Various approaches are applied in the process of understanding the competitiveness of an industry and the relationship between products within it. One of the methods used is the product hierarchy approach, which allows a relationship between products and the needs they serve to be identified. The product hierarchy narrows down basic needs to specific items that address and satisfy those needs. The hierarchy has seven levels, which include the need family, product family, product class, product category, product line, product type, and brand. The economy of the United Arab Emirates is composed of robust industries that provide essential services and goods to the local and international markets. Some of the core sectors include health, entertainment, banking, automobile, and technology industries. To have a deeper understanding of the industries, a product hierarchy will be analyzed to assist in determining the competitiveness of the product segments and brands.

Industry 1: The Health Industry

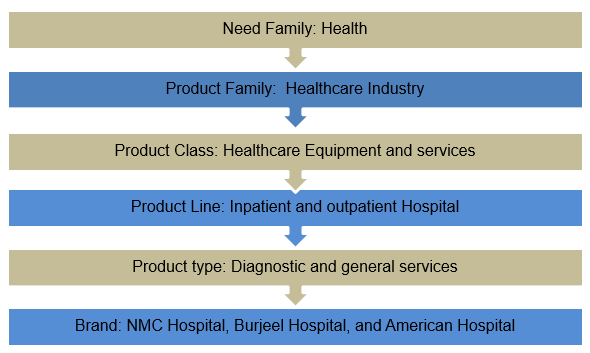

The health industry in the UAE is a multibillion-dollar sector that serves the needs of good health in both local and international populations. Health is a need family that is served by different product families. In this case, the focus will be on the healthcare product family. The following flow chart shows the product hierarchy for the health industry in the United Arab Emirates:

As presented in the flow chart diagram above, the focus of the product hierarchy for the health industry is on the provision of health services in the United Arab Emirates. The health industry is categorized in the need family of health. Under the need family, the product family that is emphasized is health care, which constitutes the segment of the industry that focuses on providing products that address curative and preventive services to individuals (Shihab 249).

The next level in the hierarchy is the product class, which is the Healthcare Equipment and Services category that is essential to meeting the health needs of patients and all interested parties. The product category in the hierarchy includes the hospitals that provide various services that are related to health care (Ahmed and Alfaki 85). They include the inpatient and outpatient services, which form the product line. The product type constitutes the diagnostic and general healthcare services that are provided in the various hospitals. Some of the most notable brands through which healthcare services are provided are the NMC Hospital, Burjeel Hospital, and the American Hospital.

Competition in the Health Industry

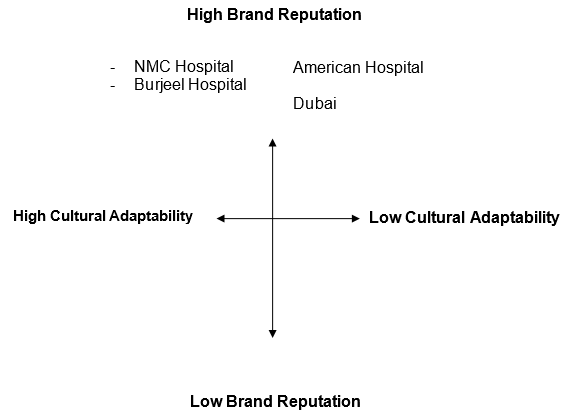

The UAE health industry is very competitive due to the high quality of healthcare services that the population demands. As one of the leading economies in the region, the country has invested heavily in the healthcare sector through elaborate policies and infrastructural developments. The sector is divided into private and public healthcare providers, which are regulated by the federal emirate-level government institutions such as the Ministry of Health, the Health Authority Abu Dhabi, the Dubai Health Authority, and the Abu Dhabi Health Services Company (SEHA). The private health sector is driven by many multi-national American hospitals that have set base in the country (Ahmed and Alfaki 84). In 2013 alone, the healthcare expenditure reached USD$ 16.8 billion (Ahmed and Alfaki 88). Among the major healthcare providers in the country, NMC Hospital, Burjeel Hospital, and American Hospital are some of the main competitors in the sector.

