Introduction

Mergers and acquisitions have increased due to the technological dynamics affecting business operations. Dell consolidated with EMC in a merger that closed in 2016 after purchasing EMC’s assets at $67 billion. The company decided to fuse because it needed to control part of the software industry and expand its business to occupy a significant position in the data storage market. Dell needed to offer competitive generation technologies by harnessing EMC’s innovativeness in computer systems.

Merging would enable Dell to remain the dominant supplier for retail customers, attaining the second position for manufacturing digital storage devices. The need for flexibility in innovations and investment in research and development sparked an amalgamation between Dell and EMC. The company’s industry analysis reveals that it faces challenges from stiff competition. Small enterprises that specialize in cloud computing present massive disruptions as they faster drive solutions and technologies that affect profitability.

It also has a higher supplier and buyer bargaining power. Threats from new entrants are low, while threats from substitute products are moderate. Increasing economies of scale and innovations would create new products to increase the customer base and reduce purchasing power. Diversifying in supplier selection provides alternatives from cheaper raw materials. Dell/EMC Corporation portrays financial situations that reveal success and failure.

The company has benefited from the client solutions group, which earned more than 11 billion dollars in the fourth quarter of 2020. Income from infrastructure solutions reveals that the company is failing in some units. These solutions earned close to nine billion in the fourth quarter, implying an 11% fall. Dell and EMC would have thrived without consolidation if they invested in personnel development to meet their specific job requirements and sit more departmental demands to respond to the changing market conditions. Knowledge management, streamlining operations, and supply chain optimization would help them survive alone.

Technological disruptions have necessitated the development of mergers and acquisitions. They hasten skill seizing and fill operational gaps that existed when organizations had no affiliations. Merging means combining firms’ operations and efforts, while acquisition refers to purchasing a substantial amount of another company’s assets or takes over its control (Kumar, 2019).

The disruptions in the information technology industries associated with changes in cloud computing have full implications for organizations. The personal computer maker, Dell, acquired EMC at close to $70 billion to pool their strengths in manufacturing digital storage devices and making PCs (Dell Technologies, 2020; Meddaugh, 2017). The Dell/EMC has remained agile and responsive to market demands, maintaining a higher competitive advantage.

Dell has shifted to corporate technology, supplying storage devices and servers, earning much of its income from PCs. However, cloud computing and the increase in smartphone consumption pose significant challenges to the PC industry. Merging is instrumental in boosting a company to sell computing infrastructure and better-converged hardware. For instance, it has enabled the companies to combine efforts and provide networking equipment, software, servers, storage devices, and routers as required in the market. Dell/EMC deal has enabled them to develop their product quality and surpass rivals.

Industry Environment in Which Dell/EMC Operates

The environment in which they operate is discussed through industry analysis using Porter’s five forces. It will guide how the two companies can build a sustainable competitive advantage in diversified computer systems development by exploring profitable positions and establishing strategic positions in the technology sector. Figure 1 below shows the M&A Porter’s five forces analysis, which includes threats from new entrants, rivalry from competitors, threats from substitutes, buyers’ bargaining power, and suppliers’ bargaining power.

Threats from new entrants (low): new investors pressure M&A because they might bring innovations in diversified computer systems. Such threats include lower product prices and offering different value propositions to customers. However, Dell and EMC had established a broader customer base and won the consumers’ loyalty. Additionally, entering the electronics industry requires substantial capital investments and meeting business procedures from federal and state laws. These make threats insignificant, but the M&A should create practical barriers to protect its competitive advantage (Kumar, 2019). It should create economies of scale and invest in research and development to maintain a fixed cost per unit and encourage innovations, which bring new customers.

