Executive Summary

This paper analyses the competitive strategies of the leading global mobile phone companies, including Nokia, Samsung, and Apple within the broader context of understanding their corporate strategies in the volatile smartphone industry. Notably, this paper keenly focuses on how these companies have formulated their competitive strategies to cope with the dynamism of their business environment. In a broader attempt to understand how they survive in the fast-paced smartphone market, this paper adopts a case study approach of Nokia. Four primary research questions guide this study.

They strive to estimate the potential for Nokia’s revival in the technology industry, understand the factors that led to the company’s demise, evaluate the factors that led to the prosperity of its rivals and formulate recommendations that could help it to reclaim its market dominance. A comprehensive review of the findings gathered from secondary data analysis, and interview findings show that Nokia’s lack of understanding about changing consumer tastes and preferences, its failure to innovate, and its overconfidence on the company’s brand image were mostly responsible for its failure. Overall, the story of Nokia and its fall from grace, which is highlighted in this report, provides a compelling case of what modern technology companies, such as Apple and Samsung, should do to stay relevant in today’s competitive smartphone industry. More importantly, it provides valuable lessons for businesses that may want to enter the smartphone market. However, essential to this study is the need to comprehend why leadership is critical for managing the operations of smartphone companies.

Introduction

Background of the Study

Smartphones are among the most popular technological devices among the young and the old. A smartphone differs from an ordinary cell phone because it has more advanced features than the latter. In other words, its functions are almost similar to a computer, except for the fact that it is smaller in comparison to the ordinary desktop. Relative to the similarity of features between a computer and a smartphone, it is important to point out that the latter can perform several advanced technological functions associated with modern technical devices, such as playing high-quality videos, taking images, and web browsing. The ability of smartphones to perform these tasks largely explains their popularity in many parts of the world (Woyke 2014). Additionally, the increased availability of technological expertise associated with their development has made them cheaper than most digital devices, such as tablets and computers, further increasing their application in modern society.

The popularity of smartphones in today’s contemporary society has made them increasingly integrated into people’s lifestyles. These developments have made them not only a necessity in modern life but also a norm in the same. Their popularity in contemporary society has also created a lucrative industry for mobile phone manufacturers and their agents (Cecere 2014). Relative to this assertion, Li (2017) says the global smartphone market is a multibillion-dollar industry, which has tentacles in almost all parts of the globe. Concisely, Meyer (2012) adds that the popularity of smartphones in the global telecommunications sector has seen industry players report significant gains in profitability and brand value. Woyke (2014) adds to this narrative by saying the industry’s value has been growing at a steady rate of 7.9%, while the growth in volume has been pegged at 5% annually. Additionally, experts project that this rate of growth should prevail up to the year 2024 (Cecere 2014).

The mobile phone market is a global one because many people find cell phones useful to their lives. However, it has various dynamics such as its localized nature, which differentiate it based on the understanding that different markets exhibit unique characteristics that are only specific to their customers (MIC Research Team 2016). Experts also argue that the industry is dynamic and volatile (MIC Research Team 2016). Technological advancements are at the core of this observation because through changes in technology, shifts in consumer tastes and preferences (including the development of new smartphone functionalities) have been observed. The same volatility in the industry has created a change in corporate policy for most mobile phone companies (Ma 2016).

Despite the existence of the above characteristics of the mobile phone market, some key trends have emerged in the industry. One of them is that smartphones that are priced between $200 and $500 are the most popular in the market (Woyke 2014). The Android operating system (OS) has also emerged as the most commonly preferred OS worldwide. Ma (2016) supports this statement by quoting a 2015 industry report, which showed that the Android operating system was the most popular in the market. Li (2017) adds to this observation by saying that smartphone customers prefer this operating system to any other in the market. This explains why several mobile phone companies have signed partnerships with over 1,300 original equipment manufacturers to use this operating system on their devices (MIC Research Team 2016).

Another trend that has emerged from the global popularity of smartphones phones is the dominance of a few firms, which command most of the market share in the industry. Ungson and Wong (2014) support this assertion by saying the industry is only characterized by a handful of players who command up to 80% of the market share. Most of them have been involved in intense jostling to be at the top of the industry with innovation being a critical success driver for their success.

According to the market research firm, IDC, Samsung, which is a Korean-based technology company, currently leads the market as the world’s dominant smartphone company (Ungson & Wong 2014). In 2016 alone, it produced and sold more than 300 million smartphones worldwide (Jin 2017). Other dominant players in the market include Apple and Huawei. OPPO and Vivo are other smaller players in the sector (Jin 2017). Analysts often evaluate the activities of these technology giants based on different analytical categories, including pricing, the technology used to make their phones, screen size, and the geographical area where they have a dominant market presence (MIC Research Team 2016).

In this paper, the business strategies of these corporations are analyzed from a competitive angle. A crucial area of this discussion involves an evaluation of how these organizations are developing plans to outwit one another, within a broader competitive and analytical framework of “survival of the fittest.” This paper adopts a case study approach to the analysis by investigating the corporate strategies of Nokia, which used to be a market leader in the early and mid-2000s. The focus on Nokia is a deliberate one because the company failed to maintain its dominance in the wake of increased competition from other players. The section below explains the research problem.

Research Problem

Headquartered in Espoo, Finland, Nokia has a long history that traces its roots to 1865 when the company was founded as a rubber shoe manufacturing organization (Jin 2017). After its founding, the company divested into the mobile phone and telecommunications sector – a process that started in the 1960s when it developed several infrastructure gains in this industry (Jin 2017). Based on these developments, the company established itself as a formidable brand in the telecommunications market. Today, many mobile phone users view Nokia as a brand that brings a lot of nostalgia because it is among the first phone companies to produce flagship phones, such as the Nokia 3310 and N8, which were popular among many users in the early 2000s (Savoc 2014). While some of these brands bring many memories to different people, there are many doubts about whether the once-famous company would survive in today’s competitive smartphone industry (Ungson & Wong 2014).

Such doubts emanate from different quarters of the industry and among people who have not only questioned the company’s strategic direction in the last few years, but also the merit of some business agreements it has signed with other companies within the same period (Jin 2017). For example, the deal between Nokia and Motorola, where the latter acquired the former’s products and services for more than $7 billion and sold it to Microsoft worried some commentators who viewed it as a poor strategic move by the Finnish company because it left it strategically weaker than it was before (Jin 2017).

In a narrative aimed at painting Nokia as a relic of the past years, Microsoft is reported to have made losses amounting to $8 billion from the same transaction (Savoc 2014). Thousands of jobs were also lost in the process based on a move termed by some pundits as one of the most disastrous acquisitions in the smartphone industry (Savoc 2014). Many stakeholders have also unsuccessfully tried to “resuscitate” Nokia. Similarly, efforts by some of the company’s employees to revamp some of the company’s business divisions have also failed (Ungson & Wong 2014). Based on these weaknesses, Nokia’s market share significantly declined from 2007 to 2013. This decline happened during this period because its market share slipped from 48% to 3% (Ungson & Wong 2014). These issues have further increased people’s doubts about whether the company could reach the same heights of success it enjoyed in the early 2000s.

Purpose of the Study

The purpose of this study is to understand how mobile phone companies struggle to remain relevant in today’s competitive smartphone industry using Nokia as a case study. The organization is selected for this analysis because it has been both successful and unsuccessful within a short period of less than a decade. This review is mostly hinged on the rapidly changing nature of business dynamics in the industry, which many experts have characterized as a volatile one (Ungson & Wong 2014).

