Introduction

The Organization of the Petroleum Exporting Countries was founded in September 1960 by five major oil exporters namely Saudi Arabia, Iran, Iraq, Kuwait and Venezuela. Its initial objectives was to cordinate petroleum policies among the member countries and to formulate measures to stabilise prices.

In addition, the cartel sought to ensure consistent supply to their consumers and substantial returns for investors in the industry (OPEC 2011). The organization was further joined by Qatar, Indonesia, Libya, UAE, Algeria, Nigeria, Ecuador, Angola and Gabon but some of the countries later suspended their membership (OPEC 2011).

The formation of OPEC was essentially driven by the transition in international economic and political landscape and rose to prominence in the 1970s with its member countries dominating the world market consequently influencing oil prices (OPEC 2011). It was during this time that OPEC gained the mandate to dictate oil production and oil revenue among the thirteen member countries.

The cartel formulated a pricing policy whereby they set the market price for Saudi Arabian crude through which other member countries would standardize their prices. The policy remained effective due to the prevalent high demand and price consistency and enhanced price increment which led to increased revenue.

Due to continous increase in prices, the demand for oil fell in the subsequent years and impact on the oil industry was further intensified by the recession that took place in 1980s prompting OPEC to limit output of its member countries inorder to maintain prices at high levels.

However, the prices continued to weaken and crashed in 1986 due to the oil glut, reduced global demand as well as the increasing environmental concerns regarding the use of hydro carbon fuels (OPEC 2011). Consequently, Opec’s global market share reduced significantlyb with its total revenue dropping to such levels that the member countries experienced severe financial turmoil.

In response to constant fluctuations in the prices and market conditions, OPEC developed an oil price brand mechanism which facilitated the strengthening and stabilizing crude oil prices in early 2000 (OPEC 2011).

Trends In Crude Oil Prices And The Factors Affecting Such Trends

Crude oil prices, just like prices of other commodities, are affected by the prevailing market conditions with regard to demand and supply (WTRG 2009). OPEC seeks to regulate prices in response to changes in demand and supply of oil in the world market.

However, the cartel has been constantly criticized for failing to effectively control crude oil prices especially due to its lack of an effective mechanism to enforce member quotas other than Saudi Arabia spare capacity (WTRG 2009).

Oil Prices Trends (2000 and 2011)

The price of crude oil has risen drastically since 2006 due to the rising economic instability, increasing global demand among other factors. The increasing concerns over sustainability of oil reserves created widespread uncertainities which put pressure on prices forcing them to increase. In addition, it significantly reduced supply amidst rapidly increasing global demand for oil (Alnaswari 1991).

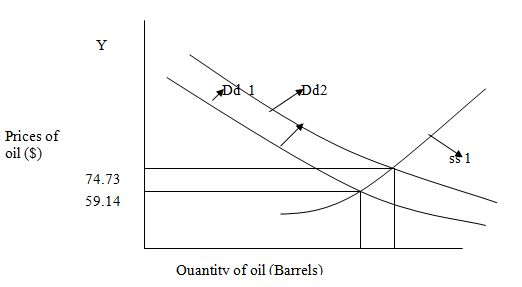

In 2006, the prices of oil remained relatively low with the highest price hitting 75 while the lowest price was around 59.14. As shown in the graph below, prices were relatively constant due to consistency in supply and slight increase in demand.

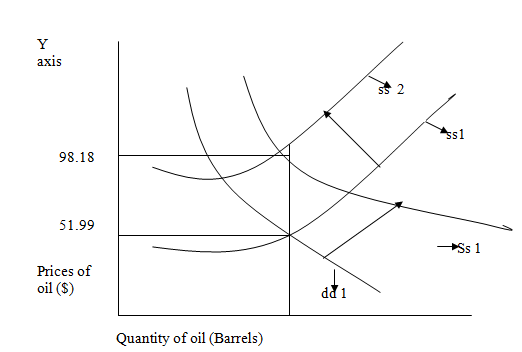

In 2007, the global financial crisis was setting in and there was widespread uncertainities which limited supply consequently increasing prices. Increasing demand for oil in the global market due to rapid industrialization had a major impact on the prices of oil world wide. Increased demand, coupled with decreasing supplies has only served to push prices above the equilibrium prices as shown in the figure below.

