Executive Summary

There has been a significant increase in the demand for notebooks in the Indian market during the past year and we want to get a bigger chunk of the market. To do this, we are launching the Acer Extensa model. We are confident we can compete with the other leaders in the industry because our product combines competitive features with affordable prices. We are targeting specific segments of the market, and taking advantage of the opportunities brought about by the demand for affordable quality notebooks.

The primary marketing objective of this plan is for Extensa to be the highest-selling notebook of its class in the Indian market, thus duplicating its success in the US market during the first year of its release. The primary financial objectives are first-year sales of $66.5 million or ten percent (121,000 units) of total market share with first-year losses at not more than half, and break-even in the second year. The ultimate objective is to capture Hewlett-Packard’s 37 percent market share or an annual average sale of more or less half a million units.

Table 1: India PC Shipments (million units).

Situation Analysis

Taiwan’s Acer, Inc., one of the top three computer vendors in the world next to Hewlett-Packard and Dell (Acer, 2007; IT Voir, 2008), is planning to sell affordable notebooks in India following a strong reception for notebooks in the market.

India is among the top three evolving economies in the world that have been predicted to be most buoyant in 2008. In 2007, total notebook sales in this market increased to 59 percent; whereas, just four years ago, notebooks accounted for less than 3 percent of the PC market. (IT Voir Network, 2008). It is projected that the demand for notebooks will continue for years (Josie, 2006).

Like China, India has the largest population in the world and can be explored for its market potential for notebooks.

To gain a bigger market share in India, Acer must focus on targeting carefully chosen specific market segments, including small to medium businesses. A study by the New York-based Access Markets International (AMI) Partners, small businesses in India invested $4 Billion in a notebook in 2007 (AMI Partners, 2007).

Market Summary

The Acer market consists of busy consumers who need to work, communicate and exchange information on the go, and corporations who want to help their middle-level executives to be able to work, communicate, and have access to vital information while being mobile. Segments to be targeted include professionals, students, corporations, and entrepreneurs.

Exhibit 1. Needs and corresponding features/benefits.

Strength, Weaknesses, Opportunities, and Threats (SWOT) Analysis

Acer has several strengths on which to build, such as a trusted brand name and affordable price, but its main weaknesses include having the least features among the notebooks of its class.

Strengths

- Good features. Acer Extensa boasts of features that are comparable with its competitors.

- Trusted brand. Acer is among the top developers and vendors of computers and notebooks in the world. The brand is the greatest strength of the product.

- Pricing. Value for money is another selling point of Extensa. Consumers are becoming more and more demanding of quality products, but remain unwilling to shell out extra cash, and Indians are generally regarded as cost-sensitive.

Weaknesses

- Least memory. Although Acer Extensa has an unquestionably high RAM for multi-tasking, it has the least RAM among its competitors, (2 GB) compared with Dell’s 2 GB expandable to 4 GB, and Toshiba’s and Packard-Hewett’s 3 GB expandable to 4 GB.

- Lower capacity hard drive. Acer Extensa has a very powerful hard drive (160 GB, 5400 rounds per minute or rpm), but it is less powerful when compared with its competitors, each of which features a hard drive of 250 GB, 5400 rpm.

- Heavier weight and bigger size. At 6.4 lbs., 1.7”, Acer Extensa is slightly heavier and bigger than its competitors. Hewlett-Packard Pavillion is 5.25 lbs., 1.5”; Dell Inspiron, 6.2 lbs., 1.5”; and Toshiba Satellite, 5.8 lbs., 1.6”.

Opportunities

Acer can take advantage of the following opportunities:

Increasing demand for notebooks. The demand for laptops is projected to continue to grow within the next two years. The trend of having a mobile lifestyle and the need to be able to work and communicate while away from the workplace, home, or school, are boosting demand for notebooks. Likewise, notebooks are projected to replace bulky desktop PCs. According to the International Data Corporation (India), consumers are now buying notebooks as second PCs (Josie, 2006). Moreover, many desktop PCs are due to retire in the next few years, and corporations are expected to change them to notebooks.

Increasing demand for good products at affordable prices. Indians are generally regarded as very cost-sensitive. So while the target segments will look at the product’s built-in features and capabilities, the cost will be an important factor to consider in what to buy (when choosing between desktop PC and mobile PC or notebook) and which model to choose.