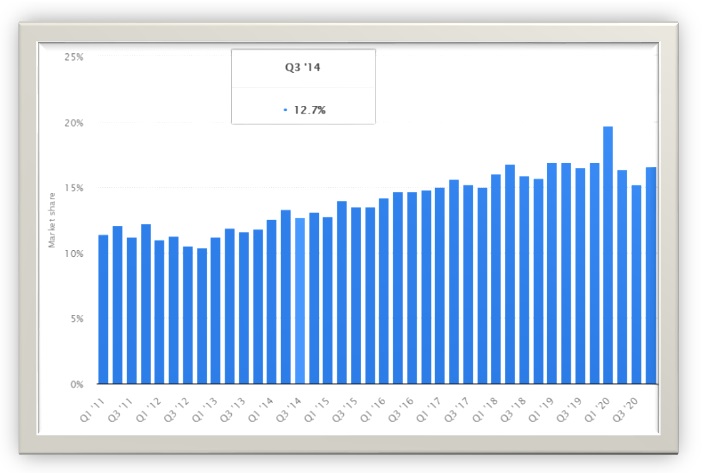

Rivalry from competitors (high): competition is stiff, for example, from Microsoft, IBM, HP, Lenovo, and Fujitsu. According to Statistica (2021), this rivalry reduces prices as the company tries to maintain customers and earn profit. Dell’s acquisition of EMC made it diversify from the PC market. It attained the third position in the global market after Hewlett-Packard and Lenovo (Statistica, 2021), as shown in Figure 2. The company also leads in IT services, hardware development, according to Statistica (2021) and Meddaugh (2017). The consolidation reduced competition from EMC and created a larger market share for the new company. The company also has improved standardization and business intelligence to sustain competition.

Bargaining power of suppliers (high): suppliers in the diversified computer system industry are numerous. Prominent suppliers can use their negotiating power to charge higher prices from the M&A as the latter keeps changing its standards to out-compete rivals (Mburu, 2018; Meddaugh, 2017). The mergers Dell/EMC can establish efficient supply chains with many suppliers to tackle this power. They should also try other product designs using diverse materials to be flexible, changing raw materials when prices rise for others.

Buyers’ bargaining power (high): consumers demand the best products and services at the lowest prices possible. This needs pressure is the M&A by compromising its profitability and sustainability since competition can set lower prices to attract customers. However, the mergers’ customer base is broad, although they are more likely to seek discounts and offers, affecting the M&A’s profitability. The firm should maintain a more comprehensive base to reduce its bargaining power and streamline production processes and sales. It should also understand the customers’ needs and improve their switching costs to tackle their bargaining power.

Threats from substitute products (moderate): some of the products that can substitute storage devices include smartphones. The phones can also hold video conferencing and web surfing as personal computers do. Additionally, Google and Dropbox are alternative storage hardware drives, threatening Dell/EMC. However, the majority of Dell/EMC products, for example, PC software, are not substitutable (Mburu, 2018).

Moreover, personal computers such as laptops and notebooks, especially in the 21st century, where eLearning has gained significant recognition in many countries, have high demands because they are powerful and portable (Kumar, 2019). Dell/EMC’s major threat from substitutes is when they offer a higher value proposition that is spectacular compared with the industry’s offerings.

Merger Rationale

Acquiring EMC would be expensive, but Dell saw other substantial reasons to accept the deal. First, it would control part of the software industry and expand its business to occupy a significant position in the data storage market. Dell needed to offer competitive generation technologies through the infrastructure solutions group, client solutions group, and VMware Inc., SecureWorks Corp, Pivotal Software Inc., Information Security, and Boomi (Kumar, 2019).

The M&A combined the top providers of the significant storage devices and the leading server and personal computer developers. Moreover, Dell’s hardware development was slow in the information technology industry, while the production rates in the software sector were high with significant profit margins. The M&A would be feasible because Dell would benefit from EMC’s centralized portfolios and gain relevance in the cloud-computing era. This can be seen from the M&A’s new contracts, such as signing a business agreement with General Electric to be its primary IT infrastructure developer. Therefore, the acquisition provided substantial product lines from hybrid computer systems.

Merging with EMC was tailored at facilitating Dell to remain the dominant supplier for retail customers. As a result, the new combination, Dell Technologies, became the world’s top seller of storage devices, the 2nd in participant to develop servers, and the third company to provide personal computers (Kumar, 2019). Furthermore, Dell Technologies was meant to expand Dell’s technology portfolio to include hybrid cloud, converged infrastructure, cybersecurity, software-defined data center, data analytics, and mobility, among other advancements (Kumar, 2019). The same author notes that Dell/EMC has developed a portfolio of more than 20000 applications and patents. Therefore, the M&A has created a vast and privately controlled technology company.

