Abstract

With the aim to investigate, the economic diversification of Qatar, this paper has looked over the relevant literature review of economic diversification that encouraged and developed the conceptual framework of such economic strategy.

By using secondary data, this paper scrutinized the economic diversification of Qatar from three arguments, such as, development of financial sector as diversification efforts, expansion of knowledge-based economy as diversification efforts, progress of other service sectors as diversification efforts by using most recent data.

The paper concludes that the progress of economic diversification of Qatar has gained a significant progress, but due to the changing nature of global economy, the authority of Qatar needs to consider the economic diversification as a continuous process to mitigate any further risk.

Introduction

Qatar is the pioneer of economic diversification among the GCC nations; although the country has been facing different economic obstacles following the impact of global financial crisis and economic downturn, the country uphold a strong record of economic development due to its diversified economic planning and moderate leadership in this region with a balance between oil and non-oil sector.

Staring from the independence in 1971, the country has discovered a vast reserve of hydrocarbon resources, but the government of Qatar introduced most dynamic economic planning to reduce its extreme dependency on the oil sector and emphasized to develop the non-oil sector taking into account of domestic needs and international market, along with regional collaboration, technical feasibility, and fiscal challenges.

This paper has aimed to investigate the degree of economic diversification of Qatar from the theoretical viewpoint and practical data available from different research in this area with to aim to provide a better understanding in this discipline that would ultimately explore new area for further research.

Literature Review of Economic Diversification

This literature review of economic diversification of Qatar has organized with the prevailing idea and inspiration of the most prominent economist in the theoretical and institutional field working with sustainable development of the global economy along with their linked data where Qatar is the focal point in this regards wit the aimed to provide greater insights with practical implication.

Ahmadov (1) pointed out that the economic diversification is the pathways of gaining economic growth of a country through the different means without providing excessive pressure on the plentiful in natural resources of that country due to the reason that the natural resources are not renewable and the overall stock is limited.

Many scholars argued that unaccountable use of natural resources would bring profound deformation in the economy with less industrialization and reducing employment opportunity, less saving and investment that ultimately provide deprived mobility economic activity and economic growth of the country.

Klinger and Lederman (11) and Humphreys (3) added that extreme national wealth gathered from the natural resources would lead the government to turn into the autocratic regimes violating human rights and democratic values that ultimately lead to the civil war or armed conflict in the country and even foreign countries make interference in the local confects with different interests.

Thus the significance of economic diversification is that it would generate a balanced economic level where the government may not impose tremendous pressure on the natural resources for quick economic development, but balance it through right use of resources ensuring transparency, stabilizing expenditures, national saving, and investment to generate employment opportunity.

At the same, time the economic diversification initiatives would also lead to accelerate privatization, right allocation of resources, homogeneous development of different regions of the country, establishment of special economic zones, welcome foreign direct investment, including the institutional development along with the development of the capital market and legislative reformation.

Kozeibayeva (3) demonstrated that the abundant natural resourceful countries may not gain economic growth as faster as the less-resourced countries perform, the historical data of Nigeria and Venezuela and GCC counties evidenced that their over all economic progress is lesser than the poor natural resourced countries like Japan and Taiwan where rich natural resource as curse rather than blessing.

A variety of research demonstrated that resource curse in the developing countries functions to prevent economic transition with shocking effects in the structure of deep debts in the public and private sector, collapse of export and tradable sector, generate civil wars, and increase poverty with economic and political instability that destroy normal economic performance.

Moore (1) pointed out that the economic diversification drive would provide an assortment of reimbursement to the national economy that increases economic growth by creating job opportunities with attractively high-wage that increase the living standard of the working class, increase saving and further investment and the economy gets more stability than ever by economic diversification.

The consequence of economic diversification could be indicated by the sector-wise GDP contribution, but the actual measurement of economic diversification could be assessed by the job statistics and wage incensement data provided by the employment department of a country that generates an economic diversification index.

Ahmadov (2) also argued that in the countries with enormous natural resources have the same scenario of political instability and conflict could find a balanced solution though encouragement of economic diversification that would provide long-term solutions to overcome socioeconomic unrest providing huge economic benefits by improving education, democracy and human rights.