Threats

Increased competition. There are now several key players in the Indian notebook market with models offering more features and benefits than Acer Extensa, but at much higher prices. Therefore, Acer’s marketing communication must stress pricing, and the availability of functions that the consumers need, not on the extras other brands carry, which the target segments may not use.

Downward pricing pressure. Heightened competition and market-share strategies are pushing notebook prices down. Still, our objective of seeking 10 percent of the market in the first year is realistic, given the lower margins in the notebook market.

Competition

Heightened competition in the notebook market has put considerable pressure on notebook vendors to continually add features and lower prices. Following are key competitors and an overview of their positions and marketing strategies:

Toshiba. Japan’s Toshiba has recently adapted the go-to-market strategy, putting in place a dedicated CSD team in Delhi to interact with channel partners “to ensure good sales revenues and efficient logistics.” The company, which has offices in Mumbai and Delhi, will soon be present in Bangalore and Chennai. Toshiba is targeting large format malls and tie-ups with retail stores. Likewise, it has revamped its existing exclusive stores (Gupta, 2007).

Hewlett-Packard. With about 40 percent share worldwide, Hewlett-Packard is the leader in the notebook market. With its dual-brand strategy, Hewlett-Packard is perceived among Indian consumers and retailers as the best brand. Like Acer, Hewlett-Packard also uses the channel-route strategy. Hewlett-Packard’s strength lies mainly in the A market. In a survey conducted by the Computer Reseller News, the brand won in almost all categories, namely: performance, service, and support (having local service posts), channel relationship (having the most number of sale/support personnel in the field), and marketing and branding (Nambiar, n.d.).

In 2004, Hewlett-Packard announced a three- to six-percent price cut on notebooks across models to further boost growth in this market (The Hindu Business Online, 2004).

Dell. Dell India Pvt. Ltd., which used to target the large corporate segment, shifted its focus on the small and medium businesses and the government sector, as well as the financial services sector. Although it slipped from being the third IT vendor in India to fifth in 2007, it has remained the fastest growing IT vendor in the same year, having grown 50 percent in revenue (Rao, 2008).

Unlike its competitors, Dell uses the direct-selling model as its marketing strategy. Just recently, it switched from being product-based to solution-based and was impaneled by the Doctorate General Supplies and Disposals, thus enabling it to be among the IT vendors who can compete in the government sector (Rao, 2008).

Product Offering

Acer Extensa has the following features:

- AMD Turion™ 64 X2 mobile technology TL-58* for AMD dual-core technology in a thin-and-light design; HyperTransport™ and AMD PowerNow!™ technologies and improved security with Enhanced Virus Protection

- 2GB DDR2 SDRAM for multitasking power

- Multiformat DVD±RW/CD-RW drive with double-layer support records up to 8.5GB of data or 4 hours of video using compatible media

- AMD dual-core technology for working or playing with multiple programs without impacting performance (AMD64 technology provides simultaneous support for 32-bit and 64-bit computing)

- 15.4″ WXGA LCD widescreen display with CrystalBrite technology and 1280 x 800 resolution

- 160GB Serial ATA hard drive (5400 rpm)

- ATI RADEON X1250 graphics with up to 896MB HyperMemory (total of local and shared system memory used by GPU); DirectX 9 support; S-video TV-out

- Built-in Crystal Eye Webcam and microphone make it easy to chat with and send video mail to family and friends

- The 5-in-1 media card reader supports Secure Digital, MultiMediaCard, Memory Stick, Memory Stick PRO, and xD-Picture Card

- IEEE 1394 (FireWire) interface and 4 high-speed USB 2.0 ports for fast digital video, audio, and data transfer

- Built-in high-speed wireless LAN (802.11b/g); 10/100/1000Base-T Ethernet LAN with RJ-45 connector; V.92 high-speed modem

- Weighs 6.4 lbs. and measures just 1.7″ thin for portable power; lithium-ion battery and AC adapter Microsoft Windows Vista Home Premium Edition operating system preinstalled; software package included with Acer GridVista, CyberLink PowerDVD, NTI CD-Maker, and more.

Exhibit 2. Comparison of features and prices: Acer, Hewlett-Packard, Dell, and Toshiba.

- 1 Acer Extensa features.

- 2 Hewlett-Packard Pavillion features.

