Proposal

This proposal looks at the related problems of lack of internal control function in Tamweel Islamic Finance which was founded in 2004 in a partnership between Istithmar controlling 22 % and Dubai Islamic Bank controlling 20% of total free float. Specifically, the proposal dwell on the human resources problems specifically in the auditing segment experienced at Tamweel Islamic Finance Company.

Scope

In this project, I will be discussing a problem in a company in a defined industry. I will provide a proposal in which I will argue about the problem. Afterwards, I will be presenting researches on the effect of that problem on the company and ways on how to solve the problem. Finally, I will be presenting the outcome of my research and will include ways on how to overcome this problem, argue it, and try to solve it. The scope will resonate on problems experience in the audit control and organization challenges experience in this finance institution. Specifically, the scope dwells on the problems as a result of failure and weaknesses in the internal control science.

Company Introduction

Background

Tamweel Company was introduced in 2004 and has grown to be the largest in Abu Dhabi real estate industry. It is a government owned real estate firm. It is located in Middle East. Currently, the institution has financed property worth over AED 10 billion. The Tamweel offers services especially in the real estate industry. It is one of the most active financiers of real estate development in U.A.E.

Specifically, Tamweel Company specializes in financing investment projects following the Islamic Sheria. Among the finance models it adopts include the Ijara. Ijara is a contractual agreement in which Tamweel purchases an asset from the owner for a defined amount as demanded by the client. Later, this property is rented to the same client on a periodic lease agreement. On the other hand, Murabaha is another finance model practiced by the company. In this model, the company enters into a contract with a client following a mutual agreement based on the promise made by the client to honor the pledge.

In addition, the Istisna’a finance model operates on an agreement with the client in which the company erects a premise in line with the particulars defined in the requirement blue print which automatically becomes valuable upon completion s per the set deadline. Besides financing property development, the company deals in brokerage among other activities. The company also participates in staff assistance programs that are aimed at instilling moral suasion in business. It serves as a subsidiary of Dubai Islamic Bank. The company has four branches across the United Arabs Emirate. Currently, Tamweel only control forty percent of ownership which is opened to foreign trade. As part of its policy, this institution specializes in customer based vis-à-vis in line with the Islamic Sheria provisions.

Vision

“To become the most admired leader in the financial industry regionally”

Mission

“To maximize shareholders value and become the first choice fiancé provider through securing home base, product and service differentiation and regional expansion”

Core Values

“Caring professionalism, reliability, teamwork, preserving confidentiality, and inclusively Islamic”

Financial performance

The Group is engaged in the business of property leasing and trading in accordance with Islamic Sharia’a. It is important to also point out that the financial statements are also prepared in accordance with Sharia’a. Total operating income for the institution was AED 646 million in 2010. In 2011 it went down to AED 601 million. The financial performance for the 12 months ended December 31, 2011 shows that the institution made a net profit of AED 102 million. This is a 242.3% increase compared to AED 26 million net profits earned in 2010. Also, net profit reported in the fourth quarter of 2011 amounted to AED 31 million. This was up by 287.5% (AED 23 million) reported in 2010. Basic earnings per share were AED 0.03 per share in 2010 and AED 0.10 per share in 2011. Total assets for Group was AED 10.2 billion in 2010 down to AED 10.0 billion in 2011. The robust financial performance of the Group was as a result of turning Tamweel into a subsidiary of Dubai Islamic Bank. Dubai Islamic Bank holds 58.2459% of the shares while the general public holds the remaining number of shares which amounts to 41.7541%.

The table below shows the performance of this company in 2007:

Union Property market Ratio

Union Properties

Notably, the revenues for this firm increased in 2006 financial year up from $381m experienced in 2005 to $688m. Besides, Net income also experienced upward trend from $159m to $167m. However, the aim of pursuing geographical expansion has been experiencing a series of financial constraints since over reliance on the already congested Dubai market has put the company on the verge of collapse. Despite series of development plans in place for expansion, it is apparent that the outcome is worrying! Therefore, this necessitates inquiry into the structural organization and efficiency especially in the Audit section which function to spur growth through reviewing decision science and viability before implementation.

