Understanding the operations of an organization calls for an analysis of its internal and external environments. Internal environment refers to the internal forces shaping the strategy and the operations of the company while external environment refers to forces outside the control of the organization that affect its strategy development and implementation processes (Porter, 1980). This project concerns itself with the quality service profile of Crescent Petroleum. This is a multinational oil company based in the United Arabs Emirates (UAE). The objective of this phase of the project is to examine the internal and external operating environment of Crescent Petroleum. The examination will address the organization’s Quality Service profile by the analysis of its mission, strategic objectives, its environment and competitive landscape, and its current structure and formal design.

Crescent Petroleum started operations forty years ago as an oil and gas exploration and marketing company. The company’s headquarters is in Sharjah in the UAE (Crescent Petroleum, 2012). However, it has international offices in the UK, Iran, and Iraq, with liaison offices in Canada and Egypt (Crescent Petroleum, 2012). In addition to its oil interests, Crescent Petroleum is also the largest shareholder of Dana Gas Company. Dana Gas is the largest traded gas company in the UAE.

Current Mission

The website of Crescent Petroleum does not provide a specific mission statement. Rather it describes the issues the company prioritizes in its business interests. As such, it is possible to derive the organizations current mission based on its current business focus. In its website, Crescent Petroleum (2012) states that its “current focus is upon energy opportunities in the Middle East, specifically within the Gulf region, but more widely also encompassing North Africa, the Caspian Sea region and South Asia.” From this statement, Crescent Petroleum seems set to develop its energy interests in the wider oil belt of the Arab countries in the Middle East, North Africa, and South Asia (MENASA). The mission of the company is to develop the oil and gas resources in these regions. It has a strong foothold in these countries because of the extensive concessions it holds for oil exploration and development (Crescent Petroleum, 2012).

Strategic Objectives

The company’s website lists four “business objectives” which forms the basis for the discussion of its strategic objectives (Crescent Petroleum, 2012). The first strategic objective of the company is the “exploration and development of existing acreage and the acquisition of additional exploration and producing properties in the MENASA region” (Crescent Petroleum, 2012). This objective demonstrates the company’s business focus in terms of geographical presence. The company already holds several concessions from several oilfields in the MENASA region that require development. As such, the development of the existing acreage is an important element of the company’s current strategy. In addition to this, it also wants to acquire more acreage covering the MENASA regions to bolster its business position. If it manages to expand its acreage, then it will remain in a competitive position as an oil giant in the region.

The second stated objective of Crescent Petroleum is, “expanding upon the existing arrangements to facilitate the development and expansion of the gas market in the MENASA region, with a view to becoming the largest private gas player in the market along with its affiliated companies” (Crescent Petroleum, 2012). Gas is becoming more important in the global energy mix. The attention that Crescent Petroleum is giving its gas interests demonstrates the company’s realization that its profitability may depend on gas. Crescent Petroleum is not new in the gas sector. It maintains its interests in the gas sector through Dana Gas Company, where it is the majority shareholder. The company intends to expand its gas interests beyond the UAE.

The development of oil markets depend on the reliable transport of oil and oil products. Crescent Petroleum realizes that it needs to have a presence in the oil transport business. Based on this realization, the third objective of the company is, “investment in pipeline interests” (Crescent Petroleum, 2012). Pipelines are the fastest and safest way to transport oil. They have lower maintenance costs and can deliver larger volumes compared to other modes of transport. However, oil markets span the whole world making the development of pipelines to cover the all the supply routes unfeasible. Nonetheless, there are many opportunities where the construction of pipelines increases the supply chain efficiency of petroleum. Crescent Petroleum will improve its competitive position by investing in oil pipelines.

The fourth strategic objective of Crescent Petroleum is, “participation in and development of oil and gas projects, utilizing the Company’s strong relationships in the MENASA region” (Crescent Petroleum, 2012). Crescent Petroleum understands the value of reducing competition and increasing cooperation with other players in the MENASA region. In addition, the company knows its unique strengths based on its oil exploration history. It is in a position to offer specialized services to other oil players in the region. Apart from the MENASA region, the global offices of the company are the avenues used to access global markets. They give Crescent Petroleum a strong negotiating position both in MENASA and in the other global oil markets.

