Company overview

Cinderella of Boston is a footwear company that was established in the year 1939. The company specializes in the production of low-cost shoes, sandals, and other accessories for male and female customers. The company is owned by a family, and it is not yet listed in the stock market. The company has more than 20 branches within Boston and other states within the US. The company is interested in launching a new brand for customers who are below ten years. The proposed name for the new brand is Cinderalla and it comes in different colors and designs to appeal to the young generation.

Description of the project

Changes in fashion, taste, and preference in the footwear market have greatly impacted the demand for footwear. Cinderella of Boston Company has concentrated on the production of shoes that are appealing to the customers to satisfy their needs. Based on the market research conducted, it was found out that our current product line concentrate in the production of footwear for male and female in the age bracket 20 to 40 years. Little attention is given to the production of footwear for the population younger than 10 years old. Our proposed new shoe line Cinderella is designed for a population younger than 10 years old. In addition, this is also based on the fact that the population is growing at an exponential rate, targeting the young generation would be profitable. This treatise is a project plan for the proposed venture and a proposal for capital injection into the undertaking. It highlights the forecasted financial performance of the new footwear based on market research conducted.

The proposed undertaking will concentrate on the production of Cinderella footwear for the population younger than 10 years. Even though there are several shoes in the market, products of that age group are not explored. Therefore, the production of Cinderella footwear will bridge that gap by introducing products for that age group in the market. Further, we will produce attractive and high-quality products for the end-users. Based on the market research conducted in ten states, it was established that out of every ten shops, only two stocked footwear for children. Further, out of every 15 shelves in these shops, only one was allocated to such footwear. They attributed such low stock to the supply of the product. It was evident that there is low production of footwear for children. It also noted that the prices of such products are extremely high priced due to the high demand and low supply. This informs the rationale for introducing Cinderella footwear at a competitive price in the market.

Cinderella footwear will be the brand name for the new footwear. As an element of the marketing mix, an entity can use its products to generate high profits. This can be achieved by selling products that always satisfy customer needs. High-quality materials shall be used in the production of Cinderella footwear such would guarantee a high-quality product that would satisfy customers’ needs and aid in gaining a large market share within the shortest time possible and at a low cost. Further, the product will be packaged in attractive and colorful packets that can be appealing to our target market. A good pricing strategy is essential in launching a new product. Such prices should be able to allure the market and make the product attractive. Cinderella footwear will hit the market at competitively lower prices than the prevailing market price. Based on the market research, current footwear for children is overpriced. This can be attributed to the knowledge that demand exceeds supply. The introduction of Cinderella would boost the supply of footwear for children in the market hence a reduction of price. Therefore, prices for Cinderella will be set below the market price to attract a large demand.

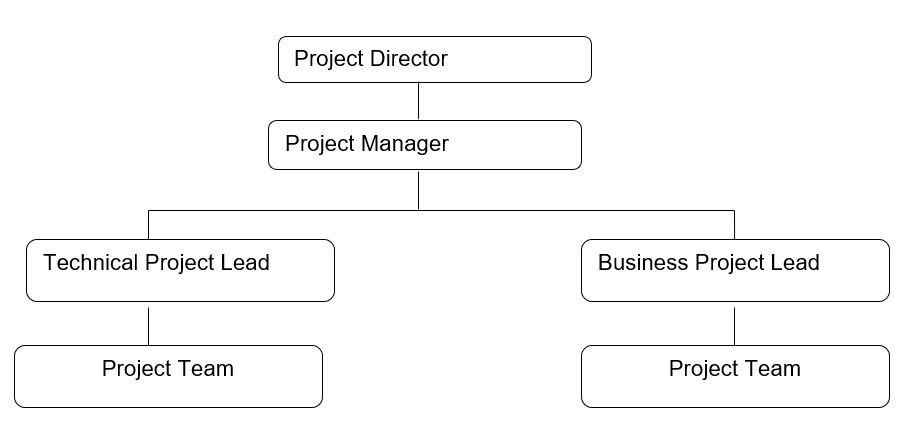

Project governance

The project governance will be accomplished by four main project personnel managing a team implementing the project. The project will be headed by a project direct subordinated by a project manager who supervises technical project lead and business project lead managers. The business and technical project lead managers will manage a team each during project implementation. This means that any progress report will pass through the lead managers who will communicate the report to the project manager. The project managers will communicate the progress to the project director at the apex of project leadership (Eugene 23). This is illustrated in the chart below.

Structure of financing the project

Since the proposed project is capital intensive, the primary source of financing the project will be from external funding sources such as bank loans and share capital from external investors. However, the company needs to review the fixed lending period, interest rates, and repayment period to minimize risks associated with funding the project. To determine the number of funds required for the project, it is necessary to carry out marginal costing, which is a technique in which only variable manufacturing costs are considered and are used in valuing inventories and determining the cost of goods sold (Brealey and Myers 33). Only additional cost (marginal cost) in form of labor, material, expenses, and overheads variables incurred in producing an extra unit is considered relevant in marginal costing as fixed costs are constant in production in this project as presented below.