Through this analysis, it would be possible to estimate the company’s potential to revive and possibly stake a claim in the global mobile phone market. Key areas of emphasis in this report would involve understanding the kind of strategies adopted by the technology giant and exploring whether they have been able to redeem the organization. Another area of analysis that would be examined in this report is why the strategies adopted by Nokia were ineffective when it was losing its market share. Stated differently, some sections of this paper would explain the factors that led to Nokia’s demise. Conversely, this analysis will also reveal the main factors that contributed to the success of the company’s rivals. By analyzing both sides of the argument, it would be possible to formulate a set of recommendations that could make Nokia successful again, relative to the quest to command a significant market share of the global smartphone industry. Furthermore, this analysis would be instrumental in comprehending how Nokia could outwit today’s market leaders, Apple, and Samsung.

Aim of the Research

To understand how players in the smartphone industry are coping with increased competition.

Research Questions

- What factors led to Nokia’s fall?

- What factors contributed to the success of Nokia’s rivals?

- What is the potential of Nokia’s revival in the smartphone industry?

- How can Nokia reclaim its once-dominant position in the mobile phone market?

Research Objectives

- To estimate the potential for Nokia’s revival in the smartphone industry

- To understand the factors that led to Nokia’s fall

- To evaluate the factors contributing to the success of Nokia’s rivals

- To formulate recommendations that could help Nokia reclaim its once-dominant position in the mobile phone market

Scope and Limitations of the Study

Although this study principally explores the strategies that different mobile phone firms have chosen in their effort to overcome stiff competition in the sector, our analysis will primarily be limited to Nokia’s corporate plans. Relative to this assertion, this investigation would be focused on understanding Nokia’s past and present struggle to remain relevant in today’s competitive smartphone market. The analysis would be limited to a review of the company’s strategies, which led to its failure to reclaim its position in the industry and its present positioning, which would help us to ascertain its potential for revival. The current analysis is also hinged on explaining how Nokia lost its market dominance in the wake of a changing and competitive smartphone industry, which saw other entrants slowly diminish the company’s market share in the global sector (Ungson & Wong 2014). This review highlights the company’s international strategies and not regional ones. Thus, the scope of the analysis is centered on investigating the company’s global plans and limited to its competitive actions, with a specific emphasis on how it has fared, relative to other players in the smartphone market.

One limitation of the study was the time available for carrying out the research. In other words, the entire research process had to be conducted within a short period, which made it difficult to carry out and process many interviews to answer the research questions. Consequently, the information obtained from the data collection process was received from a small sample of respondents who came from a few selected consultancy firms. The second limitation associated with this study relates to the data collection strategy, which was based on interviews and secondary research data. Consequently, the findings presented in this study were limited to the information obtained from these sources of research. At the same time, most of the respondents who gave their views in this investigation were constrained by their obligation to perform other responsibilities in the course of executing their duties. This issue may have restricted the time, which they accorded the interviews. Lastly, since some of the findings obtained from this report relate to published research data, the results of this study are also limited to the quality of information generated by the original researchers.

Significance of Study

This review is significant to the area of strategic management in the mobile phone industry because it provides useful insights regarding the strategies that work and those that do not work in the same. It also demonstrates the need for a strategic fit in organizational performance, based on corporate decision-making processes and their effects on organizational performance, relative to environmental and market dynamics. Lastly, this study is significant to the growth of academic literature that has focused on corporate governance and strategic analysis because it touches on the core of organizational decision-making skills that could spell doom or success for organizations. It is also instrumental in understanding the influence of environmental factors in corporate management and the development of proper leadership acumen.

Literature Review

This second section of the report highlights and explains what other researchers have said about the study topic. Part of the analysis includes a review of existing theories of competitive analysis and a broader analysis of what other researchers have written about competitive strategies being applied in the smartphone industry. The first section of this chapter evaluates existing theories of inquiry to explain competing tactics in the smartphone industry.

Theoretical Analysis

Several hypotheses of competitive advantage have been developed to illustrate situations where organizations generate a set of essential competencies or attributes that they could use to outwit their competitors. Relative to this assertion, Hasan (2014) says the management community has been preoccupied with this area of corporate governance for the better part of half a century. This section of the literature review would help to highlight and explain some of these theories and models. The first segment of the analysis describes the theoretical foundations that were developed during the early periods of management review (the 1960s) where the market-based, relation-based, and resource-based views were predominantly popular. The second section of the analysis would highlight the knowledge-based and capability-based views of competitive performance that were introduced in the last half of the century.

Resource-based View

The resource-based view of competitive analysis focuses on leveraging an organization’s resources to outwit its competitors (Burton & Rycroft-Malone 2014). In other words, it is an inside-out strategy adopted by companies, which strive to exploit their internal competencies (as opposed to external skills) for the benefit of their shareholders. A critical underlying philosophy in the analysis of the resource-based view is the understanding that firms are heterogeneous because they possess resources of similar characteristics (Hasan 2014). The resource-based view is often used by different companies that follow unique processes, which include identifying an organization’s vital resources, evaluating whether the resources meet key criteria, such as being valuable, rare, imperfectly imitable, and non-substitutable) (Bromiley & Rau 2016). The last step involves caring for and protecting the resources that meet the characteristics mentioned above.

Although the resource-based view has been touted as a useful theory in understanding the competitive processes of different firms, it is important to point out that some researchers have criticized it for its tautological nature (Burton & Rycroft-Malone 2014). Others have cast their doubts on its ability to create sustainable competitive advantages because they argue that when resources are configured harmoniously, competitive advantage is lost. After all, firms would experience the same value in the end (Hasan 2014). Some critics have also expressed similar reservations regarding the application of the theory on product markets because they say it is not entirely designed to work in companies that are product-oriented (Bromiley & Rau 2016). Lastly, some critics of the theory say it is limited in perspective (Burton & Rycroft-Malone 2014). Nonetheless, there have been counter-arguments developed to address some of these criticisms, but they will not be comprehensively covered in this paper. Overall, researchers who are unsatisfied with the merits of the resource-based view have turned to the market-based view to explain firm performance. The market-based aspect is illustrated below.

Market-based View

The market-based view of strategic development primarily focuses on aligning an organization’s policies and strategies with industry or market dynamics for strong competitive positioning (McGee 2015). This approach of competitive positioning aims to shape an organization’s systems and structures to exploit critical opportunities in the market. Relative to the dynamics of the market-based view highlighted above, Hasan (2014, p. 34) says, this approach “works by understanding how firms perform similar activities to other firms but in very different ways. In this perspective, a firm’s profitability or performance is determined solely by the structure and competitive dynamics of the industry within which it operates.”

Proponents of the market-based philosophy often view strategic analysis within the broader context of industry dynamics. This review has been further explained in the extended understanding of the industrial complex paradigm, which has also been referred to as the structure-conduct-performance paradigm by Burton and Rycroft-Malone (2014). These models have explained how industry dynamics often affect firm behavior and, by extension, their performance. Some industry dynamics known to affect firm performance include barriers to entry, rivalry among competitors, and supplier power (Burton & Rycroft-Malone 2014). Most of these external market dynamics are explained in Porter’s five-force analysis, which shows that supplier bargaining power, rivalry among competitors, buyer purchasing power, the threat of substitute products, and the potential of new entrants in the industry affect firms’ competitive behaviors (McGee 2015).

Based on the presence of these environmental factors, corporations always have to align their strategic goals with the prevailing market dynamics. This approach explains the gist of the market-based view in understanding competitive strategies. Nonetheless, it is common to find different organizations pursuing one (or both) of the tactics mentioned above, based on their goals, corporate cultures, or market dynamics. For example, Hasan (2014) says that Dell has used both approaches in a concerted effort by the company’s managers to shift from the resource-based view to the market-based approach, owing to market dynamics (recession) and competition from some of its primary rivals, such as HP. Companies, which do not find the resource-based or market-based views of analysis as integral to their competitive performance often resort to the knowledge-based view or capability-based views of competitive analysis. The knowledge-based view is explained below.

