Introduction

Different companies, similarly to people, have their own unique culture that is founded on ethnic, regional, temporal and industry-relevant factors. Therefore, when two or more businesses work together or decide to merge, these specific attributes may clash, leading to conflicts and worsened performance outcomes. The process of acquisition has to be planned in detail from the first contact between the companies to their full integration. In most successful cases, firms prepare thoroughly to enter the new relationship by mapping out the process of the merger and trying to predict the potential issues.

However, the importance of the steps following the official merger may be overlooked by managers who fail to account for the fundamental cultural and structural differences between the businesses. In foreign mergers, this lack of attention to the whole strategy may be detrimental to the outcome of the project. This problem is especially evident for cultures that have some opposing views formed under the influence of closed borders and a history of isolation.

Such nations as Japan and South Korea, for example, have been existing and evolving without any international intervention for decades (Shook, 2010). As a result, their business structure and their standards and expectations may be challenging for European and American companies to understand. Here, all steps of the merger, including post-acquisition, can be detrimental to the final outcome.

The central set of case studies under investigation looks at the failures and successes of Renault, General Motors, and DaimlerChrysler in acquiring companies in South Korea and Japan. These companies, while existing in the same industry, did not complete their mergers or alliances with the same conclusions, which points to another factor of impact in the process of acquisition. First, the report will discuss the theoretical underpinnings of cross-cultural integration and its factors in acquisitions and mergers. Then, the cases of Renault, General Motors, and Daimler Chrysler will be investigated to see whether their examples reveal the importance of certain postinclusion activities.

The central hypothesis of this analysis is that the results of these organisations’ managing efforts demonstrate that specific post-acquisition techniques and approaches to cross-cultural management increase the rate of compliance and ensure that the integration is smooth.

Concepts and Theories

First, it is necessary to understand why the field of cross-cultural differences is vital to business interactions. In many situations, it is beneficial for companies to merge. Some businesses are failing to perform on their own, but still possess resources that may be valuable for businesses in the same sphere (Badrtalei and Bates, 2007). Other companies aim to expand to increase their growth and support the rising demand for their services. Overall, joint ventures and alliances happen to raise the value of the merging entities, whether this value is connected to the brands’ presence, technologies and other resources or economies’ scaling (Deloitte, 2009).

Cross-border acquisition and merger can be motivated by these factors as well – companies often want to enter new markets, for which international collaboration is essential (Sarala, 2010). Its unique challenge, however, is that the market the foreign company is entering is completely new to it in many aspects.

Merger and acquisition (M&A) are processes that impact all levels of the organisations, including its top management, other employees, processes, resources and clients. In research, two primary elements of such integration are considered – organisational and human (Dixon, 2005). Both sides of M&A have to be analysed as they oversee the merger in processes and human resources, respectively. First of all, organisational integration is a part of the M&A operations that deal with most of the business-focused activities.

These are production methods, facilities and staff management and others. When measuring the speed of the integration according to organisational principles and needs of merging companies, managers believe that all mergers have to happen quickly to lower the resistance of the workers and streamline the processes without sufficient losses (Dixon, 2005). Arguably, this part of the mergers is the most researched by managers initiating an integration, as it contains the core aim of the M&A processes – the reconfiguration of resources to increase profit. Nonetheless, it is not the only aspect of acquisitions that has to be utilised in planning.

The second part of the M&A is human integration, which is concerned with people affected by an M&A. In this case, various human resource management (HRM) strategies become the centre of all plans (Dixon, 2005). For instance, while organisational integration proposes an aim that the production has to be streamlined, human integration investigates this goal and concludes that management replacements may be necessary to achieve it (Hajro, 2015).

Apart from staff restructuring, this field of M&A also considers the need for changes in companies’ management practices. These may be based on the different approaches to business, partnerships, employee relations, client interactions and much more. HRM is focused on people; thus, its strategies cannot ignore communities and nations’ unique personal characteristics.

