Summary

The historical financial analysis also referred to as accounting analysis is an assessment of profitability, stability and variability of a business or project. Historical financial analysis is performed by specialized accounting professionals in accordance with international accounting standards. The analysis takes into consideration information from financial statements. This analysis is used in core business decision-making. The financial analysis compares financial ratios of solvency, profitability and growth. Thus, this paper presents an analysis of financial ratios which provides users with metric performances measurements to understand the overview of the business trend and to create a comparison standard to the competitive industry.

Bank’s Background

Riyadh bank is a financial organization that is reported to be among the top three positions of the largest financial institutions in the Saudi Arabian region, particularly in terms of assets. It is also said to take the fourth position when considering the size of the market, size of market capitalization. This organization has been in operation for more than half a century. The bank has been operated in several major areas which comprise funding and investments, group/corporate banking as well as retail banking (Oxford Business Group, 72). The bank has continued to operate and serve its clients based on these three main areas, though there are some other minor ways that have also contributed to the growth and development of the organization. The company has opened numerous branches accounting to almost two hundred that are distributed at different parts of the world. Out of the 200 branches, there are 110 branches sited within the Saudi Arabian kingdom and which are fully made to serve only the Islamic community. Some of the remaining branches are situated in parts of the United Kingdom, United States of America and other places like Singapore. In order to increase the company’s financial performance, the organization has opened a thousand plus ATMs in its regions of operation (Oxford Business Group, 73).

Financial data and trends

The Riyadh organization based in the Saudi region has realized a net profit increment for the last three quarters of the year, 2011. By the end of the third quarter of the year 2011, the organization has recorded a 15% increase in its net profit. The 15% net profit increase is worth equivalent to SAR 2.37 billion. In connection to this net profit increment, there has been a general trend in the earnings gained from the various areas of its operation. For instance, the organization’s data and information showed that by the end of the first quarter, the profit of the organization was SAR 741 m, which was an eight percent increase, and within the first six months of the year, Riyadh bank had made a net profit of SAR 1.58 billion in which it had made a 9% net profit increase (Zughaibi, 30).

Comparisons with the previous year

During the year 2011, the organization realized some improvement in the earning of its income. Such an improvement in income earnings was not witnessed in the Riyadh organization only, but there was a general increase in revenue within the banking sector. Such improvements were connected to the changes in the delivery of services as well efficacy in operations. The Riyadh organization’s revenue generation steadily rose, which made the corporation make about 8.3 percent net profit improvement for the first three months of the year. With fewer hindrances being experienced in 2011, the organization continued to show the same trend of income increase in the next three months. The organization has an estimated net profit of almost 750 million, which is several folds above the estimated 180 million figure, the amount that was garnered as the net profit of the previous year. Moreover, the last year’s grand operating profit of the organization increased by several million to amount to 410 dollars at the end of the first quarter of the year 2011. In the first three months of the year, the organization’s assets were almost worth 46 billion dollars, but these kept on changing with durations, hence, in the third quarter, the organization’s asset value had accumulated to almost 48 billion. During the same period of the year, the company’s investments went high from about 8.5 billion to more than 10 billion. The climbing of the various factors or aspects contributes to the overall change realized by the organization, particularly in the improvement of the organization‘s performance indicated by the overall change of net profits within the three seasons (Zughaibi, 30).

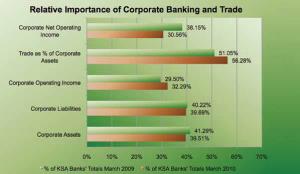

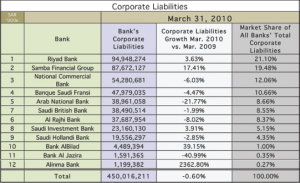

Focusing on specific banking activity: assets

In the assessment of the Riyadh bank financial operations based on diverse aspects of assets, income, liabilities among other things, there are varying degrees on the company’s financial generations. Having different ways of contributing the company’s assets, group or corporate banking appears to be the leading channel of generating the organization’s assets. While the total corporate assets tend to in the first quarter of the year, the bank’s group banking activity stands out as being strong. It can therefore be said that the bank has great income generation accrued from the group banking activity as compared to others banking activities. It can also be added that the organization is employing the use of group banking in order to cushion the negative effects of the present boom of cheap lending of loans by the organization. Precisely, the corporate activity is much significant to the organization in sense that it will cushion the company from the increase loan defaults as well as deteriorating situation of credits repayment by organization’s clients. As the assets contribution towards the bank’s growth and operation remain to be of key importance to the organization, the organization’s liability side has more or less similar significance to it. Even though this is not the leading portion of bank liability, it takes the second position after retail in the ranking of the organization’s liability. With forty percent of its overall liability being drawn from the corporate groups, it signifies the important role the corporate and the retail section plays in the generation of income to the organization through interests charged on credited loans to the clients. On the evaluation of both assets and liabilities of Riyadh bank, there is no much difference; hence, the bank integrates the two on a well balanced way (Shoult 57).

Income and expenses

While focusing on the generation of the operating revenue of the organization, the back has shown growth from one financial period to another. With close scrutiny of the fiscal quarterly data, each of the three fiscal sessions being examined in this paper showed a variation in the amount of operating cash flows of the organization. It is however not surprising to notice that income earned from other areas is shrinking in the course of the different fiscal sessions of the year, especially when the income is evaluated with the main focus being placed on the retail section and activities. The ten plus percentage income earned by the bank from the corporate group affirms the organization’s high dependency on the income generation of the group. From the other side of expenses, it is worth noting that the bank’s overall expenses on operation and management excluding those associated with credits were on the low side for the three quarterly fiscal sessions. Information for the three sessions showed that the expenses of the organization had a decreasing trend. In this case, we assume that the bank management had an improvement in its efficiency and performance of work.

Predictions

Based on the organization’s data and information reviewed, there several financial predictions which can be made. First and foremost, we predict that the bank will experience burgeoning incomes in the next few years. This will be due to the fact that the organization has now expanded its net profits, which is a provision that is necessary to counter the negative financial effects arising in the organization (Shoult 46). Similarly, there is also enough cash flow to cater for the daily activities, thus, it will possible for the organization to clear short and medium-term expenses without constraints. Finally, we expect the organization to expand more through the investment of its burgeoning net profits.

Works Cited

Oxford Business Group. The Report: Saudi Arabia 2008. Oxford Business Group, 2008. Print

Shoult, Anthony. Doing business with Saudi Arabia. GMB Publishing Ltd, 2006. Print.

Zughaibi, Kabbani. Technical Analysis | Stock Screener: Riyadh Bank. GulfBase.com, 2011. Web.