Knowledge-based Theory of the Firm

The knowledge-based aspect of a business often considers a company’s knowledge as being the most integral to its overall performance, relative to its competitors. This approach is a relatively new area of competitive theoretical development because it mostly characterizes 21st-century companies, which are tapping into the dynamics of today’s knowledge-based economy. The growth and spread of the internet around the world and the consequent plugging in of many organizations to this platform has increased the relevance of this theory because many smartphone companies are trying to leverage their knowledge to stay competitive. Hasan (2014) says that experience is a powerful competitive tool because it is difficult to imitate.

Furthermore, for some organizations, it is socially complex and difficult to replicate. These factors make heterogeneous knowledge bases as some of the most powerful in the smartphone industry. Different platforms within an organization often carry or replicate this entity among workers, thereby making it an almost immortal type of competence that runs deep in the memory of all workers involved. For example, some kinds of knowledge are often replicated in organizational cultures, while others are safeguarded through corporate rules and policies (McGee 2015). A classic example of the power of the knowledge-based view in competitive performance could be demonstrated through the dominance of Coca-Cola in the beverage market. The company has maintained its position as the leading beverage brand it is today because of the knowledge it has safeguarded in the production of its drinks.

Capability-based View

As its name suggests, the capability-based view of competitive strategic development hinges on leveraging an organization’s key capabilities (Hasan 2014). In other words, this approach derives its power from the assumption that not all companies will have the same skills at the same time. Thus, it is possible to find one organization performing one aspect of its operations better than another does. Consequently, teams, which could work better than their competitors have a real chance of outwitting them. This view of competitive performance could be applied in the smartphone market differently. For example, it is possible to find companies that have tremendous capabilities in operational software better than its rivals do. This approach is a source of capability power. At the same time, another organization could have immense knowledge in hardware development, which would allow it to outperform its rivals, which do not have equal competencies (Savoc 2014). This distinction reveals how the capability-based view could differentiate companies from one another and create a source of competitive advantage among them. Broadly, the same view also draws our attention to the theory of specialization of labor, in international competition, among nations because the concept also taps into the ability of countries to develop goods and services better than others do, depending on their capabilities (Woyke 2014).

Besides the smartphone industry, different companies have used the capability-based view to outwit their competitors. For example, Hasan (2014) says Toyota is one of the most prominent companies to use this strategy for creating dominance in the global automobile market. Other researchers have mentioned Disney World, Boeing, and General Motors as other companies that have effectively used the strategy to outwit their competitors in their respective markets (Savoc 2014). While different groups have used the capability-based view as one of the critical instruments of competitive decision-making processes, some observers agree that the knowledge-based and resource-based views of competitive rivalry have a role to play in elevating the power of the capability-based view in explaining competitive performance (Woyke 2014). For example, Hasan (2014) points out that companies can’t develop a competitive edge without relying primarily on their knowledge-based resources.

As opposed to a resource-based view, such an assertion automatically draws our attention to the power of organizational capabilities in explaining competitive positioning, primarily because the presence of resources without the knowledge to use or deploy them would automatically lead to poor competitive positioning. In other words, it would not be possible to experience capability-based competitive advantages without the deployment of appropriate resources. This statement overtly means that the resources organizations need to create a competitive advantage are capability-based. Comprehensively, a review of these theories of competition draws our attention to the need for institutions to apply each one of them well, depending on their market or organizational dynamics. The process of doing so largely depends on a proper understanding of their industry. Since the locus of focus in this paper is the smartphone market, the following section provides an analysis of the same.

Smartphone Market – An Analysis

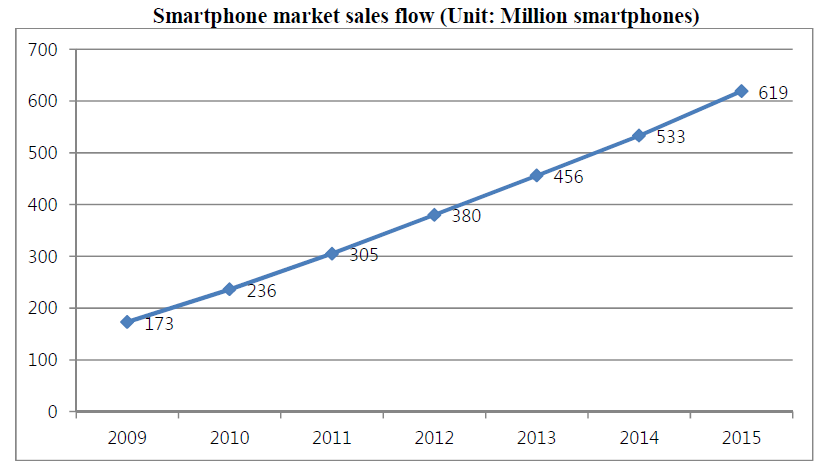

Although the world has witnessed volatilities in the global economic landscape, the smartphone market has been characterized by several years of impressive growth in sales numbers. According to a research firm, Credit Suisse, the sales numbers of mobile phones have been fluctuating, but the same trend has not been reported in the global smartphone market because the growth has been steadily on the increase. Figure 1 below shows this pattern.

Today, 50% of the total sales of mobile phones is because of smartphone purchases. Although there has been increased growth in the sales volume for most companies operating in this industry, many of them have devised unique strategies to outwit their competitors in the fight for global dominance in the same. Many factors account for this. For example, the rise in disposable incomes in developing countries has been a significant consideration in the formulation of marketing strategies for many mobile phone companies in the industry (Ungson & Wong 2014). Notably, there has been a constant emphasis on significant economies in the developing world because they have huge populations and are witnessing substantial increases in their household incomes.

Rising disposable incomes have been ordinarily attributed to increased consumer spending on entertainment and luxuries (Cecere 2014). Increased consumption of media reports, online networking activities, and gaming consoles are also associated with the same market driver, thereby increasing the sales of technological gadgets, such as smartphones and laptops (Cecere 2014). This explains the high rates of adoption of smartphones in urban areas compared to rural ones. Similarly, the same phenomenon explains why there is a higher rate of smartphone use in developing countries that have a significantly higher proportion of urban residents compared to rural inhabitants (Ungson & Wong 2014).

To differentiate their products from competitors, most phone companies, such as Apple and Samsung, are investing billions of dollars in the production of unique application processes that would enable them to “lock-in” their customers from competitors (Ungson & Wong 2014). The increasing popularity of mobile commerce is driving part of the innovation because it is widely popular among the working-class population who now prefer to own mobile phones that could have this feature (Ungson & Wong 2014). Growing internet penetration in many cities and suburbs is primarily informing an increase in the number of customers in this market segment. The increased number of subscribers to online social media sites is also supporting the same growth (Savoc 2014).

The production of excellent and affordable smartphones is also another competitive area where industry leaders in the mobile phone industry are competing (Song 2017). This competing platform is buoyed by several views from different observers who believe that the production of high quality and affordable smartphones would define the growth trend in the next decade (Savoc 2014; Song 2017). The popularity of smartphones as the most desirable type of phone to have has also contributed to the growth in the global market. Similarly, increased investments in the development of mobile operating software, such as Android, iOS, and Windows Phone are also set to provide the next growth area in the market segment. Nonetheless, the impressive growth in the global smartphone market is partly influenced by different market dynamics, which are explored in the section below.

