Executive Summary

This case study entails the examination of various data and information and decision-making recommendations for the Boeing Company’s board. The impacts of the 9/11 terror attack and America’s economic trend are some worrying issues for the board to approve the 7E7 project. The analysis examines the project’s profitability and attractiveness.

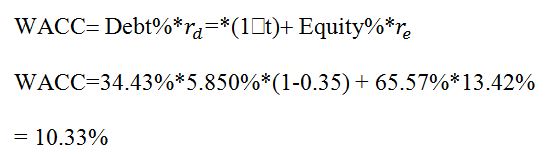

The project’s WACC remains consistent compared with that of the commercial division, which resulted in the determination of beta using unlevered industrial average and Boing’s leverage, and division beta using the WACC of two different departments. This produces the project’s WACC to be 10.33%.

The analysis also uses IRR to measure the project’s profitability, since its comparison with the WACC determines if the board should approve the project or stop it. Moreover, sensitivity analysis is conducted to give the board a comprehensive perspective of the project regarding internal and external environmental forces such as costs and returns. It is therefore concluded that the board should accept the project due to its opportunities and benefits to the company.

Introduction

Boeing had planned to initiate a project known as 7E7 in 2003. Starting such a project in the manufacture of airplanes is considered one of the most daring moves a company can make. Mr. Bair must show evidence that Boeing 7E7 is profitable based on his valuation of the project and sectoral analysis for the board to accept it. Therefore, this analysis considers the project’s strengths and weaknesses, its major competition, calculations of costs and capital, and scenario scrutiny.

The Boeing 7E7 Project

The Boeing 7E7 entailed the design of an airplane that was meant for short and long distances and various cargo and passenger capacities. At the same time, the jet was supposed to consume 80% of fuel compared to its predecessor and would cost customers 10% cheaper. The aircraft was thus designed to make more profits and save Boeing from its lost customers in the commercial air carrier sales.

Strengths and Weaknesses of the Project

The Boing 7E7 project was flexible in handling short domestic travel and long international ones. The aircraft would be 10% cheaper thus attracting more customers in addition to consuming less fuel than other aircraft of the same size. Moreover, its production cost would be less because of composites and carbon-reinforced matter. However, the project’s downside was its choice of Snap-On wing extensions, which would cost a lot more due to the limits of technology.

Competition

Boeing faced and still faces aggressive competition from its main rival Airbus. Boeing would reduce this competition by lowering its operational costs and fuel consumption. This can help the manufacturer get more aircraft buyers, thus gaining its market share. Moreover, it should implement its expandable wing, to give the airline owners options to cover more cargo and passenger routes. Enabling carrier companies to access more routes means more customers and more revenue, which would attract airline buyers to purchase from Boeing.

Cost of Capital

Since Boeing mainly builds its aircraft for defense and commercial use, it shows the commercial division of the manufacturer faces more risk, thus higher Beta compared to the defense division. The cost of equity rises with the level of Beta, showing that the commercial division must have a higher weighted average cost of capital (WACC) (Vitolla et al. 525). The comparison of the commercial division’s WACC and the project’s rate of return can help be the board decide whether to accept or reject the Boeing E7E. Consequently, this analysis utilizes the 21-month S&P 500 Beta, which eliminates the impact of 9/11.

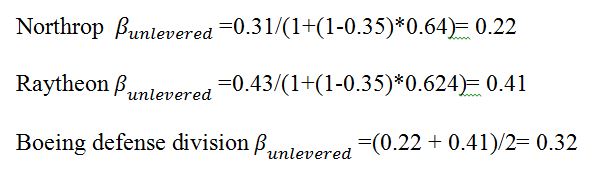

This analysis uses the pure-play technique to identify companies that operate as the defense division of Boeing and determine their unleveled Beta. The analysis then calculates the average of the individual company Betas and uses that for Boeing (Santos). This analysis uses the information from Raytheon and Northrop Grumman, which relate closely to Boeing.