Products

As mentioned earlier, the company trades in real estate financing. Currently, the company offers five key products. These are home finance plus, home finance takeover program, BAITI-National home finance program, home refinance program and non- residents program. These programs are run concurrently though each is independent of the other. The products offered by this financial institution are distributed across the major region of United Arabs Emirate. Specifically, the institution major on financing real estate projects for short term, midterm, and long term.

People

The board of directors is made up of seven members. It is chaired by Abdulla Ali AlHamli. Five people make up the management team. The acting chief executive officer is Varun Sood. Other members of management are the Chief Business Development officer, Chief financial Officer, Chief Operating Officer, and Chief Risk Officer. Besides, the institution has several specialists in the fields of accounting, actuarial science, finance, and economics among others. These employees work under the departments of development, finance, operations, and risks. The audit chapter is found within the finance department.

Internal Control in Financial Companies

Fraud is very common in financial companies all over the world UAE companies included, even in the best of financial times fraud due to lack of internal control in companies is still reported, but, this problem grows substantially in times of financial recession (Ford 34). For diverse reasons financial companies like Tamweel often have weaker internal controls than other industries, this is alarming because the best financial companies like Tamweel are at great risk, they might lose up to or greater than 5% of their annual income to fraud. Due to fraud, companies in the United Arabs Emirate have lost large sums of money due to misappropriation, lack of accountability, and inadequate support systems that monitor progress and use of company resources. But, fraud is not the only reason for financial companies to adopt strict formal internal controls. Internal control assist in making transactions and business processes more efficient, and it improves accounting functions (Ford 144). Reflectively, an efficient and systematic accounting system acts as a shield against misappropriation and monitors the same.

In the financial industry internal control is necessary due to the diversity of financial services offered by the companies, as already discussed in the background to Tamweel, this company offers over 15 different services, the services are also scattered in various construction sites, real estate development sites, property and rental housing locations. This diversity makes bookkeeping vulnerable in this company due to lack of sufficiently enough personnel to handle every particular hitch in bookkeeping. The vast number of customers served by this company is also a need for internal control and finally, the fact that committees in charge of the internal control does not act in a swift manner to deal with fraud and other internal vices immediately, correcting and identification of negative issues concerning internal control tend to be a great challenge to financial companies (Ford 65). In an efficient control matrix, these aspects must operate simultaneously within the set guidelines that determine and create a scheme for control. Unfortunately, the above scenario has not been the case.

Lack of Internal Control in Tamweel P.J.S.C

Bloomberg business week (2009) describes Tamweel P.J.S.C. as a company with unlimited financial operations, and this makes it prone to suffering from lack of internal control (Bloomberg business week 21). There have been a couple claims of lack of internal control in this Saudi Financial hub. Khan (2008) wrote an article titled “No slowdown in corruption fights” (Khan 2), in which he hinted about lack of internal control in Tamweel. Ford (2007) notably, emphasized that even though there is a steady growth in Dubai’s business and financial companies, Tamweel P.J.S.C. face a struggle with several internal corruptions suggesting lack of internal control. The magnitude of corruption is worrying and beyond negligence. Specifically, this suggests that the company has weak or unreliable internal control models or systems. Tamweel being one of the financial companies mentioned in this article.

The irony in the fight against lack of internal control in U.A.E comes with the fact that The Dubai Financial Authority (DFA) has no responsibility for any financial organization/company that fails or is not able to maintain its internal control (Ford 48). In response to the earlier sentiments by the whistle blowers, Tamweel in 2009 outlined what they described as an effective risk management structure; this was reflected in Tamweel’s 2009 financial report. This report gives the responsibility of maintaining internal control, to an effective internal control system that is managed by The Audit and Risk Management (ARM) Committee. The success or failure of Tamweel’s ARM Committee can only be evaluated through a well structured research and this is the essence of this research.

Research Problem

Problem Statement

Internal Audit function is of essence in a financial institution. In many jurisdictions, it is mandatory to have independent internal audit functions in financial institutions. Many people consider internal audit as the overseer of an institution operations. This is because they report directly to Board Audit Committee. The Audit committee is expected to offer adequate support to internal audit to ensure that internal controls are adhered to. Unfortunately, there are scenarios were the internal audit department is not efficient and therefore fail to take up key control issues in time. Also, the department may get compromised and collude with management of an institution to commit fraud. This trend may go on for a long while for as long as the board is not efficient. Therefore, it is important to have an effective board audit committee to review internal audit department on a quarterly basis.