Market Analysis

This part of the chapter reviews the mobile phone market by outlining how industry dynamics have shifted, based on changing consumer tastes and preferences, including evolving market dynamics. The analysis below provides a review of the current market fragmentation according to operating systems

Market Fragmentation (OS)

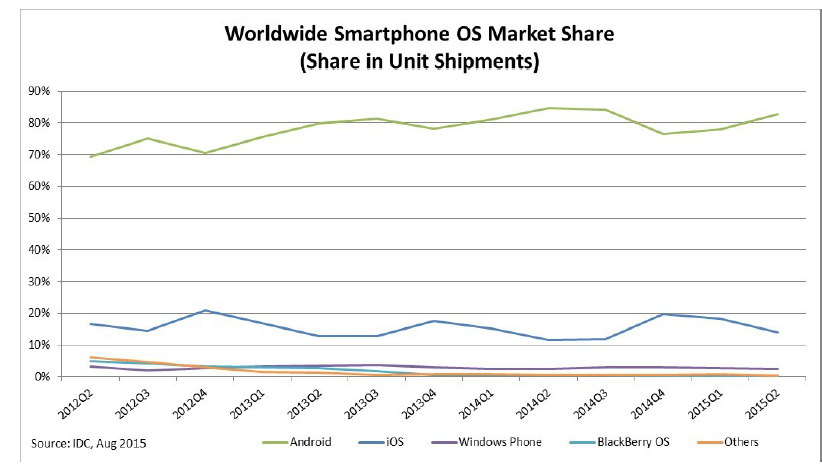

According to a 2015 report published by Ungson and Wong (2014), mobile phone providers who use the Android operating system mostly dominate the global smartphone market. This fact is supported by figure 2 below.

The Windows Phone, Blackberry OS, and iOS trail the market leader inapplicability. In later sections of this paper, this analysis would be instrumental in explaining how the OS market performance contributed to Nokia’s downfall. However, several research studies have highlighted different reasons for the collapse of traditional tech giants, such as Nokia and Blackberry, in the section below.

Lost Grip of Smartphone Pioneers

Perhaps one of the most documented issues in the smartphone industry is the lost dominance of the pioneer companies in the smartphone sector. Besides Nokia, many researchers have mentioned Palm and Blackberry as other giant organizations that fell by the wayside (Savoc 2014). All these companies lost their dominance in the market based on different reasons. Some studies have shown that Blackberry lost its market dominance in the smartphone market because of internal disagreements within its company’s leadership structure, especially after Apple started gaining prominence in the market, post-2007 (Ma 2016). The conflict was mostly focused on divided opinions about whether the company should embrace the revolutionary touchscreen technology or stick to the brand’s identity of using the keyboard on its mobile phones (Ungson & Wong 2014).

Pundits say the decision to venture into the touchscreen market heralded a period of financial hemorrhage for the company, especially after it became clear that it made losses of $965 million because of a weak decision-making process (Ungson & Wong 2014). The damages mostly arose from the failure to clear its Blackberry Z10 stock (Ungson & Wong 2014). The inability of Blackberry to allow app developers to run their programs on the Blackberry OS also stunted the company’s growth because, as Woyke (2014) observes, the developers did not want a platform that constrained them. Evidence of this fact manifests in the refusal by some program developers to allow their applications to run on the Blackberry OS. For example, Instagram and Tumblr refused to let their apps run on the blackberry operating system. However, some experts say blackberry’s failure in the American market was partly caused by the company’s inability to work with Verizon to defeat the competition, which was forged by Apple and AT&T (Hasan 2014). The failure of Blackberry to penetrate the Chinese market further dented the company’s prospects of success and diminished its ability to forge a recovery plan. Today, most of the company’s sales come from a few loyal users in the Americas, Asian, and European markets (Hasan 2014).

Palm is another smartphone company that lost its popularity among smartphone users, despite being a household brand in the late 1990s for its flagship brand – Treo600. In 2010, Hewlett Packard (HP) bought the company for 1.2 billion (Ma 2016). Afterward, it was sold to a Chinese technology company known as TLC because of low sales numbers. The reasons for the company’s collapse are many, but some researchers point to poor leadership and the pursuit of ineffective marketing strategies (Ma 2016). The collective failures of these corporations are extensively highlighted in different academic works, but few have bothered to explain them in greater depth. However, some researchers have pointed out that changes in the smartphone market have partly contributed to their collapse. These changes are highlighted below.

Changes in the Smartphone Market

Shift of Core Value

A key trend in the global smartphone industry that has happened in the last decade is a critical shift in the core value underpinning the industry’s operations. The change in value has been from hardware to software (Savoc 2014). Traditionally most phone companies focused on hardware development, while software content growth was mostly offered through their respective portals. However, the instability involved in exposing customers to new content made this strategy untenable. Nokia was a principal player in this market because it was among the first few companies to focus on software development. However, as Woyke (2014) observes, it did not execute this portion of its corporate strategy well enough to have an impact on the market. This inability made the company’s mobile phones unmarketable to most would-be-customers. At the same time, most customers were focused on having phones that provided good quality functionalities, such as good sound quality, camera quality, and display quality (among others) – attributes that still focused on hardware development (Ma 2016). Thus, companies, such as Nokia, LG, Motorola, Sony Erickson (and others) dominated the market because they had developed essential competencies in hardware development.

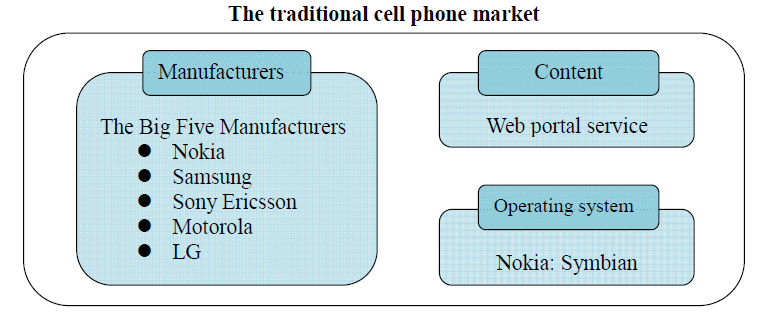

An IDC research study published in 2006 affirms this trend because it shows that in the same year, Nokia led the market by selling 347 million units (Ma 2016). Comparatively, its rival (at the time), Motorola, sold 217 million units, while Samsung sold slightly more than 100 million units (Ungson & Wong 2014). Smartphones only contributed 10% of the total sales. Figure 3 below shows the structure of the traditional phone market.

The standardization of hardware technology and developments in internet configuration changed the entire landscape of the cell phone market and made it possible for software-oriented companies to stake a claim in the market. A critical contribution that came with this change was the ability of users to make significant changes to their mobile phone interfaces, as opposed to the standardized interfaces associated with traditional cell phones. Comprehensively, this analysis shows that a shift in core values from hardware to software has characterized market developments in the last decade. However, this trend has further morphed into new market dynamics that are explained below.

Current Market Analysis

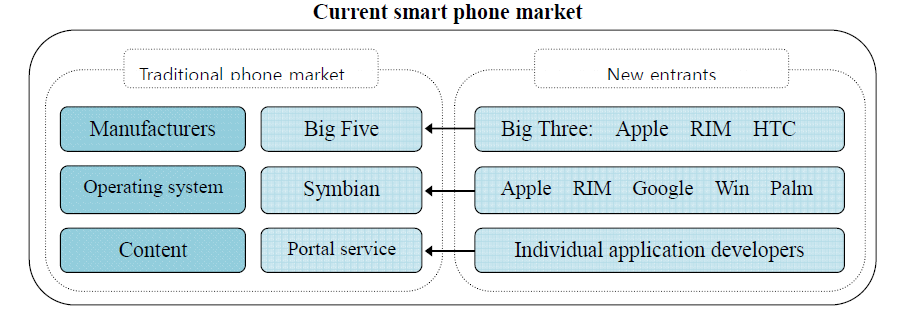

The current market for smartphones can broadly be divided into three main categories that include software-orientation, hardware orientation, and content-orientation. Experts deem the hardware-oriented market as one of the most competitive in the industry (Ma 2016). The second category of the market (software-orientation) has seen new players become increasingly interested in the sector through app development (Ungson & Wong 2014). Some notable players include Apple, Google, RIM, and Nokia. Many researchers regard the process of developing content as a new area of market growth, and it consists of all Smartphone companies because its structure has a vertical integration as industry players look for partnerships that would allow them to achieve their long-term business goals (Ungson & Wong 2014). Figure 4 below provides a synopsis of the current market segmentation, relative to traditional players in the phone market as well as new entrants in the same.

