Executive Summary

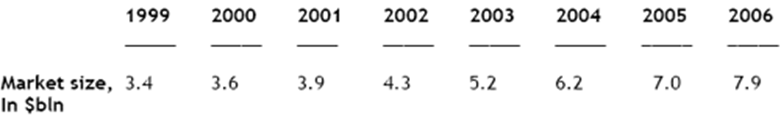

The Russian cosmetic industry is a rapidly growing industry that has a lot of promise and future potential therefore making it a hot spot for business. Research from Euro monitor and other commercial research institutes have made it clear that since the year 1999 the industry has been experiencing growth. Furthermore, it is amazing that when other industries were hard hit by the recession the Russian cosmetic industry was still able to experience overall growth although premium products saw a deep in sales (BAC 2011). Revlon being an American cosmetics manufacturer with a great reputation and superb brand value together with numerous product lines, Revlon is, therefore, a company that hasn’t fully yet gone multinational and therefore is still on the verge of expanding their business to become a fully-fledged multinational company.

On the other hand, a stiff competition that can emanate from currently existing industry participants is of consequence and therefore cannot be ignored the likes of Cosmopack Pro Group, EMG Staraya, Krepost, Faberlic, Garmonia plus Jazz-Smell Kalina, Revlon, Avon, Procter & Gamble of Avon, L’Oréal Russia, Gillette Group, Procter & Gamble, Schwarzkopf & Henkel, Beiersdorf, Kalina Concern, Colgate-Palmolive, Amway, Unilever Russia, and Nevskaya Kosmetika, is not to be taken lightly because statistics show that approximately 67 percent of all cosmetic sales are shared amongst ten companies, therefore, meaning that any new entrant will most likely face an uphill task (BAC 2011). Consequently, it is the formulation and implementation of a strategy that can be able to determine the best-performing companies and separate them from poorly performing companies, and therefore for Revlon to enter and be successful in this Newmarket must be extremely careful and cautious.

Introduction

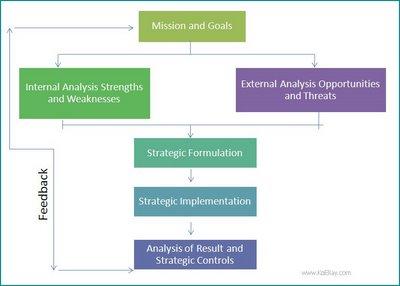

Good Business decisions aren’t made blindly, and neither are they arrived upon by gambling and so forth strategy is, therefore, the key to commercial success. By conducting a Swot analysis, environmental scanning, and looking at how competition intensity within the Russian cosmetic industry it then becomes more plausible and rational to make any conclusions and recommendations about Revlon’s desire to expand its business and enter that market ( Hunger & Wheelen p.56). Of course, the nature of strategy within the industry can be used by Revlon to give them an idea of how business is usually done and assist the company to persuade a suitable business path. The figure below explains why it is important to conduct research and create highly useful data that will assist the business make a difference by helping it formulate and implement a strategy that will help it move forward in its new environment with much more ease and confidence.

It, therefore, becomes very apparent that when venturing into a new market a company must carefully use all avenues to gather data so that it may usefully use this data that is relevant to its market situation to help top leadership and other business executives make good decisions (Kotler p.122).

The Russian market

Research that was conducted by Angel on the web indicates that Russian cosmetic industry forecasts have shown that Russia has emerged as one of the Fastest Growing and most promising cosmetic markets in the world and especially Europe and despite the recession, the industry managed to grow annually by an approximately 8.1%. Moreover, research also indicates that the level of competition between local manufacturers and foreign manufacturers is very high. With participants ranging from Cosmopack Pro Group, EMG Staraya, Krepost, Faberlic, Garmonia plus Jazz-Smell Kalina, Revlon, Avon, Procter & Gamble of Avon, L’Oréal Russia, Gillette Group, Procter & Gamble, Schwarzkopf & Henkel, Beiersdorf, Kalina Concern, Colgate-Palmolive, Amway, Unilever Russia, Nevskaya Kosmetika, Mary Kay, Faberlic, Estée Lauder, Johnson & Johnson, Vesna, Londa Russia, Vichy Laboratories, Svoboda, Christian Dior SA, Eurocos Cosmetics, Krasnaya Liniya Chanel, GlaxoSmithKline, and others it is clear that the Russian cosmetic industry has attracted a lot of participants and will continue to attract more due to its growth pattern as suggested by (PNCOS industry Research Solutions 2010).

Many cosmetic manufacturers are therefore Rushing and concentrating their efforts in the Russian industry simply because it is because Russian women are said to be the highest consumers of cosmetic products more than any other women in Europe. It is said that an average Russian woman uses makeup four times more than any other European woman and Russian women start using Cosmetics when they become 16 years of age and therefore making the Russian cosmetic industry quite a lucrative business venture for multinational companies ( crazy for cosmetics 2008). The Russian economy has also made it possible for businesses and corporate ventures within Russia to become more successful therefore empowering its citizens to have a slightly higher disposable income than its other European counterparts. Research shows that Russian citizens enjoy up to 70 percent disposable income and therefore have more money to spend on purchasing consumer goods and also luxury goods (Aginsky Consulting Group 2007).

