Executive Summary

The Asian food industry consists of several small players operating as either exclusive restaurants or large hotel chains. Demand for Asian food has increased in the western markets in the last few years due to its superior taste, fair price, and perceived health benefits. The outbreak of COVID-19 forced governments to close restaurants, hotels and other food outlets to reduce the spread. As a result, the industry experienced a large decline in sales, as most customers rely on retail outlets for their supply of Asian foods. In addition, the closure of most manufacturing and food processing companies in Asia led to major shortage of raw materials used in the preparation of cuisine. Restrictions on restaurant dining led most companies to start take-away and home delivery services. These delivery services sustained the industry’s revenue during the lockdown.

Introduction

The Asian food industry consists of several small players operating as either exclusive restaurants or hotel chains. Demand for Asian food has increased in the western markets in the last few years due to its perceived health benefits (Persistence Market Research, 2021). Specifically, most customers view Asian foods as healthier compared to the conventional fast foods sold in the western markets. In Europe and North America, demand for Asian food has been on the rise due to the customers’ preference for spicy foods and sauces, fair prices, and superior taste. Moreover, rising disposable incomes both in most countries has led to the widespread adoption of hotel dining culture. Nonetheless, major supply chain setbacks that occurred following the advent of COVID-19 could reverse the gains in market share and brand preference achieved in the last decade.

Market Segments

The key market segments in the Asian food market include Chinese, Vietnamese, Japanese, Korean, Thai, Indian, and Indonesian. While the customers for each of these segments is in their domicile, recent demographic changes in the west and other emerging economies have created viable segments outside the domestic market (Persistence Market Research, 2021). In particular, the Asian region is a key source of immigrants to the west. These immigrants move to Europe or North America in search of education, employment, or investment opportunities. As a result, these immigrants create viable market segments that attract investors into the Asian food market. This establishment of Asian food markets in far-flung corners of the globe necessitates the formation of efficient supply chains to deliver fresh raw materials to these markets.

Market Overview

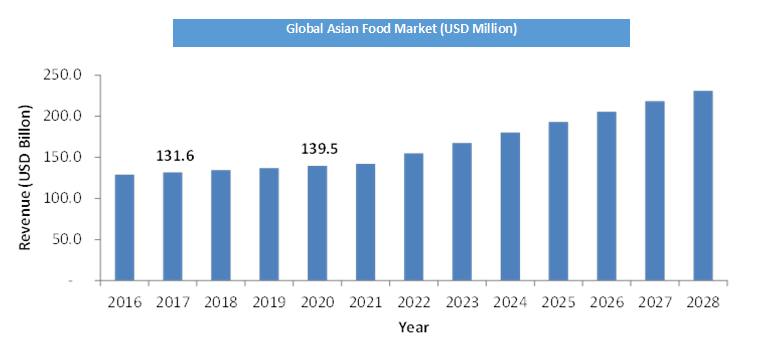

The global Asian food market generated $20 billion revenue in 2020. The market is expected to grow at a compounded annual growth rate of 7.2% to reach US$231 billion by 2028 (Zion Market Research, 2021). Figure 1 shows the expected growth in the global Asian food market.

The most notable players in the global ethnic food market include Ajinomoto Company, McCormick & Company, General Mills, Associated British Foods, and Orkla SA (Modor Intelligence, 2021). Nonetheless, competition for market share is intense, and several companies seek to dominate their specialty areas. While a few players offer Asian foods exclusively, most offer a diversified array of ethnic cuisine to appeal to a large market. These companies also offer these products through multiple channels of distribution. The key distribution channels include retail stores, supermarkets, and hypermarkets. These companies control more than half of the Asian food market.

Impact of COVID-19

The outbreak of COVID-19 forced governments to close restaurants, hotels and other food outlets to reduce the spread. As a result, the industry experienced a large decline in sales, as most customers rely on retail outlets for their supply of Asian foods (Zion Market Research, 2021). In addition, the closure of most manufacturing and food processing companies in Asia led to major shortage of raw materials used in the preparation of cuisine. Therefore, the food companies could not access important ingredients for making their products amid a shrinking market.

Companies that had access to raw materials experienced a significant hurdle in transportation. As the pandemic ranged across the globe, countries imposed nearly complete ban on cross-border transportation to guard against the spread (Zion Market Research, 2021). Authorities erected barricades to ensure that only the essential items could pass through the boarders. These measures led to delays in getting the raw materials to the food companies.

Most of the raw materials used in making Asian foods are perishable. Transportation of perishable foods requires use of refrigerated trucks to avoid spoilage (Zion Market Research, 2021). In addition, there were delays in getting the prepared food to the customers. Notably, customers prefer the Asian cuisine due to its perceived better taste and freshness. As a result, delays in reaching the market compromised the quality of the final products. Maintaining the raw materials and ready food fresh led to additional expenses. Nonetheless, the reduced demand led companies to produce in small quantities to avoid waste.

Restrictions on restaurant dining led most companies to start take-away and home delivery services. The advent of home delivery services led to a resurgence in demand for ready to eat meals in most countries. In the United States, the market for food delivery services increased by more than 100% during the lockdown period (Ahuja, et al. 2021). This growth followed a historical 8% annual growth experienced since 2017. Therefore, the supply chain evolved to reach the customer faster and without exposing the customer to the dangerous infections.

The evolution of home delivery services occurred in tandem with technological innovations to support interactions with the customers. New mobile phone-based applications were developed to enable customers to specify and pay for their desired meals (Ahuja, et al. 2021). In addition, technology-enabled driver networks emerged to aid in the accurate identification of customers’ location. However, the new home delivery model is plagued by significant challenges that could impede its growth in future.

Four main factors have emerged as the main hurdles affecting the growth of the home delivery model in the Asian and the larger global market. These include cost, operational scale, regulations, and changing customer habits (PriceWaterhouseCoopers, 2021). Firstly, home delivery business is a cost-intensive undertaking. In addition, the margins earned from a single delivery are small and often fall short of the cost incurred in delivery. Secondly, food delivery businesses have to operate at a large operational scale to breakeven. Thirdly, there is a looming rise of regulatory burden on home delivery businesses. Lastly, customers’ consumption patterns change constantly, which necessitates constant changes to remain in the market. Therefore, the success of the home delivery model could be in doubt especially after the full opening up of the food outlets.

Conclusion

The Asian food market is likely to continue on its upward trajectory over the next decade. The main factors influencing this growth include rising disposable incomes, preference for healthier and tastier food, and the rising population of immigrant populations in the western countries. The market is competitive and is dominated by five main firms, which control more than half of the market. However, disruptions occasioned by the COVID-19 pandemic led to delays in sourcing materials and escalation of costs. Nonetheless, the industry will resume its growth after the lockdowns.

References

Ahuja, K., Chandra, V., Lord, V., Peens, C. (2021). Ordering in: The rapid evolution of food delivery. McKinsey & Company.

Modor Intelligence. (2021). Ethnic foods market – Growth, trends, COVID-19 impact, and forecasts (2021 – 2026).

Persistence Market Research. (2021). Asian food market.

PWC. (2021). Impact of COVID-19 on the supply chain industry.

Zion Market Research. (2020). Asian food market – Global industry analysis.