A major factor of human integration that determines companies’ essence and impacts all internal and external processes is culture. Culture is a set of practices, values, standards, assumptions and beliefs that each firm develops over time and maintains (Deloitte, 2009). The elements of corporate culture are incorporated into the business’ objectives, mission and vision, employee behaviour and hierarchy. Thus, culture is a complex ideology that brings meaning to each action in a company, being implicitly present in every element. It may be challenging for people inside a cultural environment to recognise its unique features as, to them, each process and idea are inherent and standard (Deloitte, 2009).

The culture is also resilient to change, as it is usually formed over time with the growth and evolution of the business (Dixon, 2005). Arguably, the two presented points – the implicit and resilient nature of culture – are vital for cross-cultural mergers. The ability to recognise cultural influences and use this knowledge to change the status quo in order to combine two different entities together is a process necessary for any merger.

It is also vital to understand what aspects of business culture can influence. First, culture determines the place of the hierarchical structures and decision-making styles in a firm – rigid level and title distinction and flat hierarchies with informal communication as well as clearly defined leadership figures or egalitarian structures (Deloitte, 2009). Second, the preparedness of the management and workers to risk is also determined by culture.

Teamwork and role definition are parts of another aspect – people may focus on individual achievement and internal competition or prioritise a larger collective goal (Froese, 2010). Finally, this description of people’s collaboration also influences how people define success – as something that one achieved alone or people completed together (Hildisch, Froese and Pak, 2015). As one can see, these characteristics can lead to absolutely different values, which reveals the number of cross-cultural issues that may occur during a merger.

Another vital aspect of any corporate culture is its national background. Each country possesses a set of values that it deems the best due to historical reasons. These beliefs are ingrained in business behaviour as well – as a result, companies differ in their core philosophies, depending on the location of their creation and development (Hajro, 2015). Thus, human integration has to include cultural implications in all goals that the merging companies aim to achieve. According to Dikova and Sahib (2013), the current focus on cultural implications is increasing in the research of cross-cultural integration. Moreover, this sociological investigation is now closely tied to the outcomes of business operations.

It is now widely recognised that different philosophies and values of employees and businesses can determine the success of an M&A. For instance, Dikova and Sahib (2013) argue that there exists a link connecting the cultural distance between companies and their success of a cross-border acquisition. According to the authors, cultural distance is the existence of “differences in the norms, routines and repertoires for organisational design, new product development, and other aspects of management” in the companies’ countries of origin (Dikova and Sahib, 2013, p. 78). The more values and characteristics of the nations vary, the more culturally distant their firms are from one another.

Thus, Dikova and Sahib (2013) propose that businesses with distant cultures that are also not experienced in mergers are less likely to benefit from cross-cultural integration due to the lack of awareness about the values of another company. The term that represents a conflict between organisations’ core beliefs is a cultural mismatch (Dixon, 2005). The factors of cultural distance and mismatch can be, therefore, used to analyse each merger in particular.

Another aspect of M&As that may be impacted by cultural distance is equity participation. According to Malhotra, Sivakumar and Zhu (2011), equity participation refers to the “percentage of equity in the target firm that the acquiring firm obtains after the CBA [cross-border acquisition] transaction” (p. 321). The authors hypothesise that higher equity participation results in more control over the acquired firm, but find that firms often compensate for the cultural distance by acquiring more equity (Malhotra, Sivakumar and Zhu, 2011). This finding suggests that, during cross-border integration, power plays a significant role, and merging businesses choose to impose control through owning a more substantial part of the integrating firm.

The role of cultural integration is currently described in many academic works as a foundation of successful M&As. Sarala et al. (2016) find that this process allows for better social control, which, in turn, leads to effective governance. It should be noted that the major portion of all activities related to social control happens post-acquisition. Employees of the target and acquiring firms have to interact closely after the merger has been put in action, and this is the point in time when their unique cultural aspects show themselves fully (Sarala, 2010). This is the stage at which a merger can fail not just due to financial or manufacturing problems, but also due to human-related behavioural issues.