The diagram above shows that different companies have been jostling for the top position. However, various market dynamics and leadership strategies are at play to explain their performance. It is pertinent to investigate each company at a time to understand its effects. This study adopts the case-specific approach.

Summary

The findings of this chapter show that since the popularity of smartphones soared in the last decade, mobile phone companies have been engaged in a bruising battle for the global smartphone market. This chapter has also explained what other researchers have written about the industry and provided a synopsis of its competitive nature that could provide a context, which people could use to understand the successes and failures of the world’s most prominent mobile phone brands. Additionally, this chapter has highlighted different theoretical bases used by various researchers to explain the competitive behaviors of different firms in the global smartphone market. The market-based view, capacity-based view, knowledge-based view, and resource-based view have notably emerged as critical theoretical foundations for analyzing the competitive behaviors of different firms in the industry. However, these frameworks provide general views of how various firms could compete against each other. Therefore, they fail to recognize unique organizational dynamics that are central to making sure organizations succeed.

Of importance in this chapter is the revelation that past studies have generalized changes in the smartphone industry to different organizations without adequately scrutinizing their internal intrigues to comprehend their performance. More specifically, this literature review has not identified research studies that have focused on Nokia as a case study that would help to explain how companies strive to survive in today’s competitive smartphone industry. At the same time, most of the studies that have touched on this research topic are either outdated or too broad in perspective. Based on these gaps in the existing literature, this paper will explore the competitive strategies of one Smartphone Company that is struggling to find its relevance in today’s fast-paced market. Chapter 3 below highlights the research strategy used for answering the research questions.

Methodology

This chapter outlines the research strategies used to answer these research questions. It contains six sections that describe the research approach, research design, data collection strategy, data analysis technique, ethical considerations, and how to address the reliability and validity issues that emerged in the investigation.

Research Approach

According to Ivankova (2014), there are two main types of research approaches – qualitative research and quantitative research. Researchers often use the qualitative research method in cases where they want to explore subjective issues about a research topic. Comparatively, the quantitative research approach is instrumental in answering research questions that have a measurable or quantifiable attribute (Mette 2016). The mixed methods research approach is a third research method used by some researchers, and it includes characteristics of both the qualitative and quantitative approaches. This research approach applies to this research study because competitive strategies in the mobile phone market contain subjective issues (such as consumer-based preferences) and quantitative issues (such as sales numbers).

This paper concentrates on the business strategies adopted by smartphone companies as they compete with one another in today’s fast-paced and aggressive market. Based on the topic’s business-oriented nature, qualitative and quantitative elements of analysis are instrumental in exploring this research topic because business strategies are often formulated through qualitative processes (management outlook and decision-making processes), but the final goal is usually quantitative (profitability). The four research questions underlying this paper also mirror the same dichotomy. Thus, the mixed-method research approach is justifiably used in this study to accommodate both the qualitative and quantitative elements of analysis.

Research Design

According to Mette (2016), there are six research designs associated with the mixed methods research approach. They include the sequential explanatory design, sequential exploratory design, sequential transformative design, concurrent triangulation technique, concurrent nested technique, and concurrent transformative method. These research designs are explained below.

Sequential Explanatory Design

This research design is characterized by the collection of quantitative data as the primary type of information to be relied on in the study. Comparatively, subjective data is integrated complementarily to the analysis. Thus, researchers who want to use qualitative findings to explain quantitative findings mostly use this design of data collection (Riazi 2016).

Sequential Exploratory Design

The sequential exploratory design is often characterized by the predominant use of qualitative data to answer research questions. Quantitative information is also obtained at the same time, but priority is given to qualitative data when answering the research questions. Researchers who prefer to use this research design are often interested in exploring a research phenomenon. For example, it has been commonly used when testing a new instrument of scientific investigation (Mette 2016).

Sequential Transformative Design

This type of research design does not give priority to any data as the predominant one, or one that should be collected first. Instead, it allows researchers to receive equal numbers of quantitative and subjective data during the initial phases of the research. Afterward, the researcher could integrate both types of information when developing the research findings. The goal of choosing this research design is usually to give a researcher enough room to choose whichever type of data that best suits a theoretical perspective (Riazi 2016).

Concurrent Triangulation

As its name suggests, the concurrent triangulation technique is often used when researchers want to gather data concurrently. In other words, it is possible to collect both numeric and subjective data in one study. The purpose of doing so is to cross-validate the information obtained from one type of data with another. Since data collection is concurrent, it is also possible to corroborate the findings obtained. The principal purpose of using the concurrent triangulation technique is to make sure the weaknesses of one type of data do not affect the overall results of the research because they would be counter-managed with the strengths of the other (Mette 2016).

Concurrent Nested Technique

The concurrent nested technique is characterized by the reliance on one type of data and the use of another in a nested or embedded manner. This research design is often used in cases where researchers want to address a research question at multiple levels of analysis. Similarly, it is commonly used in situations where researchers would want to discuss a different matter other than the dominant one (Mette 2016).

Concurrent Transformative Technique

The concurrent transformative technique is used in situations where researchers want the theoretical foundation of a study to guide the entire process of data collection. Since the gist of the research design is based on a specific theory, researchers who want to analyze a particular approach at different levels of analysis mostly use the concurrent transformative technique (Riazi 2016).

Based on the characteristics of the research designs mentioned above, this research study was more adaptive to the sequential exploratory method because it has a strong focus on gathering qualitative data as the central source of information for the research. The qualitative data would be expounded using the secondary data analysis method as a point of reference and corroboration of the findings obtained using the interview method. Thus, the sequential exploratory design emerges as the best research design for the study. Further details surrounding the data collection process appears below.

Data Collection and Sampling Strategy

Information about the research process was obtained on two fronts. As mentioned above, qualitative data was collected using interviews, as the principal data collection method. The meetings involved engagements with professionals who have vast knowledge about the smartphone market. The interview protocol provides a point of reference for understanding some of the fundamental issues discussed in the interview. In total, 16 respondents who worked in two London-based consultancy firms were recruited using the snowball technique. The snowball sampling technique works by selecting respondents based on referrals or recommendations from initial contact (Garner, Wagner & Kawulich 2016). This sampling technique is chosen for the study because the researcher knew one of the professionals who introduced the other respondents to the research. The interviews were semi-structured and took about 30 minutes to complete. Discussions happened via telephone.

The second front of data collection involved a review of published research materials. The research materials were mainly books, journals, and credible websites. Emphasis was made to include only those documents that were published within the last five years. Similarly, only those materials that were released, or verified, by credible authors were included in the study. The keywords and phrases used to conduct the investigation were “Nokia,” “smartphone industry,” “business strategy” and “competition.” The information obtained through this data collection technique was used to verify, compare, and corroborate the interview findings.

Data Analysis

The thematic and coding methods were applied in this study as the central data analysis techniques. The technique involved collecting information obtained from both sets of data highlighted above. The data were categorized into different themes and coded for purposes of easy identification and analysis. The main thematic areas were coined from the main points of focus highlighted in the four research questions, while the codes assigned corresponded to the specific areas of study interest. Since there were four areas of interest in the study, four codes were generated, which were numerically arranged as 1, 2, 3, and 4. The thematic and coding process included six simple steps highlighted in table 1 below.

