Rate parity is the practice of including a fixed price across all sources of customer attraction into the agreement between a hotel and a platform. Its inclusion in contracts between hotels and the leading online travel agencies (OTAs), such as Expedia, Priceline, and Booking.com, became a controversial topic for discussion in the hotel industry. Booking.com, being the largest platform of that type, holds up to ~40% of the booking market in various countries (Davies, 2015).

The article by Phil Davies provides an analysis of the situation with rate parity and related antitrust concerns, which puts OTAs in a dominating position and allows them to control prices in the market. It describes the recent deal between Booking.com and antitrust commissions and its consequences. This report aims to assess the necessity of the agreement between Booking.com and several EU authorities regarding rate parity across all distribution channels.

Prior to this agreement, Booking.com did not allow hotels to use different prices on other platforms. Essentially, this meant that hotels were unable to control the lowest price they were able to give to a customer. Rate parity has been implemented as a tool to regulate the relationship between hotels and OTAs since both parties need each other (Nicolau and Sharma, 2018, p. 525). However, as the platforms continued to grow exponentially, their leverage has increased to the point where they became able to control the market. Nowadays, Booking.com stays the number one platform for booking services, while smaller companies struggle to increase their market share.

The article gives an in-depth look at the state of the hotel industry. The author makes it clearly visible that the current state of OTAs, especially Booking.com, gives them an influence that prevents the market from operating in favor of its customers. There are several considerations to the changes that are introduced by European authorities that make these new regulations ineffective at their task (Davies, 2015). Several sources mentioned in the article argue that new laws will not promote competition, instead, they will further increase the expenditures of hotel owners and increase the influence of the top OTAs on the market (Davies, 2015). In general, the article presents substantial concerns regarding the efficiency of the new policy against OTAs and Booking.com in particular.

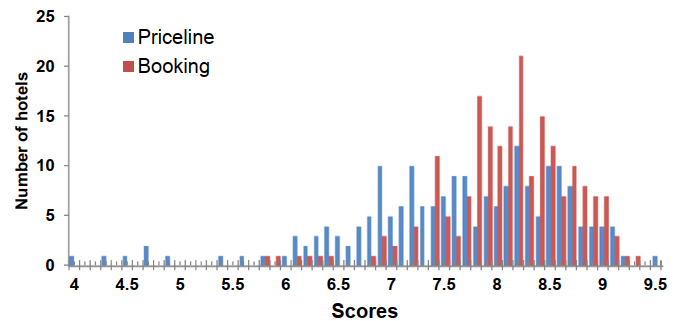

There are several key issues that put Booking.com under the suspicion of antitrust agencies from many countries. The largest online travel agency has been targeted by European authorities for being too restrictive in regard to price competition (Davies, 2015). Its behavior made it impossible for other platforms to compete against Booking.com successfully due to the fact that fixed prices would hurt hotels that use multiple OTAs with varied rates. Moreover, the website produces more favorable results in terms of scoring for hotels that choose to adhere to its strict rules about pricing. Figure 1 shows that it is visible from the evidence by Mellina et al. that the Booking.com scoring system leads to inflated scores due to its unorthodox scale.

It is essential to understand what rate parity implies for both hotels and customers before drawing conclusions regarding its effect on them. Oskam and Zandberg (2016, p. 270) state that “price parity constitutes an important cornerstone of the business model of OTAs, as it prevents hotels from regaining market share through rate discounts.” While its origin holds valid concerns regarding the fairness in relationships between booking platforms and hotel companies, the disproportionate growth of customers who use OTAs and travelers who do not put hotels at a disadvantage. Its current form brings into question the primary role of OTAs in the hotel industry and has a significant impact on the prices.

First of all, its effect on customer experience can be perceived as a positive one. Travelers are able to find the best possible price without having to look through the multitude of platforms to determine which one to use. Moreover, the fact that hotels rely heavily on OTAs implies a higher validity of reviews. However, since the prices are fixed while rates that OTAs charge from hotels vary significantly, hotel owners have to adapt their prices in accordance with these expenses. Therefore, the lowest price on the market becomes higher than it could be without rate parity in place.