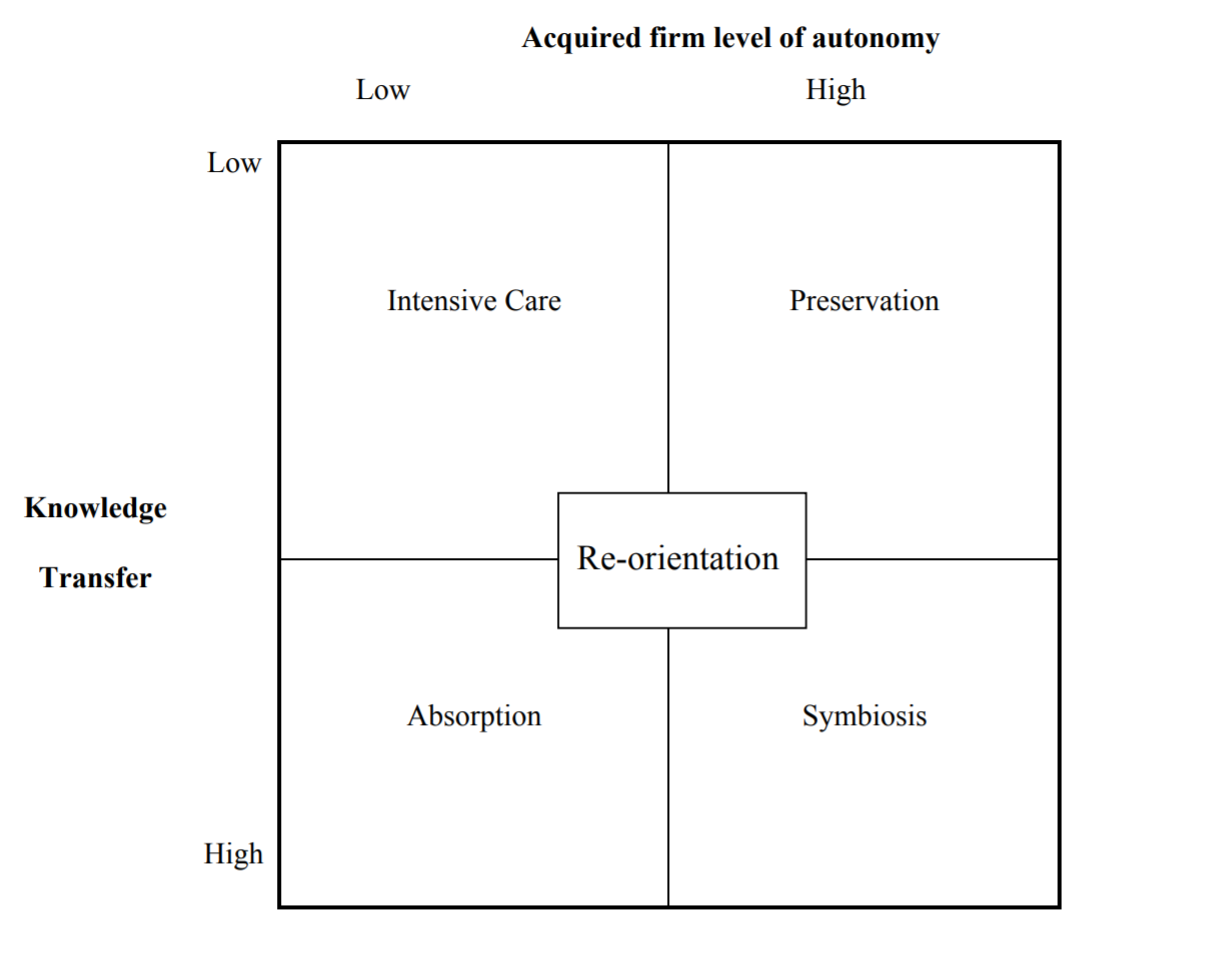

Thus, when discussing sociocultural perspectives, most scholars centre their attention on post-acquisition strategies. Angwin and Meadows (2015) argue that the stage of post-acquisition is the primary source for value creation during the M&A process. Thus, apart from the reasons for the merger, managers have to consider the cultural characteristics of the company they are working at and the one they aim to integrate. Nonetheless, this statement does not mean that companies have to act according to one type of M&A cultural integration. In fact, Angwin and Meadows (2015) propose a set of five main styles which organisations use most often (Figure 1). These models of integration depend on firms’ knowledge transfer and autonomy levels preserved by the acquired businesses.