- 3 Dell Inspiron features.

- 4Toshiba Satellite features.

- *Price varies according to color.

The main aspects that differentiate the Acer Extensa from the competitors’ products lie with the memory, hard drive, weight, and capacity of the card reader. As to memory and hard drive, Acer is the least powerful. As to weight and dimensions, Acer is the heaviest and biggest, although only very slightly. As to the capacity of the card reader, Acer’s is comparable with the others, except with Dell which leads the pack in this category.

In short, Acer is highly powerful but not as powerful as its competitors. But then again, it is the cheapest, and considering that it has all the things that most customers look for in a notebook at a considerably lower price, Acer can be marketed by playing upon its affordability as the main selling point.

Distribution

Acer Extensa will be distributed through a network of the carefully chosen store and non-store retailers.

Computer stores. Major office depot carrying Acer products like A1 Computer, A2Z Computer, Inc., and ACDL Computers, will carry Extensa.

Electronic stores. All electronic stores that also sell computer products will carry Acer computers, including Extensa.

Online retailers. Web site retailers like e-Bay India, its online store, will carry Acer notebooks.

Acer exclusive distributors. Retail channels that carry only Acer products will likewise distribute the new Extensa model.

Acer Extensa will initially be distributed in the major cities of India during the first months and then be made available to the other major provinces within the next two months.

Marketing Strategy

Objectives

Our objectives for the first year of product introduction are aggressive yet realistic. Our main objective is for Extensa to be the top-selling notebook of its class, and to achieve 10 percent of the overall notebook market.

An important objective would be to establish the Extensa model as the best buy in its class, it being a product of a well-regarded brand, and considering its capability and affordable cost. To achieve this, we will have to heavily promote the product as a brand that emphasizes quality and value. The marketing strategy is to play on Indian’s cost-sensitivity and appreciation of high-quality products.

While the promotions part, we must also measure the target segment’s awareness of and response to our product. We must find out if we are putting across our message, and if the Indian market is buying it. Should there be a disparity between expected response and actual response, marketing adjustments will be made at any point during the promotions period.

Target Markets

Business targets

Our main business targets are small to medium corporations whose desktop PCs are about to retire and/or need their middle executives to be always able to work and have access to critical data while on the go. We will also target entrepreneurs and small-business owners who, like their corporate counterparts, need to be able to have access to vital information and get connected while on the go.

Consumer targets

Our main consumer targets are those within the middle- to upper-income brackets who need to be always able to work and communicate with them while conducting business and or do business while on the go. This segment of the market will need to have mobile PCs with them for their product presentations, gatherings, business proposals, and so on. We will also target students, specifically those in college and graduate schools. This segment of the market will need a mobile computer to do their school activities, researchers, papers, presentations, studies, notetaking, and so on.

Positioning

We are proposing the Acer Extensa as a high-power yet an affordable model for personal and professional use. The marketing strategy will focus on the price as the main feature differentiating the Acer Extensa model from its competitors.

Strategies

Product

The Acer Extensa, including all the features in the Product Review section, will be sold with a one-year warranty plus a 20 percent discount on the laptop bag. Another strategy is to sell the unit with the same warranty plus free computer peripherals, like a flash drive or a pack of CDR-Ws.

After the first year of Extensa in the market, we will introduce a slightly less powerful but very cheap model (priced at $350, wholesale), with a minimum of 1 GB RAM and 130 GB hard drive. The target segment of the new product will still be students, middle executives, and small businesses.

Pricing

The Acer Extensa will be priced at $550 wholesale, $649 estimated retail price per unit. We might have to slightly lower the price of this model when we expand the product line when we launch another model. With the launch of the cheaper model, more segments of the market will be able to own laptops, and we will have a much bigger share of the market, and hopefully keep it that way, even if the key players in the notebook market would follow suit.

At $649 retail price, Acer is very cheap compared with competitors’ models. Acer Extensa is cheaper by at least $100 than the cheapest version of Hewlett-Packard Pavillion ($749 to $949), cheaper by at least $150 than the cheapest version of Dell Inspiron ($799 to $1149), and cheaper by at least $350 than Toshiba Satellite ($999).

Distribution

Our channel strategy is to maximize the use of reliable channels to have Acer Extensa sold through well-known and even smaller retail stores and online retailers. During the first year, we will have the Extensa available in major cities of India, and featured in all electronics catalogs and Web sites, in local televisions and papers.

