Introduction

According to Jaffer, the Takaful is a young insurance company which was formed in 1979. Its growth over the years has, however, been quite robust (63). These days, Takaful has extended to other Muslim populated areas across the world. Along with Takaful, there has been growing another “co-operative system of reimbursement”, Re-Takaful which started in 1985. Takaful operators now attract considerable interest and in turn, there is an awareness of the need for Re-Takaful to comply with the requirements of Sharia (Jaffer 64). These are the key elements of the strong adherence to the community’s first principles and its need for Takaful.

As noted by Borscheid and Haueter, the Sharia regulates Islamic insurance market, and Takaful does not have a long history in the UAE. It has grown very quickly due to the rapid expansion of a number of companies, which were built on the assumption that the public wanted Islamic institutions. In the year 2010, the market share was 6 per cent of the total premiums written. However, between 2005 and 2008 the UAE’s Takaful market grew by 135 per cent, before shrinking in a declining local economy (Borscheid and Haueter 406). The first Takaful insurance company in the UAE, the Abu Dhabi National Takaful Company, only began its operation in 2004. By the end of then year 2010, the number of Takaful companies had grown to ten.

Brief History of Takaful

Takaful began in 1979 in Sudan and Saudi Arabia (Jaffer 64). The need for Islamic principles in Islamic banking transactions pioneered this phase. This was led by Bank Faycal and the Al Baraka, two groups that were interested in developing an insurance offer based on the Sharia.

In 1985, Al Baraka launched the first re-Takaful operator BEST Re. In the years that followed, two other re-Takaful operators were launched. These were the Islamic Takaful & Re-Takaful Company, owned by Dar Al Mal and the Islamic Insurance & Reinsurance Company (IIRC).

A dynamic impetus to growth, however, came from South East Asia. From the 1980s onwards, the Muslim world saw Takaful evolving considerably in Malaysia. The Malaysian Takaful operator, Syrikat Takaful Malaysia, illustrated the swift growth of the first Takaful portfolio in the country, all based on a model which served as a platform for expansion to the other countries in Asia (Aziz 3).

In recent years, Islamic finance has witnessed new growth following the rising strength of petrol exports. New Takaful companies started their operations in other Islamic countries such as Kuwait, the United Arab Emirates, Pakistan, Sri Lanka and Malaysia. The recent development in the Re-Takaful world is the launch of Re-Takaful in Dubai, a fully fledged re-Takaful operator spearheading growing interest from the international insurers in this niche market (Jaffer 64).

Takaful Insurance and How it Different from Conventional Insurance Sold in Dubai

Takaful is a Shariah compliant mutual risk transfer agreement, which involves participants and operators. Sharia is based on Quran, the words of God as revealed by the Prophet Muhammad, and As-Sunnah, the practice or life of Prophet Muhammad. To some degree, the concept of mutual risk sharing covered under takaful is similar to mutual risk sharing in conventional insurance. It is mutual; sharing of risk based on Taawun or Mutual Protection” (Iqbal 2).

The Takaful and Conventional Insurance have two major differences. First of all, it is the way in which they are managed, and second, is the way in which they are evaluated and handled. In addition, the legal relations between the operator (insurer) and participant (insured) have a different nature.

As it is widely known, the religion of Islam governs all areas of human activities, including finance. Thus, risk assessment also follows the principles of Sharia. Those principles dictate the rules of business conduct. Thus, there are three major prohibitions which must be completely avoided by Takaful operation. Those are the prohibitions of interest (riba), uncertainty (gharar) and gambling (maisir) (Archer, Rifaat, and Volker 34).

The Takaful contracts should be open and clear, any hidden information would be the violation of gharar. Maisir which goes for gambling is absolutely unacceptable. Thus, both parties of the Takaful contract should be stayed assured of its reliability and security; any speculative elements would automatically discriminate the subject matter in which both, the insurer and insured are interested in. Furthermore, Riba is absolutely unacceptable in the Sharia Law and thus, under a Takaful arrangement as well. According to Venardos (4), Takaful treats participants’ contribution to the risk sharing scheme not as a premium in the way conventional insurance does. This is done so as to avoid the riba. Besides, Takaful operators are required to properly manage participants’ contributions according to the Sharia teachings (Iqbal 3).