Environmental and Competitive Landscape

The environmental and competitive landscape of Crescent Petroleum has several aspects. First, the oil industry is a capital-intensive industry. The capital required to set up prospecting operations is very high. In addition, developing oil wells requires very large sums of money. A large time gap exists between the discovery of oil from prospecting operations and profiting from sales of crude oil. This makes it very difficult to enter the oil and gas exploration and development industry. Expanding acreage is also very risky because it requires exploratory work. The process of locating potential deposits of oil and gas, and proving the commercial viability of deposits takes a lot of time and money. Finding an oil deposit does not guarantee its commercial viability.

Competitive advantage in the oil sector does not depend on the quality of the product, because oil does not have a significant quality differentiation (Mongay, 2011). The products derived from oil refining are similar regardless of the type of oil. Therefore, consumers do not make their decision to purchase based on the quality of oil. As such, oil companies compete on price, and on the efficiency of their supply chains. The industry requires a long-term view and normally features long-term contracts.

The MEDASA region is home to some of the largest oil deposits hence there is a large concentration of oil companies in the region competing for markets. On the other hand, the Organization of Petroleum Exporting Countries (OPEC) controls the prices of the commodity and sets export quotas for the member countries (Mongay, 2011). The result is that the oil industry is under a lot of regulation from the governments in the region.

Current Structure and Formal Design

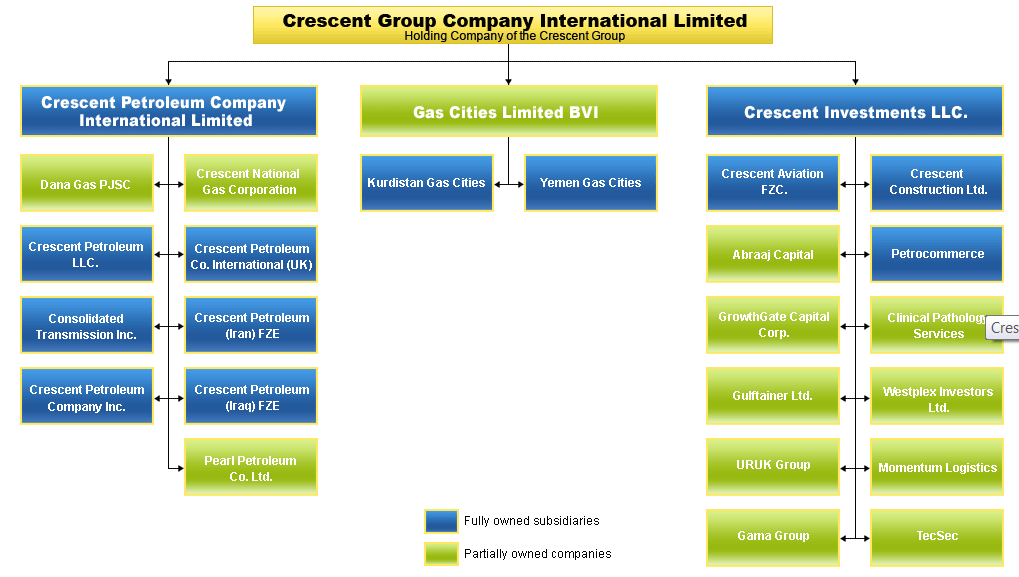

Crescent Petroleum Company is part of a wide consortium with interests in various sectors. The holding company of the Crescent Group is the “Crescent Group Company International Limited”. The holding company has three wings, the Gas Cities Limited BVI, the Crescent Investments LLC, and the Crescent Petroleum Company International Limited, as indicated in the Table 1. The focus of this phase is the Crescent Petroleum Company International.

