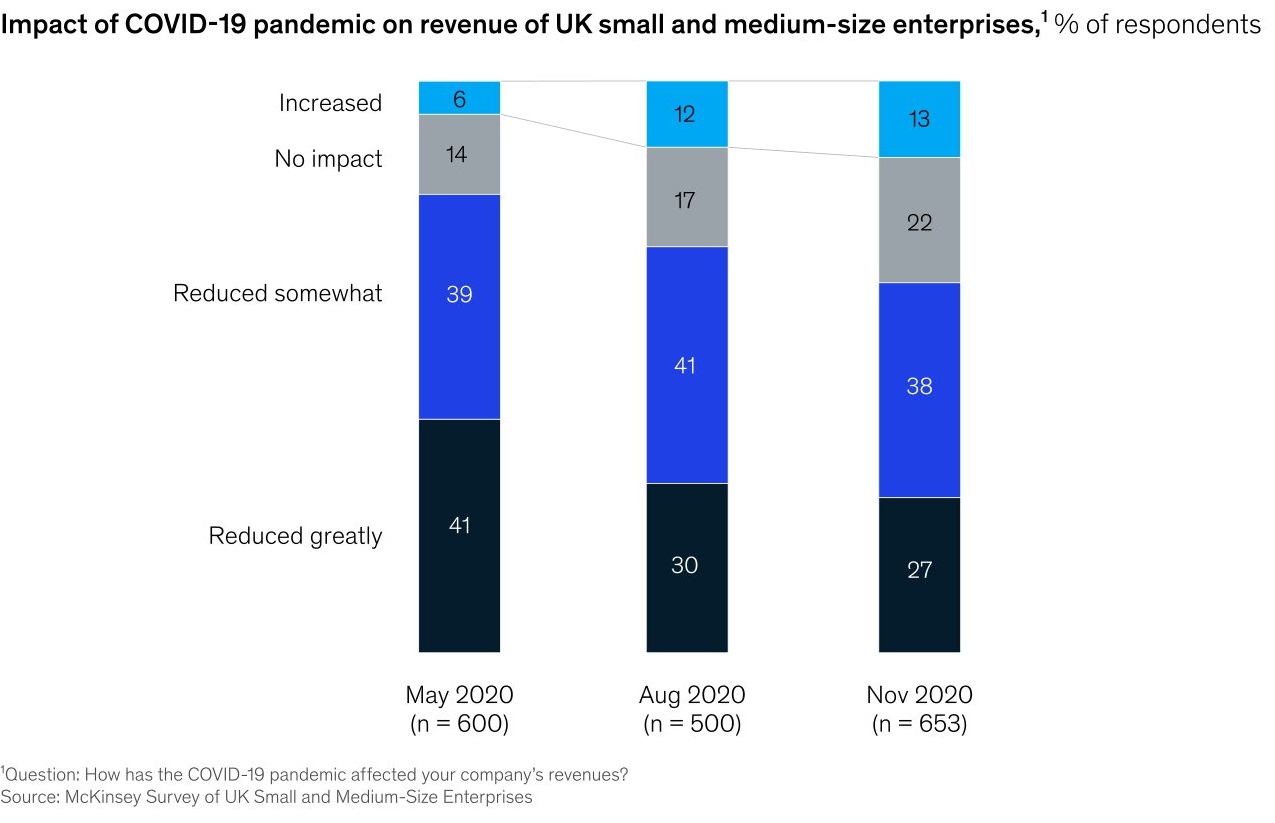

It is possible to outline several consequences of the COVID-19 on small enterprises and their owners. First, it is necessary to focus on such relevant indicators of business sector deterioration as revenue rates. As it is shown in Figure 1, there was a significant reduction in this rate, according to the survey conducted.

It is possible to notice that in May 2020, 80% of respondents said that their companies’ revenues reduced because of the COVID-19 crisis. Over time, the situation increased slightly, as, in August, 12% of respondents replied that they had noticed the positive dynamics. Simultaneously, in this month, 71% of respondents said that they experienced a reduction in revenues, and the next month this rate dropped to 65%, which is still the negative tendency overall.