Cinderella Footwear

Marginal Costing Cost Statement

The marginal costing statement for the footwear provides a contribution margin of £ 5.1 per unit. With the assumed annual sales of 50, 000 units for the first year the contribution margin amounts to £ 753,000. The fixed cost of £ 498,000 is adjusted to get the net profit of £ 255,000, which works out to 20% of the total sales revenue for the first year. According to Finnerty (2013), several techniques are used to determine the costs of goods, marginal and absorption costing is the most common methods used. Marginal costing is a technique in which only variable manufacturing costs are considered and are used in valuing inventories and determining the cost of goods sold (Finnerty 54). Only additional cost (marginal cost) in form of labor, material, expenses, and overheads variables incurred in producing an extra unit is considered relevant in marginal costing as fixed costs are constant in production.

Cinderella Footwear

Marginal Costing Cost Statement

The marginal costing statement for the footwear provides a contribution margin of £ 5.1 per unit. With the assumed annual sales of 50, 000 units for the first year the contribution margin amounts to £ 753,000. The fixed cost of £ 498,000 is adjusted to get the net profit of £ 255,000, which works out to 20% of the total sales revenue for the first year. This means that the company has to seek funding for the project up to £ 498,000.

Risk and return structure of the project

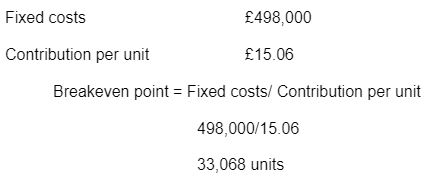

The breakeven point in units is computed by dividing fixed costs by contribution per unit. From the marginal cost statement above, the breakeven point for the new footwear will be computed as below.

This would imply for the costs and the revenues for the new footwear to be equal, the company will have to produce, 33,068 units. There would be no profits or losses at this point, the company will just cover its costs.

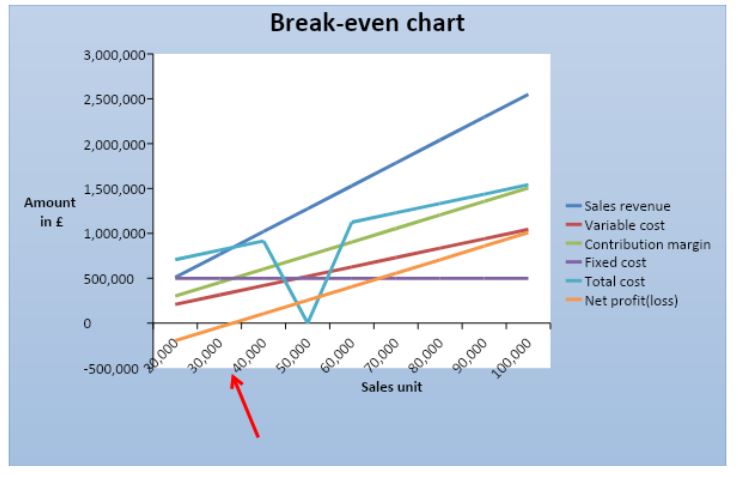

The table below shows a profit at a different level of sales revenue and cost.

Break-Even Table

The graph presented below shows the values of sales, revenue and break-even point.

The initial capital proposed to be introduced is set at £ 154,000 and the venture will try to arrange for a long-term loan of £ 534,000 with an interest rate of 10% payable quarterly. The repayment of the loan will take place in 5 years. For calculating the cash flow, sales will be made both on cash and credit and there will be accounts payable of 15 days outstanding. Similarly, for the supplies of materials, the venture will enjoy a credit period of 15 days. The venture will invest £ 348,000 in property, plant, and equipment and this amount will include the cost of furniture, fittings, and office equipment. The operations will be carried out initially in rented premises. A rental advance of £ 99,600 being 12 months’ rent in advance is payable.

From the cash flow statement above, we note that sale of the new footwear will generate a positive net cash flow amounting to £431,270 in the first year of operation. The cash net flow is generated by deducting the cash outflows, resulting from expenses such as wages, rent, administration cost and electricity and sales promotion cost among others, from revenue generated from sales. Further, loan repayment amounting to £ 154,000 will be made. We can deduce that the company would be in a position to meet its obligations and still have adequate working capital for the operations of business. The table below is a forecast income statement for the Cinderella footwear.

From the above income statement for Cinderella footwear, net profit before tax is £ 340,920 is arrived at by deducting costs of sales, fixed expenses, interest and depreciation from sales revenue. This is 26.7% of sales while net profit after tax is £ 238,644. The profit margin for the first year of operation stands at 18.72% while the gross profit margin for the year 2012 is at 59.06%. The above ratios indicate that first year of operation offers a good return to the potential investors (Ormiston 32).The table below will show the forecast financial position of the new company in terms of assets, liabilities and capital.

The above balance sheet show total assets, liabilities and capital base of the new footwear. The total assets stand at £ 772,644 and equity at £ 392, 644 at the end of the first year.

