Introduction

The year 2001, saw America rise up to the prospects of a grim economic outlook since there were signs of an impeding depression. As a result, former president Bush decided to introduce new tax measures that were going to simplify the tax system, as well as, act as an incentive for economic growth (Harvard Law School 3).

The new tax system was meant reduced tax rates on individual income, child taxes, married couple’s tax and other tax groups. Certain taxes such as the estate tax were completely eliminated and deductions such as the poor only benefitted in terms of percentage cuts only (Citizens for Tax Justice 1).

However, the tax cuts, which were enacted during Bush’s first term, are soon to expire and as a result, there is a lot of debate charitable deduction made available to non-itemizers; however, the biggest gainers were low income families because their percentage of tax cut was overwhelmingly huge.

However, this fact did not take long before it was highly politicized because of allegations that the wealthy benefitted most when it came to the dollar amount, while thegoing on between the republicans and democrats regarding if the tax cuts should be extended into the future or not.

Focus is also on the president’s plan to restructure the tax system, with certain allegations implying that, the president’s new tax plan is set to make small business owners pay up to half their earnings in federal tax (Los Angeles Times 2).

Calls to end the federal tax cuts are majorly spearheaded by the democrats because they are of the opinion that the tax cuts majorly favor the rich and consequently lead to the growth of the national tax deficit.

It is therefore their belief that eliminating the tax cuts should cover a major milestone towards closing the deficit gap created by impliemmntinf the tax cuts in the first place. This study seeks to explore arguments for, and against, the retention of the tax cuts.

Advantages of Extending the Tax Cuts

Letting the Bush tax cuts stay, is likely to save small business owners from having to pay hefty taxes to the federal government – a move which will ultimately influence the overall growth of the national economy (Los Angeles Times 1). This is true because small businesses submit individual tax returns the same way large businesses do and therefore, they would be harmed by a change in the tax system (Los Angeles Times 1).

It is also estimated that the rich who are allegedly being protected by conservatives of the Bush tax system, will pay less than they would, if the tax cuts were left to expire naturally (Los Angeles Times 3).

This means that though the tax cuts were largely seen to favor the rich, the rich would further benefit from the tax cuts if the Obama tax proposals are implemented. It is therefore better to let the tax cuts prevail because the rich would pay more taxes as a result.

Disadvantages of Extending the Tax cuts

Extending the Bush tax cuts would have significant impact on the American government national deficit because it is projected that if the tax cuts are extended over the next year, the government is expected to lose about 690 billion dollars.

It is also true that though the Bush tax cuts were meant to significantly cut taxes for everybody, it heavily favored the wealthy (Citizens for Tax Justice 1). It is therefore going to be highly inefficient for the government to extend the tax cuts because it benefits the rich the most.

Moreover, extending the tax cut means that the national debt is going to increase to about nine trillion dollars if it is extended for the next ten years (Center for American Progress 5). This means that, Americans will have to pay for the national debt at higher rates (in the future) because the government will have to borrow money to sustain itself, despite the deficit.

Furthermore, it is morally wrong to maintain the Bush tax cuts to benefit only 2% of America’s population, which is also the richest income group, while middleclass citizens do not reap as much benefit from the tax cuts (Citizens for Tax Justice 3).

In other words, there is no point of maintaining the tax cuts to people who do not need it, while letting other national issues like healthcare, infrastructure, education and the likes, suffer as a result.

Incentives

Despite the raging debate regarding if it is right to extend Bush’s tax cuts or eliminate them altogether, democrats and republicans have agreed that the tax cuts should be extended, at least for people who earn 250,000 dollars, or less (Center for American Progress 5).

This means that most of the incentives for individual income, child tax credits and marriage couple’s tax would be extended, but the tax system changes for people earning more than 250,000. The incentives for the existing tax brackets are explained by Department of the Treasury that:

“The top two brackets would be cut from 39.6 and 36 percent to 33 percent, and the next two from 31 and 28 percent to 25 percent. The lowest existing bracket would remain at 15 percent, but a new ten percent bracket would be added for the first $6,000 of income, $12,000 for married couples.