The matrix of the five styles is based on the companies’ different approaches to information sharing and autonomy preservation. For cases, where acquirers do not integrate any new technology or processes into the newly added company, while also significantly changing its government structure and assuming control over organisational and financial spheres, the authors propose a name “Intensive Care” (Angwin and Meadows, 2015).

“Preservation” refers to situations, in which the acquiring and the acquired firms do not exchange knowledge or influence each other’s autonomy. The third and fourth styles refer to businesses that engage in knowledge transfer by sharing technology, workers, experience, and process details. Here, “Absorption” resembles a full integration of the acquired company in accordance with the standards of the leader and stakeholder. In contrast, “Symbiosis” refers to the relationship of integration with retention of personal differences and unique cultures. Finally, the authors propose a new style, “Re-orientation” which present a balanced model for moderate knowledge transfer and a degree of autonomy.

The strategies demonstrate that each firm can determine which actions it needs to take, depending on the internal corporate situation and the outcomes it wishes to achieve. It is apparent that such styles as absorption are chosen by companies with a robust and overpowering culture that has to be maintained by acquired entities to be entirely accepted and supported (Angwin and Meadows, 2015). In contrast, preservation describes the way of the least visible intervention, where the acquiring company does not share its information, while also not putting restrictions on the obtained business.

Interestingly, Angwin and Meadows (2015) propose the fifth style, re-orientation, which is placed in the centre of all actions. It represents a new strategy that does not accept extremes in both governance and knowledge transfer, focusing on partial integration on higher levels of management and leaving a significant level of autonomy (Angwin and Meadows, 2015). According to the authors, this strategy may be the most effective in many cases where cultural mismatch is a serious issue. The application of these styles in the analysis is crucial for understanding which approaches were the most effective in the discussed cases and why.

All strategies for post-acquisition integration consider knowledge transfer and autonomy as the main characteristics of the M&A style. Ahammad et al. (2016) find that the former of these aspects plays a significant role in the merger’s success – the higher the level of knowledge transfer, the better the outcome of the acquisition. Nonetheless, the researchers point out that cultural distance negatively affects cross-border integrations, but organisational culture has the potential in mediating these conflicts and supporting knowledge exchange (Ahammad et al., 2016). Here, the distinction between national and corporate culture opens additional topics that require further research.

These conclusions raise the question of whether specific sociocultural techniques in post-integration activities can raise the chance of positive merger outcomes. According to the knowledge-based approach, these techniques include the reduction of causal ambiguity, cultural knowledge sharing, leader effectiveness and motivation and early target involvement (Lakshman, 2011). Thus, clear goals, strong leadership, and cultural and informational openness are proposed as the basis for a successful merger. Harikkala-Laihinen et al. (2018) test one of the aspects of sociocultural integration, dialogue, which incorporates knowledge exchange and information transparency.

The authors determine that dialogue can overcome national culture differences which further supports the idea of high knowledge transfer rates being the pillar of M&As. The importance of dialogue has to be addressed when considering cases of cross-border acquisition, along with other discussed concepts.

Case Study Analysis

Case studies that are considered in this analysis discuss the acquisitions made in the automotive industry in the 2000s. Renault, General Motors (GM) and DaimlerChrysler are European and American companies that wanted to expand to the Asian market by acquiring businesses that originated in Japan and South Korea. Their financial situation and size were comparable at the time of the operations, but their success or failure in the mergers demonstrates a difference in the chosen strategy. Each case is investigated separately below to determine which aspects of their approach contributed to the outcome of their efforts.

