employee directors obtain a form of long-term equity reimbursement, but non-employee board members merely receive salary for their board service; however, it fails to ensure high compensation and benefits to attract and retain qualified associates. The following figure shows information related with equity compensation plan –

Management Controls

The management of OfficeMax is committed to control the company and review the performance of the Company by maintaining ethical codes with integrity, the regulations and conducts for the board member, and legal provisions of national and international markets; however, Ethisphere Institute awarded this company for quality leadership in ethical business practices (OfficeMax 1).

Types of Organizational Structure

OfficeMax is following hierarchical or formal organizational chart to control the company; in addition, OfficeMax is highly differentiated in its own industry, which influences the company to maintain several common functional departments to operate the business, for instance, legal department, merchandising, supply chain, diversity management and human resource department; however, the subsequent figure shows a simple organizational of OfficeMax-

Works Cited

Barney, J. & Hesterley, W. Strategic Management and Competitive Advantage. London: Prentice Hall, 2011. Print.

Countryman, A. Major shareholder seeks sale or breakup of OfficeMax Inc. 2005. Web.

IBISWorld. 2011. Office Stationery Manufacturing in the US. Web.

Morningstar, Inc. OfficeMax Inc OMX. 2012. Web.

OfficeMax. Annual Report 2011 of OfficeMax. 2011. Web.

OfficeMax. Corporate Governance of OfficeMax. 2012. Web.

OfficeMax. Organizational Chart of OfficeMax. 2012. Web.

Official Board. Organizational Structure 2012 of OfficeMax. 2012. Web.

O’Malley, Judge. 2000. In re OfficeMax, Inc. Securities Litigation. Web.

OMX, Inc. Company Facts. 2012. Web.

OMX, Inc. OfficeMax Reports Fourth Quarter and Full Year 2010 Financial Results. 2012. Web.

OMX, Inc. 2009. OfficeMax’s Living Values 2008, Corporate Social Responsibility Report. Web.

OMX, Inc. 2011. OfficeMax’s Fact Sheet 11. Web.

Yahoo Finance. Comparison of stock price performance between OfficeMax and Office Depot, Inc. for the last 5 years. 2012. Web.

Yahoo Finance. Comparison of stock price performance between OfficeMax and Staples, Inc. for the last 5 years. 2012. Web.

Yahoo Finance. Direct Competitor Comparison. 2012. Web.

ZACKS. 2012. OfficeMax Incorporated. Web.