The organizational structure of the company has two levels. The Chairman’s office has three members of the Jafar family. The Group Chairman of the company is Mr. Hamid Jafar (Crescent Petroleum, 2012). He is also the Chairman of Dana Gas Company. The President of the company is Mr. Badr Jafar (Crescent Petroleum, 2012). He also serves as the company’s Vice Chairman. The company’s CEO is Mr. Majid Jafar (Crescent Petroleum, 2012). The President and the CEO run the company on a day-to-day basis. In the UAE, it is common to find large companies run by a close-knit family. This structure is popular in the Arab world because of its strong cultural system of inheritance (Walker, Walker, & Schmitz, 2003). In the political scene, the Arab world tends to get rulers from the same family such as the Saudi family in Saudi Arabia, while in business, children grow up to take leadership in family businesses.

Apart from this line of officials, the company has fourteen executives in charge of various functions. They include a Senior Legal Counsel, Iraqi Country Manager who is also the Baghdad Branch Manager, and a Group Senior Adviser (Crescent Petroleum, 2012). In addition, the company has a Head of Accounts, Head of Supply Chain and Contracts, a Senior Finance Manager, and an External Communications Manager for Iraq (Crescent Petroleum, 2012). Other important officials of the company are Head of HR and Operational Development, Head of Insurance, Reservoir Development Manager, Projects Manager, Head of IT, Branch Manager of the Irbil Office and the General Manager of the Tehran Office (Crescent Petroleum, 2012).

The second phase of this project builds on the organizational profile of Crescent Petroleum to evaluate its competitive advantage based on its current Quality Service profile. The oil sector depends on the efficiency of the supply chain because competition based on price is uneconomical. In addition, the option of competing on product quality is not viable because of the uniform nature of oil. Differences in the quality of the crude oil do not constitute a significant competitive advantage. The particular issue this phase will address includes the relationship between organizational design, organizational culture, and organizational performance. Secondly, this phase will cover the analysis of the current organizational culture, and the opportunities for improvement. The final section of this phase will examine the need for changes and offer recommendations. Current Quality Service Sources of Competitive Advantage

The current Quality Service sources of competitive advantage for Crescent Petroleum include the benefits derived from its diversified portfolio, its competent staff, and its focus on supply chain efficiency. The diversity of its portfolio makes it an attractive business partner and supplier because of its ability to offer end-to-end services. This portfolio also protects the company from shocks in oil prices caused by international forces. As a result, the clients of the company can rely on it to provide them with its services with minimal disruptions. Another benefit the company derives from its diversified portfolio is that it is able to export the best practices of one field to improve the processes in another field.

The second Quality Service source of competitive advantage is the staff of the company at senior levels. The executives come from very diverse backgrounds, which demonstrate a desire to offer the best possible services to clients. Diversity in the backgrounds of senior executives ensures that a company benefits from different views and opinions relating to the issues the company faces. This staff portfolio also gives the company an international image. This image is necessary for it to survive the fierce competition for oil markets. Finally, having competent staff improves service delivery in terms of offering consistency in strategy implementation (BCG, 2010).

The oil sector does not present viable options for developing competitive advantage based on the quality of products on offer. One of the essential features of quality service in the oil sector is uninterrupted supply. Therefore, Crescent Petroleum is on the right track by focusing on supply chain efficiency (Kopezak & Lee, 1994). Its goal of investing in pipelines will improve product delivery and reduce the risk of supply disruption. If Crescent Petroleum achieves this goal, it will increase the certainty of supply of its products. This will increase the quality of their services in the perspective of their clients.

The sustainability of these sources of competitive advantage is in the control of the company. On diversification of the company’s portfolio, it is not easy to match the portfolio the company currently controls. Therefore, it is hard for any competitor to rob Crescent of this Quality Service source of competitive advantage. Secondly, it is impossible to match the human resource at Crescent petroleum. The mix is unique and it took time to achieve it. This source of competitive advantage is fragile because a rival firm can make offers to these employees leading to loss of critical staff. The only way to maintain this source of advantage is by ensuring that there are incentives for them to remain at Crescent Petroleum (BCG, 2010). Thirdly, Crescent Petroleum’s desire to invest in the pipeline sector will give it a very important source of competitive advantage because of improvements in supply chain efficiency (Kopezak & Lee, 1994). Once implemented, it will be very difficult for a competitor to match Crescent Petroleum’s service delivery.