In support of our channel partners, we will provide detailed specification handouts, full-color photos, and displays featuring Extensa, as well as demonstration products. We will also arrange promos and interesting terms for retailers that place volume orders.

We will also open exclusive Acer centers in some major cities in India which will have regular promotions to promote Extensa.

Marketing communications

Using all available media, we will reinforce the brand name and its best selling point, which is the marriage of quality and affordability. Research about consumer demands, preferences, and consumption will help our advertising department identify the media that will best deliver our objective, as well as the timing of promotional activities. Thereafter, advertising will appear regularly to maintain brand awareness and communicate our key message, that Acer Extensa is a smart buy.

We will also conduct public relations efforts to further boost the Acer brand. To attract market attention and encourage orders, we will offer as a limited-time premium a carry-case, a free computer peripheral like a flash drive, or a set of CDR-Ws. To maintain and motivate channel partners for a push strategy, we will use trade sales promotions and personal selling to channel partners.

And to reach a wider audience, we will utilize the Web site retailers, as well as a tie-up with local television and radio, shows to promote the product.

Marketing Mix

The Acer Extensa will be introduced in April. Here are the action programs we will do during the first six months to ensure that we achieve our objectives as previously stated.

March

We will use a $5,000,000 trade sales promotion campaign to excite the dealers of the product launch in April. We will exhibit at the major consumer electronics trade shows. Select product reviewers and opinion leaders will be provided with product samples as part of our public relations strategy as well as handouts on the features and capabilities of the product. Our training staff will work with sales personnel at major retail chains to explain Acer Extensa’s features.

At this point of the promotional period, preparations should already be made for next month’s launching.

April

We get into multi-media campaigns (print, radio, television, and Internet) targeting professionals and consumers. The campaign will focus on the benefits of owning a high-power notebook at an affordable price. The benefits of huge savings made from buying a good but affordable product will be played up in different scenarios in the advertisements. Point of sale signage and radio and TV specials will be used to support the campaign.

A well-conceptualized cocktail event or even a concert will kick off the launching of Acer Extensa. Present during the event is the image model (a local or Bollywood celebrity) as well as some of the country’s well-known personalities and opinion-makers. During the event, at least three units of Acer Extensa will be raffled off, and small computer peripherals will be given away to the first 50 to arrive at the event.

During the launch week, the endorser’s TV appearances will be heightened to promote the product. It will be best if the endorser will also have a solo project launching that will coincide with the event, say a release of his or her movie or album.

May

The massive multi-media campaign will continue, with some add-on sales promotion activities such as giving away leather carry-cases and other computer paraphernalia as premium. We will also distribute point-of-purchase displays.

Still, tie-ups with television shows will continue to maintain target segments’ excitement of the product.

June

We will roll out a national advertising campaign, with a carefully chosen celebrity endorser. On TV advertisements, the endorser will be seen using his or her notebook; on radio, the endorser’s voice will be heard promoting the product; and in print, the endorser will be using the product.

July

We will hold a trade sales contest with interesting prizes for the salesperson and retail organization that sells the most notebooks during 8 weeks. Prizes will be a unit of Acer Extensa for the winner in each category.

August

Another angle of the advertising campaign will be launched this month. New tie-up with other television and radio shows may be done to retain consumer’s awareness of the product. If the local endorser has solo projects, Acer Extensa may tie-up with the event to support the endorser while at the same time, promoting the product.

Marketing Research

We will conduct marketing research to identify exactly which of the specific features and benefits of notebooks our target market segments value. We will also want to know if they would mind having a slightly less powerful notebook but at a much cheaper price. Moreover, we want to find out which segment of the market would want to have low-cost notebooks, and how big that segment is. We will also measure and analyze how customers perceive our competitors.

Feedback from our market research will help us decide which features to add and which features to remove from the new notebook to be launched after Extensa. With our brand awareness research, we will be able to measure the effectiveness and efficiency of our messages and media. Finally, we will use customer satisfaction surveys to gauge the market reaction to our product and brand, their expectations, as well as their needs.

Financials

With a projected market share of 10 percent, we expect $ 66.5M sales by selling 121,000 units at $550 per unit (wholesale) in the first year. For the second year, with a projected market share of 37.80 percent, we expect sales of $251.5M from the sale of 457,380 units at $550 per unit.