Further, the board of directors may engage external bodies such as external auditors or government regulators to review activities of internal audit and the quality of their work. In addition, these managers are attuned to events and people surrounding them and appreciate the essence of analyzing forecasted turbulent turns and twists within the organization. Unfortunately, artistry approach is neither quantifiable nor precise since it only interprets experience on basis of components that can be appreciated, understood, and felt simultaneously. Generally, the art of internal control is intrinsic of ambiguity, subtlety, and emotion. On the other hand, a well structured institution consisting of an expertise mandated with the responsibility of systematic knowledge gathering from which testable and definite condensed results are achievable. Tamweel lack these and is prone to manipulation by employees.

Justification of the Research Proposal

Background and Significance

Internal control is a systematic measure that is instituted by an organization in order to maintain efficient and cost effective operation matrix. Further, internal controls aid in safeguarding assets and resources of an entity, helps in deterring and detecting errors, fraud and theft, ensure accuracy and completeness of its accounting data. Also, they produce reliable and timely financial and management information and ensure adherence to its policies and plans. Therefore, it is important that to have effective internal controls within an organization to ensure efficiency. Besides, it is important for an institution to also have effective risk management. Ultimately, the responsibility and accountability for the Group’s risk management rests with the Board of Directors. Management of risk is driven from the top down by those charged with the whole responsibility of managing the risks. Currently, the actual status of internal control in Tamweel is not certain; this is due to lack of latest published financial audit and statements, there is no properly formulated and carried out research on the internal control of this company and finally there are various literature that suggest lack of internal control in this company.

Since the literature are speculative, implying that they lack the backing of a conducted scientific research, aiming at establishing the lack of internal control, estimating its extent and finally, suggesting the preferred solution to the negative outcome, the lack of internal control in Tamweel still is a big set back to its public relation and financial performance. Therefore, the research problem questions is, what factors or occurrences are responsible for the weak audition control system in Tamweel finance institution ? Are these problems quantifiable? What is an alternative model to address these challenges?

Objective Aim

The objective of this study is to provide sufficient information to the management of Tamweel Finance institution of the real management problems that have facilitated occurrence of lose management blamed for the challenges in the finance company. This objective substantiates differences between management, employee behavior, and professionalism in monitoring control system. Thus, the management may find this information vital in improving monitoring and audit systems, investor’s confidence, and inclusive structuring as the market may demand. The procedure can be applied to other branches across the region of U.A.E.

The findings may be necessary in creating satisfactory management practices and policies at micro and macro levels. Besides, the objective is to obtain information that the management team may use to formulate an inclusive behavior control and monitoring techniques expected of the employees. On the other hand, the management team might find this information necessary in creating future structures that can boost performance of auditing modules. In addition, the study may present a stable and relevant base for understanding poor managerial structure in organizations n the process of giving an expansion into existing literature review on the same.

In summary, the aims and objectives of this research paper are:

- To gauge and quantify the reasons for the occurrence of internal problems associate with failure in the audit department of Tamweel finance institution.

- To identify the management weaknesses that exist within the hierarchy of authority and management faculty at Tamweel finance institution.

- To identify the effects of these internal problems on the finance, human resources, and social aspects of Tamweel financial institution.

Statement of Research Questions

- To what extent, if any, does employee satisfaction and motivation contribute to fraud and misappropriation in branches of Tamweel?

- To what extent, if any, does lack of internal control affect performance of Tamweel institution?

- To what extent, if any is there a relationship between the internal management and misappropriation especially on the facets of auditing unit?

- To what extent, if any, does the quality of management practices differ from those of the neighboring companies dealing with the same products?

- To what extent, if any, does management models allow for easy manipulation of company accounts?

Hypotheses

Below are the null and alternative hypothesis based on the research problem.