Table 1: Data Analysis Process.

Ethical Considerations

Privacy and Confidentiality issues

The respondents were guaranteed that the information obtained from them would be presented in the study anonymously. The purpose of doing so was to protect the identity of those who took part in the study. Thus, no names of the respondents are included in the study.

Consent

Consent involves the free will of participants to take part in the research process. All the interviewees did so without any coercion or receipt of payment. They also enjoyed the free will to withdraw from the study at any point without any repercussions.

Treatment of Data

Data obtained from the research was stored and secured in a computer using a password that was only accessible by the researcher. After completion of the study, the data would be destroyed to protect the privacy of the information obtained from the research participants.

Validity and Reliability Issues

Two methods helped to safeguard the quality of the study’s findings. The first one is the member-check technique, which ensured that the results obtained from the respondents were shared with them. The purpose of doing so was to make sure that the views presented in this study were actual representations of what the respondents said. Amendments were made in areas where the interviewees felt that their views were misrepresented.

Findings

As highlighted in the third section of this paper, the principal sources of information for this study were interviews and secondary research data. These two sources of research information were used to answer the four central research questions of the investigation. This chapter outlines the main findings that emerged from the analysis.

Interview Findings

Eighteen respondents were recommended for the study using the snowball sampling technique. However, only 16 of them found time to participate. Four thematic areas having unique codes as depicted in table 2 below summarised the findings. The table below shows the main thematic areas represented by each code.

Table 2: Thematic Areas and their assigned Codes.

Factors that Led to Nokia’s Fall

The reasons given by the respondents as the main factors that led to Nokia’s decline were widespread and far-between. However, the emergence of Apple and the Android operating system in the mobile phone market became a typical response from most of the respondents. They believed that these two entities made it untenable for Nokia to continue doing business (as it was) because they offered customers better alternatives such as superior products and services. However, some of the respondents deemed the explanations for the failure of Nokia to rise to the challenge posed by Apple and Android as “mysterious”. However, two of them tried to clarify this issue by saying that Nokia underestimated the power of the software business to its corporate model.

At the same time, they pointed out that the company did not understand the importance of transitioning to the smartphone business as a critical component of its business model. One of the respondents said that this inaction was in a way a case of the company being trapped in its past success. The same respondent said, “You know, in one way, I cannot blame Nokia for its failure because most of its profits around 2007 were not predominantly coming from the smartphone business. Therefore, it is forgivable that they did not see it as a threat to their bottom-line. However, this should not have been an excuse for it not to be ahead of the curve.”

Another respondent who shared a similar opinion said, “You have to look at this issue in the right context. In 2007, the touch screen and smartphone business largely looked like a high price-low volume kind of business. In general business terms, we would refer to this market as a high-risk model. Therefore, I understand Nokia’s reluctance to venture into it. However, I must admit that its failure to transition into a new age of mobile telephony contributed to its failure.” Another reason touted by some of the respondents as part of Nokia’s failure is its inability to gauge its brand strength. They argued that the company significantly overshot its brand value by thinking that it was probably “too big to fail.” One of the interviewees further opined that Nokia thought it could catch up quickly with the market, but this did not happen. Thus, it was left in a disadvantaged position when most of its competitors produced better mobile phones for its traditional customers, who later changed their brand loyalty.

Factors That Contributed to the Success of Nokia’s Rival

A key theme that emerged from the respondent’s views regarding the main factors that contributed to the success of Nokia’s rivals was an innovation. Notably, the interviewees argued that innovation was perhaps the most revolutionizing thing that Nokia’s competitors did to outwit it. The touchscreen technology was also one example highlighted by some of the respondents as another type of innovative development that contributed to the success of Nokia’s rivals. For example, creative mobile phone designs are also featured among some of the views highlighted by the respondents. One of them explained that innovation influenced how companies designed their phones – a process that revolutionized the smartphone market since 2007.

The respondents commonly drew comparisons between Nokia and Apple because they said both companies had different visions of the industry and executed them as such. While Nokia’s vision was mostly focused on making some of the world’s best handheld devices, Apple focused on revolutionizing the industry by creating a similarly revolutionary touch interface that was a big hit among many smartphone users. From this understanding, a better grasp of consumer experience also emerged as another strength of Nokia’s rivals that helped them overshadow the once-dominant tech giant.

Respondents who used Apple as an example of Nokia’s rivals mostly referenced this attribute. One of the respondents had the following to say, “See…some of Nokia’s rivals were facing absolute irrelevance in the tech market, mostly because they were facing stiff competition from other companies. One such example is Apple, which was facing stiff competition from its rivals. The company knew that if it did not do something drastic, it would be “game over” for them. So they had to innovate and come up with a dramatic product that could disrupt the market. Their gamble paid off, and I must admit Nokia did not see it coming.” Comprehensively, based on the findings of this interview area, innovation emerged as a key area of analysis that helped to answer the question regarding what helped Nokia’s rivals supersede its market dominance. However, it was interesting to note that the respondents considered Apple to be Nokia’s main rival that contributed to its fall.

Potential for Nokia’s Revival

When the respondents were asked to state their views about the revival of Nokia, only two of them answered in the affirmative. They believed the company has a real potential of reinventing itself because the smartphone industry is not static. However, most of them believed that so much had happened in the industry, since the fall of the tech giant for it to forge a formidable comeback. One of the respondents who held this opinion said, “I do not believe Nokia could forge a comeback because it takes years to build some of the competencies that existing market leaders have developed. In the past five years, it has not been able to do so. I do not see how it could do so in the next five years, or even in the next decade.” Another respondent who held a contrary opinion said, “The smartphone industry is a very volatile market. Companies that dominate the market today were not known a decade ago. All it takes is ingenuity and clear organizational strategies for Nokia to make a comeback. If it were possible for a completely new company to have an impact on the market today, I would not deem it impossible for an experienced organization, such as Nokia, to make a comeback.”

The above views notwithstanding, most of the respondents sampled did not believe that Nokia could make a comeback in the market. Their views were mostly hinged on the company’s failure to make any significant attempts to reinvent itself in the past five years, thereby casting doubts regarding the management’s ability to do so. Changing market dynamics also emerged as an impediment for the organization to tap into current market opportunities. Thus, the collective view was that Nokia has a low probability of reviving its business, at least to the level of market dominance it used to enjoy.

How Nokia Could Reclaim Its Market Dominance

When the respondents were asked to state their views regarding how Nokia could reclaim its market dominance in the wake of today’s competitive and fast-paced smartphone market, most of them expressed their reservations about the likelihood of such a thing happening. Their main point of discussion was the company’s inability to marshal a robust infrastructure, or pool of resources, to match its competitors. The sale of some of its principal divisions mainly sprung up as a common point of discussion for most of those sampled because they believed that this action rid the company of some of its key competencies or business divisions that would have ended up aiding it in its long path to recovery. The sale of some of the company’s business divisions to Motorola was mainly identified by some of the respondents as an example of the company’s inability to make a significant comeback. Only two respondents believed the company could make such a turnaround because they argued that its hardware and engineering competencies could still be leveraged on its competitors.

Secondary Data Analysis Findings

This section of the analysis highlights the findings obtained from a review of secondary data analysis. In total, 43 articles matched the search criteria highlighted in chapter 3 of the report. However, only 21 materials were used in the paper based on the exclusion and inclusion criteria mentioned in the same chapter.