Renault-Nissan Alliance

The first M&A is not an official merger, but an alliance between the French Renault and the Japanese Nissan that was initiated in 1999. While the integration did not receive the official status of a merger, it can be considered as such. Renault assumed control over improving the operations at Nissan and acquired a stake of 37% (later, this number was increased to 44%), which is viewed as a ruling stake in Japan (Froese, 2010, p. 53). In response, Nissan gained 15% of Renault’s shares, making it a non-voting stakeholder in the French company (Froese, 2010, p. 53). These numbers, as well as the level of intervention performed by Renault, make this alliance a merger.

During the post-acquisition process, the French company chose a high integration level, meaning that it significantly changed the structure of the Japanese company as well as its own processes to deliver the promised results. Renault organised specialised cross-company groups, the primary purpose of which was to find the best approach to the merger (Renault-Nissan, an alliance, 2013).

Moreover, the company established a clear promise of transparency – the information about the alliance was shared with all employees, and Japanese workers of all levels, from the management to factory workers, were contacted by Renault’s representatives to explain changes and introduced the plan for future action. The commitment of the main board, including the crisis manager in change, Carlos Ghosn, was put in worlds in a commitment to improve the financial performance or quit the company (Strom, 1999). The integration was a success, and, in several years, Nissan became a significant player in the international car market.

The application of the concepts discussed above may explain why this acquisition yielded such positive results. First, it is apparent that Renault and Nissan had significant cultural distance – the corporate and national cultures of France and Japan vary in many ways. Japanese businesses are constructed according to the country’s values of collectivism, commitment, hierarchical relationships and hard work, while European companies value individualism and freedom (Warter and Warter, 2017). Moreover, Japanese workers are strongly biased against foreign management, and they are highly reliant on their local leadership (IG, no date; Froese, 2010). Thus, the establishment of trust and high autonomy is crucial for succeeding in the country.

Renault’s strategy combines transparency, knowledge transfer and independence of Japanese managers. According to Angwin and Meadows’ (2015) classification, this approach adheres to the style of symbiosis. Indeed, Renault made efforts to keep Nissan operating as a separate entity, placing its crisis managers on the board of directors but leaving most operations in the hands of Japanese managers and workers (Froese, 2010).

Arguably, this strategy allowed to overcome the cultural distance between the companies. Moreover, one can pose that the company also used sociocultural factors to influence the outcomes of post-acquisition integration. The principles described by Lakshman (2011) are visible in Renault’s actions. The French company established clear goals and communicated them to the employees. Next, it provided effective leaders while also integrating local authority figures to inspire commitment. The motivation was strengthened with serious promises and an argument demonstrating personal responsibility.

Overall, one can see great attention to sociocultural aspects of the merger and HRM practices in the activities of Renault. While on their own, these actions do not adequately prove that Renault’s integration was successful due to its focus on post-acquisition practices, the comparison of this case with those of General Motors and Daimler-Chrysler allow making such conclusions.

The Case of General Motors

The acquisition of the Korean company Daewoo by the American General Motors (GM) in 2001 followed a different path and reached its positive outcome much later than the M&A described above. In contrast to Renault, GM chose to acquire a firm that was not fully independent, being a part of a more extensive system of Korean businesses. As a result, the coordination between Daewoo and its headquarters placed additional restrictions on the American company (Froese, 2010).

Nevertheless, GM hoped to achieve substantial changes quickly, choosing a more authoritative and controlling result. Therefore, the communication between employees was not as open as in the Renault-Nissan alliance, and the knowledge exchange happened on the top management level. GM created rigid plans and established strong management that controlled the implementation of all strategic decisions. Moreover, the American company appointed specialists from within and outside of its staff who had experience with cross-border integration. In the end, the merger was initially unsuccessful but reached performance improvements later.

Arguably, the outcome of this case can be explained by the concepts described above. First of all, the company, similarly to Renault, has stated its goals and plans transparently, although this information was only available to the highest executive level. Moreover, consistent with the research by Dikova and Sahib (2013), GM hired professionals with sufficient knowledge of M&A, which raised their chances of positive results. At the same time, the lack of dialogue with employees and the high-level control by both GM and the parent company of Daewoo impeded the process and failed to inspire Korean employees of Daewoo to contribute to the integration in a more meaningful way.