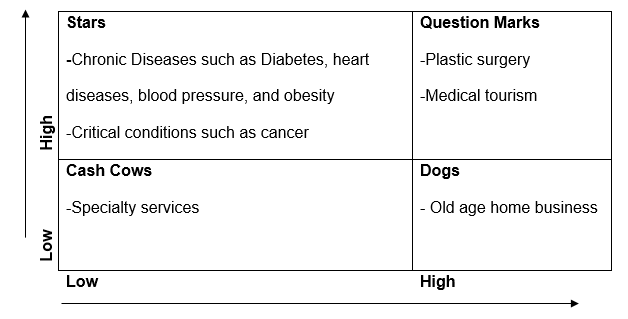

Firstly, the NMC Hospital is the largest private healthcare provider in the United Arab Emirates where it offers various inpatient and outpatient services in its locations throughout its fourteen divisions in the country. The hospital attracts both local and international clients. The facility is increasingly involved in medical tourism that the country is keen on promoting. The following is a BCG Matrix for the NMC Hospital in the UAE:

The ‘question marks’ segment indicates the areas of investment that have high potential, yet are not profitable, due to the low market share. For instance, the current questions marks for NMC Hospital include plastic surgery and medical tourism. In this case, the hospital is focused on ensuring that the areas become profitable, although it is yet to achieve a high level of competitiveness due to competition from within and outside the country.

The sources of income refer to the market segments that are profitable, yet they require little or no investment. In this case, the hospital has established itself as a leader in services such as MRI scans, X-rays, and other diagnostic services, which bring much income to the company. Lastly, the dogs refer to the business segments that the company should liquidate or cease to run. In this case, the old age home business is a major stagnated area of business that does not require investment from the company.

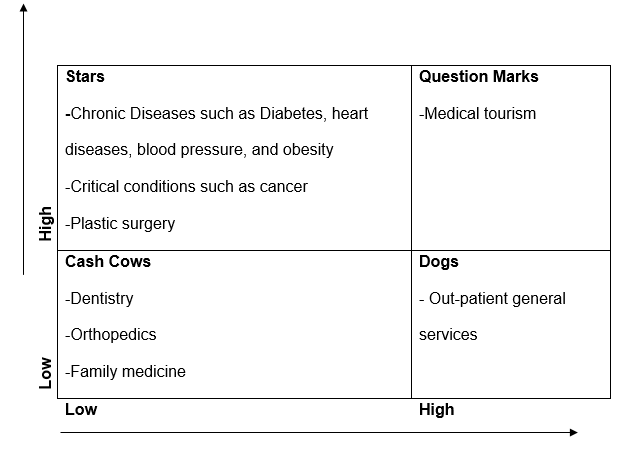

The second competitor in the industry is Burjeel Hospital, which is one of the largest tertiary and specialty healthcare service providers in the United Arab Emirates. With a 202-bed capacity, the hospital is the largest in Abu Dhabi. The diagram below represents the competitiveness of the hospital:

The matrix above shows that the hospital is highly competitive in providing specialty services that focus on chronic and critical conditions. The question marks reveal how the medical tourism segment has a high potential. However, the organization is yet to gain adequate revenues from the segment (Al-Malkawi et al. 105). The sources of income include the dentistry, orthopedics, and family medicine. They have given the hospital a high reputation. However, some of the general outpatient services are not profitable. They are wastage of human resources and time and hence the need to review their continued provision.

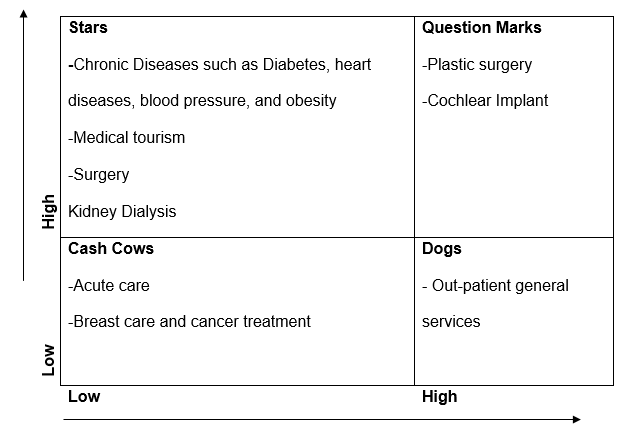

Lastly, the American Hospital in Dubai is one of the leading providers of healthcare services in the UAE. In the Middle East, the hospital is accredited by the Joint Commission International Accreditation, which ultimately puts it among the leading healthcare facilities in the country. The following diagram represents the BCG matrix for the American Hospital:

The leading sources of income include the acute care and breast cancer treatment. On the other hand, the company is struggling to break even in the plastic surgery and cochlear implant. The general outpatient services are not profitable. Hence, they are costly to the company.

