Introduction

The economic aspect of various societies plays a pivotal role in spearheading development at different levels. The fluctuating global currencies demonstrate the influence of different factors on international trade thus explaining the varying demand and supply trends globally. Additionally, the role executed by financial institutions similarly determines the money system and economic growth trends in a given country. In this regard, understanding the several elements of a financial system in a given economy holds essence on the economic disparities and variations noted today.

For this reason, the book “The Money Machine: How the City Works” authored by Philip Coggan, a renowned financial journalist, provides insight into financial systems in a particular economy. Importantly, the author covers areas including currency trends, the institutions that affect the financial systems, and issues that lead to the collapse of an economy.

The clear and precise account of urban growth linked to fiscal development employed by the author makes it easy to comprehend how the system works. Furthermore, comparing Coggan’s perceptions of the financial processes in a city with that of other scholars reinforces the readers’ comprehension of the economic system. This paper provides an appraisal of the book, “The Money Machine: How the City Works” by considering the views of other authors on the main issues covered in the guide.

The Use of Financial Jargon

The media plays a chief role in educating the public concerning the various financial matters that affect the undertakings of the City. However, in most cases, the news media uses financial jargon to explain the economic trends in a given economy, in a manner that makes sense to financial professionals and those with limited or basic financial knowledge.

As such, the greatest majority in the City fails to capture the correct meaning of the financial headlines thereby making the news less informative since it fails to capture the attention of the public. For this reason, Coggan underlines that besides media houses’ efforts to avoid the use of complex terminology when addressing financial issues, the public needs to put any effort into learning the meaning of different financial jargon. As such, I agree that understanding the meaning of the jargon goes a long way in facilitating the comprehensiveness of issues on economic matters including the financial markets, banking, and housing aspects.

Likewise, Van Rooij, Lusardi, and Alessie suggest that news media professionals need to use straightforward terminology if possible when addressing financial developments that would affect the public. Importantly, I agree with the authors as they pinpoint that today the public is more concerned with issues on money, as a depiction of the effects of the International financial revolution, a bandwagon that has a substantial number of people on board. Particularly, Van Rooij, Lusardi, and Alessie identify jargon like market capitalization, equity, liquidity, and market value as the common terminology used in the headlines today that misses passing the intended information to the greatest majority.

Moreover, the use of s simple language when publishing articles on financial issues ensures that the audience, irrespective of their educational background, understands the various elements that determine the prevailing state of the financial system. Besides isolating a potential audience, the use of jargon could also make it untrustworthy and thus fail to deliver the intended message to the public.

Conversely, I would hold that the use of jargon to describe financial issues condenses the intended meaning thereby allowing professionals to share the information efficiently. Therefore, illustrating issues regarding the prevailing financial matter build a particular community. For instance, Accountants would comprehend a particular issue in their field in a better way if the meaning gets condensed through the use of jargon. Moreover, I also support that jargon gives the message authority thus securing the attention of the interested parties affected by the headlines-making financial events.

The International Financial Revolution

The current structure in the City depicts the events brought about by an international financial revolution. Coggan insists that one needs to know that the various systems functioning within a particular sector have gone through years of development to attain the current position. As such, the financial revolution ignited several decades ago manifests in the form of economic modernization experienced today by various sectors including the financial and stock markets, banking, transportation, and housing.

However, Coggan identifies the banking sector in England as one that experienced a slower pace of development compared to other areas of the economy (129). Government restrictions and political influence caused the lagging of the sectors as vested interests emanating from authoritative parties undermined the realization of a streamlined growth of the industry. For instance, Coggan identifies the administrators at the Bank of England as the cause of uneven growth in the economy as it selectively offered loans to applicants.

Similarly, Mishkin pinpoints biased usury limits and government restrictions practiced by the West-End London bank as the key factors that derailed the growth of the economy in London in the late 19th Century up to the onset of the 19th Century. In this regard, I firmly agree that the different levels of development within a City imply that various inhibitors and facilitators shape up the current state of financial systems as demonstrated by the revolution experienced in the banking sector.

In addition, Mishkin notes that government interference in the banking industry seeks to control the flow and circulation of currency in the economy in a bid to curb the realization of an economy marred with inflation. Therefore, a revolution in the sector needed government intervention to oversee and control the imposed interest rates and allowable taxes for different operations pertinent to the banking area. In doing so, I believe the Treasury Department ensures that financial institutions impose fair interest rates to borrowers and also offer attractive interest rates for savings made by account holders.