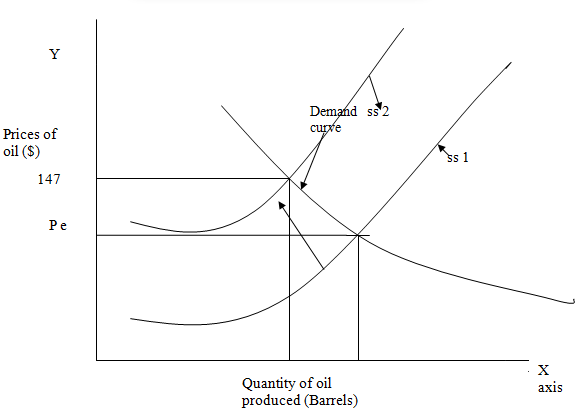

The period of 2007/2008 was characterised by the global financial crises which saw the prices of oil increase sharply during the period. In 2008, the crude oil prices reached a record high of $ 147 per barell due to widespread uncertainities which limited supply. However, prices fell rapidly in mid 2008 due to rapid decline in demand from the OECD countries (ESCWA 2009).

The financial crisis adversely affected the oil prices due to the dwindling of global demand and liquidation of operators in the commodity market but the conditions in the petroleum industry were expected to improve in the subsequent years.

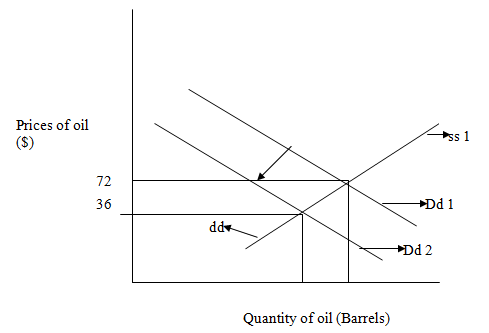

In 2009, the prices of oil continued to decline from the high levels achieved in 2008. Price increment in 2008 had risen partly due to speculations to bid up prices which led to creation of a bubble. However, these unsustainable prices fell drastically due to lack of adequate demand to support the inflated prices. In deed, towards the end of 2009, the price of crude oil had fallen by 70% (ESCWA 2009).

The prices however stabilized in 2010 with the highest price being 91.38 and the lowest being 91.3.

Conditions Facilitating The Formation of OPEC

OPEC was established as a permanent organization with international status by an agreement concluded between the five founding members in 1960 (al-Otaiba 1975).

Formation of OPEC was preceeded by increased conflict between oil producing countries and multinational oil companies which were operating under the concessionary agreement which gave such companies the rights to extract oil in return for royalties. This arrangement diminished the influence of oil producing countries on oil production and oil prices which called for extensive reforms in the industry.

The early 1970s were characterized by rising demand for oil which led to increased revenue for OPEC member countries. However, the Yom Kippur war and the arab oil embargo made a major impact on the operations of OPEC during the early 70s.

The oil embargo imposed by OPEC in response to the American decision to provide support to the Israeli militia during the war adversely affected the overall petroleum industry leading to an oil crisis. Consequently, the oil prices shot up, supply was disrupted and the economy in most regions went into recession.

The oil market was tightening which prompted the oil producing countries in the Arab world to strategically use the oil resource as a means to secure economic and political objectives (Anonymous 2001). This led to international prominence of OPEC during the decade with the member countries dominating the sector both domestically and internationally (OPEC 2011).

The Arab oil embargo of 1973 and Iranian Revolution of 1979 however led to sharp oil price increments which prompted OPEC to broaden its scope of control and advocated for cooperation in international relations. Opec members further sought to increase their incomes by increasing world oil prices which resulted in massive income declines and fall out with major oil companies operating outside the cartel.

The years preceeding the mid1980s were characterised by price weakening which saw the eventual price crash in 1986. The overall consumer market was reducing in favor of alternative sources of energy and OPEC market share continued to shrink. Towards the end of the decade, prices began to increase coupled with substantial recovery in the cartel’s output share (OPEC 2011).

This was facilitated by introduction of a production ceiling and a reference basket for pricing coupled with increased cooperation between OPEC and non OPEC member countries which promoted market stabilization. The iran Iraq war had a major impact on the oil production in the Opec region which led to the need for intervention from external bodies.

Hence the cease fire that took place in the mid 80s and the UN intervention on the war positively impacted on OPEC operations through promotion in oil production in the warring countries and enhancement of political stability in the region.

