Introduction

Financial budgeting is an essential part of organizational development, and the objective of the Alberta Budget 2022 plan is to support the health-care system of the province. The budget estimates a province deficit of 3.2 billion dollars for 2021-2022 compared to the projected 18.2 billion dollars in the previous fiscal plan (Alberta Government, 2022). The budget forecasts a $500 million surplus representing a profound turnaround from the deficits from the last financial period.

Budget 2022 Objectives

Budget 2022 intends to foster economic growth and prosperity, with Alberta at work being the central theme to reduce the employment barriers. The Alberta Health Services are budgeted $22 billion devoted to strengthening and expanding the intensive care unit over the next year. In addition, $600 million is allocated to the health operating budget, representing a commitment rising to $1.8 billion for 2024-2025 (Alberta Government, 2022). This money shall recruit more staff in the rural and remote areas and finance hospital spaces and labs. The labor market has recovered from the pandemic, with shortages in critical sectors, barriers to entry for the underrepresented, and youth unemployment challenging for Alberta’s labor market. The budget has allocated $600 million for the next three years to increase strategic investment for Alberta at Work. This initiative seeks to help Albertans with $15 million for labor market improvement no matter their career path.

Advancement in education ensures Alberta has a solid foundation from the world-class education system. Budget 2022 allocates $25 million operating expense and the addition of $47 million capital investment for the next three fiscal years as a priority. To build the skills of Alberta’s the Budget 2022 provides $264 million for skills development and job strategizing for the targeted groups. This is shared to various sectors with $171 million set for expansion of technology, agriculture, financial and aviation services, $59 million to expand the veterinary school at the University of Calgary, $30 million for apprenticeship program expansion, and $5 million to increase training opportunities for people (Alberta Government, 2022). There is a severe shortage of skilled drivers, and the government is committed to reducing this gap by allocating $30 million for the next three years for Commercial Driver Grants.

Budget 2022 Comparison

Total revenue is forecasted at $62.6 billion for the period 2022-2023, which is an increase of 1.5 percent compared to the period 2021-2022 and 45 percent higher than the actual revenue of the period 2020-2021. Resource revenues are budgeted at $13.8 billion, showing a five percent increment over the estimate for the year (Tombe, 2019). This is attributed to the increased demands in energy resulting from the COVID-19 pandemic restrictions. Expenditures are projected to fall to $62.1 billion within 2022-2023 to the estimated expenses of $64.9 billion in the last budget. This decrease is because of decreased need for support to the pandemic.

Financial Analysis and Implications

Over a decade, the Alberta budget targets a modest surplus for each year in the next three fiscal years. The revenue from resource royalties will help balance the books for the second time in more than a decade. Consequently, income tax revenues depend on the primary household income and net corporate operating surplus, which are forecast to rise significantly (Alberta Government, 2022). Concerning the former, it is predicted to rise by almost 7 percent by the end of the year (Alberta Government, 2022). Consequently, the net corporate operating surplus will most likely increase by 31 percent, which is the most significant change since the 2015-2016 fiscal year (Alberta Government, 2022). The budget forecast is $500 million in 2022-2023, $900 million in 2024, and $700 million in 2025 fiscal years as surpluses (Tombe, 2019). Revenues have had a large swing during the pandemic, with total expected revenue of $18 billion for 2021-2022. This is an increase from the previously projected revenue for the past government projects.

