Introduction

This paper examines how the Dell Company operates in the competitive climate of the computer market, which variables are crucial to success, and how Dell effectively leverages its business structure. In addition, an internal analysis will be done, with the ensuing strengths and shortcomings provided. After this study, the future directions of computer technology in general and Dell Technologies, in particular, will be reviewed.

Boundaries of Dell Technologies

The American global technology business Dell Technologies Inc. is based in Round Rock, Texas. It resulted from the September 2016 amalgamation between Dell and EMC Holdings. Among Dell’s products are laptops, data centers, cellphones, TVs, computer software, and information security (Dell Technologies, n.d.b). Dell sold its stakes in Boomi, VMware, and Pivotal Software, although it still controls Secureworks, Virtustream, and Pivotal Software.

Recent History

The most significant acquisition in the technology industry’s history was when Dell merged with EMC. On October 12, 2015, Dell Inc. announced its desire to purchase EMC Corporation in a cash-and-stock transaction valued at $67 billion (Dell Technologies, n.d.b). It significantly combined Dell’s embedded Linux, home computer, and smartphone operations with EMC’s network storage business. Dell was restructured under a new parent company, Dell Technologies.

Strategic Management Model

Company Mission and the Scope of Its Operations

Mission

Dell’s mission statement is to be the most successful computer company in the world in terms of delivering the best customer experience in the markets we serve. In doing so, Dell will meet customer expectations of the Highest quality (Swab & Gentry, 2018).

Dell’s Business Model and the Annual Objectives

The inherent benefits of their company strategy facilitated rapid expansion by providing cheap pricing, specialized goods, and extensive support. The firm uses a supply-chain-management system, which is the primary benefit of its build-to-order and direct sales approach (Lakshmi, 2018). The strategy serves both short- and medium-term objectives. Consumers of Dell often pay for the end product before suppliers are compensated for the PC’s components, resulting in a negative cash conversion cycle. Dell’s annual objectives over the long term are to develop the company into an IT services firm that can compete with IBM, HP, or Cisco (Dell Technologies, n.d.a). Moreover, the firm’s annual objective of maintaining corporate clients with its approach to controlling the PC sales market is enviable.

The Management Model and the Grand Strategy

Dell employs a team-based approach in administrating its personnel as its grand strategy. The team-based strategy with explicit behavioral diversification has been crucial to implementing the business model effectively. To reach a unified output, the primary functional equivalents must collaborate throughout the creation and implementation of the business model (Lakshmi, 2018). The workforce has similar performance targets that cross their functional domains and are arranged in a fashion notably during periodic meetings.

Functional Strategies

Dell Technologies uses such functional strategies as the build-to-order method guarantees efficient sales distribution. In this instance, the corporation delivers the PCs to the clients immediately.

Indicators for Control and Evaluation

Dell Technologies uses the Information to Run the Business (IRB) System, which provides business productivity, sales margins, and quality control as essential control and evaluation indicators for all Dell management.

Dell’s Hierarchical Structure

The company’s functional departments report straight to the headquarters in Austin, Texas. Michael Dell is the company’s founder, chairman, and CEO (Dell Technologies, n.d.b). However, 14 senior executives report directly to Dell’s top CEO and directors (Dell Technologies, n.d.b). Dell also has two COOs under the CEO in addition to Chief Officers for consumers, advertising, operations, human resources, worldwide sales, infrastructure, and budget.

Contending Forces and Contestable Markets

Threat of New Entrants (Major Determinants of Competition)

Entry Costs

The cost of launching a computer firm is relatively high, and many investors have dreaded investing in the enormous expenditures of conquering the market. In addition, significant expenses are associated with advertising new goods on worldwide markets to increase their adoption. The market has been adverse to new entrants since the expenses of joining the industry have been quite expensive, making the incumbent firms continue dominating the market.

Economies of Scale

The computer business demands that things be produced on a massive scale in order to generate money. This has prevented investors from entering the market since it is impossible to do so when a business creates modest goods. Companies without adequate capital to produce in huge numbers cannot maintain themselves in the market in the long run.

Structure of the Industry

Product Differentiation

Product differentiation is a crucial factor in the business. Companies in the sector have produced various items to increase their market position worldwide. There is a free flow of knowledge in the sector, and no one firm has a monopoly on producing certain items. This enhances the amount of competitiveness in the market.

Capital Requirements

Dell Technologies has low capital requirements because of the build-to-order strategy demands a lower working capital investment than its rivals.

