The smartphones industry, which has phone makers like Apple, HTC, LG, Samsung, and Lenovo, falls under the Electronic Computer Manufacturing section of the NAICS, with code 33-4111. The industry takes a similar category name and category number 3571 in the SIC classification.

Market size

By 2020, the smartphones market will have reached USD 608.4 billion. Currently, the market is dominated by the Asia-Pacific region, which commands 40.7 of the total share. Europe, which comes second, has a 32.2 percent market share. Shipments for the year 2014 third quarter were 327 million units (Elise par. 1-3).

Scope of rivalry

Competition is very high for all market segments, with companies launching marketing campaigns and new products frequently throughout the year. The number of rivals is more than 50. Apple sold 74.8 million phones or 20.2 market share, while Samsung sold 73 million (19.9 percent market share) phones, and Lenovo took a 6.6 market share in 2014 (Chowdhry par. 2-3).

Growth rate and industry stage

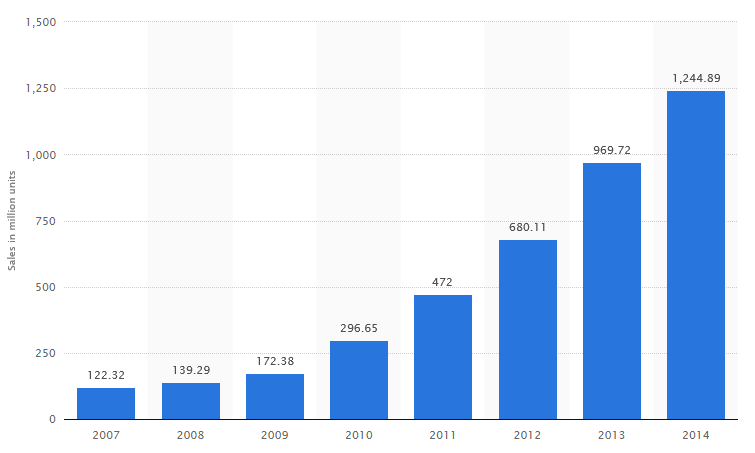

Shipments have been growing yearly. The third quarter of 2013 had 261.7 million units shipped. Emerging markets globally have a growth rate of more than 30 percent (IDC par. 4-5). The phone industry is on a mature stage.

Forward/backward integration

Manufacturers conduct trade among themselves for phone components and provide standardized accessories that work with both newer and older models in most cases.

Channels of distribution

Distribution happens online, in traditional retail channels, and through carriers or company stores.

Process and technology change

Feature phones were dominating the phone industry A few years ago, but now even emerging markets have a high prevalence of smartphones. Premium models now have metallic full body designs and fingerprint readers; technology and manufacturing process change fast.

Product differentiation

Smartphones are different in their make and operating systems, but overall they perform the same functions. It is the consumer tastes and preferences that determine the popularity of a given make. However, the main differences are that Apple phones run on the iOS, Blackberry phones run on the Blackberry OS, Microsoft phones run on the Windows OS, while many others, including Samsung, LG, and HTC, run on Android OS. Smartphones also have different specifications, such as metallic bodies, removable or non-removable covers, and different wireless connectivity capabilities.

Economies of scale in purchasing, distribution, advertising

Large manufacturers like Samsung, Microsoft, and Apple have considerable global distribution capacities that allow them to launch different smartphone makes in various markets simultaneously. They also have enough marketing resources to sensitize consumers in the different markets to buy their products. Smaller players concentrate on particular markets. For example, many Chinese phone manufacturers only serve the Chinese market, while other low-cost manufacturers strictly cover Africa. Large capital outlay and wide-scale manufacturing capabilities allow manufacturers to make deals with carriers on exclusive distribution rights and advertising to improve their sales (Woyke 200-241).

Learning curve

New entrants do not face a steep learning curve, as most markets and products are similar. The only challenge is to upset the distribution and marketing networks of the incumbents.

Rates of capacity utilization and importance

Given that phone manufacturing is a capital-intensive industry, a high level of capacity utilization ensures high production and potential higher returns to offset manufacturing costs. However, many smaller players completely shift their manufacturing costs to third parties and rely on online networks for distribution to reduce overhead costs.

Profitability

The two biggest players, Apple and Samsung, have dominated the profitability of the industry, with the former taking almost 93 percent of all profits in 2014 (Elise par. 4).

Segments

Segments within the phone industry exist; the main ones are high-end, mid-range, and low-end segments. The high-end segment attracts a majority of the companies in the industry. Moreover, the phone models in this category have the latest innovations in technology and design. The models sell at premium prices. The mid-range segment includes more manufacturers, with many serving specific markets like Asia, Latin America, Europe, or Africa.

However, the main manufacturers, HTC, Samsung, Huawei, and others, serve the entire global market. The low-end market includes phones that are selling at low prices and only have the basic features. The phones also rely on cheap and generic materials and designs. Profit margins are small in the low-end segment and very high in the high-end segment.

Works Cited

Chowdhry, Amit. “Apple Surpassed Samsung as Global Phone Market Leader, Says Report.” 2015, Forbes. Web.

Elise, Abigail. “Apple Dominates Smartphone Industry With 93 Percent of the Profits.” 2015, IBTimes. Web.

IDC. Worldwide Smartphone Shipments Increase 25.2% in the Third Quarter with Heightened Competition and Growth Beyond Samsung and Apple, Says IDC. 2014. Web.

Woyke, Elizabeth. The Smartphone: Anatomy of an Industry. New York: New Press, 2014. Print.