Executive Summary

The government of Saudi Arabia has strived to achieve economic success by investing heavily in infrastructural development, leadership, and the creation of conducive environment for industries to thrive. Unsurprisingly, Saudi Arabia is one of the fastest-rising economies in the Middle East due to thriving industries such as tourism and real estate. Indeed, it is the home to two of the world’s most popular shrines, namely Mecca and Medina, which attract a lot of positive attention.

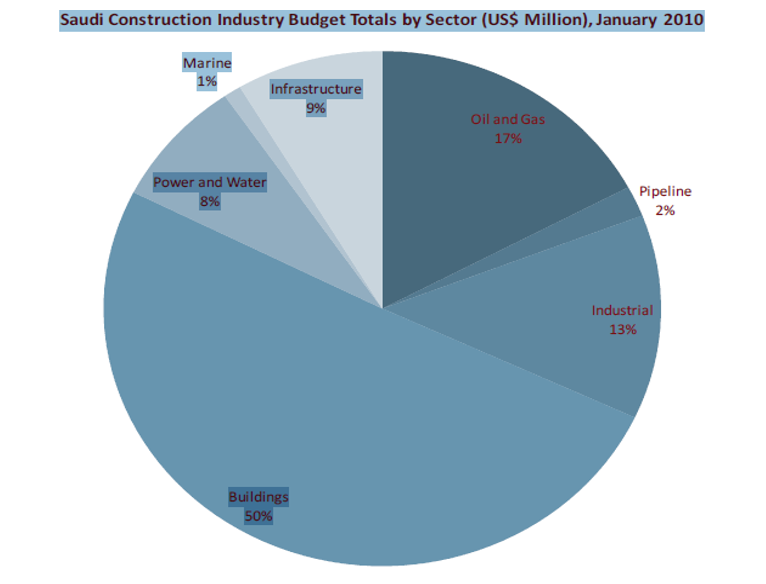

In recent years, the real estate and construction industry has become the biggest booster of the economy, thanks to its fast growth. Importantly, the oil business is performing well in international markets, bringing revenues that are used to improve the living conditions of Saudis. As the economy becomes stable and population grows, demand for housing rises thus contributing to the increased investment in real estate and the construction industry.

This assignment will seek to discuss how the real estate and construction industry has risen in Saudi Arabia and the challenges it has faced in achieving this enviable success. The key areas that will be mentioned include the size and rate of growth of the real estate and construction industry over the years. The paper will also look at the economic cycle to unravel the economic side of real estate and construction business. Ideally, in every business, there are competitors and this is no different in construction industry. The paper will highlight the main business rivals and compare the industry with construction industries in the world. This would be aided by a SWOT analysis, which will look at the strengths and weaknesses inherent in the industry as well as opportunities and threats available in the wider national and international market.

Description of the Real Estate & Construction Industry

The construction of real estate in Saudi has grown at a very high rate in recent years mainly due to the increasing number of tourists visiting the country and good returns from the oil sector. The government has introduced numerous economic expansion strategies that wish to divert the economy’s direction from oil to non-oil sectors (Ali, 2013). With rising rate of tourism and population, there is need for construction of more residential houses and hotels. As it stands now, the demand for housing in the upper and middle class category has exceeded supply, leading to increasing construction of the same (Hines, 2001).

Riyadh, Al Khobar, Muscat, and Dammam are some of the cities where business is ubiquitous and doing well. The country has attracted a number of investments from other countries and signed contracts that have helped in boosting economic growth over the years, especially in construction of hotels and accommodation facilities. Indeed, it has an estimated growth rate of 35% over the next three years, which will place it among the highest growing sectors. In 2013, a confounding amount of $76 billion was set aside from the national budget to aid in construction projects. Continuous growth estimates the figure to increase to $3 trillion come year 2020. Evidently, the government has allowed the building of skyscrapers in Riyadh in order to help in the transform the skyline of the capital and create a healthy competition for the developers advertising their products (Al Zoumah, 2011)

The country has major business plans that are underway, which are set to begin with the funds set aside. These include $15 billion King Faisal University, $16 billion Jeddah Kingdom Tower, and their target being to make it the world’s tallest building. Others are the $40 billion Sudair Industrial City and six main economic cities, which will cost over $160 to complete.

A country with a GDP rise of 7.5 per year is bound to attract a number of investors from other countries who would want to partner with local investors and companies. With the real estate growing at a staggering rate, inputs such as stones, cements, and metal among others used in construction are also selling well in the market. Importantly, foreign investment has helped with the immense growth of the real estate and construction industry (Ali, 2013). The hospitality sector has also flourished, adding to the list of real estate constructions in the economy (Al Zoumah, 2011)

With growing commercial sector, the country has established some of the most active markets in the region where people come from different nations to conduct business. This has seen the real estate and construction industry stake progressive increase of about 42.4% and 24.2% respectively (Tadawul, 2014). Mecca, the holy city for Islam whose population is approximately 1.5 million is known for its high-rise buildings. The city has attracted religious tourists who visit every year, making land in the city to be among the most valuable commodity in the world (North & Tripp, 2012). In Mount of Omar district, developers have a plan of demolishing old buildings and pave way for 120 residential towers, each 20 stories high that can accommodate 100,000 people. Moreover, Mecca’s housing capacity is bound to increase by 50% if the developments are completed (North, Tripp, 2012).