Net present value

Before estimating the net present value of the project for the year 2016, it is important to estimate the weighted average cost of capital for the project. This value will be used as the discount rate for estimating the value of net present value. The weighted average cost of capital will be estimated from the values of cost of equity and cost of debt. The calculations are present below.

Calculation of Cost of Capital

Cost of equity = risk free rate of return + beta * risk premium

= 3.41% + (1.02487 * 5.92%)

= 9.4772%

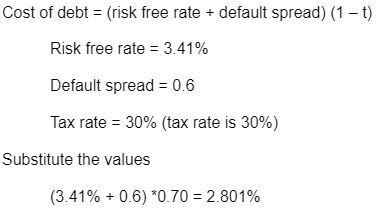

Determination of the Cost of Debt

Determination of the Weighted Cost of Capital

Thus, the discount rate for the project is estimated at 6.20%. Thus, the net present value can be computed from the values of cash inflow and cash outflow. The table presented below summarizes the calculation of the net present value.

Thus, the present value of the project is £406,092.28. The value is positive and it indicates that the project is viable.

Return on assets

= Net income / total assets

= 238,644 / 772,644 * 100

=33.02%

The return on assets is high. This implies that the business is likely to generate a high amount of revenue per unit of asset. It also indicates a high level of efficiency in the use of assets.

Return on debt

= Net income / debt

=238,644 / 380,000 * 100

=62.80%

The return on debt is also high. The value shows that the amount of profit generated per unit of debt is high. It shows that the business is efficient in using debt to generate profit.

Risks

There is always a risk involved in any business decision. There are no risk-free decisions for the company. Even if there are strict credit policies, uncertainties will always exist in any business environment (Subramanyam 45). The main risks are identified as described below.

- Operational and Risk

Since the project has a specific timeline for execution, there are operational and technological risks when the timeline elapses before the project is completed. Therefore, the fixed time for execution of the project might face the challenge of delay. The level of risk for this category is high. - Economic and Financial Risk

Since the project is financed through external sources, there is a need for a specific timeline for completion within the set deadline to minimize fines or higher interest rates that the external financer might charge for any delay. This risk is classified as a medium since there are no major hurdles that might affect implementation. - Other Risks

The other risks that will face this project are the economic swings in the market for footwear. Besides, the fluctuations in major currencies might affect earnings remitted since the business targets the international market (Wainwright 22). In addition, this market is highly structured and depends on the perception of the potential consumer. Since the target age group is barely in the independent decision-makers bracket, the success of the outfit will depend heavily on the perception of the adults purchasing these products for the young age group.

Recommendations for improvement of financing, governance, and risk allocation

In the worst-case scenario, where the project fails to break even as projected, the management and board of directors have several optional actions to ensure that the business survives in the market. First, the management may consider disposing of idle assets of the company. This will ensure that only assets in the business are actively used to generate revenue. Second, the management may undertake aggressive cost-cutting in the form of downsizing, employing cheap labor, and cutting on unnecessary expenditures such as health insurance. Management may also consider leasing the facilities for use to established businesses for revenue (Brealey and Myers 34).

Critical to the success of the proposed auto restoration project is to proactively manage issues that arise from the conception to execution of the project. Thus, it is necessary to ensure that the stakeholders are active in resolving arising issues that might have an impact on the triple constraints, which are scope, schedule, and budget. Upon registration of any issue, the necessary stakeholder will be mandated with the responsibility of creating an action plan aimed at proactively resolving the issue within the shortest time possible, that is, weekly. The status report will be updated each time an issue is identified and resolved (Brealey and Myers 19).

Conclusion

The project plan is achievable. This is because the Net Present Value is positive. It means that the initial investment into the project will be recovered within the first year of operations if the targets are achieved. For the project to be successful, it requires the support of all parties because of the capital intensity and short duration of execution. It is based on the assumption of a ‘best case scenario’ where it is possible to obtain a credit facility considering the financial position of the company. It also assumes that the new products will penetrate the market with ease since the cost of production and projected returns are positively skewed. However, these assumptions may cast doubt on the practicality of the project, especially due to the unpredictable nature of swings that often affect projects of similar magnitude.

References

Brealey, Richard and Stewart Myers. Principles of Corporate Finance. 10th ed. 2011. New York, NY: Irwin. Print.

Eugene, Brigham. Financial management theory and practice, USA: South-Western Cengage Learning, 2009. Print.

Finnerty, John. Project Financing: Asset-Based Financial Engineering. 3rd ed. 2013. New York, NY: John Wiley & Sons. Print.

Ormiston, Fraser. Understanding Financial Statements. 7th ed. 2006. New York, NY: Cram 101 Incorporated.

Subramanyam, John. Financial Statement Analysis. 11th ed. 2013. New York, NY: McGraw- Hill Education. Print.

Wainwright, Simon. Principles of Accounting, San Diego, CA: Bridgepoint Education, Inc, 2012. Print.