In the years preceeding the early 2000s OPEC achieved increased price stabilization and significantly influenced the market through imposition of production ceiling. OPEC has faced great chalenges in the early 2000s emmanating from economic and political instabilities in the Middle East and the rest of the world.

Economic crisis and constant energy crisis over the decade resulted in loss of price control despite the numerous policies formulated by OPEC to regulate oil prices during the decade (Mankiw 2007). In addition, Opec had to deal with the increasing concerns regarding sustainability of reserves and the increasing demand especially in China and India.

Future Decline In World Output And Its Likely Effects on OPEC’s Behavior

The future of world oil production will be dependent on the same factors that have affected the same in the past. These factors include the prevailing market prices, the rate of economic development, availability and relative prices of alternative sources of energy, technological change in production and public policies (shojai 1995).

There exists sufficient oil supplies to sustain high levels of production for a considerable period of time with the distribution of oil reserves across the world strongly favoring OPEC members (Shojai 1995). Thus, the role of OPEC in future oil production and oil prices regulation continues to be emphasized.

The greatest challenge that OPEC will face in future oil regulation entails decision making on issues regarding the level of production effective to ensure sustainability of the declining oil reserves in the long run (Pattra 2004). In addition, the cartel has to develop efficient production facilities that can facilitate deeper exploration and enhance future productivity.

The cartel will be faced with the dilemna of whether to increase or restrict current and future exploration. Increased restrictions on oil production either currently or in the future may lead to price increment which may negatively impact on the demand by consuming nations (Shojai 1995). On the other hand, increasing production in order to lower prices will only lead to further depletion of oil reserves.

Hence, in planning for future production, OPEC’s failure to increase future capacity will result in high prices while increasing capacity will result in overproduction which only serves to complicate the role OPEC in the future.

The past actions of non OPEC member countries have played a significant role in strengthening the future capabilities of OPEC in oil production. Countries outside the cartel have engaged in overproduction which has resulted in depletion of their oil reserves relative to OPEC members (Patra 2004).

The single most improtant objective of OPEC will therefore be to maximize the revenue of its member countries through manipulating oil prices in their favor. This objecctive will only be achieved if the prices are kept at levels capable of sustaining both demand and supply over a long period of time (Patra 2004).

This critical future role of Middle East and OPEC producers will be heavily influenced by rate of global demand for oil, energy efficiency, non OPEC production, conservationand alternative sources of fuel (Patra 2004). With decline in OECD production, OPEC will continue to grow making the most powerful oil cartel in the world.

OPEC is expected to account for less that 50% of total projected U S petroleum imports with the share increasing gradually to 50 % by 2019 (OIAF 2003).

This calls for the need for extensive future investment among OPEC member countries which incorporates confiigurations that are more advanced than those currently in operation in order to enable the countries to meeet increasing world wide demand for environmentally friendly fuels, lighter products, upgraded residual fuel, and fuels with reduced lead levels (OIAF 2003).

The projected increases in OPEC production capacity is consistent with announced plans for OPEC’s future capacity expansion with its 2025 projections being estimated to be about 61 barrels per day which will be twice the daily capacity produced in 2001 (OIAF 2003).

However variations prevalent in forecast figures are a clear reflection of the uncertainities sorrounding prospects of OPEC’s future production. Expansion of production capacities in the future will entail substansive capital investment which will depend on availability and regulation of foreign investment in the OPEC region (OIAF 2003).

Reference List

Alnaswari, A. 1991. Arab nationalism, oil, and the political economy of dependency. Connecticut, Greenwood Publishing Group.

Al-Otaiba, 1975. Opec and the petroleum industry, London: Taylor & Francis.

Anonymous, 2001. History of OPEC. Web.

ESCWA, 2009. The impact of the global fnancial crisis on the world’s oil market and its implications for the GCC countries. Web.

Mankiw, G. N, 2007. Essentials Of Economics. New York, Cengage learning.

OIAF, 2003. Annual energy outlook 2003: with projections to 2025. Washington DC, DIANE Publishing.

OPEC, 2011. Organization’s Official Website. Web.

Patra, C. D. 2004, Oil Industry In India: Problems And Prospects In Post-APM era. New Delhi, Mittal Publications.

Shojai S, 1995. The New Global Oil Market: Understanding Energy Issues In The World Economy. Connecticut, Greenwood Publishing Group.

WRTG, 2009. Oil price history and analysis, London:WRTG Economics. Web.