The Economic Cycle of the Industry

The industry has evolved in the past few years and become very vibrant due to increased demand of housing. The real estate and construction in Saudi Arabia may be viewed as being in the cost or shakeout phase. In this phase of life cycle, companies are seen to have settled and economies of scale are realized especially for large firms. Due to intense competition, small players are obligated to leave the field, as they cannot cope with the huge investments in terms of capital and machinery used by large firms. In addition, firms engage in large-scale partnerships thus barricading entry of new players. Evidently, the situation on the ground shows some of the leading global construction companies setting base in Saudi Arabia to reap from this lucrative market.

The real estate and construction industry has grown and already made a name for itself within and outside Saudi Arabia. Currently, the country is working on expanding the industry further and coming up with sophisticated buildings that are unique compared to those built before. The industry is working towards improving the estate business through demolition of old buildings to build new ones that will help accommodate the increasing population (Al Zoumah, 2011).

Construction investment cycles should be considered by a government in order to make good investment decisions. When it comes to construction of real estate, time is needed for development of the plan and for stocks to respond to new market conditions. Ample gaps flanked by planning and completion segments cause construction to react cyclically to exogenous shocks. Investors, real estate marketers, and other people with vested interest in this industry have adapted construction cycle volatility to avoid losses and other long-term effects caused by casting a blind eye.

Constituents of the Real Estate & Construction Industry

Tadawul is the main and only stock exchange in Saudi Arabia. When looking at performance in the stock market, the real estate and construction industry has kept growing over the years. From 2002 to 2005, the price of houses rose significantly by 13.7% annually and land prices rose by 16.5% per year according to the National Commercial Bank Capital, which is the largest in the Middle East. These figures increased in 2006, with land price playing at 20-40% (Al Zoumah, 2011). Such economic surges can only be experienced if the rate of business in a country is increasing through investments and positive response from the world at large. At that time, due to the growing demand and limited supply of housing units, prices were bound to increase.

Data obtained from the ministry of economy and planning 8th development plan (2005- 2009) showed that there was a shortage of 0.73 million housing units and an unmet demand of 0.27 million housing units by end of the 7th development plan (Al Zoumah, 2011). This number is not expected to stagnate but to increase by 2015 due to the change of landscape and a favorable working policy.

The robust growth has made it an attractive destination for many investors from all over the world, international suppliers, and other real estate business developers. According to some study done by Global Investment house, the real estates’ GDP was to rise to 7.2% in 2010 from 6.8% in 2004 ( Al Zoumah, 2011). Currently, the industry boasts of $36bn of Foreign Direct Investments and over $500bn of real estate projects already in progress. The FDI improves the local growth immensely and the government has tapped into this fully.

When looking at Tadawul, the real estate’s business value is at 6128.80, construction is at 3,897.87, while the hotel and tourism industry is at 18,870.44 (Tadawul, 2014). This shows that the tourism industry helps in the real estate and construction business tremendously.

Industry SWOT Analysis

Strength and Opportunities

The industry boasts of internal capabilities that have seen it take a prominent position in Middle East region, only second to UAE (Oxford Business Group, 2008). With the increasing population in the country, and the government striving to provide employment for youths through diversifying investment from the oil business, then the real estate will benefit through demand for housing by local people. The upper class and middle are looking for places to put up their families when they move to the commercial centers to work. With Mecca and Medina becoming robust, the tourism industry is bound to continue increasing and attracting more people to the country and thus more hotels and restaurants will need to be constructed (North & Tripp, 2012).

Due to the stability of the economy and government’s commitment to promote investment through accommodative trade policies, there is increased appetite for investment in construction and real estate industry. In addition, foreign investors are and contractors are finding it more attractive to collaborate with local investors who have better knowledge of the market (Hines, 2001). Liberalizing the property laws has also added a boost to potential growth of the industry. Moreover, the sophisticated technology has greatly assisted in blending the old ideas and the new ones in order to create great results for the benefit of all players in the industry.

Weaknesses and Threats

Even though the Nation is endorsing colossal developments in construction sector, the housing market still smarts from a huge demand-supply fissure as a result of prompt growth of the local community and briskly waning household sizes. The real estate also suffers from corruption in the country to an extent that brokers make deals, only to have them snatched by the moguls in the industry; thus, some of the rich owners in real estate and construction industry are there through dirty deals. They also need to improve on the delivery of capital projects, as this has been a challenge to them (Hines, 2001). They might also want to work on moving from only publicly financed projects to produce infrastructure of higher quality than the traditional ones. Lack of mortgage facilities has also been a challenge to potential owner of real estate; this should be reviewed in order to accommodate as many people as possible in this industry.