Using the styles of post-acquisition integration, one can describe GM’s strategy as absorption – GM did not aim to preserve Daewoo’s original values, focusing on the financial and organisational sides of the process instead.

The cultural distance between the companies – the Korean Daewoo being driven by collectivism and commitment to the local management and the American GM focusing on its own values – was not overcome with open interaction and knowledge exchange. Instead, it was analysed by outside specialists and overpowered by the need to save the firm from the financial crisis. GM acquired more than 44% of Daewoo’s stake and raised this number to 51% later (Froese, 2010, p. 53).

This made GM the main decision-making force in the firm and contributed to its control over the acquisition. This choice of the company is consistent with the idea that equity participation is determined by the business’ desire to use executive power to influence the outcome of the merger.

Using the analysed theoretical findings, one may argue that the strategy of GM could have been improved to complete the acquisition faster and with better results. One may see an apparent lack of attention to sociocultural factors – the culture of the employees and management and the need to deliver information transparently, to all levels of the business (Sarala et al., 2016). This failure to provide a sufficient amount of knowledge possibly led to the workers being resistant to change, which had a detrimental effect on the process. Thus, while the strategy yielded positive results, eventually, it could have been made more effective using a sociocultural approach.

The Case of DaimlerChrysler

In 2000, DaimlerChrysler attempted to acquire the Japanese company Mitsubishi the financial situation of which was critical at the time. While the aims of the German-American company were similar to those of GM and Renault, its strategy did not deliver the same results of global expansion and technological innovation. First of all, it should be noted that the Western company was not experienced in cross-cultural integration at the moment of the deal (Froese, 2010).

Second, in contrast to the independent Nissan, Mitsubishi was a part of a larger business system (keiretsu) which have a rigorous hierarchical structure in Japan (Froese, 2010). Finally, Daimler Chrysler failed to provide the same level of transparency and communication during the post-acquisition period. One can use the principles necessary for post-acquisition integration offered by Lakshman (2011) to demonstrate how these factors are detrimental to the outcome of the merger.

The lack of strong leadership, for instance, led to the failure to inspire commitment and establish a dialogue with Japanese employees. According to their own comments, they did not treat DaimlerChrysler as a new authority, seeing its managers as outsiders instead (Froese, 2010). Thus, no channel of communication was established, and the companies did not trust each other to deliver excellent results. Furthermore, Daimler Chrysler did not formulate goals that would be understandable to both parties which caused further confusion and failed to create a sense of urgency which is vital in changing the financial situation of the acquired entity (Begley and Donnelly, 2011).

The cultural distance between the countries was not addressed in any way, and the companies, while trying to develop a structure of control, did not see each other’s goals as valuable (Badrtalei and Bates, 2007). Daimler Chrysler did not attempt to hire professionals to fix these issues.

According to the data provided by Begley and Donnelly (2011), the merger, while planned to be quick and intensive, was not actively pursued for about two years. During this period, both sides of the acquisition struggled with developing personal growth strategies and deciding what they can contribute to the integration. The first executive managers were appointed two years after the merger happened, and this factor significantly lowered the workers’ trust and their responsiveness to change.

According to both organisational and human integration principles, the faster the integration happens, the more chances there are for a positive outcome (Deloitte, 2009). The failure to plan for the post-acquisition stage, in this case, reveals an obvious flaw in DaimlerChrysler’s plans as well as the importance of this step in determining the outcome of an M&A.

The failure of Daimler Chrysler to integrate Mitsubishi is apparent when analysed through a sociocultural lens. Angwin and Meadows (2015) would classify the company’s merger strategy as Intensive Care – a procedure that requires high levels of control and an aggressive way of implementing changes. However, this style requires strong leadership and clear goals which the acquired company can achieve without a flow of information from the acquiring business (Angwin and Meadows, 2015).

According to research, if Intensive Care is successful, the acquired company may reach the right level of financial performance, but still not be a part of the acquirer’s corporate culture. This failure to overcome the cultural distance can be explained by the lack of positive communication and shared commitment.

