Introduction

The Airline industry in Saudi Arabia is one of the largest business industries in the Middle East. It contributes 1.8% to the total GDP of the country. According to Oxford Economics (2011), air transport business in Saudi Arabia creates three different types of economic benefits for any country i.e. contributes to GDP, creates jobs and subsidizes towards tax revenues and develops a strong supply chain network for the country. In support of this claim, Mishra (2013) contends that Saudi Arabian Airlines have contributed in all these ways for the economy of the Kingdom of Saudi-Arabia (KSA).

Saudi Arabian Airlines (SV) started operations as a national carrier of KSA since 1945 (PWC 2017). In the following six decades, it became the largest in the business across the world. The reports in 2017 still name SV as the fastest expanding airlines despite the social and political pressure in the region (Gulliver 2017). The purpose of this report, therefore, is to shed light on the reasons of the success of this airline service by paying special attention to the airline/airport relationship and the role this has played in helping SV gain a competitive edge in the airline industry. The second section of the report presents the financial analysis of the SV and building on from this analysis suggests future perspectives for KSA.

Section I

Airport/Airline Relationship

According to Oxford (2015), airports are divided into airside and landside. Airside includes all the areas like taxiways, ramps and runways accessible to aircraft; whereas the landside includes stations, roads, and ability to handle cargo, parking lots and access to railway stations. The airside and landside of the SV are discussed below.

Airside bases of Saudi Arabian Airlines

The main operations of SV take place from the Jeddah’s King Abdul Aziz (JED) Airport. Its secondary hubs are at Dammam-King Fahd International Airport (DMM) and Riyadh-King Khalid (RUH) airport. The Dammam Airport was opened in 1999 for the commercial usage. SV is the largest airline in the Middle East in terms of revenue and passengers. SV used to occupy a lower position as compared to Emirates and Qatar Airways, but in the recent years, it has jumped a position up. The detailed financial analysis on the subject has been carried out in the second section. SV operates international and domestically scheduled flights to about 120 destinations in the world, including Asia, Africa, Middle East, North America and Europe. Saudi Arabia has joined the Skyteam airlines alliance since the year of 2012 and since then, it is recognized under the banner of this alliance (PWC 2017).

Gulliver (2017) reveals that in the recent year, this Skyteam carrier has been serving 81 airports across 36 countries. Recently services to Indonesia, Munich (Germany) and Ankara (Turkey) have been added to the airside fleet services of the airline. The airline has further two business subsidies which are cargo and catering.

Below the growth, capacity and strength of the major airport bases of SV have been discussed.

King Abul-Aziz Airport in Jeddah: The Jeddah International airport, following a contract with Saudi Bin-Laden Group, is investing $7.21 billion to develop infrastructure and add a new terminal at the Jeddah Airport. This project intends to expand the traffic handling capacity of Jeddah Airport from 17 million passengers to 30 million passengers, hence strengthening the airbase of SV (ACEC 2011). Jeddah Airport aspires to support the airlines on its facilities by aiming to increase its annual capacity to up-to 80 million passengers by 2035.

Riyadh Airport: The table below indicates the increase in capacity of the passenger handling facilities by the Riyadh Airport (Table 1). This growth can be attributed to the GACA approved expansion plan which aims to expand the passengers’ capacity from 14 million to 26 million (ACEC 2011). The expansion is mid-phase and therefore, the passenger handling capacity has seen an upward trend. Later, the part of the expansion would include providing places for handling private jets but due to limited resources at the moments, the authorities cannot continue with this plan.

Table 1: Aircraft Services

Dammam Airport: The Dammam Airport perhaps has seen the most promising figure of growth when compared to other airport competitors (Table 2). Its passengers and cargo handling facilities are constantly increasing and therefore the catering and cargo business of SV prefers Dammam Airport for the business purposes. This airport gets the maximum traffic for commercial purposes from the SV Airlines.

Table 2: Aircraft Services

Landside services for SV Airlines

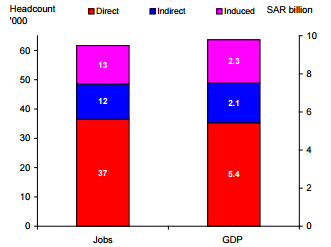

The Riyadh, Dammam and Jeddah Airports together have the capacity to handle the baggage, ticketing and retailing of 32 million passengers per year (ACEC 2011). They have grown to handle thousands of tons of freight on behalf of the national carrier. SV Airlines, along with the others, support their supply chains by hiring the airport staff directly, hence contributing $11.3 billion to KSA’s economy. The chart shown below indicates the direct and indirect contribution made by the land-based and air-based services of the airlines and the airports for the GDP of the KSA (Chart 1).

The Airport, Airline Relations and Business Opportunity

In a relationship between airlines and airports, it must be understood that both share two common goals: to serve the customers and to gain business for themselves. In the past, all the monopoly belonged to the airports, but in the recent years, the power balance has shifted towards the airlines (Isaka 2012). The new well-connected airports are giving competition to the ones which have limited routes and limited access of slots for the airlines and the passengers. However, in order the serve the customers well, the airports and airlines need to deepen their partnership as it has been done by SV Airlines and its key service providers.