Dell also merged with EMC because it sought flexibility in innovations and investment in research and development. Consolidation has united Dell and EMC’s operations to ensure adaptability in the market. The step combined their strengths to achieve 98% of Fortune 500 companies (Kumar, 2019). For EMC, merging with Dell was a strategy that the company had been seeking for years. Some influential agents, such as Elliot Management, to sell part of its assets and change its management to open shareholder values initially pressurized it. The company also wanted to maintain its storage position and extend Dell’s servers, apart from building customer support for consolidated offerings.

Dell also saw the future generation largely depend on technology in the health sector, business, legal systems, and education sector. Thus, merging with EMC would encourage innovation and gain larger market power in the tech-needy generation (Kumar, 2019; Meddaugh, 2017). The company also noted the rising number of connected devices and sensors transmitting large quantities of data. Therefore, it acquired EMC, an innovative storage business, to meet the demand for enterprises to analyze the information in real time, securing a competitive edge.

When the 21st century turned digital, Michael Dell wanted to utilize a new landscape for growth and productivity. Merging with EMC would unlock independent ecosystems, encouraging partnerships with other players such as Microsoft to reduce competition (Dell Technologies, 2020). The strategy would enable Dell Technologies to develop a cheaper product that would enable the company to survive amidst the rapid adoption of Microsoft’s products, such as windows 10 (Kumar, 2019). Merging would foster research and development because EMC was already innovative, helping the companies devise ways to survive in a technologically dynamic market.

Dell and EMC seemed to have struggled to transition from the customer-driven PC businesses’ information technology solutions. They also faced stiff competition from small enterprises which specialized in cloud computing. EMC primarily faced a risk of massive disruption as rivals offered faster drive solutions and technologies that affected profitability (Mburu, 2018). The competitors were making their technologies accessible through the cloud, reducing the market share of EMC’s high-end storage systems (Kumar, 2019). Harnessing EMC’s robustness in the cloud and Dell’s PC development superiority would help them out-compete the rivals.

Lastly, Dell was able to acquire EMC due to its numerous sources of financing. It first sold its IT services to NTT Data Corp in Japan at three million dollars (Meddaugh, 2017). Moreover, the deal arose from selling eight million shares of Secure Works and junk bonds at approximately nine billion dollars, raising more capital (Meddaugh, 2017).

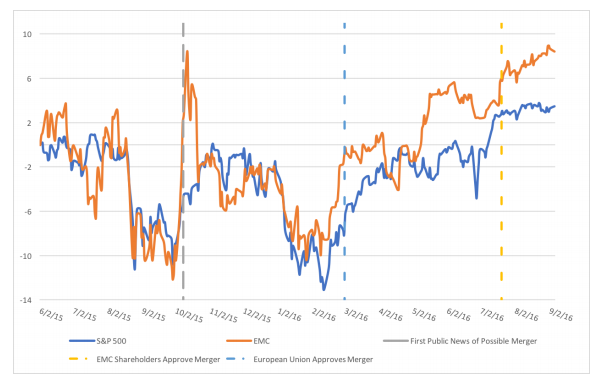

Dell also paid EMC shareholders in cash and developed a specular plan for tackling VMWare, whose 81% of shares were held by EMC (Meddaugh, 2017). Thus, Dell would have most VMWare shares if it acquired EMC. EMC also had volatile stock prices, as shown in Figure 3. The robustness of the stock price changes was seen in October 2015, when Dell announced the deal. EMC opted to affiliate its operations with Dell because the stock prices were declining.

Reasons behind Dell/EMC Success or Failure

The newly created Dell Technologies is both successful and limited. On the positive side, the companies have achieved dominance in the IT sector because Dell needed essential IP elements, such as virtualization and cloud software, to sustain its products. Software partnership increased Dell’s strength in the PC market, setting up the merger to create a robust solutions portfolio for clients. Product integration from the consolidation of companies leads to risks associated with economies of scale and synergies (Meddaugh, 2017). This problem underscores Dell Technologies’ position after Lenovo and Hewlett-Packard mentioned earlier.

Dell Technologies also portrays success through the risen profits and stock prices. Product competitiveness has also been positive over the years after merging with EMC (Dell Technologies, 2020). The rationale behind this allegation is that the companies have seen a downward trend in their commodities and services prices.