From the above discussion, it is evident that NMC Hospital is the most competitive by sheer of its size and establishments across the country. On the other hand, the American Hospital in Dubai leads in terms of quality services since it adheres to the American quality-level services and training. Lastly, the Burjeel Hospital is also competitive, but its focus is limited to Abu Dhabi only.

Industry 2: The Entertainment Industry

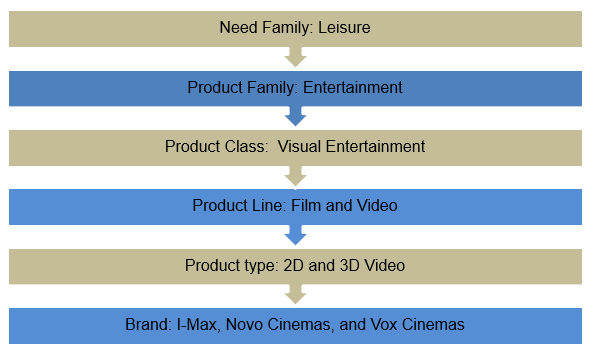

The entertainment industry in the United Arab Emirates constitutes many services and products such as sports, computer games, music bands and groups, and film and cinema entertainment among others (Yunis 51). The sector belongs to the leisure need family, which comprises different parts in its product hierarchy as presented below:

The entertainment industry serves an important need of leisure in the country’s population. However, leisure is an extensive need family, which is made up of many other activities. In this case, the product family in focus is the entertainment where the product class is the visual entertainment. In the recent past, film and video segment of visual entertainment has grown tremendously across the world, as well as in the country. Consequently, for the purpose of the analysis of the entertainment industry, the product line will be Films and Videos that are provided through 2D and 3D forms that are accessible through theatres in the country (Yunis 52). The main brands in the country include the I-Max, Novo Cinemas, and Vox Cinemas.

Competition in the Entertainment Industry

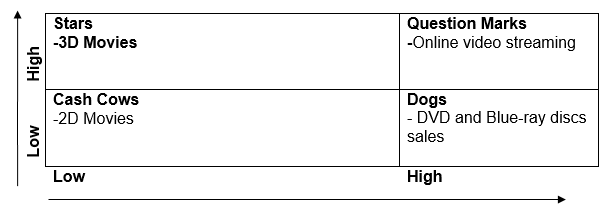

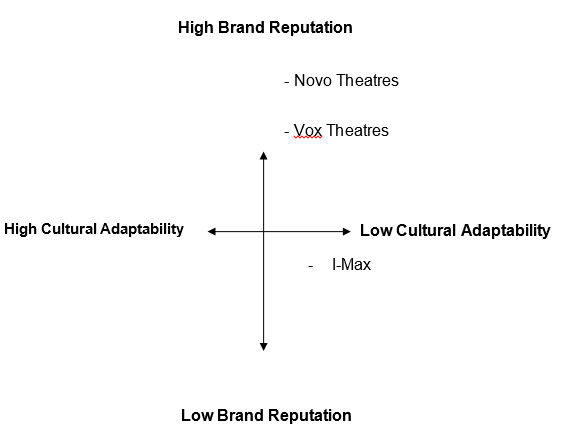

Three key players, namely I-Max, Novo Cinemas, and Vox Cinemas, dominate the Film and Video segment of the entertainment industry in the UAE. The companies provide theatres through which customers can view the latest 2D and 3D movies. Firstly, the NOVO Cinemas has seven theatres spread across Dubai and Abu Dhabi. It is the second leading provider in the country due to its reach as compared to others. The following diagram represents the BCG matrix for the Novo Cinemas Company.

