Abstract

The users (both internal and external) of financial information are always concerned about the future holding of the firm that what has occurred in the past because the past performance and occurrence are not capable to change the history. Here financial forecasting is a good technique and can be used for planning and budgeting purpose. The forecast offers to the user, to predict or expect an output based on historical performance, data, and facts.

Role of financial forecasting

The success of a firm depends much upon the forecasting function. Especially public limited companies make their budget and plan based on prediction and budgeted expectations. However, here are some roles which forecasting plays:

- A financial forecast says or identifies how much finance (both internal and external) and assets are needed.

- By the financial process and organization can set up its goals and estimate cost.

- A financial forecast helps the firm to find a way how to meet the different needs.

- It points to the interaction among the different elements in the organization.

- Financial forecast helps the company to decide on which finance option will be favorable and which will not.

- Financial forecasting also helps the company to avoid unexpected situations or surprises because it incorporates interest rate and inflation/deflation rate.

Forecasting mainly answers the question of five “WH” questions; these are:

- How many profits will the firm make

- What is the demand level of the product or service

- How much per unit cost for the product and services

- How much many the company need and how much to borrow

- How long the borrowed firm can be used and when it will be repaid

Importance of forecasting in an organization

Financial forecasting is now a vital fact for an organization. Bushman (12 April 2007) has mentioned several importance of forecasts, these are:

- Financial forecasting enables management to change operations at a right time to reap the greatest benefit.

- It says the company what inventories are needed to reach their business targets.

- It is important when a firm goes for launching new products or services.

- Forecasting saves time and money which a company may spend on developing, marketing a product or service which likely to fail.

Forecasting process

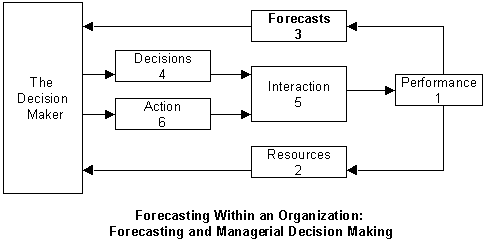

Forecasting is a continuous and integrated process. Forecasting is the continually changeable thing that depends on the impact of the actual performance of measurement and it also is updated and modified when it is needed. Forecasting is not a vanishing point of measurement of performance.

The integrated process is shown in figure:

Financial Planning

Financial planning is like the blood circulation for an organization. It works as a roadmaps and guides control and coordinates the overall actions of an organization. However financial planning is concerned with two main aspects like:

- Cash planning

- Profit planning

Cash planning is concerned with preparing the cash budget whereas profit planning is concerned with preparing a Pro-forma income statement. Cash budget and Pro-forma income statement, both are used for internal financial planning. Generally, a budget is used to implement as a statement of an organization’s preplanned cash inflows and put flows. The budget is also important for the project. The cash is needed for the short term and also pay attention to cash surplus or cash shortage. The study intends to show the pro forma of the income statement that was taken from ST 3-3 from the book Principles of Managerial Finance (Gitman, 2005, p.129).

Requirement

Preparation of Pro-forma income statement and comments:

Comment

The ‘percent-of-sales’ method may underestimate actual ‘2004 pro forma income’ by assuming that all costs are variable. If the firm has fixed costs, which by definition would not increase with increasing sales, the 2004 pro forma income would probably be underestimated.

Conclusion

Around ninety percent of managerial decisions are taken based on forecasts. Every decision taken by the managers comes to operation in course of time that is why the decision should be taken on the forecast of the future situation. Finally, no organization can run properly in the present condition without forecasting, because it is vital in every shape of an organization.

References

Arsham, Hossein. (1994). Time-Critical Decision Making for Business Administration. In Chapter-2. 9th Edition. Web.

Bushman, Melissa. (2007). Why forecasting is important to an organization. Associated Content. Web.

Gitman, J. Lawrence. (2005). Principles of Managerial Finance. 11th edition, Addison Wesley.

All Business, (n.d.). Differences between Common and Preferred Stock. Web.

Bizterms.net. (n.d.). Risk-Adjusted Return on Capital (RAROC). Web.

Center for Private Equity and Entrepreneurship. (n.d.). Private Equity Glossary. The Trustees of Dartmouth collage.

Cooper. N. Richard (November 2005). Living with Global Imbalances: A Contrarian View. Policy Briefs in International Economics. I-10.

Gitman, J. Lawrence. (2005). Principles of Managerial Finance. 11 edi., Addison Wesley.

Harvey, R. Campbell. (2003). Financial Glossary. Web.

Islam. M. N. Sardar., and Watanapalachaikul, Sethapong. (2004). Empirical Finance: Modelling and Analysis of Emerging Financial. Physica-Verlag Heidelberg.

MiMi.hu. (n.d.). Financial institution. Web.

Rose, S. Peter., and Marquis, H. Milton (2006). Money and Capital Markets: Financial Institutions and Instruments in a Global Marketplace. 9th edition. McGraw-Hill Irwin.