Econometrics offers a number of mathematical applications utilized in the field of economics to bring forth some unique analysis to both economic and non-economic data. The OLS estimations and the regression models are the more commonly used models evaluation of relationships between the various economic data. This paper focuses on the Tobit model of estimation. The model was proposed by James Tobin (1958). The most important element introduced by the model in the analysis is the description of the relationship between two variables yi and xi. Yi is the dependent variable, while xi is the independent variable.

Before engaging in the actual discussion of the Tobit models, it is important first to understand some of the underlying concepts which inform the analysis. In this analysis, the concern is in looking at regression is completely observed but in a selected sample that does not fully represent the population as well as regression analysis in times when the partially observed in the population. There are several reasons which lead to the emergence of incomplete data. The two most important causes are truncation and censoring. Truncation is a result of the loss of some observations on regressors as well as the dependent variable.

The loss is mainly occasioned by the inability to access accurate data required for analysis. In a case of an analysis involving the general income as the dependent variable, if the available data is on the high-income group of the population, then a truncation in the analysis will result. Indeed most truncation is a result of the use of data derived from a subset of the relevant population as opposed to the entire population. The effect of this is that the sample data used does not fully represent the population, meaning that generalization of the results may not be accurate. Such situations are very common in economic analysis, which relies heavily on secondary data (Greene, 2003, par4).

Censoring, on the other hand, is a result of losses or limitations in data on the dependent variable only. This means that data on regressors are not lost or limited in this case. Using the same illustration involving incomes, data on income for all the subsets which comprise the entire population may be available, but there could be a defined maximum income among the high-income group.

For example, the low-income group may be defined as the group earning between zero and one hundred dollars, the middle income earning between a hundred and one dollars and two hundred while the high income earns between two hundred and three hundred dollars. In most cases, there are possibilities that some people earn above three hundred dollars. This means that the data is largely representative of the population; however, a very small proportion may not be included. Thus censoring may result in a defect in the chosen sample. Without it, the sample data would accurately represent the population. Therefore truncation is a more severe loss of data in comparison to censoring.

In a normal distribution, y distribution has a mean of µ and a variance of δ2. The relationship is represented as y͠ ̴ N (µ, δ2 I). Any such normal distribution can be represented as N (0, 1). Since y͠ ̴ N (µ, δ2 I) then (a+by) ̴ N (a+bµ, b2 δ2I). In this case, y is completely observed. In the truncated Normal distribution, the y variable is incomplete as the sample is obtained from a subset of the entire population. Therefore y=y* where y* is greater than truncation point T, then data is lost on the values lower or equal to T. In this case, we assume that the distribution is truncated such that the y/y>T (Long, 1997, par4). Consequently, the distribution does not equate to one as a part of the distribution is removed. The case of a continuous random variable which is a function of y and a constant T is represented as:

f(y/y>T) =f(y)/ [P(y>T)]

solving this we have a situation where

P(y>T) =1-Φ [(T-µ)/δ] =1-Φ (δ)

The truncated normal distribution has a likelihood function in the form of

L=πNi=1 f(y)/ [1-Φ (α)]

The two common outcomes of the truncated distributions result due to the truncation occurring at the higher or lower side of the data. If the truncation is on the lower values of the variable, then the resultant mean will be larger than the original mean. If the truncation is on the higher side, then the resultant mean is lesser than the original mean. Truncation also results in a different variance from the original.

The censored distribution can also be to the left or to the right. When censored to the left, observations have the value of T at Ty.

Y=

Generally, the assumption is that T=0. This means that the data are censored at a value of zero. Consequently

Yi=

Using the Likelihood function defined above, where the censoring point is T. Traditionally, T is set at T=0, and the µ is Xiβ. Incorporating this in the likelihood function becomes

L =πNi [(1/δ) Φ (yi-Xiβ)/δ] d1 [1-Φ (Xiβ)/δ)] 1-d1

The log-likelihood function for the model becomes

lnL=ΣNi=1

This function is comprised of two major parts. One portion caters to the classical regression for the observations which are uncensored. The second portion caters to the probability that the observation is censored.