The 3D movies are highly profitable. They attract many customers wherever they are screened. As such, the company should dedicate more resources to the screening of such movies. On the other hand, 2D movies are many in terms of supply. Hence, they provide consistent and reliable income for the company. The online streaming services have potential of attracting clients. However, the high competition from other online streaming companies both within and outside the United Arab Emirates means that the segment cannot reach the required potential (Yunis 56). Lastly, the sale of DVD and Blue Ray discs is an added cost to the company due to competition from other vendors in the country.

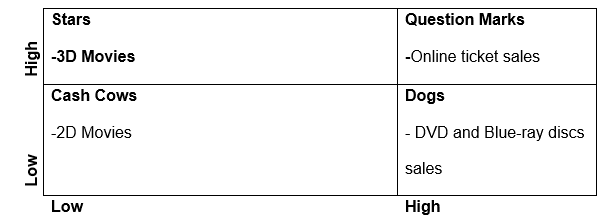

The second service provider is the I-Max, which is one of the leading providers of film and video theatre services in the world. However, the company is a new entrant that has collaborated with NOVA Cinemas to gain a footing in the country. The following is a BCG industry for the I-Max in the country:

As evident in the diagram above, the 3D movies are categorized under the Stars segment of the BCG matrix, which indicates that they provide the highest returns for the company. However, the 2D movies are sources of income, as they are more sustainable and available in the market. Online ticket sales have the capacity to bring high returns, but the company is yet to break even in the segment. The DVD and Blue-ray sales form a redundant segment that should be eliminated from the country.

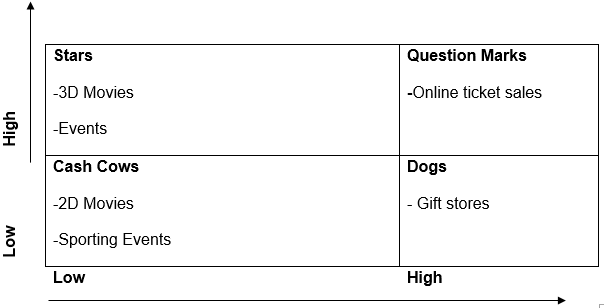

Lastly, the Vox Theatre is the leading film and video screening service provider of 13 theatres through the major cities in the country. The following BCG Matrix represents the competitiveness of the company:

The Vox Theatre’s leading segment of its business is the 3D movies and events segments that are categorized as the stars in the BCG Matrix. The company hosts many events, which provide it with high income as compared to other areas of its business. The online ticket sales area has question marks since most of the tickets are bought over the counter, despite the convenience of online sales. The 2D movies and sporting events are the sources that provide a consistent income for the company. However, the gift stores are dogs in the business since they have not been able to provide the consistency that is demanded in such business.

From the above discussion, Vox Theatre is the most competitive due to its widespread reach, as well as other supporting activities such as events hosting, which provide it with consistent income.

Industry 3: The Automobile Industry

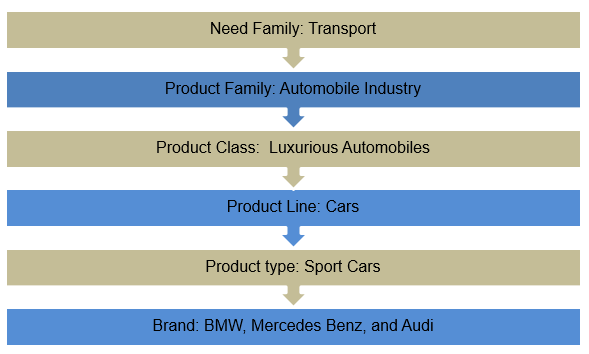

The automobile industry is a very critical segment of the United Arab Emirates economy in terms of providing transport for people and goods across the country. Just like other countries, the transportation services are the backbone of any economy. The country is a major consumer of automobiles that provide both luxury transport and logistics support for people and companies. The products hierarchy of the automobile industry is as follows:

The automobile industry provides important services to the population. In this case, it is categorized under the need family of transportation. However, the need family is very broad since various means of transport are accessible to people. In this case, the product family that will be focused on is the automobile industry. The product class includes the luxurious automobiles, which focus on the high-end customers in the sector (Al-Malkawi et al. 108). The product class is further narrowed down to the product line of cars and the product type of sports cars. Several brands serve in the sports cars segment, including BMW, Mercedes-Benz, and Audi.