Renault-Samsung Merger

The case of the second merger that Renault went through is discussed at the end because it differs from the previous situations significantly. While the previous mergers were focused on high speeds (which aligns with the principles of organisational integration), this acquisition happened over several years (Froese, 2010). Renault chose to acquire Samsung in 2000 when the result of its alliance with Nissan was only emerging (Tagliabue, 2000). However, reviewing the position of Samsung, its culture and financial situation, Renault chose to pursue a completely different strategy.

Samsung is a Korean company that was not independent of Nissan, but a part of a larger conglomerate (chaebol). Thus, some connections had to be restructured during the merger. However, Korean chaebol does not depend on its headquarters in the same way as keiretsu (Froese, 2010). This position allowed Samsung to retain a high level of autonomy. Moreover, Samsung was much smaller than Nissan, employing fewer than 2,000 workers, which was about ten times less than the staff of Nissan (Froese, 2010). Renault also analysed the cultural differences between Japan and South Korea – the relationship between South Korea and the West was more amicable, and Korean managers were open to communication and innovation (Hildisch, Froese and Pak, 2015). On the basis of these findings, Renault decided to pursue a slow integration with gradual changes.

It is notable that Renault selected a strategy that, in theory, is considered to be dangerous, especially if companies need to achieve results quickly. As noted above, the speed of the post-acquisition activities may determine the success of the whole process. Nonetheless, Renault’s focus shifted away from short time periods but remained on cooperation, information flow and commitment.

Similar to their work with Nissan, Renault’s management focused on combining the efforts of new and old professionals from both sides, delivering all vital information to the staff of all levels (Froese, 2010). Furthermore, Renault established a leadership position with new appointments and solidified its decision-making power by acquiring as much as 70% of the stake (Froese, 2010, p. 53). Once again, the sociocultural side of the merger was not neglected by the acquiring company.

The discussion of this case and the end demonstrates that the speed of acquisition is not the most defining factor of success. The comparison with the DaimlerChrysler merger, therefore, shows that the German-American company could have taken more time to complete the process, and it lacked not time, but planning for a post-acquisition merger. The crucial role of sociocultural aspects, in contrast, becomes more apparent when considering the mentioned above acquisitions.

Comparison

The comparison of the four cases allows one to see how the increased attention to the sociocultural factors influences the outcomes of the merger. Both Renault and GM have made efforts to understand the internal processes and the acquired companies. While they chose different methods – Renault appointed a crisis manager to the board, and GM hired professionals with a background in cross-border integration – the firms did not dismiss this part of the procedure.

Daimler Chrysler, on the other hand, did not consider the unique differences of Mitsubishi, including its dependable position on the conglomerate and the influence of the Japanese culture. It can be seen in the actions of Daimler Chrysler that the business did not account for sociocultural factors and did not develop a plan for post-acquisition integration. The lack of leadership, clarity, information flow, and managerial collaboration led to failure.

The last of the discussed cases reveals the value of these principles, even if the acquired company does not experience a sense of urgency. In most scenarios, this fear of losing the company of one’s job acts as a driver for change, which Daimler Chrysler did not create. Nevertheless, the examination of the merger between Renault and Samsung shows that even without urgency, integration can yield positive results due to the commitment of the personnel and management and correctly distributed authority.

The four scenarios demonstrate the effectiveness of the different post-acquisition styles, placing the approach with high autonomy and high knowledge transfer at the top of the list. In the examined acquisitions, symbiosis creates the most integrated structure in which employees and management understand their goals as well as the reasons for an M&A. Furthermore, it is possible that this strategy is also the most effective in dealing with cultural distance. While other factors such as equity participation, authority and unique cultural mismatches influence the outcome of cross-culture mergers, the commitment to investigating and addressing sociocultural factors seems to overcome most problems.

Conclusion

The increasing role of post-acquisition practices in cross-cultural integration is apparent in recent scholarly research. The focus on sociocultural aspects of acquisitions is discussed in many papers, and the impact of cultures arises as one of the topics that may determine the outcome of any merger. Cross-cultural management has to consider the concepts that allow one to plan a successful post-acquisition process. Such vital factors as strong leadership, transparency of information, knowledge flow, and collaboration contribute to the successful outcomes of any integration.