On this note, Meddaugh (2017) notes that mergers take two to three years to converge products and reduce prices. This happened a while after the formation of Dell Technologies. The formation of a merger aimed to increase their market share by a quarter. It led to near-monopoly power in the development of storage devices. Companies purchase products from a single supplier. Thus, the M&A succeeds because customers appreciate the convenience of meeting different needs under one roof.

Further, fusion has led to the development of product brands with relative reliability and similar characteristics, increasing their competitive advantage. Dell and EMC had technological similarities, which have facilitated research and development. Therefore, Dell Technologies is likely to achieve long-term synergies and cost savings through research and development. Its future competitiveness depends on the competence the company develops in new technological fields and its ability to modify its resources.

As mentioned earlier, consolidation has enabled Dell to gain a larger market share by buying the competitor’s business, including customers. Combining its PC development with EMC’s leading edge in storage system solutions has strengthened Dell’s server, storage, networking, and computer system development. The success is seen from Dell Technologies’ ability to provide IT infrastructure to General Electric, as mentioned earlier.

EMC initially supplied sophisticated technologies for storage, virtualization, document management, and security. Similarly, Dell manufactured low lost PCs with significant operational efficiency. Merging the two companies is critical in positioning them in the list of end-to-end providers in technology and other tailored services that come with consolidation. They regularly combine strategies with conventional M&A innovations to maintain a competitive advantage.

The consolidated company has demonstrated a colossal impact in the computing industry. The scale is significant, acting in almost every enterprise and data center aspect. Their combined operations make the new company flexible to adapt to changes in the market, having a concrete record of acquisitions and integrations.

The merger forced the two companies to indulge in debts exposing Dell to interest rates that reduce profitability. Most consolidating organizations face difficulties incorporating different cultures and creative incentives to maintain critical stakeholders. It offsets organizational income as seen in EMC’s initial indebted situation for long-term and short-term bases. Moreover, Dell has not successfully leveraged EMC’s sales force, although the latter’s world has provided insights on how Dell can create value from its high-end servers and mid-market (Meddaugh, 2017). Dell’s leadership in the Internet of Things brings insights to client computing models is a crucial driver for current and future data center requirements.

Dell Technologies seems to be failing at an alarming rate due to the Covid-19 pandemic and other reasons. Haranas (2020) states that the company is dismissing employees for the second time. It sought to reduce costs associated with the coronavirus pandemic, but Haranas (2020) also notes that laying off 165000 employees in July 2020 was not due to the pandemic. The action affected all teams following a three percent decrease in sales in the second fiscal quarter.

The author confirms that regular evaluations of Dell Technologies’ structures led to the retrenchment, meaning some flaws exist in the M&A. A company that is laying off staff is likely to be earning losses, and reducing the workforce would help it to save on production costs. Thus, Dell Technologies seems to have failed in its economies of scale because it could not sustain all employees.

An analysis of Dell Technologies’ operating segments shows that consolidation has been successful despite the few challenges discussed. Dell’s client solutions group earned more than 11 billion dollars in the fourth quarter of 2020 due to increased consumer and commercial revenue. The company’s operating income was close to $600 million, while the whole year earned $45.8 billion in client solutions.

Further, Dell Technologies (2020) records that the merger has acquired a better PC unit share for the last seven years and received substantial revenue growth in commercial workstations and desktops. Dell Technologies are successful because it shipped close to 50 million units during 2019 compared with other years (Dell Technologies, 2020). Therefore, the company’s acquisition of EMC is more profitable than working alone.

Further, Dell’s income from infrastructure solutions reveals that the company failed in some units. These solutions earned close to nine billion in the fourth quarter, meaning an 11% decrease, while they yielded storage revenue of $4.5 billion, receiving $4.3 billion from networking and servers (Dell Technologies, 2020). A decrease in sales or revenue foreshadows a downsizing company instead of expanding. However, the author reports that Dell/EMC has introduced a subscription-based model, which eases customers’ acceleration to hybrid cloud computing, apart from simplifying IT operations.

Another factor showing that Dell Technologies has failed is its absence in the stock market today. The company was publicly traded before it went private in 2013. Although it would help focus on the long-term strategies through privatization, the company ignored the needs of shareholders (Meddaugh, 2017). Amalgamation with EMC has improved its performance, but personal computers sales are still low as tablets and smartphones have had higher demand. Retaining the current position and improving further needs substantial changes in the firm’s model and diversification of products and services.