- H1o. There is no link in management efficiency and fraud at Tamweel finance institution

- H1a. There is a link in management efficiency and fraud at Tamweel finance institution

- H2o. There is no link between the level of employee satisfaction and corruption in Tamweel financial institution

- H2a. There is a link between the level of employee satisfaction and corruption in Tamweel financial institution

- H3o. There is no link between management structures operating in Tamweel and the ease of misappropriation of company resources

- H3a. There is a link between management structures operating in Tamweel and the ease of misappropriation of company resources

- H4o. There is no link between the quality of management practices at Tamweel and chances of internal fraud

- H4a. There is a link between the quality of management practices at Tamweel and chances of internal fraud

- H5o. There is no relationship between performance of audit monitoring instruments and fraud in Tamweel

- H5a. There is a relationship between performance of audit monitoring instruments and fraud in Tamweel

Literature Review

Creswell (1994) asserts that research methodology revolves on a quantifiable relationship existing between structural orientation of an organization and performance indicators within the desirable limits (Creswell 26). Further, Creswell (1994) opine that proper placement of monitoring systems such as an efficient audit procedure may be the solution to financial misappropriation and fraud in big organizations (Creswell 24). In addition, Creswell (1994) conclude that the essence of maintaining an efficient and streamlined management structure is to provide a predictable and easy to monitor system that minimize case of fraud while at the same time improve on efficiency (Creswell 41).

According to Biswas (2011), companies that have strong structural systems are the least affected by fraud since every activity and channel is easy to monitor at minimal cost. Specifically, the auditing unit of such institutions is objective and engaged in keeping the brand of audit periodically and balancing (Biswas 56). In relation to Tamweel, the company has experience series of financial swings which made the company withdraw from stock market trade in 2006. Besides, performance has been unpredictable despite being an established entity with four branches across UAE.

PEST Analysis

In order to understand the underlying aspects associated with the problem statement in this research proposal, it is of essence to reflect on important aspects such as political, social, environmental, and other aspects that directly influence the current trend in performance and company structure flexibility. Specifically, this part reflects on the aspect of social factors and cost balancing that has direct impact at micro and macro levels of company performance. In order to understand the instability as a result of environmental uncertainty, the proposal presents a check list of cataloguing framework that regulates and manages diversity associated with political, social, economic, and technological spheres.

Specifically, the proposal dwells on the results on the periphery of merits and demerits of these aspects and how they are associated with lack of internal control in Tamweel Company. The company has evolved from offering simple financial services to technologically advanced products which are very complex and detailed and have been tailored to the customer’s specification. For instance, their well organized unique packaging and distribution network has made the company a house hold name in the global business arena (Kothari 76). Detailed appraisal of cultural, economical, and demographic inclination of Tamweel Company clearly indicate that its market is fast growing with a substantial population who actively are users of their products. This forms the basis for feasible investment position. With an already existing marketing structure, though currently dysfunctional, Tamweel should apply cauterization of management control and audit consciousness because the most of its employees are Muslims controlled by the Sheria laws.

The challenges that Tamweel Company faces in the fresh re-entry bid include limited political, cultural, social freedoms encircled in a religious parameter and its Sheria laws based business platform. This arrangement concentrates on the moral aspects of doing business and controlled profit maximization. Therefore, some employees are likely to take advantage of the loosely functioning monitoring structure to carry of fraud and other under dealings. Besides, there are legal restrictions and poor infrastructure challenges which are encountered. For instance, the law protects employees even when accused of fraud as long as the legal system has not given a verdict. These restrictions make investigations and prosecution expensive in terms of finance involved and time. However, the legal avenues for prosecution available outweigh the challenges.

Putting into consideration of the external and internal dynamics, Tamweel Company should create a flexibly, self regulation and consistent monitoring structure in order to reduce loses as a result of inconsistency in decision science and misappropriation of company resources. Also, this strategy will facilitate the restructuring effective employee awareness to develop structure knowledge and respect for law and order. If well merged with appropriate management mix, the strategy will secure a continuous quantitative increase of market by constantly maintaining relatively fare prices of the products it’s offering as well as the maintenance of up to per competition levels from other agricultural competitors as employees will internalize moral suasion and respect the evaluation structure (Khan 34).

In order to enhance the achievement of the same, the company needs to introduce different auditing policies which in return will attract various types of control management thus creating consistency and fear among employees who might be tempted to fraud it. Consequently, managers will be required to maintain the monitoring and success of the evaluation procedures and endeavors of the company. In line with the management principles, this recommends the proper scrutiny of various factors creating a direct or indirect impact on the economic trends and changes of the economy of UAE. The products of Tamweel need to be integrated into the achievement of various organizational goals through the distribution processes to ensure that the products reach all designated customers without fraud (Khan 12).

