Introduction

General Overview of “Tobacco Companies Elude Tax Increase.”

One of the most successful steps taken by President Barack Obama was signing a law where the issue of children’s health insurance is concerned. This information is mentioned from the very beginning of the article by Matt Apuzzo for Associated Press in November 2009. This author touches upon the issue of tobacco usage as one of the most effective means which can be used to improve our health care system and prevent people from making the biggest mistake in their lives – star smoking. The main theme of the article und1er consideration is that Obama’s law has led to a considerable increasing in taxes on cigarettes but still promoted the development of another, less taxed industry – pipe tobacco.

Economic Concepts to Describe

Walter Wessels (2000) admits that almost all economists try to use economic models or concepts in order to comprehend this world better. In this work, some economic models will be considered in order to understand the intentions of the author of the article “Tobacco Companies Elude Tax Increase” and clear up whether the information presented is reliable and useful. First of all, the concept of demand and supply (Adil, 2006) should be considered and investigated in the sphere of tobacco. Secondly, it is necessary to evaluate the tobacco market in action during some period of time and find out what years and why to become beneficial for the tobacco industry.

The thesis of the work

Apuzzo (2009) states that many tobacco companies just try to find out a new and effective way out to cope with a tax increase, this is why it turns out to be important to evaluate the tobacco market in action and the concept of demand and supply to clear up what encourage people to use tobacco and what components have to be included.

Main Body

Taxation of alcohol and tobacco

Tierney Plumb (2009) admits that “raising alcohol taxes saves lives and saves society money.” His words about alcohol and its fast development may also cover the tobacco industry and explain how beneficial the tax increase may become for both spheres. When people start paying more for products, services, or information, they become thinking more about the outcomes and consequences of their actions and analyze whether these issues may cost so much. The changes in the sphere of alcohol and tobacco have much in common: both of them have many consumers, both of them have many competitors, and both of them face troubles from the governmental side.

Challenges of the companies who suffer from taxation

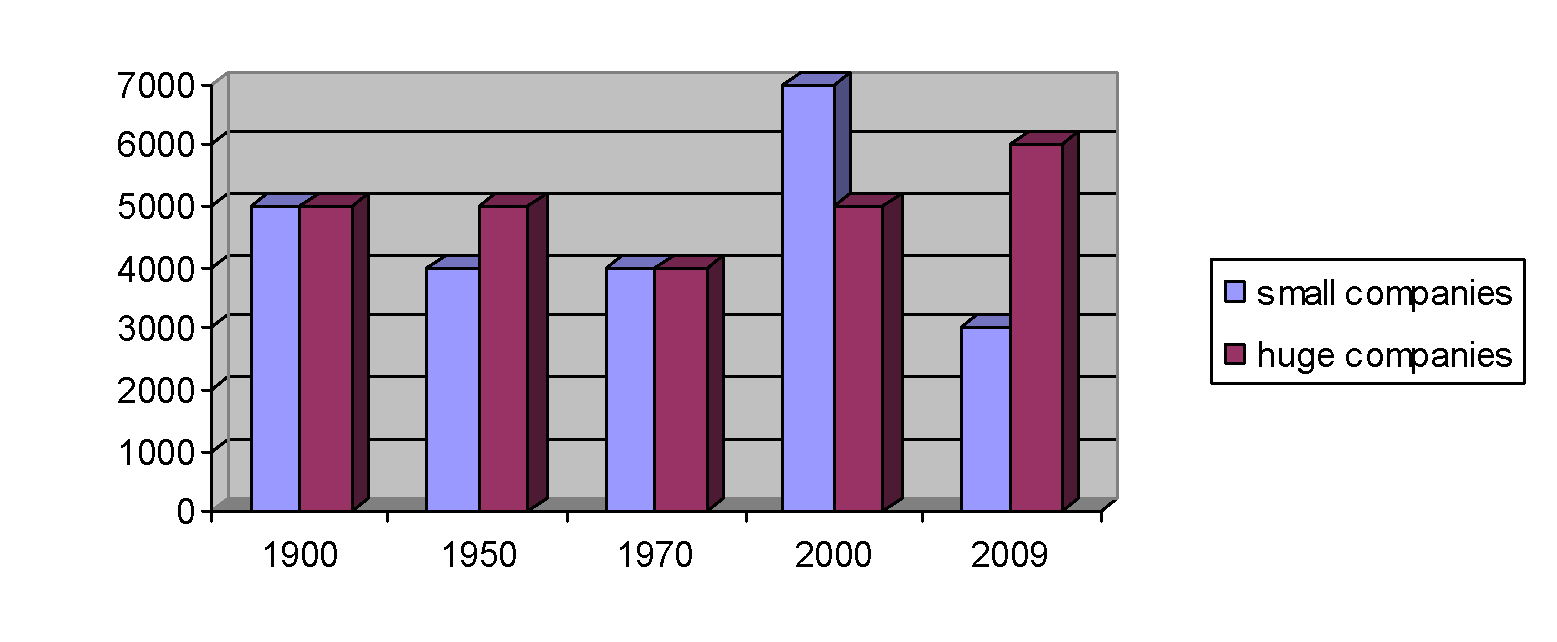

The increase in taxes makes any company take considerable actions and offer interesting propositions to attract new customers or at least not to lose old ones. Matt Apuzzo (2009) informs that small companies within the tobacco industry face considerable challenges because of huge and famous companies, and if it is not difficult for big organizations to change tobacco for pipe tobacco, small organizations cannot adapt to new working conditions and purposes. The demand for tobacco do not decrease, and people still continue buying cigarettes; but supply of tobacco faces challenges, and many companies lose their constant clients in a short period of time.