What the Companies Could Have Done Without Merging

A company can remain competitive in a changing market without consolidation. Dell and EMC would have sustained their products by utilizing other business models. Merging means explicit structural changes, and the companies could have managed and integrated their inherent mindsets instead of changing their structures. Moreover, a successful business focuses on appropriate economic models based on its situational factors. Meddaugh (2017) proposes that a contingency model is appropriate for particular situations in a changing market. Essentially, Dell and EMC would have remained successful by creating individual frameworks for sustainability and working to achieve their business goals.

The companies would have thrived through vertical integration of design and manufacturing and strategic sales and marketing frameworks. While research and development are vital in maintaining a competitive advantage, innovation out-competes rivals and attracts new customers. Vertical integration can benefit the company with subsidies, reducing manufacturing costs. Moreover, focusing on consumers’ unmet needs is fundamental in maintaining success. The companies, aiming to provide customer-focused design processes, would win buyers’ loyalty. This could include holding focus groups with new and long-term customers in various regions to help Dell and EMC track their product roadmap.

The companies could also sustain their competitive advantage by developing cross-functional individuals. It is not enough to hire staff and train them to meet particular job requirements. They should learn many functional areas within the organization to remain flexible to various departmental changes and encourage effective information sharing (Mburu, 2018). Further, knowledge management in an organization is vital in achieving a competitive advantage. It specifically enables an organization to offer same-quality services, reduce production costs, and increase the chances of expanding the business. It also enhances employee coordination and productivity, improving organizational performance.

The companies would have also survived through complete optimization of their supply chain using the operations research approach and strategic modeling and planning. Applying expert knowledge in decision-making is also vital in manufacturing and logistics, and procurement approaches (Mburu, 2018). In the latter, the strategy would help Dell and EMC to deliver services and products on time and optimize operations.

Another strategy is to streamline business processes and delegate non-core activities to contractors (Muru, 2018). Streamline means analyzing current processes, dividing them to prioritize primary operations, adjusting to the results, continuously innovating and improving workflow. It would enable Dell and EMC to quantify processes and identify potential areas of improvement as they aim to remain sustainable without merging.

Conclusion

This report aimed to discuss Dell & EMC Corporation Merger and Acquisition. Formerly referred to as Dell-EMC, Dell Technologies is the most significant M&A in the technology industry. The acquirer purchased all the smaller firms that fell under EMC at $67 billion, setting a higher price tag in history. It sold various assets to obtain the funds to meet its acquisition requirements. The M&A corporation’s industry environment was analyzed using Porter’s five forces framework. It showed that competition from competitors is intense, threats from new entrants are low, threats from substitutes are moderate, and suppliers’ bargaining power is high. At the same time, buyers’ bargaining power is also high.

The company’s factors underscoring success and failure were also discussed. Its competitive advantage relies mainly on the larger market share gained from consolidation, while competition from major players such as Hewlett-Packard and Microsoft is attributed to its failure. The companies would have survived by investing in employee development to diversify in the organizational functions, apart from fostering research and development to ensure that products are tailored to meet customer needs on time. Lastly, optimizing the supply chain operations, knowledge management, and utilizing expert knowledge in decision-making help to maintain a competitive edge without amalgamation.

References

Dell Technologies reports fiscal year 2020 fourth quarter and full-year financial results.(2020). Dell Technologies. Web.

Haranas, M. (2020). Dell confirms layoffs; Says it is addressing ‘cost structure.’ CRN. Web.

Kumar, B. R. (2019). Wealth creation in the world’s largest mergers and acquisitions.. Springer.

Mburu, D. G. (2018). Mergers and acquisition effects to competitive advantage within information technology companies: A case study of Dell EMC Central, East Africa [Unpublished doctoral dissertation]. United States International University-Africa.

Meddaugh, C. (2017). An Event Study Analysis of the Dell-EMC Merger (Publication No. 2749) [Master’s Thesis, Clemson University]. Tiger Prints Publishing Company.

Statistica. (2021). Dell’s market share of personal computer (PC) unit shipments worldwide from 2011 to 2020, by quarter. Statista. Web.