SWOT Analysis

Also known as TOWS analysis, this analytical tool presents potential organizational opportunities and advantages attached to the same in an evaluation facets of weaknesses and strength in the measurement scale. In order to understand the position of Tamweel Company on the facets of organizational weaknesses and strengths, this proposal reflects on threats and environmental opportunities as a strategic tool for management analysis. The proposal identifies threats, strengths, opportunities and weaknesses of Tamweel Company especially on the basis of management structure.

Strengths

Tamweel Company has public awareness programs through advertising a range of financial products and frequently diversifying some of the products from its new customers that have worn out. The success of this marketing initiate is as a result of constant evaluation criteria of the effectiveness of its marketing strategies by the quantity in terms of figures of customers in UAE consumption market. As mentioned earlier, the company trades in real estate financing. Currently, the company offers five key products (Kothari 76). These are home finance plus, home finance takeover program, BAITI-National home finance program, home refinance program and non- residents program. These programs are run concurrently though each is independent of the other. The products offered by this financial institution are distributed across the major region of United Arabs Emirate. Specifically, the institution major on financing real estate projects for short term, midterm, and long term. Currently, the company has no major competitor and controls the major share of housing finance market. The company has successfully financial strategies and qualified management team consist of experts in financial services.

Weaknesses

Tamweel have weak internal controls putting the company at great risk. At present, the company loses up to or greater than 5% of their annual income to fraud. Due to fraud, the company has lost large sums of money due to misappropriation, lack of accountability, and inadequate support systems that monitor progress and use of company resources.

Opportunities

The company offers the best tailored products that suit the expanding market of UAE. Besides, its flexibility and diversity is a common ground for minimizing risks involved in doing business. At present, the demand for competitive financial services has been increasing steadily (Khan 32). Fortunately, the company is co-owned by Dubai Islamic Bank which controls 58% of its shares. Therefore, the company is in a better position to expand due to its strong liquidity and easy accessibility of loans from the partner bank. Notwithstanding, diversification of the economy has led to the definition of the inter dependence of sector components of the economy that translate to the realization of a restricted business operation. Besides, the finance departments operating in UAE, foreign trade plays a great role in the market operations. Further, this interaction has a direct impact on the economic currency value of the country. Fortunately, the company has strong expansion ability that can be exploited to reap maximum benefits from this scenario.

The penetration strategy should be that which causes minimum disturbances to the company both in terms of financial resource and the daily organizational activities of the company. Potential target markets have been established in a number of ways and means. The two general ways of differentiating and segmenting the UAE market would be through using the basic consumer based market segmentation procedures and the enterprises’ opinion of the same. For consumer based segmentation technique, the company will be involved in the evaluation of the different groups in the given market and their specific and respective consumption needs. To a great extent this particular criterion lays strategic regards to the issue of the consumer involvement in the designing of the product (Kothari 76). Fortunately, the company already has an established penetration strategy which is applicable in the macro and micro market segmentation.

Threats

A comprehensive analysis of the financial performance for the 12 months ended December 31, 2011 shows that the institution made a net profit of AED 102 million. This is a 242.3% increase compared to AED 26 million net profits earned in 2010. This is in consideration of all the global economic hardships that had hit businesses all over. It is undeniable that the investment costs will be high and this may in turn be felt on the calculations of the final profit. However, this could be in the short term (Kothari 66). With an overtime focusing, this trend might capsize in the years subsequent to the second and third years of business in UAE. Factually, this is a large market share that may trigger profitability. Similarly, due to the expansion and development of the market share, there might be other potential buyers who may seek to make their material purchases through the company directly. However, the aim of pursuing geographical expansion has been experiencing a series of financial constraints since over reliance on the already congested Dubai market has put the company on the verge of collapse. Despite series of development plans in place for expansion, it is apparent that the outcome is worrying!