The current structure of Crescent Petroleum features two levels of top leadership. The company has the office of the Chairman and the company executives. The office of the Chairman has three positions, the company Chairman, the company President who also serves as group Vice Chairman, and the company CEO. The executives are in charge of various businesses and business functions within the group. Three members of the Jafar family fill all the top slots. While this is ok, it is better to have an appointed CEO in order to have better accountability. The business world views positions attained by virtue of family with suspicion. This does not mean that members of the Jafar family should not hold those positions. It only means diversity at this level is desirable.

According to InfoGrokEnergy, Crescent Petroleum is at position 14 out of 12062 energy companies in the InfoGrokEnergy Company Index (InfoGrokEnergy, 2010). This makes it one of the top 0.12% energy companies in the InfoGrok Company Index (InfoGrokEnergy, 2010). In addition, the company holds position 19 out of 35419 companies in the InfoGrokEnergy Index (InfoGrokEnergy, 2010). This position makes Crescent Petroleum one of the top 0.05% in the InfoGrokEnergy Index for all the companies (InfoGrokEnergy, 2010). These rankings show the strength of Crescent Petroleum. The user perception of the company is 50%, which is similar to the company’s overall rating by various factors measured by InfoGrokEnergy (InfoGrokEnergy, 2010). While the positions are commendable, there is need for the company to work harder towards increasing the value consumers attach to it.

The organizational culture of the company includes elements of inclusion and cultural diversity. In addition, the company believes in strong family control, which also informs its transition planning. In terms of its plans, it is clear that Crescent Petroleum has strong growth prospects. It is in the process of increasing its acreage in order to attain a stronger market position.

Change Proposals

Crescent Petroleum can improve on its Quality Service sources of competitive advantage. The proposals below come from the general understanding of the company and its operations. They deal with issues affecting customer perception of Quality Service.

The first issue the company needs to consider is the composition of its top-level management. Currently, there are three members of the Jafer family holding the top positions in the company. It is understandable why the top management has people from one country based on the business environment. However, this composition may compromise the perceptions of the clients of the company from other parts of the world. Merit is very important to many of the client markets. If the company wants to have an international image, then it is imperative for it to consider reducing the number of members of the Jafer family in the top level of leadership.

The second issues that can help improve Quality Service perception would be structural change to the leadership model. Currently, the company’s top leadership is composed of three members of the Jafer family. All these officials have a lot of say in the day-to-day running of the company. In order to increase the Quality Service levels of the company, there is need to institute a Board composed of people removed from the daily undertakings of the organization (Mongay, 2011). This Board can also help the company to reduce the potential negative impact of its family image on non-Arab clients.

It is instructive to note that there is no explicit mention of the physical environment in the goals of the organization. As an oil company, there is an implied responsibility to support the sustainable use of the natural environment. Oil mining and distribution processes form one of the largest environmental hazards today. The list of environmental disasters caused by oil-related operations is worrying. Therefore, there is need for Crescent Petroleum to consider its involvement with environmental conservation. As an oil company, clients want to see efforts in place to mitigate environmental disasters. If the company implements this recommendation, then its perception as a company with quality services will improve.

The final proposal for the company is in line with its diversification program. As a player in the energy industry, the company needs to consider its involvement with renewable energy development. The company has a strong brand name and a strong presence in the energy industry. If the company takes on the challenge of developing renewable energy solutions, then it will increase the perceived quality that clients expect in the area of energy services.

References

BCG. (2010). Creating People Advantage in 2010: How Companies can Adapt their HR Practices for Volatile Times. Boston, MA: The Boston Consulting Group.

Crescent Petroleum. (2012). Business Strategy. Web.

InfoGrokEnergy. (2010). Crescent Petroleum. Web.

Kopezak, L., & Lee, H. (1994). Coordinated Product and Supply Chain Design. Case Study , 331-404.

Mongay, J. (2011). Business and Investments in Asia. Madrid: ESIC Editorial.

Porter, M. E. (1980). Competitive Advantage: Techniques for Analyzing Industries and Competitors. New York, NY: Simon and Schuster.

Walker, D. M., Walker, T. D., & Schmitz, J. T. (2003). Doing Business Internationally: The Guide to Cross-Cultural Success. New York, NY: McGraw-Hill Professional.