Based on the information provided above, it is clear that both, Gharar and Maisir are basic prohibitions that present a great challenge for Takaful operators. It is very important to make sure that all Takaful arrangements and actions are free of any uncertainties and vagueness. Moreover, riba is also the area which requires great attention. Consequently, riba free investment and fund management today are the areas that need close consideration and need to be separate disciplines. Considering the abovementioned information, one thing should be explained in order to avoid confusion in understanding of the Islamic finance and business operations. Thus, the major emphasis is done on the fact that Islam does not prohibit risk or uncertainty, what is strictly regulated is selling and exchange of risk and its transfer to other parties using the sales contracts (Iqbal 3).

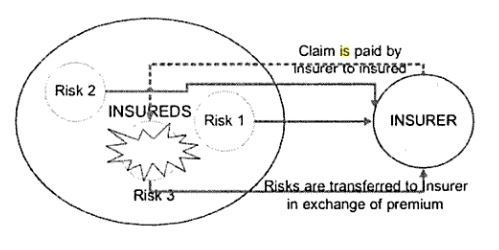

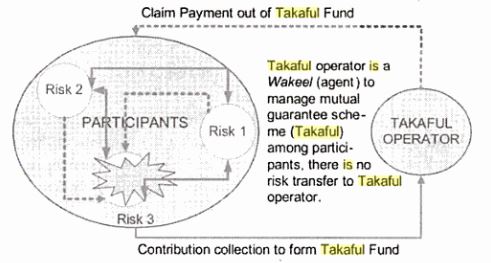

On the other hand, Islamic teaching encourages such virtues as helping other people in any situation. According to Sharia, sharing is essential if men and women have to assist one another (Iqbal 3). Figure 1 and figure 2 show the different concepts between conventional insurance where risk is generally transferred, and Takaful where risk is shared (Iqbal 3).

Under conventional insurance, insurance is a risk transfer mechanism by which an organization can exchange its uncertainty for certainty. The uncertainty experiences would include whether loss will occur, when it will take place, how severe it will be, and how may there might be in a year. Insurance in this case offers one the opportunity to exchange this uncertain loss with certain loss through the insurance premium. The organization agrees to pay fixed premium and in return, the insurance company agrees to meet any loss which will fall within the terms of the policy. Exchange of uncertain loss with certain loss as it is done in conventional insurance exactly falls into the meaning of Gharar and it is thus not allowable in Islam. In Takaful concept, therefore, there is no transfer of risk from participants to the Takaful operator. Risks are shared among participants under a mutual guarantee scheme or Takaful scheme. It is part of the operator role to ensure that each participant pay equitable contribution, as well as to ensure that the unfortunate one who suffers a loss will get proper compensation.

Implementation of Takaful In Actual Practice

According to Iqbal and Mirakhor (85), there is no standard operating model for Takaful companies, as each country may decide on a particular model. In particular, Takaful models can be mudarabah based, wikala based, or a hybrid of the two. In discussing the practical implementation of Takaful, Bank Negara Malaysia (BNM) will be used as an example.

Typically, the implementation of Takaful is carried out in the form of solidarity mudarabah, where the participants agree to share their losses by contributing periodic premiums in the form of investments (Mitchell 94). They are then entitled to redeem the residual value of profits after fulfilling the claims and premiums. One of the critical differences between contemporary insurance and Takaful is the participant’s right to receive surplus profits. While the participants in a given Takaful mudarabah have the right to share the surplus profits generated, they are at the same time liable for additional amounts if the initial premiums paid during a period are not sufficient to meet all the loses and risks incurred during that period (Venardos 84). Apparently, Takaful companies can constitute reserves which allow the need for the insured to make supplemental contributions if claims exceed premiums.

Bank Negara Malaysia Guidelines

BNM was established in 1959 under the Central Bank of Malaysia Act of 1958. It is owned by the Government of Malaysia. One of the main responsibilities of the bank is the conduction of the monetary policy.

Thus, the main responsibilities of the bank include:

- Bringing about financial system stability and fostering a sound and progressive financial sector;

- Playing an active role in advising on macroeconomic policies, and managing the public debt;

- The sole authority in issuing currency as well as managing the country’s international reserves (Gönülal 15).