Governmental Policies

The government has supported a competitive atmosphere in the computer sector to guarantee that firms deliver the finest goods at the highest possible costs.

Bargaining Power of Suppliers

Horizontal Linkages

Horizontal connections relate to the cooperation of value chain operators inside a functional node to boost their competitiveness. In this scenario, for Dell Technologies, the multiple suppliers in the computer sector create a horizontal linkage as there is no one supplier with total domination on the supply of materials and equipment. Numerous firms have joined the market and are supplying products at reasonable prices. Therefore, the suppliers have no authority to regulate the price of supply in the market.

Vertical Linkages

Dell is an example of a forward vertical linage and connection since they sell their goods directly to consumers without many in-between co-suppliers.

Bargaining Power of Customers and Buyers

Understanding Consumers and Buyers

The cheap switching costs for customers make it simple for them to go from one provider to another. More companies are joining the industry, which is becoming more concentrated, and this has enhanced the degree of competitiveness in the industry.

Threat of Substitute and Compliment Products

There is low threat of substitute and compliment of product because with over 133,000 workers in 2021, the corporation has the ability and potential to service the clients and the manufacturing unit without stock interruptions (Dell Technologies, 2022).

Rivalry Among Competitors and Dell Technologies’ Competitors

Existing enterprises in the computer sector have seen a very high degree of competition. The firm has such competitors as Lenovo, HP Inc., Apple, ASUS, and Acer among others. This has resulted in high threat of substitute because of availability of many alternative companies with the same service line.

Cost Advantages and Disadvantages

This just-in-time (JIT) technique enabled the company to operate with the lowest inventory level in the industry. Reducing surplus inventory gave Dell a considerable cost advantage as component prices fell in the electronics sector. However, cost disadvantages include technical development that renders prior expenditures or knowledge obsolete.

Distribution Channel Access

Dell’s distribution channel has no supply chain intermediates since all its goods are sold straight to consumers. As an early service, they previously delivered orders by telephone; however, they are the first e-commerce firm to provide personal PCs for online ordering straight to clients. Dell is leveraging the direct channel in both letter and spirit by selling low-cost goods and maintenance services to their suppliers through a horizontal linkage network.

The Extent of the Product Line

Dell manufactures several product lines. The XPS range is intended for gamers or graphics pros, so we will skip that line. Other goods include Back Laptops, Inspiron Laptops, Vostro Laptops, XPS Laptops, G Series Laptops, and Alienware Laptops (Global Data, n.d.).

The Exclusive Technology and Patent Protection

The 2016 saw the merger of Dell with EMC Corporation, resulting in the formation of Dell Technologies. The company sells personal computers, network servers, data storage systems, and software. Globally, Dell Technologies has a total of 51713 patents. These patents belong to 34380 distinct patent families. 46587 patents out of 51713 total patents are active (Global Data, n.d.).

Price Competitiveness

The pricing strategy in Dell’s marketing mix has established a distinct set of prices depending on the consumer category it is targeting, which includes the consumer and business segments. The cost also changes depending on the hardware purchased and the operating system version picked.

Advertising and Promotion Strategy

In reaching out to prospective consumers, Dell employs various promotional methods. Dell’s promotional approach in its marketing mix relies on 360-degree branding through television, print media, and web commercials. It distributes brochures to the public through newspapers, such as Star. In addition to holiday discounts, the company provides regular deals and conducts online marketing via competitions.

Quality of the Workforce

The Connected Workplace project of Dell employs technology to assist its employees’ occupations and lives with increased flexibility. Therefore, Dell Technologies’ workforce generates excellent goods due to its quality workforce. In addition, the Dell and Intel Future workforce research offers crucial insights into the technological trends affecting the contemporary global workplace.

The Concentration Index

Concentration indices are used in various scenarios to quantify a quantity’s distribution over several topics. Herfindahl-Hirschman Indices (HHIs) is a widely established market concentration metric. The HHI is computed by quadrupling the market share of each competing business and adding the resultant values. The CR4 index is the sum of the top four companies with regard to a particular market share.

Table 1: Preliminary Worldwide PC Vendor Unit Shipment Estimates for 3Q22

From the above table (see Table 1), the HHI value obtained was 0.171211, where 0 < 0.171211 ≤1, and is a positive figure. In this case, the market share is evenly distributed between the companies (perfect competition), which does not lead to HHI = 0. In a market of n companies with perfect competition, minimum corresponds to perfect competition (Graham & Sathye, 2020). Moreover, since the value falls between 0.15–0.25, Dell Technologies HHI is a moderately concentrated market. However, CR4 is 70.1%, which is greater than 60%; thus, it is a tight oligopoly or dominant firm with a competitive fringe.

