Vision and Mission

The mission of the Prime Group is to provide highly-effective services for customers across the region and retain leading positions in the investment banking. The company’s vision includes the framework for achieving sustainable, quality growth and is based on the determination to providing the highest quality of services and gradual expansion across the region.

SWOT Analysis

Internal strengths

- Experienced personnel

- High growth rate

- Productivity

- Effective management team

- Wide range of services

- International banking experience

- Authorization to provide various services, including intra-day transactions, margin-trading services, electronic trading platforms, etc.

Internal weaknesses

- Relatively low brand equity outside the region

- Potential clashes of group cultures

- Possible conflict of interest regarding fees generated by transactions

- Absence of strategic partner

External opportunities

- Increasing the company’s global presence

- Fast acquisition of customers with appropriate product entry strategy

- Growth rates and profitability

- Expansion in rural areas

- Market diversification

External Threats

- Popularity and reputation of local competitors

- Popularity and reputation of foreign companies offering similar services

- The necessity to acquire local licenses

- The necessity to receive the approval from local government

- Increase in labor costs

- Government regulations

Internal Assessment and IFE Matrix

The internal assessment of the company needs to be based on the analysis of its internal strengths and weaknesses (Hill, Jones, and Schilling 17). As the SWOT analysis reveals, Prime Group possesses numerous internal strengths. Effective management and dedication to providing high-quality services ensure the company’s good reputation and productivity. Possession of authorization to conduct a wide range of banking and brokerage operations is another great benefit of the company.

This strength cannot be easily matched or imitated by the competitors as the proper authorization requires appropriate licensing and approval. However, the company has some internal weaknesses related to relatively low brand equity outside the countries where the company is currently operating. Moreover, after entering a new market, the company may face the need to deal with potential clashes of group cultures and conflict of interest regarding fees generated by transactions.

Creating the IFE Matrix is another crucial step in conducting an effective internal strategic-management audit (Katsioloudes 103).

As the score is 3.54, which is significantly higher than the average 2.5, the internal situation of Prime Group can be considered rather strong.

External Assessment and EFE Matrix

The external assessment of the company needs to be based on the analysis of its external opportunities and threats. As the SWOT analysis reveal, Prime Group have numerous external opportunities related to the broadening of the company’s global presence based on the fast acquisition of customers with the help of appropriate product entry strategy. Such opportunities will open the door to high growth rates and profitability.

However, certain threats related to the popularity and reputation of local competitors and foreign companies offering similar services can present a challenge to the company. Local license procedures, regulations, and position of government can also become a threat to the profitability of the company.

The EFE Matrix presents a detailed analysis of the factors mentioned above. The rating score reflects the company’s response to identified opportunities and threats (Lodato 86).

As the score is 2.76, which is slightly higher than the average 2.5, the ability of the company to respond to external factors can be considered as middling. Therefore, for successful expansion to new countries, Prime Group needs to pay more attention to improving its responsiveness to the challenges faced in the external environment.

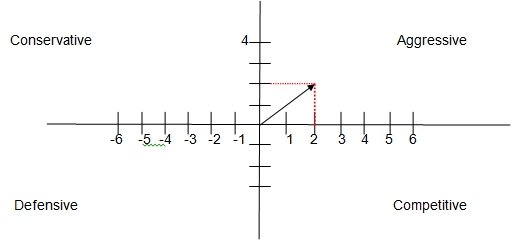

SPACE Matrix

SPACE matrix reveals that Prime Group needs to employ aggressive strategy, as the company can gain a strong competitive position and rapid growth in new markets in a short time.

Defensive Competitive

QSPM Matrix

QSPM Matrix reveals that acquiring local competitor appears to be a more attractive strategy than entering the market as a new player. Therefore, entering the markets in Morocco and Saudi Arabia would be more successful if Prime Group manages to acquire a local enterprise that already has a considerable number of customers and necessary licenses.