Such moves also ensure that the government enforces policies that prevent the collapse of the economy in a time characterized by economic tensions like the 2008 recession. Consequently, besides hindering s a substantial growth engineered by financial developments in the banking sector denoting the outcomes of a revolution, restrictions imposed by government agencies to regulate the sector have played a central role in facilitating the even development of diverse sectors of the economy. Hence, Coggan and Mishkin agree that government intervention cultivates both positive and negative outcomes that affect the financial system in a given economy, especially when the sector experiences a revolution. The graph below shows the current lending recovery trend in the UK.

Investing in the Money Markets

The various money markets in the contemporary economies provide investment opportunities not only for people operating in the City but also in the upcountry. The money markets represent an aspect of the financial systems that entail the application of financial instruments characterized by high liquidity and short maturity trades. Coggan breaks down the meaning of the money market by referring it to the trade of securities offered by enormous companies, financial institutions, and governments for a short period, usually under a year, that earn relatively high interest.

Mostly, people with limited knowledge of financial matters confuse the capital markets for the money markets. In this respect, the author clarifies that money markets usually operate within a short time-frame as the capital markets entail the trade of bonds and equities over a long period. Coggan advises individuals and entities to take advantage of the various forms of securities offered including treasury bills, certificates of deposit, and repurchase agreements among other instruments. Notably, opening a money market account would ensure that the holder enjoys higher interest rates amid the limited withdrawals, usually three in a year, and the high minimum balances allowable. In this light, I also support Coggan’s view that such investments are critical for survival in the City due to the rising cost of living experienced today.

Similarly, Hillier, Grinblatt, and Titman affirm that the money markets provide an avenue for wealth generation owing to the high-interest rates offered by the government, financial institutions, and established corporations. Further, the safety of such investments gets fostered by the low-risk aspect of investing in the various financial instruments in the area. Moreover, the money markets facilitate easy accessibility of funds through ATMs, checks, and transfers amid the withdrawal restrictions.

However, the inflexibility feature of the money markets bars investors from fully benefiting from investing in the said financial market. For this reason, the majority, especially those operating in the urban centers, feel discouraged to consider opening money market accounts. Firstly, the high threshold balance requirement applied by financial institutions, usually over $2,000, prevents individuals with low incomes to benefit from the high returns achievable through trading in the money market securities.

Secondly, the fees associated with running a money market account and the fluctuating interest rates dependent on the general market interest rates dynamic holds back potential investors from venturing the financial market area. Thirdly, similar to Coggan’s view, the issue of limited withdrawals and transfers inconvenience account holders and thus, unfavorable for unique that requires an urgent transaction. As such, I think the demerits of holding an account to trade in the money markets hold back many individuals from participating in such investments.

The Bond Market and Financial Crash

The bond market forms part of the financial markets that have attracted considerable trading activities in the Western world economies account for the economic woes experienced in the region to a substantial degree. Mainly, the bond market entails the issuance of debts in the primary market and a secondary market where traders acquire and sell the debt securities.

As such, Coggan pinpoints that the complex structure of the financial markets, particularly the bond markets accounted for the explosion of the sector, leading to financial crashes experienced in Europe and the Americas. Notably, in Europe, for instance, credit defaulters triggered trade imbalances that further induced tensions in the economy and thus, led to the economic recession. For the sake of preventing issues like credit defaulting, Coggan sees the essence of educating the public on how the function of the financial system to enlighten the audience on how they could promote the growth and stability of the structures instead of weakening the system.

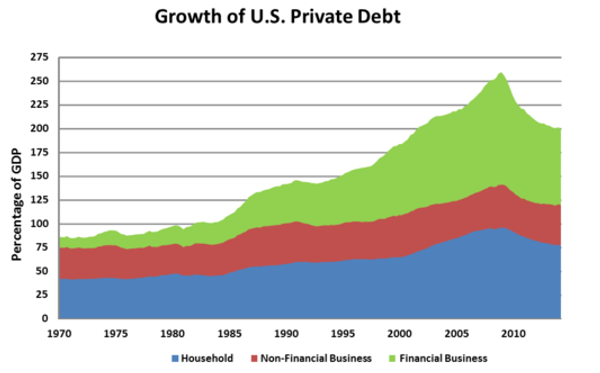

Similarly, Hillier, Grinblatt, and Titman identify the control and influence of the international bond markets over large corporations besides countries as the inducers of economic struggles experienced in the Eurozone recently. In this essence, I also think that credit-rating institutions and the bond markets have engineered a debt-ridden planet, calling for the need to streamline their operations for the purpose of realizing stable economies. The figure below demonstrates the degree of private sector debt growth in the U.S. from the 1970s to the 2000s.

