Summary

High-speed Internet and the cable television market will face greater monopolistic power due to the merger of Comcast and Time Warner Cable (TMC). The article discusses two aspects of the merger – first, the increase in monopolistic power of Comcast due to the merger and second, government regulation that might control the rise of monopolistic power in high speed internet market (Wyatt, 2014).

It points out that for the merger to be effective Comcast requires approval from two government bodies – Justice Department and Federal Communications Commission (FCC). The first will review the merger to find any violation of the antitrust laws. FCC is responsible to evaluate the merger to find if the merger “serves public interest” (Wyatt, 2014, p. B3).

Overall, the article raises concern over the increase in monopolistic power of Comcast due to its merger with Time Warner Cable. It points out that cable television market will soon be cannibalized by high-speed internet market as more people are switching to subscription from content providers like Google and Netflix.

Economic Analysis

Two questions that emerges from the analysis of the article are:

- Completion in high-speed Internet market in the US

- Government regulation to control monopolies

Clearly, the merger between Comcast and TWC demonstrates a definite increase in monopolistic power of the former. This would allow Comcast to control two markets simultaneously – (a) cable television market and (b) high-speed Internet market.

In the high-speed Internet market, Comcast gains greater advantage. As there is a definite trend towards switching cable networks to high-speed Internet services, Comcast is expected to control a greater market share. The content providers like YouTube, Amazon, and Netflix may enter into an arrangement with Comcast that would provide greater speed for streaming from any of the specific channels. Comcast will have higher control over pricing of the cable television and high-speed Internet service.

US regulations had exempted data providers from antitrust law. This clears Comcast from the data services provided. Further, in its FCC filing, the company states that in the cable television market it has two competitors, DirecTV and Dish Network who hold more than 15 percent market share as required by the competition law in the country.

However, Wyatt (2014) points out that such argument is futile, as satellite television operators cannot provide high-speed Internet service, which is the market that needs regulation. Cleary due to lack of regulation the company is expected to garner greater monopolistic power.

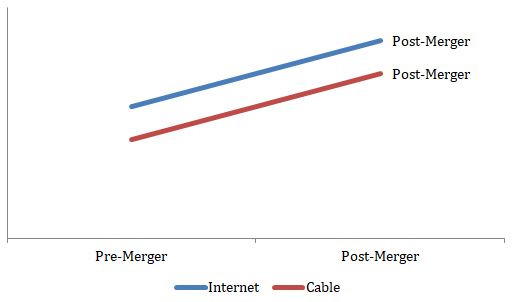

Figure 1 shows that the merger is expected to increase market share of Comcast, which will gain Time Warner Cable’s market share after the merger. The merger will increase market share of Comcast in two industries –

- Cable television

- High-speed Internet

The monopolistic power of the company is expected to rise not only due to the merger, but also due to the emerging trend in the high-speed Internet market that is expected to cannibalize a portion of the cable television market. This would increase Comcast’s market share further, increase its monopolistic power.

Further Analysis

A deeper analysis of the article reveals another problem that the merger reveals questions regarding effectiveness of government regulation to control rise in monopoly power in the US market. The merger would create entry barriers for smaller companies as well as reduce supplier power.

This is because cable and the Internet content providers will have to sell channels through Comcast, which would gain greater power over its suppliers. Evidently, the merger will change the structure of the industry and give too much control of the market to Comcast.

Reference

Wyatt, E. (2014). Internet Choice Will Be Crucial Battlefield in Big Cable Merger. The New York Times, p. B3.