The cases of Renault, DaimlerChrysler and General Motors demonstrate the crucial role of these activities and reveal that organisational principles and styles of integration may differ depending on the business and culture. However, the attention to sociocultural aspects of management should not be overlooked as they build the foundation for prosperity.

Reference List

Ahammad, M.F. et al. (2016) ‘Knowledge transfer and cross-border acquisition performance: the impact of cultural distance and employee retention’, International Business Review, 25(1), pp. 66-75.

Angwin, D.N. and Meadows, M. (2015) ‘New integration strategies for post-acquisition management’, Long Range Planning, 48(4), pp. 235-251.

Badrtalei, J. and Bates, D.L. (2007) ‘Effect of organizational cultures on mergers and acquisitions: the case of DaimlerChrysler’, International Journal of Management, 24(2), pp. 303-317.

Begley, J. and Donnelly, T. (2011) ‘The DaimlerChrysler Mitsubishi merger: a study in failure’, International Journal of Automotive Technology and Management, 11(1), pp. 36-48.

Deloitte. (2009) Cultural issues in mergers and acquisitions. Web.

Dikova, D. and Sahib, P.R. (2013) ‘Is cultural distance a bane or a boon for cross-border acquisition performance?’, Journal of World Business, 48(1), pp. 77-86.

Dixon, I. (2005) ‘Culture management and mergers and acquisitions’, Society for Human Resource Management, March, pp. 1-4.

Froese, F.J. (2010) ‘Success and failure in managing foreign acquisitions in South Korea and Japan: Lessons from Renault, General Motors, and DaimlerChrysler’, Global Business and Organizational Excellence, 30(1), pp. 50-59.

Hajro, A (2015) ‘Cultural influences and the mediating role of socio-cultural integration processes on the performance of cross-border mergers and acquisitions’, The International Journal of Human Resource Management, 26(2), pp. 192-215.

Harikkala-Laihinen, R. et al. (2018) ‘Dialogue as a source of positive emotions during cross-border post-acquisition socio-cultural integration’, Cross Cultural & Strategic Management, 25(1), pp. 183-208.

Hildisch, A.K., Froese, F.J. and Pak, Y.S. (2015) ‘Employee responses to a cross-border acquisition in South Korea: the role of social support from different hierarchical levels’, Asian Business & Management, 14(4), pp. 327-347.

IG (no date) Renault-Nissan-Mitsubishi alliance: what you need to know. Web.

Lakshman, C. (2011) ‘Postacquisition cultural integration in mergers & acquisitions: a knowledge‐based approach’, Human Resource Management, 50(5), pp. 605-623.

Malhotra, S., Sivakumar, K. and Zhu, P. (2011) ‘Curvilinear relationship between cultural distance and equity participation: an empirical analysis of cross-border acquisitions’, Journal of International Management, 17(4), pp. 316-332.

Renault-Nissan, an alliance that benefits Renault (2013). Web.

Sarala, R.M. (2010) ‘The impact of cultural differences and acculturation factors on post-acquisition conflict’, Scandinavian Journal of Management, 26(1), pp. 38-56.

Sarala, R.M. et al. (2016) ‘A sociocultural perspective on knowledge transfer in mergers and acquisitions’, Journal of Management, 42(5), pp. 1230-1249.

Shook, J. (2010) ‘How to change a culture: lessons from NUMMI’, MIT Sloan Management Review, 51(2), pp. 63-68.

Strom, S. (1999) ‘In Renault-Nissan deal, big risks and big opportunities’, The New York Times. Web.

Tagliabue, J. (2000) ‘INTERNATIONAL BUSINESS; Renault agrees to buy troubled Samsung Motors of Korea’, The New York Times. Web.

Warter, I. and Warter, L. (2017) ‘Managing the intercultural issues in automotive industry mergers and acquisitions’, North Economic Review, 1(1), pp. 264-272.