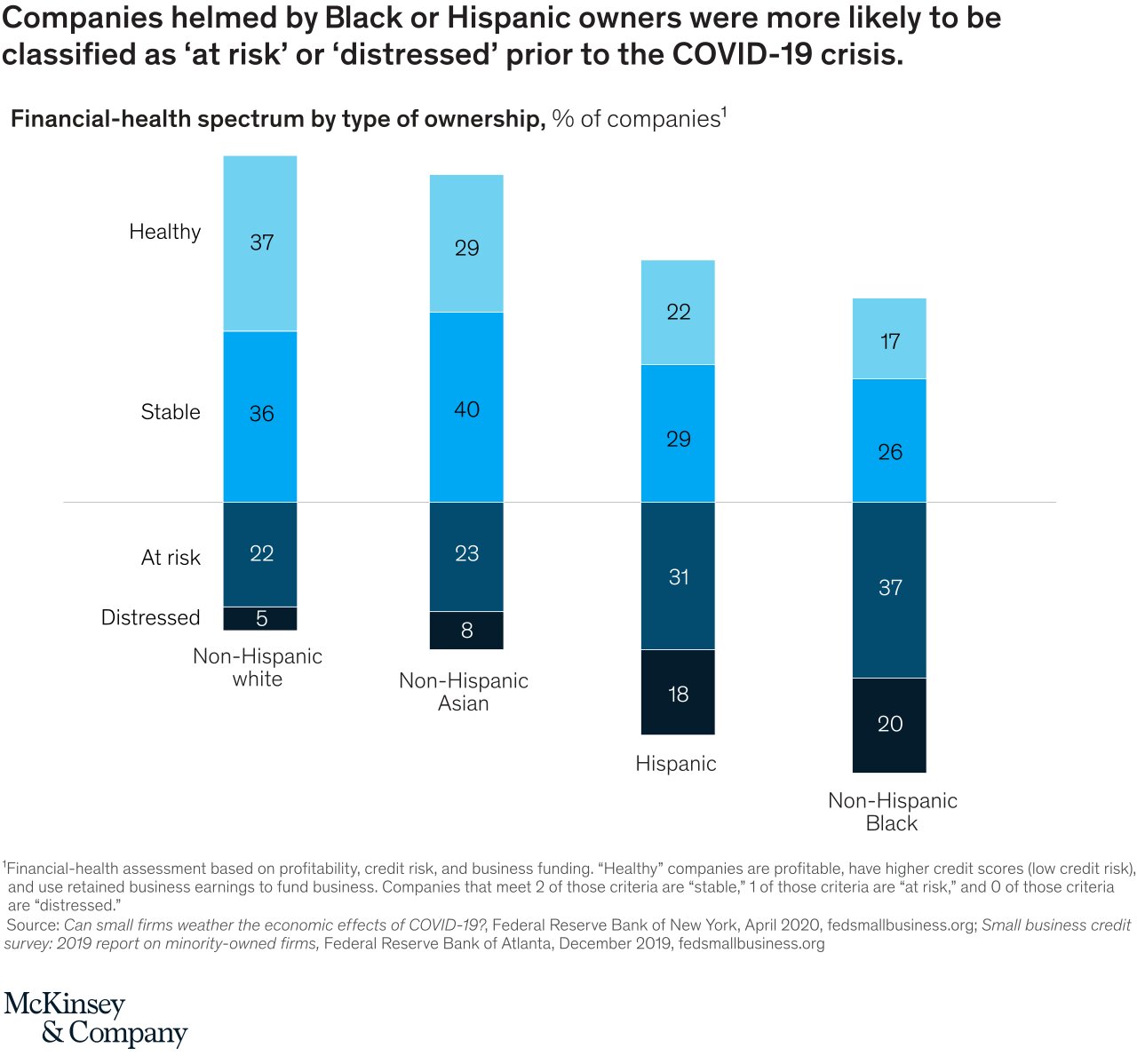

Secondly, it is possible to notice that companies run by Black or Hispanic owners tend to be classified as “at risk” or “distressed” because of the COVID-19 crisis. The tendency is vital as it represents both the general situation raised and the particular tendency based on the type of ownership. Figure 2 shows that 27 % of companies run by Non-Hispanic white are “at risk” or “distressed,” which is a significant and negative rate, while among companies with Hispanic and Non-Hispanic Black owners, 49% and 57% respectively are in danger.