Factors That Led to Nokia’s Fall

According to most research studies sampled in this report, Nokia’s failure was partly caused by the company’s perceived unwillingness to efficiently innovate and align its business strategies with changes in consumer tastes and preferences (Savoc 2014). In other words, the lack of innovation was touted as one of the main reasons for the fall of Nokia. Again, it is imperative to understand how Apple surpassed Nokia in the global smartphone market to demonstrate this fact. The latter was eager to innovate by introducing new technologies that would allow it to create new products and services for its clients. This innovation strategy is similarly demonstrable through the development of the iPhone after the introduction of the iPod in 2001 in a move that was largely touted by many observers as a deliberate attempt by Apple to cannibalize its product (Savoc 2014). This strategy was developed after the company’s founder, Steve Jobs, saw how smartphones with cameras had obliterated the camera market. Thus, he was fearful that the same would happen to the iPod, mainly because Smartphones were cheap (Savoc 2014). Therefore, he decided to innovate. Nokia did no such thing.

Nokia’s dominant failure emerged from its fixation on the hardware development market, thereby neglecting other aspects of its products that required innovation as well. This strategy was contrary to the approach taken by its rivals who decided to build ecosystems around their products that included hardware, mobile phone applications, and unique operating systems (Ungson & Wong 2014). While this finding is correct, it is equally important to point out that the company did not refuse to innovate. For example, it was among the first businesses to introduce the touchscreen feature on its mobile phones. At the same time, it was among the first companies to offer Wi-Fi and camera features on its mobile phones. However, its innovations failed to take off because of the company’s inability to provide its customers with radically different user experiences that would revolutionize its business model. These issues were the main weaknesses of its corporate strategy that contributed to its failure. In separate quarters, Nokia’s failures were mostly attributed to the company’s pursuance of an innovative incremental craft, as opposed to a radical or disruptive creative plan. In other words, the company needed to do “something big” to maintain its market share, or prove to its customers that it was still valuable to them. However, this outcome failed to suffice.

As highlighted through examples mentioned above, the entry of Apple’s iPhone in the smartphone market emerged as a key point of reference in most studies sampled. Most of them showed that before 2007, Apple had negligible sales compared to the numbers it boasts of today. For example, an article by Jin (2015) reveals that the success of the iPhone was mainly pegged on its revolutionary nature, which most competitors, such as Nokia and Samsung, could not match up to. Other reports showed a higher contrast between the performance of Nokia and Apple by demonstrating that, in 2007, Apple had zero sales in the Smartphone market, while Nokia enjoyed more than 50% of the global mobile market (Ungson & Wong 2014).

However, in 2013, the tables turned when Apple managed to command more than 40% of the market in America alone. In the same year, the California-based company managed to stake a claim to about 50% of the global cash flow in the smartphone industry. Reports also show that in 2013, Apple had managed to increase its sales numbers to more than five times those reported by Nokia (Ungson & Wong 2014). In other words, Apple was selling up to 150 million mobile phones in one fiscal year, while Nokia was only selling 30 million mobile phones (Ungson & Wong 2014). Google and Samsung also exploited Nokia’s unwillingness to innovate to further diminish its dominant position in the global smartphone market (Woyke 2014).

Factors That Contributed to the Success of Nokia’s Rivals

Different publications sampled in this report highlighted various issues that contributed to the success of Nokia’s competitors in the smartphone industry (Li 2017). Stemming from the differences in corporate strategies adopted by the company and its rivals, Apple leveraged its software to provide its customers with other products, including music, movies, and mobile phone applications. This business model allowed other players in other industries to plug into the Apple ecosystem and develop a new brand that would enable them to make money from it as well. iTunes is an example of such an innovative model. The Appstore is another unique product highlighted by a sample of the publications reviewed that emerged from this strategy. The realization by Nokia’s rivals that customers wanted a better user experience created additional value to customers, thereby making them more appealing than traditional mobile phone brands, such as Nokia. Overall, this outcome meant that, while Nokia was mostly focusing on building a brand that centered on technological competence/superiority, its rivals were able to develop a new ecosystem that allowed them to create value through product-service ecosystems. This strategy allowed them to dislodge Nokia from the helm of the smartphone market.

How Nokia Could Reclaim Its Market Dominance and Potential for Nokia’s Revival

An insufficient volume of literature explained how Nokia could reclaim its market dominance. Most of them provided a synopsis of efforts by the company to make a comeback in the global smartphone market, but none of them painted an optimistic view of the company. Nonetheless, some of the documents sampled showed that the company has a better opportunity of reclaiming its market position by trying to position itself in developing markets, as opposed to reclaiming its once-dominant position in the American or European markets (Li 2017). Besides this proposal, few studies delved deeper into this area of investigation.

Analysis

This section provides an analysis of the main findings gathered through the interviews and secondary data collection processes. As mentioned in the research design (chapter 3), the justification for selecting the sequential exploratory technique was hinged on its focus on qualitative data, which was the primary source of information for this study. Published research information was also used in this study, but it will be integrated into this chapter as secondary research information. These two sources of research data were used to answer four central research questions that strived to estimate the potential for Nokia’s revival in the technology industry and understand the factors that led to Nokia’s demise. The inquiries also sought to evaluate the elements that added to the success of the company’s rivals and formulate recommendations that could help it to reclaim its market dominance. These four areas of investigation are explained in this chapter, relative to the findings gathered in chapter 4.

Factors That Led To Nokia’s Fall

Based on the analysis of the secondary research information and interview findings, we find that both datasets support the narrative that Nokia did very little to innovate, as a way of keeping its competitors at bay. This view is primarily supported by independent studies, which demonstrated Nokia’s fall from the top. For example, several studies showed that Nokia used to be a leader among many of its peers during the early and mid-2000s. The Symbian OS was responsible for most of the company’s success, but the same operating system failed to deliver the same success through the Android era. The company’s excellent performance (pre-2000 period) was enshrined in the fact that out of the 20 best selling brands in mobile phone history, Nokia phones were at the top.

Several publications sampled in this review showed that the popularity of Nokia mobile phones was at an all-time high in the company’s history, such that it was not possible to think of mobile phones without mentioning Nokia (Li 2017; Ungson & Wong 2014). In the mid-2000s, Nokia was extensively touted as one of the world best selling mobile phone companies based on independent reports, which showed that the company was responsible for manufacturing half of all mobile phones on the planet (Ungson & Wong 2014). At the same time, its Symbian OS was used in 65% of the global mobile phone market. However, in less than a decade the corporation faltered and lost its dominance of the global mobile phone market to other players, such as Apple and Samsung.

According to a comprehensive review of the interview findings, the year 2007 was a significant one for Nokia because many of the interviewees believed the launch of the iPhone was a turning point for the company because the latter was a vital device that revolutionized the smartphone industry. During the year, Nokia’s market share significantly declined, while Apple’s skyrocketed. This outcome was also affirmed by independent reports sampled through the secondary data analysis. A more in-depth analysis of this fact reveals that the pressure exerted by the popularity of the Android operating system on low-end mobile phone users also caused a strain on the company’s bottom-line performance because it was unable to cope with different pressures from the market. Consequently, Nokia had to cede its control of the mobile phone market to Samsung, Apple, and other competitors.

This move heralded an end to Nokia’s dominance of the mobile phone market, which it had enjoyed for more than 14 years. Coupled with the company’s strategy of using the Windows operating system, Nokia ultimately failed to outwit its competitors. The company’s decline was further signified by its announcement of the sale of the Symbian operating system, which happened in 2013 (MIC Research Team 2016). At this time, the operating system was of little value to investors. In 2014, the organization also announced that it had to sell some of its products and services to willing investors. Around the same time, the company also sold its patents to Microsoft for 1.2 billion (MIC Research Team 2016). The 2014 agreement marked an end to Nokia’s dominance in the market. Most of these events have been captured in multiple materials that have documented the company’s decline. However, an interesting dynamic that the respondents sampled revealed was the identification of the company’s failure to innovate as being at the heart of the problem.