Competition in the Automobile Industry

As a high-income country, the automobile industry is very robust. Indeed, the country is the leading consumer of high-end luxurious cars in the Middle East. The luxurious cars serve a class of the rich in the country. This class uses them as tools of prestige in the society (Shihab 256). There are many providers of luxurious cars in the country. The most notable ones include the BMW, Mercedes-Benz, and Audi.

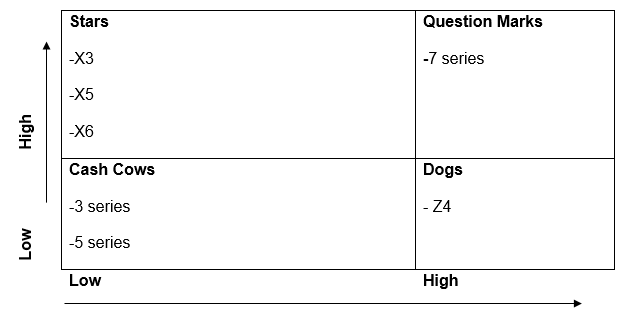

The BMW is the leading seller of luxurious cars in the country with a share of more than 30% of the automobile segment. The following is the BCG matrix for the company:

The BMW’s main selling models are the X3, X5, and X6. These models are very profitable to the company. Hence, they are the stars as presented in the matrix. The 7-series is promising, although it has a small market share that limits its success in the country. On the other hand, the 3-series and 5-series are the most sustainable sources of income for the company (Ahmed and Alfaki 91). Lastly, despite the hype that accompanied the release of the Z4, the model has not been able to provide the company with the expected returns.

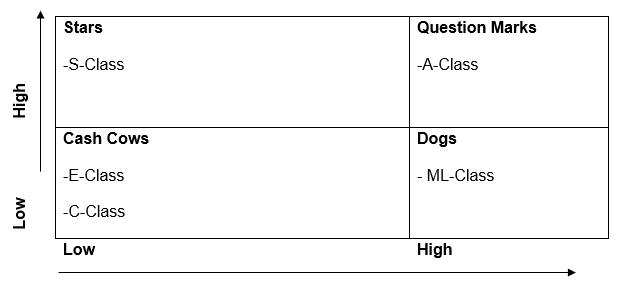

The other model is the Mercedes-Benz, which has the second highest share of luxurious cars in the country. The following diagram shows the BCG matrix for the company:

From the diagram above, it is evident that the S-class is one of the profitable cars for the organization. The E-class and the C-class are stable models whose high market share makes them sustainable sources of income for the company, although they have a low growth rate. On the other hand, the ML-class is an income draining car model that has not achieved high sales in the country.

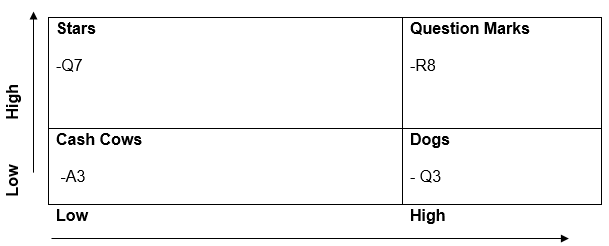

Lastly, the Audi is also a leading luxurious car manufacturer that serves the UAE market. The company, which is owned by Volkswagen, is dedicated to making high-end quality cars for customers who demand luxury. The following diagram presents the BCG Matrix for the Audi in the UAE.

The Q7 is a leading car model sold in the United Arab Emirates and across the world. As the SUV, it competes with X5 and X6 models of the BMW Company. The major source of income for Audi is the A3, which is more affordable to many people in the country. The R8 is a promising model, although it has struggled to gain monopoly in the market. Lastly, the Q3 has stagnated in the UAE.

From the above discussion, BMW is the leading luxury automobile provider in the UAE followed closely by the Mercedes-Benz. The Audi has a considerable market share, but falls short of the leading manufacturers discussed above.