Financial Analysis on Profitability

Profitability Ratios

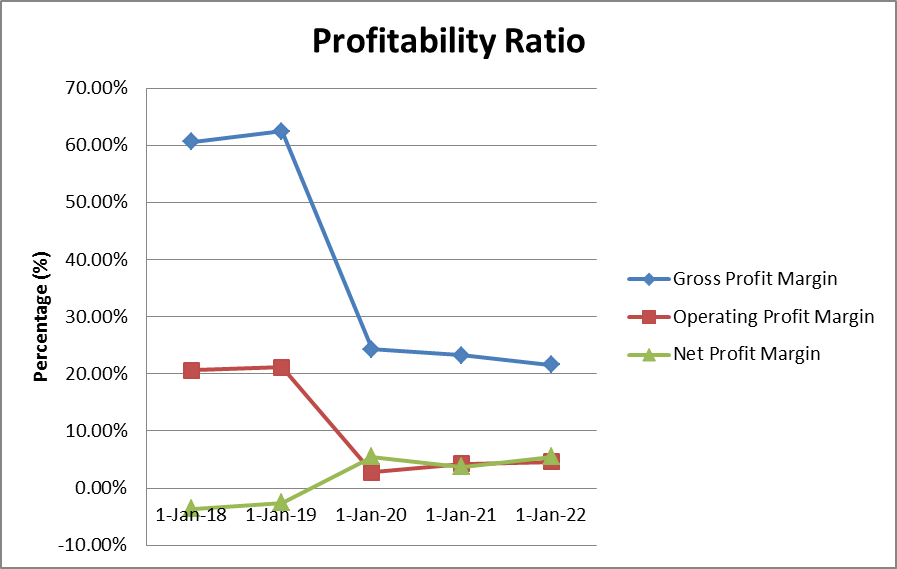

Table 2: Profitability ratio table derived from Dell-s financial report, 2022

From Table 2 and Figure 1 above, the gross profit margin from the year 2018 to the year 2019 marginally rose. However, the ratio fell from 2020 to the present year, 2022. Dell Technologies’ operating profit margin ratio rose from 2018 to 2019, then declined from 2019 to 2020, and finally increased until 2022. From 2018 to 2020, Dell Technologies’ net profit margin ratio grew, but from 2020 to 2021, it modestly dropped before rising in the current year, 2022.

Regression Analysis and Forecasts

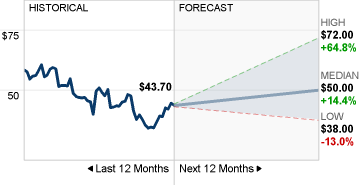

From the regression analysis, the 12-month price projections for Dell Technologies have a consensus target of 50.00, with an upper prediction of 72.00 and a low figure of 38.00. The consensus estimate reflects a +14.43% rise from the latest price of 43.70. This rating had stayed stable for the past couple of months when it was unaltered from a buy rating.

Summary & Conclusions

The primary benefit of Dell Technologies’ build-to-order and direct sales approach is its advanced supply-chain management system. There is a low danger of substitution due to the high stock levels despite the fierce competition among rivals. The threat posed by new market entrants is modest, and the corporation need not fear the admission of new competitors in both local and international markets. It is essential for management to provide reasonable costs while maintaining a high level of product quality. This can only be accomplished by controlling the suppliers’ activity in the future.

References

Dell Technologies (n.d.a). Shop for work. Web.

Dell Technologies (n.d.b).Who we are. Web.

Dell Technologies. (2022). Dell Technologies. Fortune. Web.

Global Data. (n.d.). Dell Technologies Inc: Overview. Web.

Graham, P. J., & Sathye, M. (2020). The relationship between national culture, capital budgeting systems and firm financial performance: evidence from Australia and Indonesia. International Journal of Management Practice, 13(6), 650-673. Web.

Lakshmi, S. (2018). Make to order strategy at Dell Corporation: A case study. Aweshkar Research Journal, 2(1), 21-27. Web.

Swab, R. G., & Gentry, R. J. (2018). Vision. Drive. Stamina: How Dell became the company with the power to do more. SAGE Publications.