The rising demand for economic diversification generating continuous pressure on the governments to diversify their economy, although the real scenario of all heavy hydrocarbons resourced countries in the Middle East does not prove that that the diversification is only solution for socioeconomic progress, rather it is a primary concern while political willingness of the government is a major concern.

QPC (1) added that the success of the economic diversification underlies on the dynamic leadership of the country that aimed to establish the nation upon a knowledge-based economy for last three decades with the economic policy focused on the balanced use of de natural hydrocarbon reserves with substantial use pointing to the local and international market demand.

Still the government is striving to explore further diversity with different energy projects coordinating between the public and private investments with the participation of representatives from different sectors including civil society that upholds knowledge economy estimation of Qatar along with the establishment of the knowledge-based economy as an integral part of its National Vision 2025.

Methodology

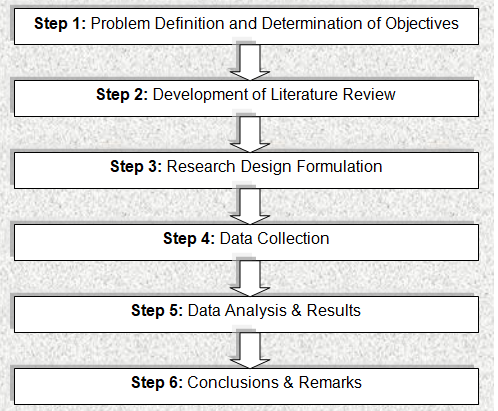

This paper will carry out research following several steps to assess Qatar’s economic diversification, such as, formulation of problem statement along with objectives, and completion literature review are the key tasks in this case; however, the following figure describes other steps more elaborately –

Research methodology is a technique of scientifically resolving the research dilemma; therefore, the researcher of this paper used case study approach and descriptive research method considering the prior knowledge and available information regarding the research problem area to discuss on economic diversification of Qatar.

Importance of Case Study Approach

- Case studies enable a rich, holistic, and in depth description of data;

- This approach would help the researcher co-ordinate the understanding with proper evidence;

- In addition, it is helpful to study complex phenomena (Yin 6);

- At the same time, it is useful method when the topic needs to discuss within a real-world context like assessing the impact of economic diversification in Qatar;

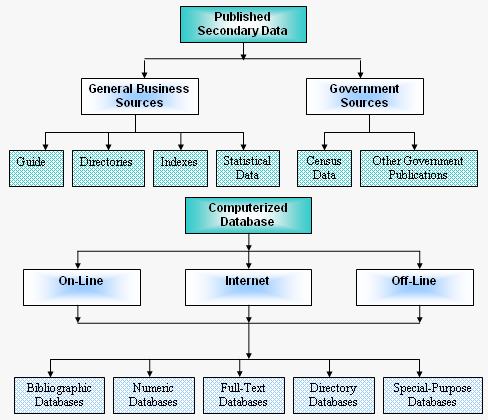

Secondary Research

This paper mainly based on secondary data sources and the researcher particularly focus on the internet databases because it is one of the most cost-effective and familiar ways to collect processed data; however, the next figure shows secondary data collection method –

In order to evaluate the impact of economic diversification in Qatar, the writer of this study considered a number of secondary sources, for instance, scholarly articles including Al-Ghorairi’s article in the development of the financial sector of Qatar, reports of Qatar Statistics Authority, World Bank, journal publications, and so on.

Limitation of the Study

- Limited words were one of the main problems to organize this paper as the topic “assessing Qatar’s economic diversification’ is the vast area of research and should point out too many relevant factors in this regard;

- In addition, the deadline was not sufficient to formulate the study;

- There were no scope to collect primary data due to short word limit; consequently, it is not possible to know the opinion of the mass people regarding economic diversification of Qatar

Results and Discussion

Al-Ghorairi (30) pointed out that there are insufficient accessible literatures, which are concerned with Qatar exclusively, even though it is to certain extent, enclosed in some studies, which deal with oil sector industry in the Arab states; in addition, the investigations published thus far does not take into account the latest considerable socio-economic changes or economic diversification of Qatar.

However, Al-Ghorairi (31) also suggested that in order to assess the economic diversification of Qatar, it is highly essential to closely observe the financial sector development, banking industry, expansion of insurance sector, and emergence of new financial services as well as the oil sector of the country.