Every participant within the Russian industry strives to uniquely brand and differentiate their products. Recent research done by Euromonitor international in July 2010 suggests that the sale of premium cosmetics has gone down simply because of the recent Recession. Furthermore, the availability of cheaper cosmetic products that originate mainly from the local manufacturers has made it hard for foreign counterparts to successfully sell premium products. Local industries enjoy some form of protection from the government while foreign cosmetic manufacturers such as Oriflame, Amway, L’Oreal, Nivea, and others are doing not enjoy the same benefits therefore they incur extra incremental costs to have their products reach the shelves the Russian government intends to protect local industries and consequently has put in place certain rules, procedures, tariffs, number of licenses and taxes for foreign cosmetic manufacturers without which they cannot start operations in Russia, companies including, Revlon, Avon, and Beiersdorf. General importation duty and VAT of 15% &18% respectively are put on color cosmetics produced by foreign multinationals, which makes it hard for foreign companies to be part of the price wars that local participants within the cosmetic Industry engage in.

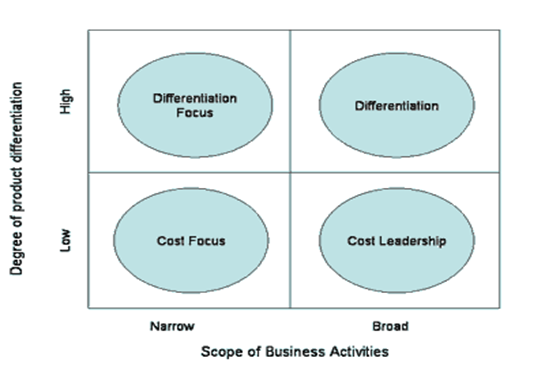

Therefore following the revelations above foreign participants such as Oriflame, Nivea, and others have been forced to adopt a friendlier pricing model. This, therefore, means that premium pricing that is normally the case with many premium products that are highly differentiated is no longer a good business market because there are cheaper brands that emanate from rivals within the industry that can be used to serve the same need that consumers who use cosmetics have. With price wars raging within the Russian industry then many companies are adopting a cost leadership competitive strategy that will allow them to use a price penetration model so that the number of units sold per brand per company can go up.

Michael Porter’s Model (Five Competitive Forces) analysis of Russia’s color Cosmetics Industry is a tool that can be effectively used by business executives to take a look at how multinational companies can enter into new markets and in this case, the market is Russia. Revlon being a prospective company intending to enter the new Russian market must know that the intensity of rivalry among industry participants is very high because there are over 40 companies that participate in the industry and compete for over 7billion dollars in sales annually. Companies like Kalina, Nevskaya, and Kosmetika have seen numerous growth patterns which are of 13%&, 10% and 17% respectively indicating that local industries are a force to be reckoned with on the other hand foreign multinationals like Amway suffered a 5.9% decline in sales while Mary Kay Registered an 8% loss of market share in 2009. Furthermore, almost 66.9% of cosmetic sales went to the 10 leading companies in the year 2009 therefore implying that it is survival for the fittest in the Russian industry (PNCOS industry Research Solutions 2010).

For the first time in 2009 total industry sales hit the $ 9 billion mark and, therefore, all participants are scrambling to get the biggest share of the pie, making competition hard for companies who participate within the industry. Revlon is a very large company with big production factories and numerous product lines and, therefore, in turn, it enjoys economies of scale furthermore it enjoys good distribution lines simply because it is a trusted brand with accumulated brand equity, which is a good asset for the company. Therefore distributors will most likely be willing to stock and put their products on their shelves (Euromonitor International 2010).

The Trends and needs of the Russian consumers especially women are very clear it is believed that Russian women are addicted to beauty and looking good, and therefore they, in turn, will always purchase cosmetic products in the future. Research is done by the Aginsky consulting group in 2007 an in-depth study discovered that Russian women beginning using cosmetics products when they turn 16 years old, while those in southern Russia start using these products when they hit 14 years old, while back in the 1980’s women started using these products when they turned 18 years of age. Moreover, research done by the Aginsky consulting group suggests that Russian women value so much their looks and that they always aim to look magnificent and sophisticated and, consequently this may be the main reason behind their peculiar expenditure on cosmetic products. Salons and beauty parlors in Russia especially Moscow dominate the streets with highly lit neon lights and attractive posters that portray Russian women’s beauty as a key pillar of the society.