The proposal would also increase the child tax credit from $500 to $1,000 per child and make part of it applicable against the Alternative Minimum Tax (AMT)” (5).

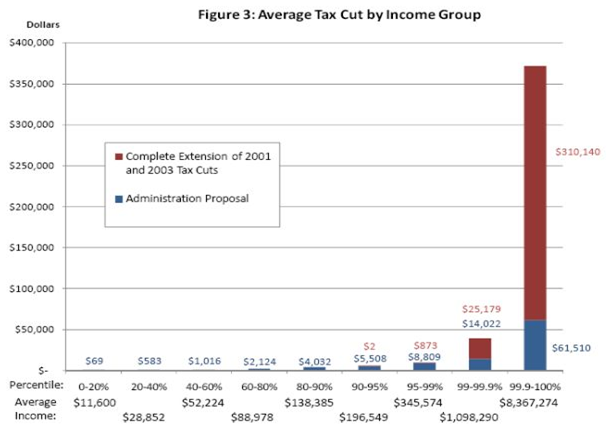

The following diagram shows these tax cuts:

Also, as a point of argument to bring everyone on board regarding the idea of repealing the bush tax cuts; in the defense of the democrats, several small business owners who were argued to suffer from the expiry of the tax cuts will not be influenced by the expiry of the tax cuts because it is estimated that only about three percent of them have earnings that exceed 250,000 dollars (Center for American Progress 2).

Moreover, it is also affirmed that some of these small businesses are not necessarily small, in comparison to the established corporate giants.

Economic Implications

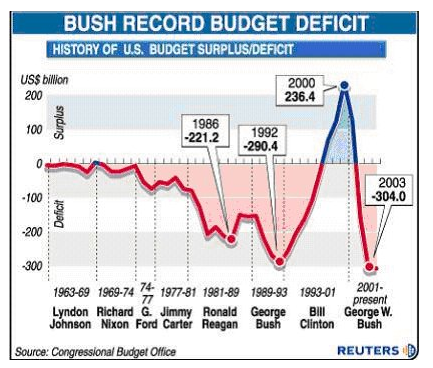

It is no doubt that the bush tax cuts have had a severe effect on the national debt burden. In the year 2000, it was estimated that the real cost of implementing the tax cuts was going to be about 1.9 trillion dollars and in reality, the US suffers significant budget deficits of close to five trillion dollars (Center for American Progress 2). The following diagram shows this situation:

Interestingly, it is on record that, Bush inherited a record surplus in federal budget from his predecessor and though he assured the nation that he was going to reduce the public debt by about two trillion dollars, he increased the public debt to five trillion dollars as soon as his tax cuts were made law.

This means that his tax cuts came at a very high cost and the current government is only seeking to decrease this debt burden. Definitely, a sure way of doing so is not maintaining the status quo, which started the problem in the first place.

Experts therefore note that if the bush tax cuts are extended, Americans may soon have to pay very high interest rates to pay back the money that will have to be borrowed by the government to finance its social programs (Center for American Progress 2). Moreover, there will be no end in sight for the ever-growing American budget deficit.

The Bush tax cuts have also significantly influenced the funding of several basic social programs such as Medicare, retirement pension schemes and the likes. In detail, it is estimated that the funding for these social programs have been scaled down by almost three trillion dollars (Center for American Progress 2).

Also, in as much as the tax cuts were meant to boost economic growth and ease the creation of jobs, it is documented that three years after the tax cuts were made law, the total jobs shrunk from 132 million jobs to 131.4 million jobs (Center for American Progress 2).

Focusing more on the creation of jobs, though the Bush tax cuts never created any new jobs in the first three years, the economy faired well in the following three years, but this cannot be specifically attributed to the tax cuts.

Evidence is made of the Clinton tax raise in 2003, where the American total job estimate was 111 million and six years down the line, there was a 16.5% increase in job creation (Center for American Progress 2). This means that the rise in job creation during the last three years (of a six year time span after the tax cuts were made law) cannot be solely attributed to the tax cuts.