Research Methodology

This term refers to a comprehensive yet systematic method of collecting, grouping, and analyzing raw data into scientific reasoning data. In the process, the result combines purpose of the research and actual, outcome (Babbie 57).Research methodology includes qualitative, quantitative, and mixed methods which are used either independently or simultaneously in experiments, surveys, studies, cross sectional and descriptive research. According to Kothari (2004), research design resonates on the facets of research project blue print that comprises of study operations to create an efficient outcome that yield the desired information at minimal cost (Kothari 76). In order to achieve the desired outcome, a quality research should assimilate systematic investigation characterized by phenomenon approach of a scenario through statistical, mathematical, and computational modus operandi (Kothari 56).

This study will use a systematic quantitative research method in collecting data. Reflectively, Non-experimental quantitative research design determines existing or perceived relationship between dependent and independent variables of any given study population (Mugenda and Mugenda 12). In collective quantitative data, survey instruments will be employed across the study. The study opts for Quantitative data collection method since it is economical on time, finance, and energy unlike qualitative method which may not be economical especially when the sample size is put into picture. However, this method limits natural expression of ideas and attitude towards the study and objective especially in responding to questions asked or reflecting on a secondary thought.

Target Population and Sample Size

The population targeted by this study includes top management team at Tamweel finance institution. Specifically, the study target managers in the finance and control departments where fraud and case of corruption are rampant. By definition, a study population is a cluster of persons or items who share common goals or aspect the study is attempting to prove. In other words, a population is the subject of inquiry in order to draw inferences form previous assumptions. Specifically, Tamweel finance institution comprises of three major departments, that is, finance, human resources, and control or operations. In order to create unbiased outcome, purposive sampling as a method of data collection is adopted since it is easy to use and gives room for selection of specific desired characteristic or event for a predetermined objective.

The research assumes that top management has the desired information since they are the engine which make decisions and participate directly in management of every aspect of the organization. Besides, the research assumes that these top managers are well equipped with professional skills and understanding of the operation models that directly impact performance of a company. Therefore, the sample size consists of five senior managers, twelve assistant managers and eighteen junior managers for every branch. The total population of this study will include four branches. Therefore, the total number of the sample population is 140. In data collection, the research will use close ended questionnaires from low management level, middle management level, to top-level management regime. To generate the sample size for this study population, the research will adopt the formulae created in 1972.

Sampling Formula

n=N/ (1+N (e2))

Where:

- n = sample size

- N= Target population

- e= Degree of freedom

- n=140/ (1+140*0.052))

- n=140/1.35

- n= 103.7037

The target population is 140 management staffs in four Tamweel branches spread across the regions of United Arabs Emirate. From this population, random sampling will be applied to 20 top managers in the three ranks of management and questionnaires with close ended questions given to each (Babbie, 2002). The procedure will be applied for mid level managers and low level managers in the firm.

Data Sources and Rights of the Participants

Primary data will be used in addressing each research question. According to Crewell (1994), primary data collection method includes use of observation, questionnaires (both close ended and open ended), interviews, and focus discussion groups (Crewell 34). Specifically, this research study employs close ended questionnaires. According to Mugenda and Mugenda (2003), questionnaires used in data collection can both be open ended and close ended depending on the nature of data and population of interest (Mugenda and Mugenda 17).

In this study, close ended questionnaires are used as the only means of data collection. This is because close ended questionnaires are easy to track since the respondent is directed to state specific answers to specific questions generated from the objectives and hypothesis. The study opts for close ended questionnaire in data collection since it is economical on time, finance, and energy unlike qualitative method which may not be economical especially when the sample size is put into picture. Since questionnaire is an example of quantitative data collection method, analysis would not be complex as other qualitative methods.

Validity and Accuracy

Validity and reliability determines the accuracy of collected data in research. Specifically, this is controlled by the nature of data collection instruments applied by a researcher. By definition, validity refers to the magnitude and level of accuracy the obtained results align towards the pivotal research phenomenon. In order to achieve validity in questions presented in the questionnaire, it is essential to carry out question pre-testing. The process of pre-testing eliminates awkward or offensive questions and eliminates ambiguity since it labors to effect changes where recommended before the actual study (Mugenda and Mugenda 31).

On the other hand, reliability quantifies the magnitude of consistency of research instruments and the outcome created by the same (Crewell 32). Therefore, efficient use of these tools and instruments ensure that reliability and validity of data collection tools are piloted in a process referred to as pre-testing. Thus, a pilot study will be carried out in one branch of Tamweel Company which represents 10 percent of the population of the study. This is necessary as a precaution against using a data collection tool in full research before determining its relevance and efficiency. After the pre-testing procedure, the most appropriate research tool (questionnaires) will be embraced in the study.