The bargaining power of Russian buyers is also somehow high and, therefore, buyers can influence highly by the needs and demands of the consumers mainly because the industry is characterized by low switching costs which make it quite easy and simple for consumers to switch brands as they wish without necessarily acquiring any costs on their part. Furthermore, the availability of numerous alternative suppliers makes it quite easy and simple for the consumers to choose for themselves the brand which they see as the most suitable and best for them furthermore this reduces the bargaining power of suppliers within the industry forcing these companies to dance to the tune of the buyers. Therefore consequently the ceiling and floor prices of the industry are determined by both the bargaining power of buyers and the bargaining power of suppliers. When the bargaining power of buyers is high then the overall industry prices will more likely be near the floor prices and are more likely to be low and therefore cosmetic manufacturer will enjoy lower profit margins, on the other hand, when the bargaining power of suppliers happens to be high then the overall industry prices are more likely to be high and near to the ceiling prices but due to the high levels of bargaining power of buyers in the Russian industry the prices are therefore low forcing cosmetic manufacturing companies to find other avenues of gaining competitive advantage ( Kotler p.89).

The cosmetic industry is quite a capital-intensive industry and, therefore, this fact places barriers for any new entrants who desire to enter into the industry. Therefore only those companies which have the capability and resources to join the industry can successfully enter the market (BAC 2011). The amount of funds that are involved in the research and development of cosmetic products happens to be very high. Furthermore, regulations within many countries demand that companies make sure that testing of these products is very rigorous so that the safety of the cosmetic products is assured so that at the end of the day no human being is injured by the products. Therefore coming up with production lines and capacity and be quite costly and discouraging for those companies that intend to join the industry. But luckily Revlon is a company that is known to have vast resources, and therefore Revlon is capable of raising such funds because it is a publicly listed company and has total assets worth over $ 750 million and an operating income of $ 180 Million (Revlon website 2010). Furthermore, it has over 6000 employees who are quite able of assisting it conducts its multinational operations such a comfortable financial position is not usually enjoyed by all companies. This, therefore, means that not all companies can freely enter and leave the industry because participants are often forced to recoup their investments before exiting the industry therefore maintaining balance within the industry.

Recommendations

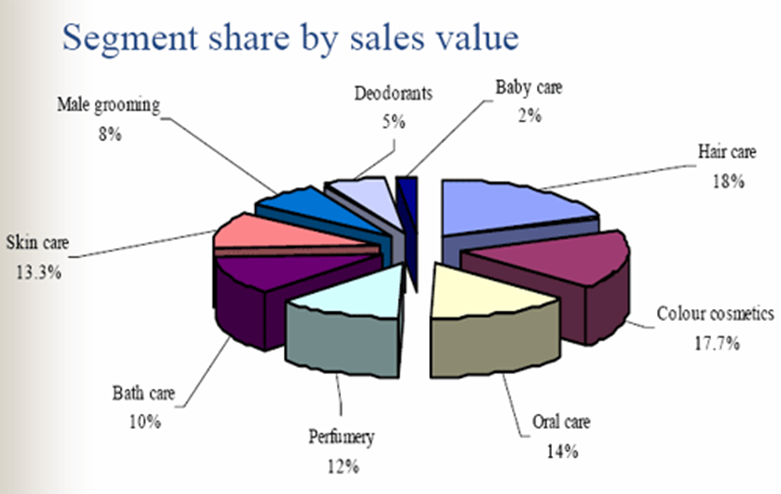

The Russian industry is quite a lucrative business prospect and therefore Revlon should include its multinational expansion plan into its overall corporate vision. With the need of increasing its profits and revenues, the Russian market offers a new frontier of business that can be very profitable if carefully pursued. Therefore the role of strategy must take center stage. Therefore, Revlon should formulate a suitable corporate strategy, business strategy, and also a functional strategy that will enable the company to pursue its business objectives in Russia. The business executives who are in charge of strategy setting should carefully ensure that the strategies set should be in tandem with the overall corporate strategies. Furthermore, to strengthen the organization marketing planning should also be taken seriously, simply because marketing is usually customer-oriented and always operates with the Russian consumers in mind. The product, place, price, and promotional activities of Revlon brands that are intended to be sold in Russia should be careful planning to the complete specification of the Russian market. This is because a good strategy is a key to success in business especially with Local companies, which enjoy 45% percent of the market share while foreign giants enjoy 52% of the market share (Podsushnaya 2010). The largest segment of the Russian cosmetic industry belongs to hair care and color cosmetics each, enjoying a sales share of approximately 18 and 17% respectively.

Conclusion

Business executives of Revlon, therefore, must make critical decisions concerning the final decision concerning its status in the Russian industry. It is also important that those in charge of this process to know that there is a lot to learn from the current industry leaders and, therefore, it is up to them to learn the way these successful companies carry out business, and if necessary borrow one or two fro them so that they, in turn, become successful in Russia.

Reference

Aginsky Consulting Group. 2007. Cosmetics market research summary. Web.

Angelontheweb.com, 2010. Russian Cosmetic industry withstood the recession. Web.

BAC. (2011). Cosmetic industry in Russian Federation: Business Report 2011. Moscow: Business Analytic Center (BAC).

Euromonitor International. Web.

Kotler Philip, 1999. Principles of marketing. New Jersey: Prentice hall.

PNCOS industry Research Solutions. 2010. Web.

Revlon 2010. Web.

Wheelen, Thomas & Hunger, David. (2002) Strategic management and business policy. New Jersey: Prentice hall.

Podsushnaya, I., 2010. Russian American Business. Web.

Crazy for cosmetics 2008. Web.