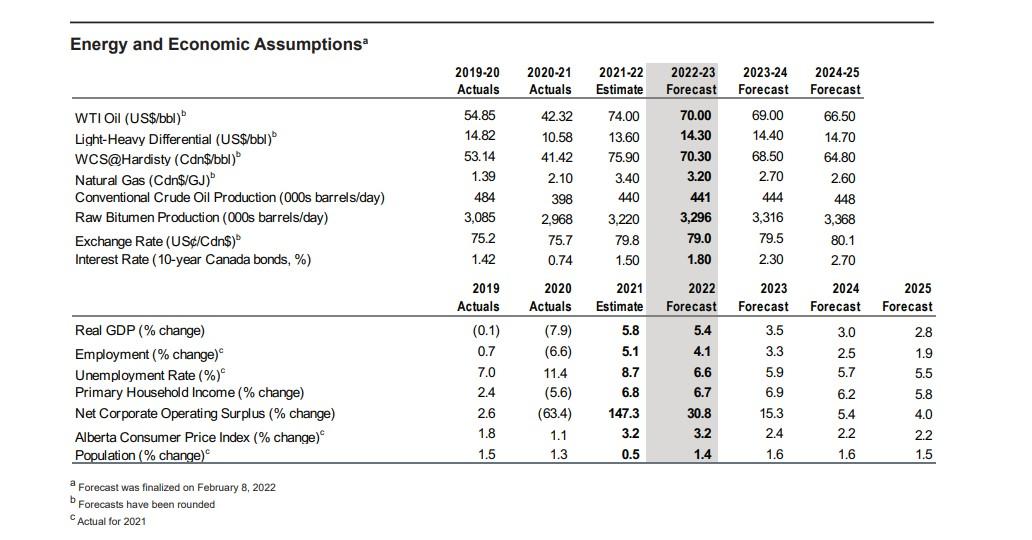

Based on the current oil pricing for 2022-2023, assumptions on government incentives are an average of $70 a barrel of crude oil. The current price is $100 per barrel, topped after Russian invaded Ukraine, creating concerns disrupting global energy supplies. Alberta’s economic recovery exceeds the worldwide pandemic and oil price crisis expectations. Expected economic growth of 5.4 percent in 2022 compared to 5.8 percent experienced in 2021 (Alberta Government, 2022). This is because oil prices are recovering from the pandemic-induced crash. Oil and gas make up to 17 percent of Alberta’s GDP and has struggled to force the industry to slash on capital spending. The Real Gross Domestic Product (GDP) is assumed to grow solid amid the strong energy prices. It is forecasted at 5.4 percent change in 2022-2023, 3.5 percent in 2023, and 2.8 percent in 2025, as shown in figure 1. The below table shows the critical energy and economic assumptions for Alberta’s budget 2022 adapted from fiscal plan 2022-2025 (Alberta Government, 2022).

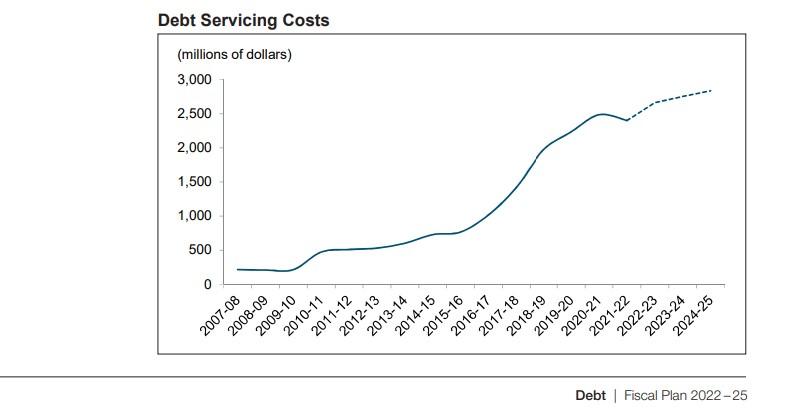

Alberta budget 2022 forecasts a rosy economic future as the soaring global energy and oil output increases, boosting provincial resource revenue. The Alberta budget allocates enormous amounts to hospitals, healthcare, and programs to bridge its labor gap. A $500 million surplus and an expected $13.8 billion from non-renewable sources through cautious and credible energy projections. Oilsands royalties are expected to account for $10 billion of the total expected from energy. Total government revenue of the forecasted $62.6 billion will offset a base expense of 59.5 billion dollars (Alberta Government, 2022). The taxpayer debt is projected at $94.7 billion, increasing $2.7 billion in debt servicing costs. This represents 3.6 percent of the estimated total revenue for 2021-2022, as shown below in the graph below retrieved from Fiscal Plan 2022-2025.

In May, the first possible fiscal update on Alberta Budget 2022 will be the increased expenses to stimulate Albertas from post-pandemic disruptions. Also, the budget is expected to receive a boost from the rising oil and natural gases that could deliver considerable capital to Budget 2022. The collection of more royalties will add revenue that will reduce the deficit. The tax aid and minimized regulation for Albertans will encourage more investment and spending, which will, in turn, increase the economy’s output. All provinces’ growth will increase due to the economic recovery from the global pandemic and the oil price crisis. Business investment will accelerate as undermined by the high energy prices, the competitive tax regime, and increased consumer spending and housing activities.

Conclusion

In conclusion, revenues from oil and gas are the prime motivator, and premier Jason Kenney will use the new oil boom to its political advantage. His government will deposit funds directly to the oil industry towards achieving economic diversification, giving all businesses the relief of tax breaks combined with fewer regulations. After long years of stagnation, oil prices are at their best and no sign of relenting any time soon because of the slow economic recovery. The United Conservative government will be keen to reduce the decades of failed attempts to minimize provincials’ dependency on fossil fuels. The Alberta administration will use this to show dedication to cleantech and the digital economy, boosting Kenney’s political standing. Based on his survival fight for political power, Kenney will gamely turn any worldwide event to his political advantage, including the oil boom. The 2022 Budget reflects efforts to stabilize the economy by the Alberta government and strengthen the healthcare system for the people and their livelihood.

References

Alberta Government. (2022). Budget 2022: Moving forward.

Tombe, T. (2019). Fiscal policy trends: Balancing Alberta’s budget by 2022 is only part of Alberta’s long-run fiscal challenge.The School of Public Policy Publications, 12.