Table 2. Financials at 1,210,000 total laptop shipment in India.

Controls

Implementation

We have to devise measures to closely monitor quality and customer service satisfaction. We like to be able to immediately react to and act on any problems that may occur. We will also closely monitor warning signs of deviation from the plan.

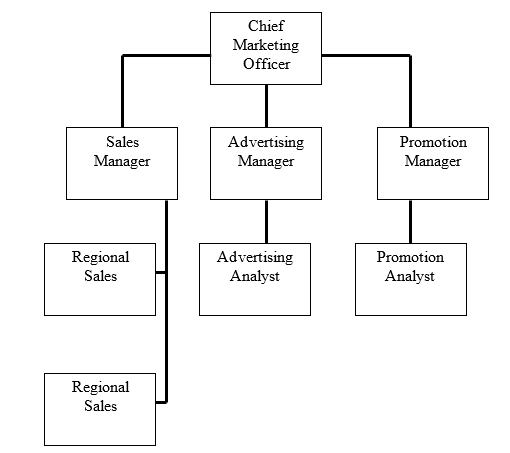

Marketing Organization

Acer’s chief marketing executive is the overall overseer of the implementation of the company’s marketing strategy and direction for Extensa’s entry into the Indian market. Exhibit 3 shows the structure of the eight-person marketing organization.

Questionnaire

Please put a tick mark on the blank that corresponds to your answer.

- Do you have a computer at home?

- Yes.

- No.

- If your answer to number 1 is yes, please classify your computer.

- notebook (or mobile PC or laptop)

- desk computer

- Do you have a computer at work?

- Yes.

- No.

- If your answer to number 3 is yes, please classify your computer.

- notebook (or mobile PC or laptop)

- desk computer

- If your answer to numbers 1 and 3 is no, do you have plans of buying a computer?

- Yes.

- No.

- If your answer to number 5 is yes, what kind of computer do you plan to buy?

- notebook (or mobile PC or laptop)

- desk computer

- If your answer to number 6 is a notebook, why?

- Internet connection

- Mobility

- Access to information

- Accessibility (communication via email and chat)

- If your answer in number 6 is a notebook, how much is your budget?

- $300 to $500

- $550 to $650

- $700 to $800

- $850 to $1000

- $1050 and up

- What is the most important factor you would consider when buying a notebook?

- budget

- features

- size and weight

- brand

- other

- Have you heard of the Acer Extensa notebook?

- Yes.

- No.

- What do you think would convince you to buy Acer Extensa?

- Price

- Brand

- Features

- Other

- What do you think would stop you from buying Acer Extensa?

- Brand

- Features

- Price

- Other

- Which of the following competitors would you buy instead of Acer Extensa?

- Dell Inspiron

- Toshiba Satellite

- Hewlett-Packard Pavillion

- What would make you buy your choice in number 12?

- Price

- Brand

- Features

- Other

- Where do you plan to purchase your notebook?

- Online retail sites

- Computer stores

- Electronic stores.

References

Acer, Inc. (2007). About Acer. Web.

AMI Partners. (2007). SMBs in India to invest $ 4 Billion in computer hardware this year. Web.

Bestbuy.com. (n.d.) Web.

Bestbuy.com. (n.d.) Web.

Bestbuy.com. (n.d.) Web.

Bestbuy.com. (n.d.) Web.

Gupta, Yogesh. 2007. Toshiba weaves new Indian plan. Channel World. November 2007. Web.

IDC India. (2007). Press release. Web.

IT Voir Network. (2008). India notebook PC market grows 59 percent. Web.

IT Voir Network. (2008). Taiwan’s Acer to launch low-cost PCs this year. Web.

IT Voir Network. (2008). IT budgets to shoot up in Asia. Web.

Josie, Priyanka. (2006). India’s craze: Laptops. Web.

Rao, Malovika. (2008). Dell India says its revenue rose by 50 percent. Web.

Rao, Malovika. (2008). Acer aims to increase notebook sales by 50 %. Livemint.com. Web.

Nambiar, KR. (n.d.). HP, the mobile moghul. Web.

The Hindu Business Online. (2004). HP cuts notebook prices by 3–6 p c. Web.