Tobacco market in action changes considerably during the 20th century

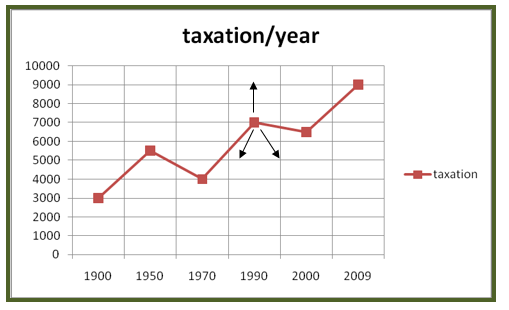

Tobacco market is in action for many centuries, and taxation of tobacco underwent considerable changes from the middle of the 1900s till the beginning of the 2000s. The diagram below shows that the beginning of the 1900s did not require taxes, and the year of 1990 made tobacco producers spend money in order to stay ion business, in order to meet the demands of customers, and in order to have some kind of material to fight against competitors. These various tobacco taxes hit tobacco industry considerably (Haustein & Groneberg, 2009), this is why the year of 2000 provided tobacco organizations with a chance to have a rest and develop their business. Unfortunately, the development of this industry was too quick, and the year of 2009 is marked by huge taxes, which exceed actual prices of tobacco:

As it has been mentioned above, small companies are now under a threat of being collapsed. In the article under consideration, the author says that huge companies, who are already known on the world market, just use their name and popularity in order to produce new products and another type of tobacco without changing prices.

These companies believe that their brands and their names will help to gain respect and recognition among their consumers, and they should not be obliged to decrease prices in order to attract attention or to be re-organized in order to achieve good results and not to spend much money and suffer because of huge costs. The inability to repeat the policy of huge companies, small organization have to analyze world market, change prices, add discounts and benefits in order to prove consumers that their production is worthy of usage:

Demand for and supply of tobacco production: why they are not equal

The demand for tobacco will hardly be decreased. Even if people know about harm of cigarettes, about the possible to get cancer, or about possible lethal end, they continue smoking and use the production in spite of higher costs. However, taxation creates numerous challenges for tobacco supply: not each company may allow to lose money and not to get benefits just in order to satisfy consumers’ demands. Apuzzo (2009) underlines that fact that “raising taxes on roll-your-own cigarettes from $1.10 to $24.78 a pound” makes companies evaluate their activities, shut down their brands of roll-your-own, and pay more attention to another category, known as pipe tobacco.

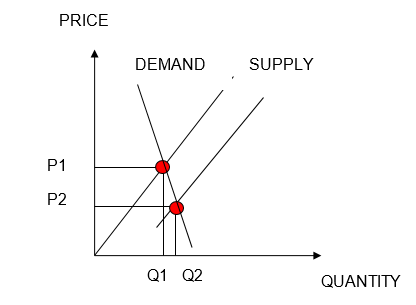

The challenges, which take place because of the changes within demand and supply of tobacco products, may be properly explained by means of the following DEMAND AND SUPPLY CURVE:

If the supply for tobacco products shifts to its right because of the improvements of technology, the prices and the quantity of the products undergo considerable changes as well: prices decrease, and quantity increases. Demand (of products from society) takes the same position, this is why the changes of prices (from P1 to P2) and its quantity (Q1 and Q2) lead to increase of supply for tobacco products only.

The changes in demand happen because of several factors. They involve changes of tastes, when people find out that cigarettes of one and the same producer may be characterized by different quality; changes of incomes, when people are deprived of the opportunity to buy good cigarettes and have to pick out another alternative; changes of population, when people leave small towns in order to check own powers in a bigger city, the demand of small town decreases and supply increases, and the demand of big cities increases, however, supply of tobacco cannot be increased within a short period of time. This is why in order to change the situation and find more opportunities to increase supply, tobacco companies try to raise prices and get benefits quickly.

The article by Matt Apuzzo explains that companies of any size may be challenged by increasing of taxation and changes of such concepts like demand and supply. However, the major point is that huge companies have more changes to cope with these challenges and control own incomes and expenses. And small companies cannot change the type of their production in a short period of time, this is why they suffer because of taxation increasing and inability to take into consideration all consumers’ demands.

Supply for tobacco is stopped, and companies lose money, customers, and popularity. On the one hand, such increases of taxes have positive outcomes for society and for markets: weak companies are eliminated, and less companies aim at producing harmful for health products. On the other hand, increase of taxation promotes the development of new companies, which try to enter tobacco market and offer products, which are still not checked by time, people, and fashion.

Conclusion

“Tobacco Companies Elude Tax Increase” is the article by Matt Apuzzo that introduces how significant and considerable the increase of taxes may be for many companies. Both huge and small companies are under a threat of being eliminated or at least checked in accordance with their abilities to cope with challenges and changes of demand and supply. Tobacco market is cruel indeed, because the failure of one company may lead to a victory of another one.

This is why it is better to follow conditions and interests of people, who may become a potential customer. First of all, it is necessary to evaluate possible changes of demand and make sure that supply will not suffer. When an organization is ready to cover the expenses, connected to taxation raising or other concepts, this company may be considered as a powerful enough. Its products will be in demand, the concept of supply will not suffer, and the desirable benefits will be observed.

Reference List

Adil, Janeen, R. 2006. Supply and Demand, Mankato, Minnesota: Capstone Press.

Apuzzo, Matt. 2009. Tobacco Companies Elude Tax Increase. Associated Press. Web.

Haustein, Knut-Olaf & Groneberg, David. 2009. Tobacco or Health?: Physiological and Social Damages Caused by Tobacco Smoking. New York: Springer.

Plumb, Tierney. 2009. Report: Raising Md. Alcohol Taxes Would Be Beneficial. Washington Business Journal. Web.

Wessels, Walter, J. 2000. Economics. Hauppauge, NY: Barron’s Educational Series.