It is also possible to show to what extend small businesses run by Black and Hispanic owners were affected by the crisis. The respondents of the survey claim that in 2019, 40% and 51,2% of businesses respectively were profitable. Currently, only 26,5% and 29,2% of respondents say that they have a profitable business. This evidence shows the significant reduction in successful enterprises and reveals the deteriorating effect COVID-19 caused.

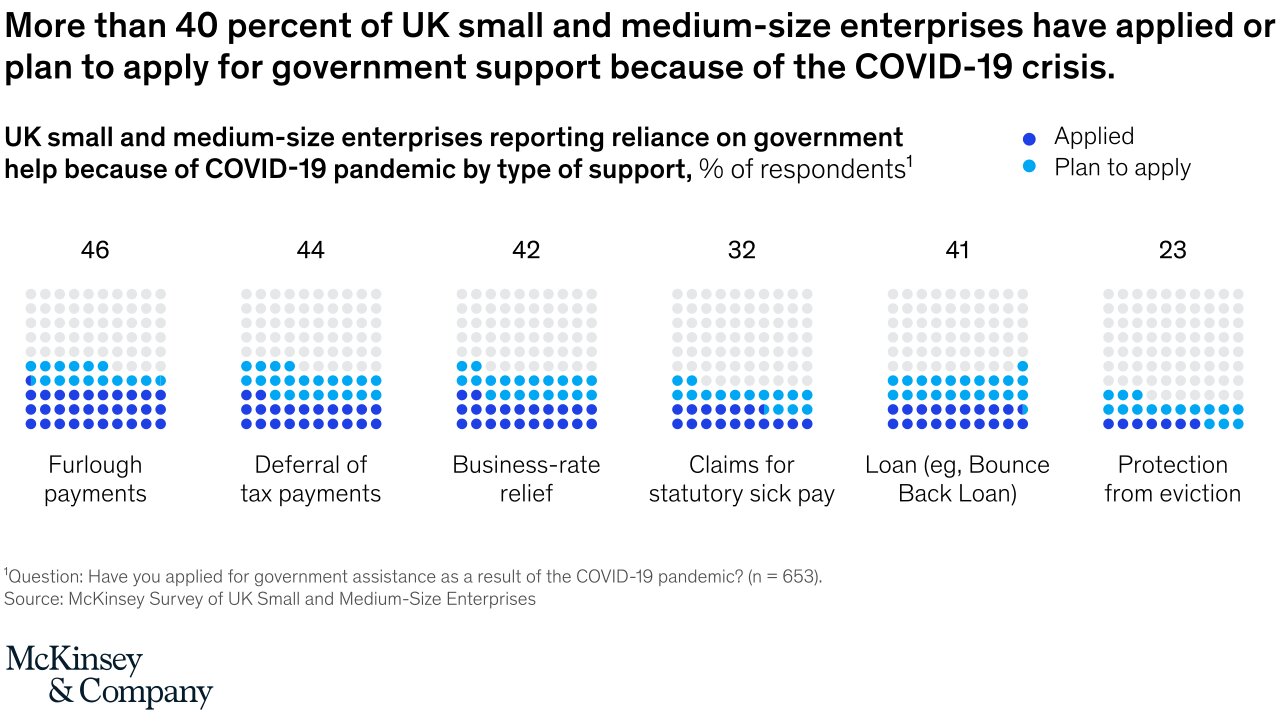

The next vital rate is the number of enterprises, which have applied or plan to apply for government support, as it represents the number of vulnerable to COVID-19 virus companies. From Figure 3, it is possible to notice that 46 percent of enterprises expect to obtain Furlough payments. The other types of support companies plan to receive are deferral of tax payments, business-rate relief, claims for statuary sick pay, loan (e.g., Bounce Back Loan), and Protection from eviction. The rates are 44%, 42%, 32%, 41%, and 23% respectively. It implies that a significant part of small businesses is in need of support to endure the crisis.