Guidelines on Investment Management of Takaful Operators

BNM provides the relevant policies that should be observed in managing investment portfolios and the associated risks. The guidelines have been developed to achieve the following objectives:

- To safeguard the interests of Takaful participants

- To institute strong and effective governance of investment activities of the Takaful fund

- To ensure an appropriate risk management framework is in place in identifying, monitoring, controlling, and mitigating the various risks arising from investment activities, and

- To ensure sound management of assets appropriate with the nature and profile of the Takaful fund’s liabilities (Guidelines on Investment Management for Takaful Operators 2).

Guidelines on Internet Takaful

Internet activities by Takaful operators are also meant to be performed by following strict rules or guidelines. The guidelines shed light on the risks associated with the Internet usage while distributing the Takaful products and services. In addition, these guidelines provide minimum risk management measures that Takaful should implement when using the Internet. According to Iqbal and Mirakhor (134), Internet insurance sites can basically be categorized into two types. The first type is the information based website and this provides predefined, publicly available marketing information about the Takaful operators, including the products and services offered (El-Gamal 59). The second type is the interactive based website that provides for transactions to be executed, including soliciting Takaful proposal and the participation and renewal of certificates that may or may not involve online payments (Rosly 76).

Example of Takfaful

The following example refers to how a personal accident cover is treated under tafakul. First of all, a personal accident cover is designed to provide compensation when a person dies or in the case of injuries or disabilities in the event of an accident. Typically, the plan clearly stipulates the jurisdiction and details of the cover (Rajhi et al. 24). Participants are expected to donate premiums based on tabarru requirements.

In case any participant suffers dies or suffers an injury as a result of an accident, all participants have a responsibility to indemnify each other. Where no claim is made during the period the cover is meant to last and maturity is reached, participants get an opportunity to share whatever surplus is available. Ordinarily, the sharing will be done based on the appropriate Takaful model (Sabri 52).

In a case where the Mudaraba model is to be used, the parties involved share the available surplus based on an agreed ratio. Imagine that the operator is to receive 50% of the surplus while the participant is to receive 50%. Suppose further that the available surplus amount is AED 200 Million and the contribution or donation is AED 500 Million. The premium or participation for the year is AED 10,000. The surplus sharing ratio will be equal to:

Agreed ratio x Surplus / total participation = 50% x AED 200 Million / 500 Million = 20%. The Participant’s share will be equal to: surplus sharing ratio x contribution. Therefore, each participant will receive 20% x 10000 = AED 2000.

Amount of Takaful Insurance Sold in the UAE Vs Conventional Insurance

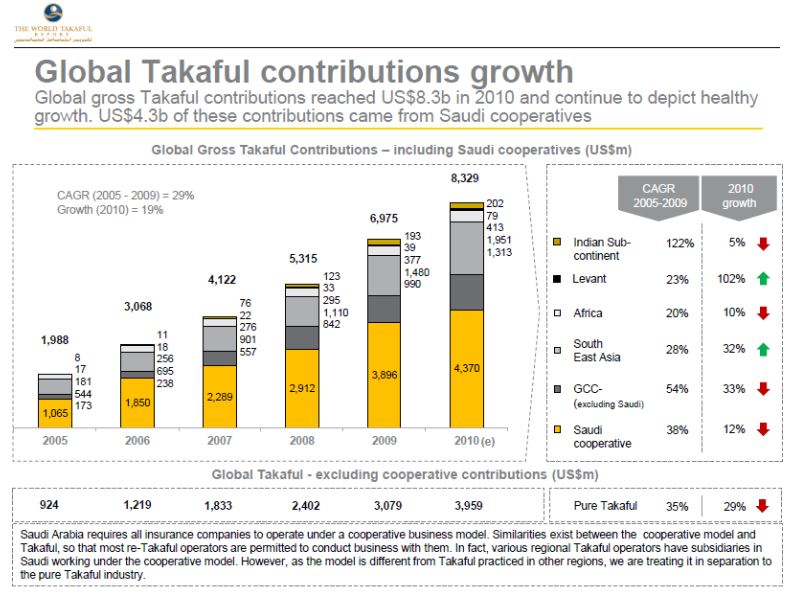

According to Nazim and Balcome (7), global Takaful contributions grew by 19% in 2010 to US$ 8.3b. Total contributions are expected to reach US$ 12b by the end of the year 2012. This is illustrated by figure 3.