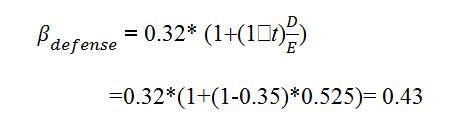

Boeing’s defense division unlevered Beta can be re-levered to determine its financial position as follows:

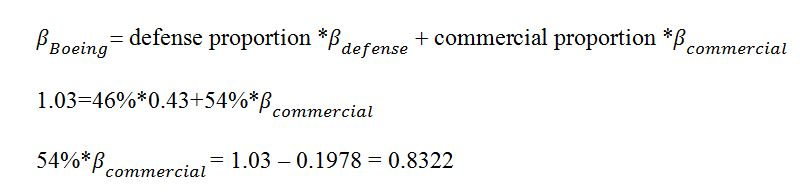

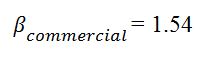

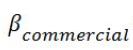

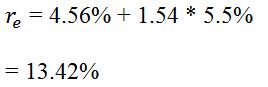

The above values can then be used to determine the company’s commercial division Beta as follows:

Therefore,

The

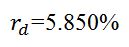

Using the 30-year period adopted above, then the project should mature in 2033. Therefore, the cost of debt is

There the commercial division’s WACC is calculated as follows:

Evaluation of Boeing E7E

The project’s sensitivity analysis gives optimistic and pessimistic estimates for the variables affecting sales costs and volume. Using the determined WACC, it is revealed that the internal rate of return (IRR) tends to equal WACC in most pessimistic scenarios (Radiant and Ahmad 137). This indicates it is not possible to disregard the project due to the above analysis conducted above. Moreover, it is also revealed that the project can be discarded in cases where the cost exceeds 8 million dollars, and the cost of goods rises above 84 %.

Consequently, this requires scenario analysis since both IRR and WACC are affected by costs and economic conditions surrounding the business. The environment affects the firm’s market premium, cost of debt, and Beta. An optimistic economy implies a reduced cost of capital, would translate to a reduction of cost of debt by 5%, which reduces WACC from 10.33% to 9.92%.

Overstating the risk reduces WACC further to 9.71% since the actual Beta for Boeing’s commercial division is 1.5. Since the market return is also crucial in estimating WACC, then the underperformance of the market will result in reduced market return, which in turn will further reduce the company’s market premium, thus lowering WACC. Contrarily, a pessimistic economy results in higher WACC due to the increased cost of debt resulting in higher risk and market underperformance.

Conclusion

Boeing must build its 7E7 aircraft to counter the forces of such rivals. The risk of developing Boeing E7E means it will develop its expandable wing, which will increase its versatility. This means the airplane will be open to new routes and serve more customers, while at the same time, utilizing fuel efficiently. The company can increase the wealth of its shareholders by ensuring that its IRR is equal to or greater than its WACC.

This indicates that Boeing must strive and sell a minimum of 1500 of its E7E aircraft within 20 years. It must ensure that its cost of developing the planes remains below $8 billion and that the cost of goods is below 84%. Amidst its risks, the project can result in better outcomes for Boeing’s shareholders, hence a desirable understanding. The board should therefore accept E7E because its benefits outweigh its risks.

Works Cited

Radiant, Joseph and Prasetyo, Ahmad Danu. “Investment Analysis of Integration Project (Case Study: Pt Bandung XYZ).” International Journal of Accounting, Finance and Business. vol. 6, no. 32, 2021: pp. 128-139.

Santos, Ricardo Sérgio Gomes. Equity Valuation: Netflix, Inc., 2021. Doctoral Dissertation.

Vitolla, Filippo et al. “The Impact on The Cost of Equity Capital In the Effects of Integrated Reporting Quality.” Business Strategy and the Environment. vol. 29, no. 2, 2020: pp. 519-529.