Competition Environment in the Industry

Capital requirements

Despite its growth in recent times, real estate and construction industry faces stiff competition from other industries like oil and gas in terms of capital requirements and access. The real state business normally demands a large capital in order to thrive, which may be a deterrent to most potential investors. Moreover, when the buildings have been constructed, there is the issue of how stable they are, or it is just a rush to have many skyscrapers that have been poorly constructed (Al Zoumah, 2011). Here, government faces a tough task trying to build partnerships with foreign investors who would provide funds needed to bring up quality and standard buildings in order to overcome stiff competition from other nations, especially in the Middle East and Japan.

Government Policy

How has the government policy helped in building positive competition in Saudi Arabia to help in building the growth of the business? This is a question one might ask in order to understand government’s relationship with foreign countries. Starting with technology, the country has adopted Western technology to replace some of the old ideas (North & Tripp, 2012). This means that they have given a chance to new development through technology in the country and have used it to their advantage. This is fostering relationships between the partnering countries as well as enhancing sharing of ideas. The government has also employed policies that allow foreigners full access to trade and partnership with local players to improve the business. These policies do not favor foreigners or locals, neither do they allow room for foreign investors to exploit local investors; this makes business easy, thus helping in attracting FDI.

Competition between the public and private sector

There is stiff competition between the private and public sectors in real estate investment, especially taking into account that the government has a keen interest in this booming industry. As a result, the government has imposed bans intended to the operations of private investors; for instance, ban on cement export limits the market for players in the cement industry. This will also affect the construction and real estate industry because the two industries are interdependent. These same interpositions are found in the labor industry where the government wants to take full control; however, this is impossible because both sectors have to exist and work together. The government therefore needs to create a lasting balance in order to tame this competition for the sake of the economy since both private and public sectors contribute to economic development (Ali, 2013).

Power of Buyers

Buyers always have the say in all industries based on their preferences and tastes. The same applies to real estate and construction industry where products have to be satisfactory to the needs of buyers. In Saudi Arabia, housing business has remained relevant amid competition by ensuring that the needs of individual consumers are satisfied, through both quality and pricing. Buildings have been built using great technologies and best architectural designs that make the industry remain competitive (Al Zoumah, 2011). This has been triggered by the realization that major competitors such as Dubai and Tokyo have great architecture and real estate technology that has been endearing to many global consumers.

Future Outlook of the Business

The globalization of trade has caught the eye of players in Saudi Arabia’s real estate and construction industry, who have been challenged to not only focus on internal market, but also on global market. As a result, the country has firms that are targeting other countries in order to lure them into construction business; one such firm is Al Oula, which has projects in major cities of UAE and Egypt.

Due to the high growing rate of Riyadh and the area surrounding Mecca, the government is working on the development of new units that will accommodate all people as well as hotels for tourists who visit the holy land each year. Land in Riyadh and Mecca is very expensive due to high demand; however, investors who will be working on this project will bring in good returns to the country. The high-rise buildings, apartments, and townhouses will be introduced to cater for people such as expatriates who would want such services (Al Zoumah, 2011). In addition to Jeddah Hills that will cost an upward of $11 billion, there will be an economic city to be built on the coast of Red Sea, north of Jeddah with three luxury residential districts that will house 75,000 residents (Al Zoumah, 2011).

One of the major factors influencing this competition is growth rate. With the population growth and a stable economy, people in the country have jobs that can sustain them. In addition, the government has worked and is still working on ensuring that the youth have stable jobs and general rate of unemployment is as little as possible, thus increasing the demand for estates these people can live. Apart from Riyadh, which has been a popular commercial center, other cities have come up and intensified competition in trade (North, Tripp, 2012).

With the rich Muslim culture in the Kingdom, many people go to Mecca and Medina to learn about the history (North, Tripp, 2012). The rate of tourism has been heightened by many visitors including schools from other countries who tour Mecca, thus contributing significantly to success of hotels around the area.

References

Al Zoumah, R. M. (2011). Real Estate Management. Aberdeen, Scotland: Aberdeen University Press Services. Web.

Ali, J. (2013). Saudi Arabia uses current budget surpluses for future. Web.

Hines, M. A. (2001). Investing in International Real Estate. United States of America: Portsmouth, England: Greenwood Publishing group Inc. Web.

North, P., & Tripp, H. (2012). CultureShock! Saudi Arabia: A Survival Guide to Customs and Etiquette. NY, USA: Times media PTE LTD. Web.

Oxford Business Group. (2008). The Report: Saudi Arabia 2008. London, England: Oxford Business Group. Web.

Tadawul. (2014). Saudi Stock Exchange. Web.