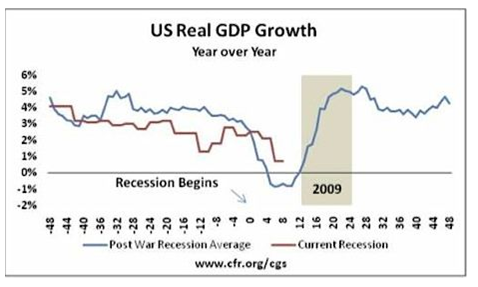

The Bush tax cuts also never did much justice to the economy either because the national economic growth rate was more stagnant when compared to the “Clinton economy”. There is a 10% difference in the economic growth rate between Clinton’s regime and after Bush’s tax cuts were made law.

This is true because in the first six years after Clinton clinched power, the national gross domestic product (GDP) grew by 26% but after the Bush administration administered the tax cuts, the GDP only grew by a paltry 16% (Center for American Progress 2).

The following diagram represents the fall in GDP during the tax cut period:

This means that the tax cuts never added any value to the economic growth, as much as it should have (or was projected to). In fact, in comparison to previous GDP estimates after the Second World War, the GDP growth never decreased to 16% because it never went below 22% (Center for American Progress 2).

These facts were recorded despite President Bush’s affirmation to the American population that “his tax cuts would deliver real and immediate benefits to middle-income Americans” (Center for American Progress 2).

To cement the failure of the Bush tax cuts, the national income for the population never increased in the same proportion it was predicted. The Center for American Progress affirms that:

“Real income for the median American household went from $51,356 in 2001 to $52,163 six years later—an increase of just 1.6 percent. Under President Clinton’s tax rates, real median household income went from $45,839 in 1993 to $52,587 in 1999—an increase of 14.7 percent” (2).

These indicators simply show that the Bush tax cuts were a complete failure and in instances where positive results were registered, little evidence can be traced to the role decreased tax cuts played in registering positive results.

There is therefore no point of continuing something that obviously does not deliver what it was supposed to deliver. There is therefore no reason why the American population should expect any more from the Bush tax cut system than what they have experienced in previous years.

Tax Cuts On Middle Income Population and Pending Obstacles

Extending the tax cuts for the middle income population is proving to be a fruitful venture because of the current economic situation in America. In other words, it is important for the government to maintain the tax cuts for the middle income population; at least temporarily, until the economy completely picks up, before the government considers withdrawing it.

This is important because the economy is still on a recovery phase and withdrawing the tax cut is not going to ease the recovery efforts in any way. However, for the top earners, the tax cuts should be immediately withdrawn because they do not need the tax cuts as much as the middle income and low income earners do.

However, the biggest obstacle to achieving this goal is founded on the fact that the rich have a very strong influence on policy formulation while the poor have a very small say in the same process. Moreover, the policy makers are largely comprised of the rich and elite in the society and therefore, advancing agendas that may not be beneficial to them may be a difficult task.

Conclusion

This study notes that the Bush tax cuts have not added much value to the economy as it should have. Letting the tax cuts prevail any longer would only be counter progressive to the goal of achieving long-term and cheap means to economic prosperity.

However, there is an exception to eliminating the tax cuts for the middle income population, at least temporarily, because the economy is still in a fragile state and needs the tax cuts for this income group. This compromise therefore needs to be observed for the interest of the majority.

Works Cited

Center for American Progress. Three Good Reasons to Let the High-End Bush Tax Cuts Disappear. 2010. Web.

Citizens for Tax Justice. Ctj Analysis Of Bush Plan Updated To 2001 Levels. 2001. Web.

Department of the Treasury. General Explanations of the Administration’s Fiscal Year 2002 Tax Relief Proposals. 2001. Web.

Harvard Law School. The Bush Tax Cuts of 2001 and 2003. 2008. Web.

Los Angeles Times. The Tax Cut Debate. 2010. Web.