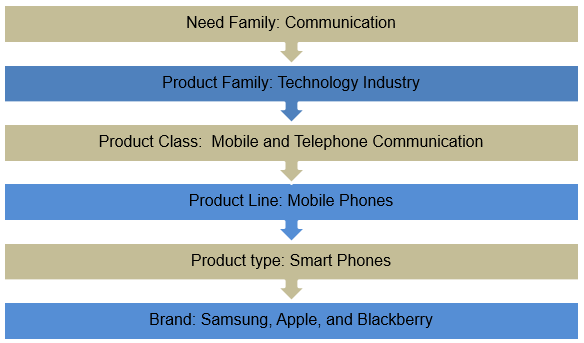

Industry 4: The Technology Industry

The technology industry provides important services and devices that support critical segments of the economy in the United Arab Emirates. For instance, as an advanced economy, communication is very crucial and hence a need that technology has been developed to address (Jabnoun and Al Rasasi 70). The following diagram represents the product hierarchy for the technology industry in the UAE:

The technology industry that focuses on communication is wide. It covers different communication modes that are present in the world. The mobile and telephone communication is currently the primary means of passing information from one individual to another (Ahmed and Alfaki 99). The advent of mobile phones has changed how communication is done. It is now possible for people to communicate with one another wherever they are through the devices. The mobile phones that the product hierarchy focuses on are the Smartphones that have emerged and grown tremendously in the last eight years in the United Arab Emirates. The main brands of Smartphones are the Samsung, Apple, and Blackberry.

Competition in the Technology Industry

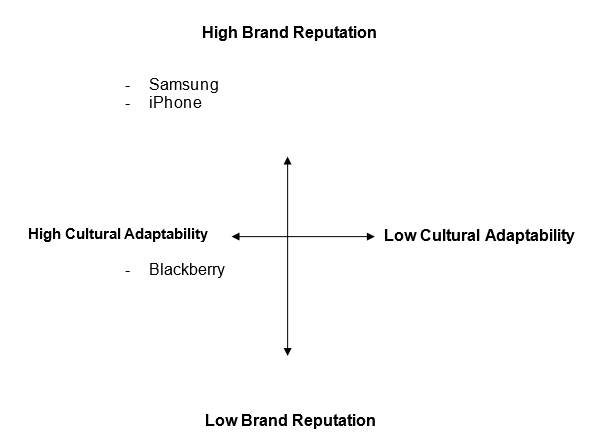

The communication industry is very competitive. It is serviced my numerous mobile phone manufacturers in the country. The leading Smartphone manufacturers and sellers are the Samsung, Apple, and Blackberry. The three mobile phone manufacturers seek to provide services for the middle and high-income segments of the population.

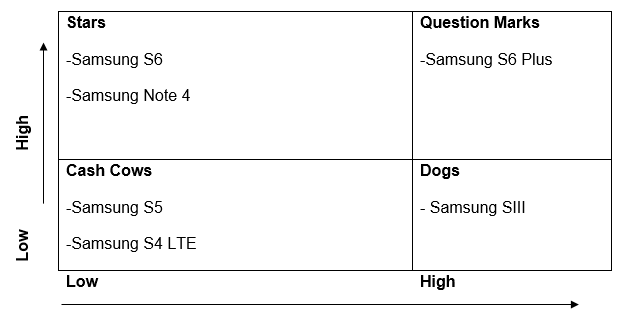

Samsung Electronics is the world’s leading manufacturer of Android OS-based Smartphones. In the UAE, it is the leading seller of Smartphones. The following diagram presents the BCG matrix for the company:

The above diagram shows that Samsung S6 and Note 4 perform very well in the market. The most sustainable and consistent income earners are the Samsung S5 and Samsung S4 LTE. However, the company should review its Samsung III product, which has been overtaken by other models. Samsung S6 Plus is a highly promising model, yet it has not lived to its expected success since it was introduced in the market.

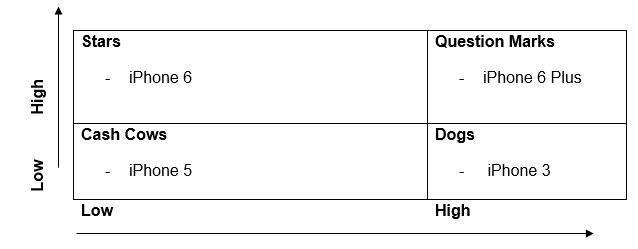

The Apple’s iPhone is the high-end line of Smartphones that are also popular in the country. The diagram below presents the BCG Matrix for the iPhone Smartphones in the UAE.