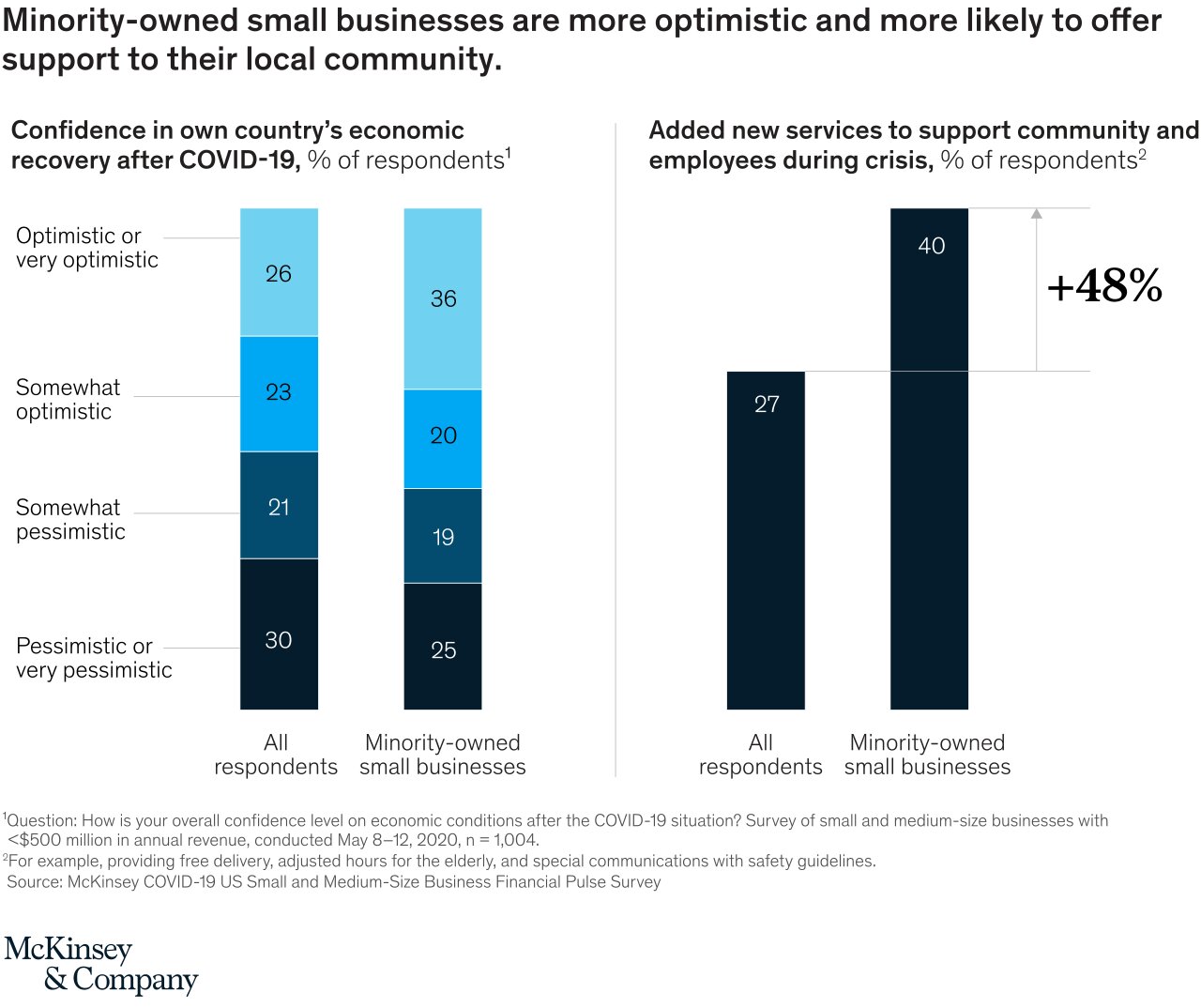

Then, it is possible to research the level of small business owners’ confidence in recovering and to track the extent to which they tend to establish new services during the COVID-19 crisis. These rates are essential, as they represent the situation in the business sector in general. From Figure 4, it can be noticed that 30% of the survey respondents are pessimistic regarding the future of their businesses, while the same rate is slightly better for minority-owned small businesses and amounts to 25%.

Finally, the attention to the new services level of adding should be paid as it represents the positive side of the COVID-19 crisis, as the force, which may provoke beneficial changes. Figure 4 shows that 27% of business owners among the poll of more than 1000 businesses have added new services to support the community and their employees. The same rate for minority-owned enterprises is higher and is equal to 40%.

References

www.mckinsey.com