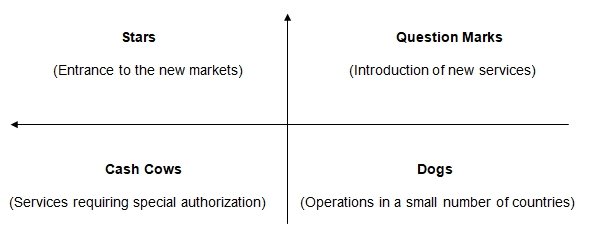

BCG Matrix

The BCG Matrix reveals that Prime Group needs to continue providing the services that require special authorization and ensure the competitive advantage of the company. The company also needs to avoid keeping the number of countries it operates in limited and invest in expansion to new markets. The introduction of new services able to diversify the range of operations conducted by the company should be carefully considered.

Strategy Implementation and Other Issues

Based on the analysis provided above, it can be concluded that the aggressive strategy based on the acquisition of local competitors can be considered appropriate for Prime Group in case it decides to enter Moroccan and Saudi Arabia markets. The strategy should be implemented thoughtfully, as the entrance into two markets requires considerable investments and should not be rash.

Prior to the implementation of the discussed strategy, the company needs to evaluate Moroccan and Saudi Arabia Markets in terms of their competition level, market share, demand for the company’s services, financial stability of the economy, and the average level of the citizens’ income. Such evaluation should be based on the relevant data reflecting the indexes for each of the mentioned criteria.

It appears that the company should enter one market at a time as the simultaneous entrance in two new markets requires significant investments and can result in the collapse of the company’s financial sustainability.

The mode of entry should be aggressive as SPACE matrix has revealed. The company possesses enough internal strength to overcome the possible external threats. Such mode of entry would help to gain the significant competitive advantage in both countries in a short period.

The target market of the company includes adult males aged 25-55 with the upper-mediate level of income aged 25-55. This social group appears to be both interested in company’s services and capable of affording them. The company possesses great international experience and provides a wide range of services, which can be considered attractive features for the discussed group of customers as they respond to the necessities caused by such global and local processes as globalization and economic development.

The company needs to implement effective marketing strategy based on aggressive promotions. Such strategy will help to attract the maximum number of potential customers in a short period and build the brand equity in new countries (Ferrell and Hartline 103; Panda 143).

The idea of broadening the company’s network in the new countries to rural areas may help it to gain a significant competitive advantage. Such decision will contribute to the company’s advantageous position as most enterprises providing similar services prefer to operate only in urban areas.

Saudi Arabia market would yield a higher return on investment in the long run as Saudi Arabia is more financially stable, its population has a higher level of income, and most of the citizens live in urban areas (Apaydin et al. 226). However, the government regulations in this country are stricter than in Morocco. Therefore, the company needs to find effective solutions to dealing with local regulations to provide the opportunities for its constant development and high revenues.

Works Cited

Apaydin, Maria, Mohamed El Ashmawy, Mohamed Ezzat, Anas Salem, and Ahmed Maher. “Prime Group – 2010.” Strategic Management: Concepts and Cases (Arab World Edition). Ed. Fred David, Abbas Ali, and Abdulrahman Al-Aali. New York: Pearson Education, Limited, 2011. 221-229. Print.

Ferrell, Owen, and Michael Hartline. Marketing Strategy, Mason, Ohio: South-Western Cengage Learning, 2014. Print.

Hill, Charles, Gareth Jones, and Melissa Schilling. Strategic Management: Theory, Stamford, Connecticut: Cengage Learning, 2015. Print.

Katsioloudes, Marios. Strategic Management, New York: Butterworth-Heinemann, 2011. Print.

Lodato, Michael. A Handbook for Managing Strategic Processes, Bloomington, Indiana: Author House, 2014. Print.

Panda, Tapan. Marketing Management: Text and Cases, New Delhi: Excel Books, 2008. Print.