The iPhone 6 is the fastest growing product by the Apple Corporation in the UAE. On the other hand, iPhone 5 provides sustainable income for the company in the market. The iPhone Plus has had a low intake, but has the potential to become the star performer. Lastly, the iPhone 3 has become redundant. Hence, it should be phased out of the market.

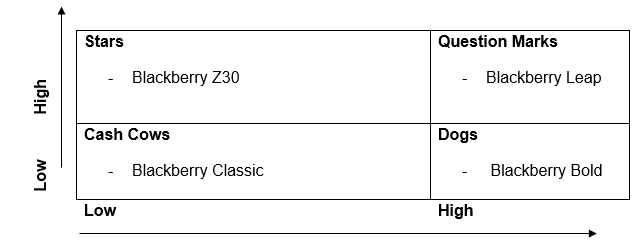

Lastly, the Blackberry phone is a competitor in the market segment. The following diagram represents the BCG matrix for the Smartphone models:

Industry 5: The Banking Industry

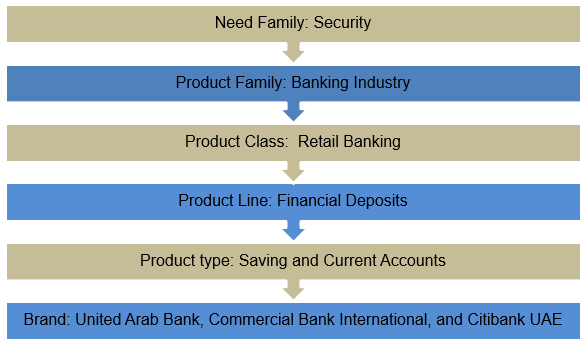

The banking industry provides essential services in the economy as a financial intermediary between the government and the population. The sector can be categorized as serving the need for security of the people (Al-Marri et al. 164). As a rapidly growing economic in the Middle East, the financial intermediary segment is very important in linking the country and the region to the global economy (Jabnoun and Al Rasasi 81). The following product hierarchy provides a representation of the industry in the country:

The banking industry constitutes different financial intermediary services that are important in the money segment. Retail banking is crucial in providing intermediation services between individual customers and the government. The banking industry provides security for persons and companies by ensuring that they have a secure environment to keep and access their finances wherever they need. The product class is the retail banking that facilitates the savings and deposits for customers in the country (Al-Malkawi et al. 114). The product line involves financial deposits while the product type involves savings and current accounts. There are various providers of the financial services such as the United Arab Bank, Commercial Bank International, and Citibank among others. The retail banking industry is very competitive in the country.

Competition in the Banking Industry

The banking industry is very competitive in the United Arab Emirates. Some of the major competitors are the United Arab Bank, Commercial Bank International, and Citibank.

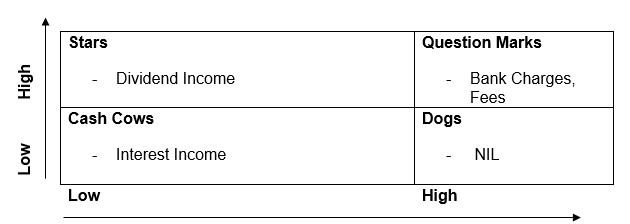

The United Arab Bank BCG matrix is as follows:

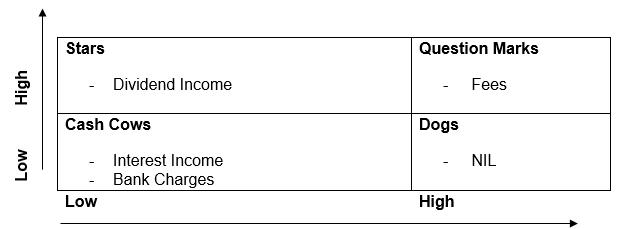

The Commercial Bank International is also a major player in the segment. The BCG matrix for the bank is as follows:

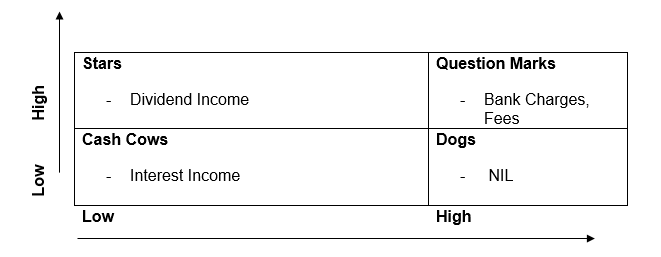

Lastly, the Citibank is one of the oldest players in the industry. The BCG matrix presents the competitiveness of the bank in the country.