Popularity of Takaful in the rest of the Middle East

Given the low insurance penetration rates in the Middle East and North Africa region of just under 2%, and with region accounting for less than 1 % of global premiums in spite of its energy wealth and the recent regional infrastructure boom, there remains plenty of room for rapid growth in insurance. Apparently, Takaful insurance is set to drive much of this growth in the coming years, supported not only by its religious and ethical appeal but also the potential for the return of some insurance premiums and often attractive pricing (OBG 15). According Jaffer (5):

Takaful has become one of the leading segments of the financial sector across the Asian, Arab, and African regions with a growth rate of 10 to 30 percent annually. Major markets currently include Malaysia, Iran, Pakistan, and Saudi Arabia.

Ethical Issues Related to Takaful

Due to the ethical issues underpinning Islamic banking, investment and finance, the increasing transparency of customers and conditions, the pricing structure, regular monitoring for compliance by Sharia’s boards, major Takaful providers need to ensure that all participants adhere to the Sharia Laws (Hassan, Lewis, and Lewis 15).

As it has already been discussed, it is unethical for any participant to go against the requirements of Islamic teachings. Under Takaful insurance, the requirements of Gharar, Maisir, and Riba must be strictly followed by all the participants. However, this poses serious challenges to regulators in their quest to match the requirements of Islamic teachings (Mitchell 132).

Challenges Facing the Takaful and Re-Takaful Industry in UAE and Worlwide

Despite other challenges, market and demand knowledge, as well as the need to meet the market demand, are two major challenges faced by the Takaful and re-Takaful industry. These elaborated as follows:

Market and Demand Knowledge

Although there has been considerable growth experienced in the Islamic banking sector, the size and knowledge of the Takaful segment is still limited. It is imperative for the Takaful industry to have a better knowledge of its existing and potential market. Demand is not gauged either by the Takaful or Re-Takaful companies. There is a need for market segmentation and an understanding of the demand constituents. Takaful and Re-Takaful, and all the operators interested in the development of the industry must make sure that they are aware of their markets (Jaffer 68).

Meeting the Demand

More market knowledge will enable the industry to meet the demand. It is clear that the Takaful industry can only witness considerable growth if it can first supply the demand originating from the retail business (Ayub 56). Individual consumers are more sensitive to the issue of Sharia compliance than corporate organizations. If the Takaful companies begin by competing with the conventional insurers on industrial risks, consumers will be unable to differentiate the Takaful from the conventional. In this respect, the industry can learn from retail banking.

Other Challenges for Takaful and Re-Takaful Operators

The potential for Takaful to grow is beyond question. However, there are still many challenges that the Takaful should overcome to properly operate in the market. One of the main obstacles for the successful growth of the company is human resources. This obstacle arises due to the fact that these days the insurance market faces a shortage of qualified staff that seem to be aware of the main insurance principles, as well as have an in-depth knowledge of the rules of the Sharia finance (Borscheid and Haueter 23)

Taking into consideration these obstacles, it is evident that of the biggest challenges is to create effective strategies to promote customer awareness. Even in the modern fast developing world where information is communicated rapidly, many Muslims still consider that insurance principles are contrary to the principles and concepts dictated by the Sharia, especially with regard to life insurance. Thus, there is an urgent need to make people aware of the fact that Takaful strictly follows the religious concepts and its operations are regulated by the main principles of Sharia. “Similarly, non-Muslims need to be made aware of why Takaful is ethical” (Hassan & Mahlknecht 46).

In the UK, Europe and the US, there is still little awareness on how the Takaful can be accounted for. Moreover, there are no strategies on how Takaful businesses can operate based on the Islam principles and, at the same time, not to contradict local national regulatory insurance rules (PWC Takaful 6). Thus, “Takaful businesses in other countries account for Takaful under International Financial Reporting Standards (IFRS). Applying IFRS to Takaful is a complex area and will be the subject of a separate PricewaterhouseCoopers’ paper”. (Kettell 30)

Furthermore, another challenge for Takaful company is the “limited availability of short-term non-equity financial instruments such as sukuk and Shariah-compliant money market instruments equivalent to treasury” (Archer 25).