Factors That Contributed To the Success of Nokia’s Rivals

The main factors that contributed to the success of Nokia’s rivals were highlighted by most of the respondents to be a better understanding of the market by Nokia’s competitors. In the words of Cecere (2014), the company’s rivals had a better grip on the pulse of the market by a better understanding of future consumer tastes and preferences. The shift from hardware to software emerged as the core point of reference for this assertion because companies that understood this fact, such as Apple, were able to significantly increase their market share, while those that did not lose customers. Nokia falls in the latter group. The ability to change with the market further draws our attention to the concept of change management, which is at the heart of the leadership of most of Nokia’s rivals. In other words, the Finnish company was unable to recognize this fact and therefore unable to respond decisively to market needs. The same problem has been highlighted in the literature review section as being a cause of Blackberry’s fall.

How Nokia Could Reclaim Its Market Dominance

Nokia could reclaim its market dominance by addressing one of its fundamental problems, which is innovation. Innovation has been highlighted as a pivotal issue in most of its business divisions and has been supported by both the interview and secondary review findings. While this may be true, it is also important to point out that innovation in a company (or the lack thereof) is mostly a leadership issue. In other words, proper or visionary leadership should help businesses to manage the market and their internal resources better. Nokia had no shortfall of funds and, as the resource-based view stipulates, it should have succeeded to develop a strong competitive position over its rivals. However, this did not happen because of a leadership problem in the company.

The contrast between Apple and Nokia’s leadership, which has been cited several times in this report, highlights this fact because Apple’s vision of developing a revolutionary device was more superior to Nokia’s concept of focusing on its hardware competencies. Typically, what Nokia lacked was proper leadership that could have helped it to navigate the murky waters of the competitive mobile phone market. Based on this analysis, Nokia could reclaim its market dominance by developing effective leadership.

Potential for Nokia’s Revival

According to the findings highlighted in this paper, the potential for Nokia’s revival was either unexplored (secondary research analysis) or perceived to have a low likelihood (interview findings). These conclusions were mostly derived from the fact that Nokia sold most of the fundamental business divisions that could have helped it to revamp its business operations. A majority of the respondents highlighted this view. Independent research findings also support this assertion because they show that Nokia sold off most of its engineering and hardware development operations to other corporations, such as Motorola – a process that has made it significantly weaker, relative to how it used to perform in the past.

However, the idea that the company could forge a new competitive front in emerging markets also appears as a possible frontier for the company’s re-emergence because some reports have shown that this potential exists in these markets. This view stems from the fact that the company has reported significant losses in several years from most of its traditional markets. It has poorly performed in the American and European markets. Currently, most of its sales come from the Asian (Middle East) and African markets (Cecere 2014). These markets are where their potential lies. Based on this analysis, the knowledge-based view highlighted in chapter 2 of this paper emerges as the central theoretical foundation for this exposition because most of the changes that have shaped the smartphone market in the past decade are mostly linked to knowledge creation.

Conclusion

This paper has set the analysis of Nokia’s business strategy within the extended context of the competitive smartphone industry. Notably, the investigation of the research questions in this paper has focused on the company’s positioning and the relationship between its competitive strategies with the dynamics of the smartphone market. This report has provided an analysis of the same market, including a synopsis of its origin, growth, and structure with a predetermined goal of understanding the critical dynamics that players have to adapt to in a bid to win more customers. Although this study has primarily concentrated on Nokia, it has also profiled the strategies adopted by other companies to stay relevant in the global smartphone market by contextualizing their policies and market approaches within the extended understanding of evolving industry trends and dynamics. This view was the overarching aim of the study, but a more specific investigation of the same drew our attention to Nokia.

Four central research questions guided this study. They strived to estimate the potential for Nokia’s revival in the technology industry, understand the factors that led to the demise of Nokia, evaluate the issues, which added to the success of the company’s rivals and formulate recommendations that could help it to reclaim its market dominance. A comprehensive review of the findings gathered from the secondary data analysis, and interview findings showed that Nokia’s lack of understanding about changing consumer tastes and preferences, its failure to innovate, and its overconfidence on the company’s brand image were mostly responsible for its failure. The same sources of information showed that Nokia’s rivals took advantage of these weaknesses and dislodged the once-dominant company from the helm of the mobile phone market.

Apple emerged as one of the company’s most formidable competitors that largely contributed to its fall. Samsung also emerged as another successful company that dislodged Nokia from the top position in the market. The focus on the software part of mobile phone operations, as opposed to hardware development, was one strategy adopted by both companies in the quest to produce superior products that led to the collapse of the Finnish company. Since both organizations still dominate the market and are spending many resources in research and development, the potential for Nokia’s revival remains grim. Although the secondary research data analyzed in this report never investigated this matter carefully, the interviewers sampled demonstrated the same pessimism. However, the recommendations section below provides some insights into what Nokia needs to focus on to improve its future market position.

Recommendations

The tale of Nokia and its decline offers a compelling story of what modern technology companies should do to stay relevant in today’s fast-paced smartphone industry. More importantly, it provides valuable lessons for corporations that may want to enter the smartphone market. However, essential to this study is the need to understand the importance of leadership in managing operations in the smartphone industry. Leadership is instrumental in this analysis because it encompasses all processes that could be instrumental in an organization’s survival strategy. Expressly, it is essential in improving the competitive positioning of firms because leadership creates an organization’s vision that helps it to navigate extreme competitive pressures, such as that which Nokia experienced.

Most of the findings highlighted in this paper drew our attention to innovation as a key aspect of operational weakness that led to Nokia’s collapse. However, what respondents may have failed to mention was that this was largely a leadership problem at the organization. The resource-based view, market-based view, and knowledge-based view cannot adequately conceptualize the weaknesses of the company because they fail to understand the intangible elements of firm behavior that are essential to their success. However, the capacity-based view of firm competitive strategies best explains Nokia’s problem because it was unable to develop the capacity to formulate influential leadership plans that would guide the company through the intense competition it was facing. Thus, the findings of this paper draw our attention to the need for practical leadership reforms at Nokia if it is to reclaim its position at the helm of the competitive smartphone market.

Reference List

Bromiley, P & Rau, D 2016, ‘Operations management and the resource-based view: another view’, Journal of Operations Management, vol. 41, no. 1, pp. 95-106.

Burton, C & Rycroft-Malone, B 2014, ‘Resource-based view of the firm as a theoretical lens on the organisational consequences of quality improvement’, International Journal of Health Policy and Management, vol. 3, no. 3, pp. 113–115.

Cecere, G 2014, ‘Innovation and competition in the smartphone industry: is there a dominant design’, Telecommunications Policy, vol. 3, no. 1, pp. 12-19.

Garner, M, Wagner, C & Kawulich, B (eds.) 2016, Teaching research methods in the social sciences, Routledge, London, UK.

Hasan, H 2014, Being practical with theory: a window into business research, THEORI, Wollongong, AU.

Ivankova, N 2014, Mixed methods applications in action research: from methods to community action, SAGE Publications, London, UK.

Jin, D 2015, Digital platforms, imperialism and political culture, Routledge, London, UK.

Jin, D 2017, Smartland Korea: mobile communication, culture, and society, University of Michigan Press, Oregon, MI.

Li, W 2017, Strategic management accounting: a practical guidebook with case studies, Springer, New York, NY.

Ma, W 2016, China’s mobile economy: opportunities in the largest and fastest information consumption boom, John Wiley & Sons, London, UK.

McGee, J 2015, ‘Market-Based View’, Wiley Encyclopedia of Management, vol. 12, no. 1, pp. 1-10.

Mette, B 2016, Mixed methods research for improved scientific study, IGI Global, New York, NY.