Data Collection Procedure

In the collection of data procedure, the research will embrace technology by use of emails and faxes to post questionnaire to top management bracket since reaching them would consume a lot of time. However, the research will adopt a drop and pick module for middle and low level managers who are readily available across the departments. Each respondent will be given a time frame of a week to respond to questions in the questionnaire.

Data Analysis

Appropriate tools for data analysis will be used to analyze and draw inference from data collected. Since the data collected will be of quantitative nature, inferential and descriptive statistical analysis tool will be employed simultaneously. According to Miller (1991), quantitative statistical analysis includes use of standard deviation, frequencies, mean, percentages, and median in inference. The collected quantitative data will be coded and passed through Statistical Package for Social Sciences (SPSS) version seventeen. In the process, cross tabulation will be used to compare and contrast management structures, management styles, employee satisfaction, auditing procedure, and magnitude of fraud for each across the ten branches. In addition, descriptive statistics including percentages, means, frequencies, and standard deviation will be used to describe target population properties. In order to quantify relationship between the independent and dependent variable, ANOVA will be essential besides figures, charts, and tabular representation of correlation analysis.

Legal Issues

Before commencing data collection process, the researcher will have to get permission from the relevant authority at Tamweel finance institution. According to Kerridge, Lowe, and McPhee (2005), ethics control judgment into right and wrong behavior orientation. Besides, ethics governs human welfare and conduction in a continuous process of interaction. This aspect is relevant in research actualization since data collection will involve exchange of information in an interactive forum (Kerridge, Lowe, and Mc Phee 45). Confidentiality and winning trust of the target population determines the success of a research project. Therefore, the study will endeavor to keep the names of research targets as confidential as possible.

Conclusion

Conclusively, this research paper will largely depend on quantitative data collected via use of close-ended questionnaires. After data collection, SPSS and descriptive statistics including percentages, means, frequencies, and standard deviation will be used to describe target population properties. The target population will be contacted through emails, fax, and physical interaction for low-level managers. The study attempts to identify an internal control problem especially in the auditing department and its effects on the magnitude of fraud in Tamweel Finance institution. The study targets a population of 350 management employees of Tamweel Company.

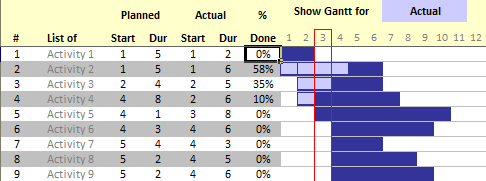

Gantt chart for project period

Weeks

Key

- Activity 1 Proposal Development.

- Activity 2 Literature Review.

- Activity 3 Research on research models.

- Activity 4 Data Collection.

- Activity 5 Data Analysis.

- Activity 6 Generating draft of the research proposal.

- Activity 7 Actual report writing.

- Activity 8 Draft finalization.

- Activity 9 Presentation.

Works Cited

“Thrifts and Mortgage Finance Tamweel P.J.S.C” Bloomberg Business Week (2009): 20-21. Web.

Babbie, Eddie. Survey research methods. 2nd ed. Belmont: Wodsworth, 2002. Print.

Biswas, Soumendu. “Commitment, involvement, and satisfaction as predictors of employee performance.” South Asian Journal of Management, 18.2 (2011): 92-107. Print.

Creswell, John. Research design: Qualitative and quantitative approaches. Thousand Oaks, CA: Sage, 1994. Print.

Ford, Neil. “Saudi banking.” Middle East, 37.6 (2007):48. Print.

Kerridge, Lowe M, and McPhee J. Ethics and law for the health professions.2nd ed. Sydney: The Federation Press, 2005. Print.

Kothari, C R. Research methodology: Methods and techniques. New Delhi: New Age International (P) Limited Publishers, 2004. Print.

Miller, Delbert. Handbook of research design and social measurement. New Park, CA: Sage, 1991. Print.

Mugenda, M and Mugenda G. Research methods: Quantitative and qualitative approaches. Nairobi: Acts Press, 2003. Print.

Khan, Sermad. “No Slowdown in Corruption Fight.” The National: 2008. Web.