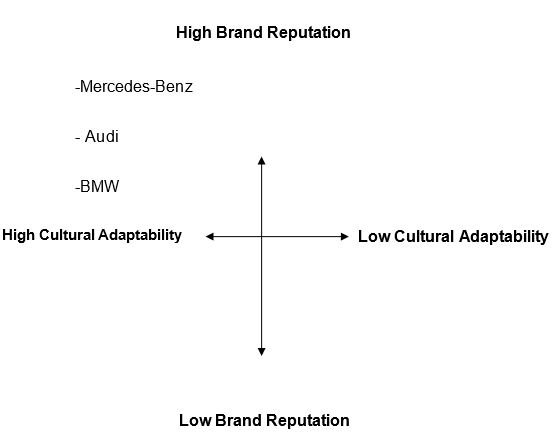

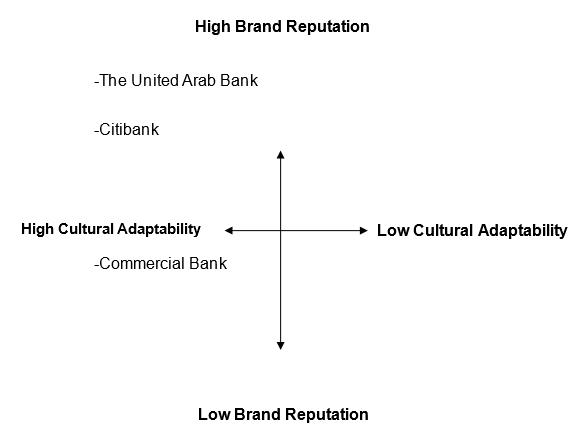

The United Arab Bank is the most competitive in the country. Although Citibank is American-based, it has a long-standing presence in the country. The banking industry is essential and continues to play an imperative role in the economy. The following diagram presents the cultural adaptability and perception of the banking industry in the country:

Conclusion

The paper has discussed the product hierarchy of various industries in the economy of the United Arab Emirates. The key areas that have been highlighted are the health, entertainment, banking, automobile, and technology industries. In the health industry, NMC Hospital is the most competitive as compared to Burjeel and the Dubai-based American Hospital. In the entertainment industry, the Vox Theatre has the biggest market share. In the technology sector, Samsung and iPhone models are the most competitive in the UAE. The automobile industry that serves the luxury cars is dominated by BMW followed by Mercedes-Benz. Lastly, the United Arab Bank dominates the banking industry.

Works Cited

Ahmed, Allam, and Ibrahim Alfaki. “Transforming the United Arab Emirates into a knowledge-based economy: The role of science, technology and innovation.” World Journal of Science, Technology and Sustainable Development 10.2(2013): 84-102. Print.

Al-Malkawi, Husam-Aldin, Hazem Marashdeh, and Naziruddin Abdullah. “Financial development and economic growth in the UAE: Empirical assessment using ARDL approach to co-integration.” International Journal of Economics and Finance 4.5(2012): 105-116. Print.

Al-Marri, Khalid, Abdel Moneim, Baheeg Ahmed, and Mohamed Zairi. “Excellence in service: an empirical study of the UAE banking sector.” International Journal of Quality & Reliability Management 24.2(2007): 164-176. Print.

Jabnoun, Naceur, and Aisha Al Rasasi. “Transformational leadership and service quality in UAE hospitals.” Managing Service Quality: An International Journal 15.1(2005): 70-81. Print.

Shihab, Mohamed. “Economic Development in the UAE.” United Arab Emirates: a new perspective 1.1(2001): 249-259. Print.

Yunis, Alia. “Film as nation building: The UAE goes into the movie business.” CINEJ Cinema Journal 3.2(2014): 49-75.Print.