Monetary circulation in an oil-based economy as Qatar depends on how much the government expends outside of the amount of credit that bank and other financial institutions provide to private-investors; however, it is notable that Qatar has been one of the fastest-growing economies in the world throughout the last ten years both in terms of financial and oil-sector development.

The nominal growth rate in GDP in 2008 was 44%, headed by 25.1% and 33.7% in 2007 and 2006 correspondingly; the GDP per capita was USD $103500 in 2008, making it one of the wealthiest countries in the planet; conversely, Qatar’s banking sector has gone through a course of evolution that has mirrored the alterations in the economy (Al-Ghorairi 55).

The following figure illustrates that currently, three-forms of banking operations exist in the country, which are, namely, commercial-banks (both local and international), Islamic-banks (which focuses on Sharia law for operations), and specialized-banks –

Figure 3: Forms of banking operations

Source: Generated from Al-Ghorairi (59)

This chapter has organized with the following economic diversification efforts of Qatar with the objectives to evaluate to what extent the country has succeeded its diversification drives –

Development of Financial Sector as Diversification Efforts

IMF (4) pointed out that among the petroleum-producing countries, Qatar is the third-largest owner of hydrocarbon reserves while t placed at the top position for it of LNG conversion, but the country has halted to develop any new petroleum production facilities until 2015 as an economic strategy to accelerate its economic diversification.

The most dominant effort to Qatar’s economic diversification is to strengthening and emergent of the financial sector while the banking system is very flexible to shocks that already influenced by the global financial crisis; however the authority has emphasized to enabling its banking sector enough stronger to protect any vigorous risk and stress by taking macroprudential strategy framework.

The reformation in the banking sector has introduced dynamic initiatives providing a scheme to support for emergency warning system before any shocks that would lend a hand to mitigate the risks of the banking system of Qatar that would ultimately strengthen the financial stability of the country while the initiative would continue to build up the domestic bond markets.

Al-Ghorairi (56) pointed out that the banking system in Qatar remains backward due to its historical and political background that engendered with the independence and the country gained the membership of IMF in 1972 while the country had not any private banking system prevailed and following the IMF membership guidance the country introduced commercial banking system in the country.

At present, there are eighteen (18) banks operating their business in Qatar, some of them domestic and the others are foreign operation introduced through the license of Qatar Central Bank the national central monetary authority that administer and control fiscal and monitory policy of the country.

The banking system of Qatar was quite different from the global banking operation while the oil export remittances transferred by the collaboration of Arab and foreign banks, now the reformation of he banking sector has aimed to explore it in context of global banking system to coup with the changing economic dynamics of the country.

Now the banking sector of Qatar has gained the capabilities to attract funds and utilize that fund in the financial instruments as well as asset-backed trading, moreover the banking sector has gained enough strength to provide equity finance in context of risk sharing, it also generated saving habit of the local people as part of their corporate social responsibility.

Like other Islamic countries, Qatar has introduced Islamic banking system called which is a profit loss-sharing scheme rather than fixed interest-based baking derived from the Islamic ‘Shariah’ law as the religion stands against interest and to prohibited interest-based transaction, this agenda aimed to legalize the banking system from the religion viewpoint.

The model of Islamic bank has facilitated the banking system with a great opportunity to impose the extreme burden of loss on the customers account in the name of Islamic banking while the modern baking sector collapsed due to the credit crush in 2009 following the global financial crisis.

Besides the banging sector, Qatar has significantly developed its stock market named Qatar Exchange and integrated it with the GCC Stock Markets, it has introduced bond market, and private equity market, including new financial services like insurance industry along with the growth of Takaful Market that explored the non-banking financial service sector with landmark success through contribution to the GDP.

In 1995, the government encouraged equity market of Qatar by establishing the Doha Securities Market (DSM) that generated huge domestic investment facilities and the development measured through the number of listed companies which was 43 during 2008 and the market capitalization was QAR six billion and explored up to QAR 279 billion in that period.

The stock markets of the GCC nations have been improving day by day with a greater openness for the foreign investors along with expatriates, the highest degrees of readiness of the Qatar has evidenced by permitting GCC citizens and foreigners to take part in the large level of capital market that sincerely increased the trading levels with superior foreign ownership.