Takaful is a rapidly grown company and one of the main challenges that it is facing nowadays is to ensure that its insurance system will come up with effective strategies to cope with such a rapid growth. Along with these challenges, “Takaful providers must improve their product innovation and continue offering a high level of customer service” (Htay et al. 5). Thus, they have to be able to understand evolving customer and market-specific needs, as well as be ready tore-design product base and provide new customer benefit packages, as well as make sure appropriate communication channels to reach their customers and spread relevant information on its insurance practices and operations (Kettell 35).

Conclusion

From the discussion presented in this paper, it is obvious that Takaful insurance will continue growing as time goes by. It is, however, important to ensure that as this happens, critical structures are put in place to guarantee successful growth. This is important especially considering that the success of Takaful insurance is largely dependent on Islamic teachings which can be very tricky to deal with.

Works Cited

Archer, Simon, Rifaat Ahmed and Volker Nienhaus. Takaful Islamic Insurance: Concepts and Regulatory Issues, Hoboken, NY: John Wiley & Sons, 2011. Print.

Ayub, Muhammad. Understanding Islamic Finance, Hoboken, NY: John Wiley & Sons, 2009. Print.

Aziz, Zeti A. Islamic Banking and Finance Progress and Prospects Collected Speeches: 2000-2006, Malaysia: Bank Negara Malaysia, 2006. Print.

Borscheid, Peter, and Niels Haueter. World Insurance: The Evolution of a Global Risk Network, Oxford, UK: Oxford University Press, 2012. Print.

El-Gamal, Mahmoud. Islamic Finance: Law, Economics, and Practice, Cambridge, UK: Cambridge University Press, 2006. Print.

Guidelines on Investment Management for Takaful Operators. 2012. Web.

Gönülal, Serap O. Takaful and Mutual Insurance: Alternative Approaches to Managing Risks, Geneva: World Bank Publications, 2012. Print.

Hassan, Kabir, Mervyn Lewis and Mervyn K Lewis. The Handbook of Islamic Banking, Cheltenham, UK: Edward Elgar Publishing, 2007. Print.

Hassan, Kabir, and Michael Mahlknecht. Islamic Capital Markets: Products and Strategies, Hoboken, NY: John Wiley & Sons, 2011. Print.

Htay, Sheila, Mohamed Arif , Younes Soualhi, Hanna Zaharin and Ibrahim Shaugee. Accounting, Auditing and Governance for Takaful Operations, Hoboken, NY: John Wiley & Sons, 2012. Print.

Iqbal, Muhaimin. General Takaful Practice: Technical Approach to Eliminate Gharar (Uncertainty), Maisir (Gambling), and Riba’ (Usury), Jakarta: Gema Insani, 2010. Print.

Iqbal, Zamir, and Abbas Mirakhor. An Introduction to Islamic Finance: Theory and Practice, Hoboken, NY: John Wiley and Sons, 2011. Print.

Jaffer, Sohail. Islamic Insurance: Trends, Opportunities and the Future of Takaful, London, UK: Euromoney Institutional Investor Plc, 2011. Print.

Kettell, Brian. Introduction to Islamic Banking and Finance, Hoboken, NY: John Wiley & Sons, 2011. Print.

Oxford Business Group (OBG). The Report: Algeria 2011, Oxford Business Group, 2011. Print.

Mitchell, Charles. A Short Course in International Business Ethics: Combining Ethics and Profits in Global Business, California: World Trade Press, 2010. Print.

Nazim, Ashar, and Justin Balcome. 2010, The World Takaful Report 2010. Web.

PWC Takaful. Takaful: Growth Opportunities in a Dynamic Market. 2012. Web.

Rajhi, Ahmed, Abdullah Salamah, Monica Malik, and Rodney Wilson. Economic Development in Saudi Arabia, New York, NY: Routledge, 2012. Print.

Rosly, Saiful. Critical Issues on Islamic Banking And Financial Markets: Islamic Economics, Banking And Finance, Investments, Takaful And Financial Planning, Indiana: AuthorHouse, 2005. Print.

Sabri, Nidal. Financial Markets and Institutions in the Arab Economy, New York, NY: Nova Publishers, 2011. Print.

Venardos, Angelo. Current Issues in Islamic Banking and Finance: Resilience and Stability in the Present System, Hackensack, NJ: World Scientific, 2010. Print.