Particularly, the bond markets can be likened to mortgages in the housing sector since they operate using a similar principle. In mortgages, the issuer of the facility faces the burden of offering sub-prime borrowers due to the volatility of the economic trends resulting from different waves. Likewise, the wealthy Western economies experience distress likened to that of the prisoners confined in the Victorian debtor’s section that expects them to every move made by the guards.

Further, the dominance of the news headlines emanating from the preferences and interests of the bond investors influence national budgets and in adverse instances, lead countries to an economic recession. In this case, Hillier, Grinblatt, and Titman agree that the mass media plays a considerable role in affecting the trend of the bond markets as it could influence parties to secure the facilities at the expense of the economy due to the vested and hidden interests of the key players in the industry.

For this reason, the public needs to liken the said financial market to the traditional loan issued to individuals over the years and thus, only secure it when necessary. Likewise, Coggan clarifies that the bond is just a piece of paper that guarantees an immediate loan, where the holder pays the loan up to the [point where the interest is settled. Therefore, I support the idea that comprehending the operations of the bond markets holds essence pertinent to the sovereign debt crisis besides the sustainability of the world economy.

Risk Management

The principle of risk management in contemporary settings holds water due to the uncertainties involved in sectors like the financial markets. Risk management entails the identification, evaluation, and ranking of threats before the incorporation of economic resources in a coordinated manner to lessen, surveil, and control the possibility and consequences of unfortunate occurrences. Coggan argues that through risks management, individuals and organizations can facilitate the maximization and realization of opportunities in the various areas of a given economy.

Thus, I agree with Coggan since today the financial markets activity has intensified thus posing various risks that if not managed effectively, could escalate into a crisis similar to that experienced during the 2008 recession. In this regard, investors need to take precautions in their endeavors since the current state of the financial market forgives no one for their failure to engage in risk management.

In a similar line of thought, Afonso, Furceri, and Gomes hold that when people engage in the trade of bonds, bills, stocks, currencies, and shares among other commodities, they need to consider risk management strictly to foster their chances of opportunity maximization. In this regard, individuals and businesses in the City need to embrace the essence of engaging in planning their trades as well as calculate the probable or expected returns before venturing into a particular investment. In doing so, one foresees the possible threats to their investments in the future and thus, make calculated moves to prevent potential losses, and support this strategy firmly.

Levinson agrees with Coggan by underlining that due to the volatility of the current markets, investors need to uphold the significance of risk management in their entire undertakings. As such, planning determines the variations between success and failure in any given investment endeavor. In this light, Levinson identifies the application of the take-profit (T/P) and stop-loss (S/L) points as key for planning trades in the financial markets. The T/P point demarks the instance where the trader considers selling the stock, share, or currency to make a profit, implying that the plan they embraced helped fostered their trade entry and exit strategies.

On the other hand, the S/L point allows the trader to sell the commodity they bought thereby making a loss out of it due to unfavorable turn of events in the market. Further, the calculation of possible or expected returns gets realized through the use of T/P and S/L points as the trades gain the ability to compare various trades before choosing the most promising ones. Therefore, I agree that besides minimizing needless trade exits and maximizing profits, the said points ensures that traders master the art and science of assessing risk in the various financial markets that characterize the City life.

Conclusion

The book “The Money Machine: How the City Works” provides an illustrative account that explains how the financial systems in a given economy work. The author underlined the significance of financial literacy since the various market trends affect the operations in a particular City. The use of jargon also emerged as a factor that bars the public from gaining interest in learning financial matters.

Additionally, comparing Coggan’s text with that of other writers depicts similarities concerning the financial revolution outcomes as seen in the banking sector. Further the money market and capital market form part of the City economy where traders seek to maximize profits in the ever-changing markets. As such, the essence of risk management is inevitable in the various markets for the purpose of ensuring the entry and exit points when trading to minimize losses and maximize profits.

Bibliography

Afonso, António, Davide Furceri, and Pedro Gomes. “Sovereign credit ratings and financial markets linkages: application to European data.” Journal of International Money and Finance 31, no.3 (2012): 606-638.

Coggan, Philip. The Money Machine: How the City Works. London: Penguin, 2009.

Hillier, David, Mark Grinblatt and Sheridan Titman. Financial Markets and Corporate Strategy. New York: McGraw-Hill, 2011.

Levinson, Marc. The Economist Guide to Financial Markets: Why They Exist and How They Work. New York: Public Affairs, 2014.

Mishkin, Frederic. The Economics of Money, Banking, and Financial Markets. Upper Saddle River: Pearson education, 2007.

Van Rooij, Maarten, Annamaria Lusardi, and Rob Alessie. “Financial Literacy and Stock Market Participation.” Journal of Financial Economics 101, no.2 (2011): 449-472.