Development of Knowledge-based Economy as Diversification Efforts

Planning Council (8) reported that the knowledge economy in Qatar based on four pillars, such as, ICT, education, innovation, and econ incentive regime; however, the government has already created a national ICT policy for the future development of the nation societal issues in profound ways, enhancing educational sector and offering outstanding healthcare services.

In addition, ICT Qatar (3) stated that ICT based economy of Qatar would develop rapidly while Qatar’s mobile penetration stands at 167%, more than 89% people have computer, and near 70% people of this country use broadband.

At the same time, ICT Qatar (5) and Planning Council (8) argued that improvement of ICT sector would enhance digital literacy and develop the skills for innovation, foster economic development, advance the quality and cost-efficiency of present manufacturing process, building a centralized government data center.

The government initiated to develop ICT sector as part of their diversification process; however, the following figure demonstrates that ICT strategy –

Al-Jaber & Dutta (4) stated that ICT master plan concentrates on three areas to implement nine specific programs including infrastructure development, innovation, security, E-health, E-education, and E-business program. At the same time, Planning Council (10) stated that there are many factors those compare the progress of the economy, for example, the next figure considers few variables –

Planning Council (13) addressed that aggregate ranking of Global Competitiveness Index 2005 to provide the position of Qatar in the index and it showed that general knowledge economy sector is well-organize to turn its economy into a knowledge-based economy compared to other GCC countries.

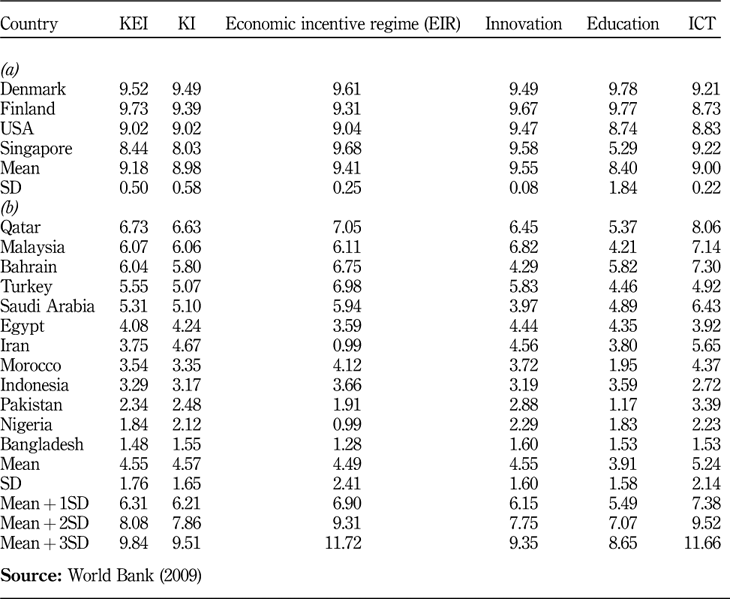

However, the following table shows the comparison of the Knowledge Economy Index (KEI) of Qatar with other competitive countries; it is notable that Qatar’s position is right after Denmark, Finland, USA, and Singapore –

- According to the report of World bank, literacy rate of the youth (age 15 – 24) was 99.06% in 2006, 95.69% in 2008 and 97.76% in 2010; in addition, Qatar has improved on adult literacy rate; however, the following figure shows scorecard on education variables –

- Planning Council (22) reported the government of Qatar spent more than $1.5 billion to develop education system by removing problems like quality and contents of education, high dropout and low enrolment rates, Weak linkages to the labor market and so on;

- To achieve its long-term vision, it focused on upgrading of the sector’s physical infrastructure;

- As per GCI report 2005, Qatar ranked 46 out of 117 countries, UAE ranked as number 32 and Kuwait number 49;

- Planning Council (15) pointed out many problematic factors for developing strong position with in Qatar by knowledge-based economy, such as, lack of skilled labor force, government instability, inefficient government bureaucracy, restrictive labor regulations, insufficient supply of infrastructure, taxation policy, corruption, and poor work ethic in national labor force;

Knowledge-Economy Index if Qatar was about 5.83 in 2005, which was greater than GCC and World average; therefore, Qatar’s economy is now not only depend on financial service or oil sector, but it has strongly turned to the knowledge-based economy.