Poh (2015), in her program on strategic Airport management contends, that the airports must adopt the “airport operators’ approach” where the airlines and airports would make attempts to strengthen their relationships. This would help the airports to gain more business and the airline would be able to gain competitive advantage in the airline industry.

The analysis of SV Airlines and its partner airports indicates that they have adopted the “airport operators approach”. The expansion in the Jedda’s Airport passenger handling facility and the expansion of Dammam’s airport in order to enlarge its freight management serves a two-way purpose. For the airports, it strengthens the barriers to entry by providing unique services so that the most airlines would use these airports. Moreover, it also reduces the threat of the substitutes for these airports. For SV airlines, by providing the unique services, these airports support the differentiation marketing strategy of the airline. The airline has added new destinations including Munich and Indonesia pertaining to the new route-network offered by these key airports. Moreover, at the same time the SV can enjoy the cost-leadership strategy through the well-connected and direct air-routes promised by the airports. The direct route means that the customer can pay a low price and hence would choose SV airlines. According to Gulliver (2017), the low-price leadership over Qatar and Emirates is the reason that SV is at number two in the business of aviation in the Middle East.

With respect to the government regulations, it must be understood that since SV is a national carrier, it has a strong political power to control business price set-up by the airports and, hence, operates at the lower cost than the private competitors. This further adds to their cost-leadership strategy.

Recommendation for Growth of Airport-Airlines Relationship

PWC (2017) presents the recommendations above to strengthen the airline-airport relationship (Figure 1). According to them, the terminal efficiency must be ensured by the airport and airline collaboration, along with the urban connectivity via high quality mass transit. Moreover, on-time performance can be improved by better airport and terminal design and by considering the business need of airlines like SV.

Section II: Financial Assessment

For the sake of this analysis, it is essential to shed light on the revenue, costs, passenger load, profitability and costs of the SV Airlines.

Revenues

Table 3: Revenues of SV Airlines

From Table 3 and Chart 2 presented above, it can be observed that the revenues for the airline have slowly increased over the years. This can be attributed to the improvement in the services, better route services and increase in the number of the air-routes. However, a slight decline in 2015-16 period is attributed to the changing oil prices and the decline in the exchange rate.

Management Costs

Table 4: Cost Analysis of SV’s management

The operating costs consist of the maintenance and repair of the aircraft. The asset acquisition, fueling, depreciation and rent and are included in the other expenses. The gradual increase in the cost can be attributed to recent asset acquisition, the oil prices decline, the higher depreciation of the aircraft than normal in the recent years and the depreciating currency of the country (Table 4; Chart 3).

Net Income

Table 5: Net Income of SV Airlines

The net income is the total earnings of an organisation available to the company after the expenses including depreciation, maintenance, repair and taxes have been excluded. SV Airlines operate in an Islamic state and therefore in the other expenses there is another extra charge of Zakat. However, the downfall in the net income from 2015-16 cannot be attributed to Zakat. It is because of the depreciating currency, the unstable oil prices and the global events like Brexit which have serious impact on the business of the company. According to Gulliver (2017), the increased competition from the Asian airlines has started to pull the business eastwards and therefore SV Airlines has lost its business.

EPS

EPS is the amount of profit allocated at the end of the business to each common stock. It is an indicator of the profitability of the company. The chart above indicates that the EPS for the common stockholders has declined since 2015 (Table 6; Chart 5). SV Airlines must pay attention to its cost management and market situation to turn around its financial position.

Seat Miles and Passenger Load

Saudi Arabian Airlines can offer 80% of its weekly seats at behemoth Emirates, and being a government air-carrier, it bears low cost for this transaction. The table below shows the weekly offering and occupancy of the seats by the middle-east competitors and shows that even though SV is doing considerably good in its business, it is still far behind than its arching rival Emirates (Table 7). Therefore, SV must devise a strategy to become a market leader. The following section would present recommendations with respect to this topic.

Table 7: Occupancy of the Seats

Recommendations

Based on the information provided above, the following recommendations can be given:

- To strengthen its economic performance, SV airlines must devise a stronger marketing strategy than the Emirates. The competition is now great not only from the Middle East Carriers, but the East-carriers like China’s domestic air passenger industry are doing much better. To combat competition, research in consumer behavior and consumer need assessment should be done and should be incorporated in the business strategy of SV airlines.

- The decline of global trade like in the year 2015 and the undulating oil prices led to the decline of profitability for the company. The SV airlines must take lessons from this and should understand that some external factors are outside the control of the company and therefore the contingency planning against risk is necessary to avoid plausible losses in the future.

Reference list

Association of Consulting Engineering Companies [ACEC] 2011, Airport opportunities in Saudi Arabia, Oman and Bahrain, Web.

Gulliver MR 2017, ‘The Middle East’s once fast-expanding airlines are coming under pressure’, Web.

Isaka, T 2012. Analysis of airport and airline relationship, Web.

Mishra, L 2013, ‘Airlines and profitability case of Saudi Arabian airlines’, Quest Journals, Journal of Research in Business and Management, vol. 1, no. 2, pp.19-28.

Oxford Economics 2011, Economic benefits from air transport in Saudi Arabia, Web.

Poh, E 2015, Relationship between airlines and airports, Web.

PWC 2017, Future-ready airports: airports are back in the spotlight as catalysts for future growth, Web.