Rate parity can be perceived as a tool for OTAs to monopolize the industry. Nicolau and Sharma (2018, p. 523) state that “some hotel managers might view it as a fair revenue management tool that benefits the customer and a device to handle complex online distribution systems.” Despite this fact, many hotel owners express their concerns that these systems can restrict their ability to set the prices as they deem appropriate (Nicolau and Sharma, 2018, p. 523). It is difficult for hotel companies to perform well without the reliance on OTAs whose influence on the market continues to grow with each year (Oskam and Zandberg, 2016, p. 275). Therefore, from hotel owners’ point of view, rate parity is a way for OTAs to ensure that hotels are using them as a primary source of customers.

The trend is being picked up by many countries outside of the European Union. Many countries picked up on the toxic relationship between hotels and OTAs, and antitrust watchdogs started to examine some of the largest accommodation platforms on the subject of creating barriers to entry (Panichi, 2020). Panichi (2020) states that “Asian regulators now view price-parity clauses as having the potential to harm competition in the hotel industry.” According to Panichi (2020), it is necessary to make platforms to be unable “to require that hotels and other lodging operators always offer a specific platform the best room prices and conditions.” It is expected that including price-parity clauses will be forbidden to incentivize market-controlled price generation.

As the initial concerns were raised several years ago, it is now possible to observe the effects of this strategy on the market. Oskam and Zandberg (2016, p. 272) state that “it was expected that the suppression of price parity would help the hotel recover market share that had previously been lost to OTAs.” However, these expectations did not change the market in a way favorable for customers, as the market concentration only went up (Oskam and Zandberg, 2016, p. 272). Rising concerns regarding the necessity of a more thorough intervention by the antitrust authorities imply that the current limitations are insufficient.

The future of hotel distribution channels is still under the threat of being completely dominated by a small number of large platforms. According to the analysts, the trends and potential developments of this situation without the intervention by authorities lead to an overwhelming power in the hands of OTAs (Oskam and Zandberg, 2016, p. 273). Hotels will be forced to accept their prices, which will lead to a decline in the quality and quantity of available booking locations. The majority of antitrust agencies in both Western and Eastern countries came to the conclusion that online platforms have to drop the practice of adding rate parity clauses in their contracts with hotels (Panichi, 2020).

In conclusion, the removal of the limitations that Booking.com placed upon the pricing strategy of hotels was harmful to the industry and needed to be removed. However, as the author of the article suggests, it is not enough to incentivize true competition among online travel agents. Moreover, it can lead to additional expenditures by hotel owners who want to advertise their services on multiple OTAs outside of the most popular ones.

Due to the restriction on pricing strategies outside of Booking.com, the hotels’ ability to control their revenue was significantly impaired, and the agreement between the largest OTA and the countries’ authorities was essential. Rate parity is a complicated issue that has a lasting adverse effect on both the prices of hotel rooms and the revenue of hotels across the globe. Sharma and Nicolau (2019, p. 429) state that there are “significant increases in the market value of hotels stemming from shareholder optimism brought about by the aforementioned rate parity bans in Europe.” There is a drastic need for additional restrictions aimed toward affecting the OTA’s ability to control hotels’ pricing strategies, sense it puts both botels and their customers at a disadvantage.

Reference List

Davies, P. (2015) Three countries agree on hotel pricing deal with Booking.com but critics say it doesn’t go far enough. TravelWeekly. Web.

Mellinas, J. P., María-Dolores, S. M., and García, J. J. (2016) ‘Effects of the Booking.com scoring system’, Tourism Management, 57, pp. 80-83. Web.

Nicolau, J. L., and Sharma, A. (2018) ‘To ban or not to ban rate parity, that is the question… or not?’ International Journal of Hospitality Management, 77, pp. 523-527. Web.

Oskam, J., and Zandberg, T. (2016) ‘Who will sell your rooms? Hotel distribution scenarios’, Journal of Vacation Marketing, 22(3), pp. 265-278. Web.

Panichi, J. (2020) Booking.com, Expedia’s Asian woes may thrust parity-clauses back onto the global stage. MLex Market Insight. Web.

Sharma, A., and Nicolau, J. L. (2019) ‘Hotels to OTAs: “Hands off my rates!” the economic consequences of the rate parity legislative actions in Europe and the US, Tourism Management, 75, pp. 427-434. Web.