Development of Other Service Sector as Diversification Efforts

QSA (5) presented the economic data of Qatar and demonstrated that by sponsoring Asian Games in 2006 the service sector of the country has gained a remarkable progress with 26% real growth in the economy, such a diversified economic gain has attracted the country and the government has aimed to be the sponsor and host of the World Cup 2022.

As a means of economic diversification, the government has taken to arranging sports events as a most lucrative strategic economic activity that can boost the economy with double-digit gains while the government Qatar is the foremost actor in the wake of the economic growth and successfully drawn the attention of FIFA to arrange large football tournament with huge investment.

By doing such economic diversification, Qatar planned utilize of its hydrocarbon reserves at a lower level that would provide ostensible GDP with an annual growth of 27.5% although the real data evidenced that the economic growth was 14.1% in 2011 which has accounted as a 36.3% gain in relation to previous year.

During the period, the country has kept the hydrocarbon production at a normal level, but due increase of price in the international market the country gained 36.3 % above and the contribution of oil sector reached at 58.3% in 2011, at the same time, the contribution of non-oil sector to the GDP reached at 42.3% in 2011(QSA, 6).

The non-oil sector of Qatar evidenced with noteworthy local investments, foreign direct investment, petrochemicals rather than oil and gas, financial services, service industry, knowledge management, education, along with infrastructure development and heavy machineries that have assisted to boosting economic returns with a significant improvement of this sector.

Following figure demonstrates the contribution of mining and non-mining sectors in the economy of Qatar –

The figure above evidenced a significant progress of non-mining sector as an effort of economic diversification in Qatar.

The economic diversification of Qatar has explored the private sector of the country with a significant progress in relation to the other GCC countries, rather than the state-owned business it has explored households, corporate sectors along with public and private partnership in different projects and value-added services that enhanced the economic performance of the country.

Following Table illustrates the contribution of private and public sector of Qatar –

The above data points up that the contribution of private sector of Qatar to its GDP was 41 % in 2009 while the public sector along with public-private partnership scored at 59 % with a gradual boost in the development of private sector while the macroeconomic achievements of private sector has been impressive growth.

Conclusion

The economic diversification drives of Qatar has committed to the sustainable economic development of the country with the intention to preserve the huge natural resources for future generation that proved rising vision of the broad socioeconomic stability, environmental responsibility and sustainability of the human race facing concurrent challenges stable economic growth.

The long-term vision of the government evidenced a strategic framework to direct the potential growth of the national economy with strong commitment of the leadership that upholds and support to explore new business, new area of diversification and to improve the condition of transparency with incentive to the innovative business concept while it considered as a transition period of development.

Thus, the government needed to identify further areas of economic performance that would strengthen the ongoing economic diversification.

Works Cited

Ahmadov, Anar. Political Determinants of Economic Diversification in Natural Resource-Rich Developing Countries. 2012. Web.

Ahmed, Allam & Al-Roubaie, Amer. “Building a knowledge-based economy in the Muslim world: The critical role of innovation and technological learning.” World Journal of Science, Technology, and Sustainable Development. 9.2 (2012): 76-98.

Al-Ghorairi, Abdulaziz. The Development of the Financial Sector of Qatar and its Contribution to Economic Diversification. 2011. Web.

Al-Jaber, Hessa. & Dutta, Soumitra. Qatar: Leveraging Technology to Create a Knowledge-Based Economy in the Middle East. 2011. Web.

Humphreys, Macartan. Natural Resources, Conflict, and Conflict Resolution: Uncovering the Mechanisms. 2005. Web.

ICT Qatar. Qatar’s National ICT Plan. 2012. Web.

IMF. Qatar Staff Report for the 2011 Article Iv Consultation. 2012. Web.

Klinger, Bailey. & Lederman, Daniel. Export Discoveries, Diversification and Barriers to Entry. 2010. Web.

Kozeibayeva, Leila. Diversification of Economy as a way of Solving the Resource Curse in Kazakhstan. 2010. Web.

Moore, Eric. Measuring Economic Diversification. 2001. Web.

Planning Council. Turning Qatar into a Competitive Knowledge-Based Economy. 2007. Web.

QPC. Turning Qatar into a Competitive Knowledge-Based Economy. 2007. Web.

QSA. Qatar Economic Statistics at a Glance. 2012. Web.

Yin, Robert. Case Study Research: Design and Methods. Beverly Hills, CA: Sage, 2003. Print.