Expected Values

As is expected, there are certain expected values of interest in the Tobit model. For simplicity, we assume that T=0

The expected value of the variable y*: E[y*] =Xiβ

The expected value of y/y>0:

E [y|y>0=Xiβ+δλ (α) where λ (α) = [Φ (x1β/δ)]/ [Φ (x1β/δ)]

The expected value of y:

E[y] =Φ (Xiβ/δ) [Xiβ+δλ (α)] where λ (δ) is defined as above.

These three expected values should be reported in terms of relevance to the analysis being undertaken and the purpose of conducting the analysis. Therefore, there is no one common agreement on whether all these results should be reported. In cases where data is always censored, the usefulness of the latent variable is reduced. Again, when employing the corner solution model, there may be no interest in the latent variable. E(y) is, however, useful in assessing the effects of explanatory variables, which may or may not be censored. Where particular interest is in the uncensored observations, the expected value E [y|y>T] is very useful. Clearly, E[y] is the most useful; however, the particular circumstances dictate the expected value to be used (Sheather, and Jones, 1991, p33).

Marginal Effects

Just like there are three expected values, the marginal effects are also three.

First is the marginal effect on the latent dependent variable, y*:

It is defined as ρE[y*]/ (ρxk=βk

Consequently, the coefficients reported depict how the latent variable is altered by a unit change in xk the independent variable (Wooldridge, 2002, p76).

The second marginal effect relates to the uncensored observation and is defined as below

ρE [y|y>0]/ρxk=βk where λα is defined the same as before. This marginal effect gives an indication of the effect on the uncensored observations as a result of a unit change in the variable xk (Tobit and Heckit Models, p23).

The third is the marginal effect of the expected value for y (censored and uncensored):

It is defined as ρE[y]/ρxk=Φ (Xiβ)/δ*βk

Notably, Φ (X1β/δ) represents the probability of observing values of X, which are uncensored. As the value of this element gets closer to one, there are lesser observations which are censored. Consequently, the coefficient βk alone gives a marginal effect. Just like in the case, the judgment on which of these three marginal effects should be reported is dependent on the analysis being conducted.

The reason why it becomes important to adopt the Tobit model in place of the OLS estimation is due to the fact that the analysis will result in highly inconsistent estimates of β. Applying OLS estimation on the uncensored sample yields

yi= Xiβ+δλ (Xiβ/δ) = εi the expected value becomes E [ε|Xi, yi>0] =0

Therefore E [εi|Xi, yi>0, λi] =0. Notably the element δλ ![]() in the OLS regression. Consequently, the omitted term should be included in the disturbance term. The effect of this is that the variables defined as X become correlated with the disturbance term, a factor known to cause inconsistencies in the estimates obtained from analysis (Romano, and Siegman1986, p213). Looking at the expected values of the OLS estimates, then

in the OLS regression. Consequently, the omitted term should be included in the disturbance term. The effect of this is that the variables defined as X become correlated with the disturbance term, a factor known to cause inconsistencies in the estimates obtained from analysis (Romano, and Siegman1986, p213). Looking at the expected values of the OLS estimates, then

E[y] =Φ (Xiβ/δ) [Xiβ+δλ (α)]

This result is non-linear as per the requirements of OLS estimation. Consequently, the estimates are inconsistent.

The Tobit and Probit models show several similarities. First, they adopt a similar structural model. The main difference is in the measurement models. This is in reference to the way in which y* is changed into they observed. Under the Tobit model, the value of y* is known when y*>0. However, in the Probit model, the value of y* is unknown, but there is information indicating whether it is greater than y*>0. Therefore, the Tobit model has more information as compared to the Probit model. The consequence of this is that estimates obtained under the Tobit model are more efficient compared to those obtained by the Probit model (Schervish, 1995, p23).

Two major assumptions are made in the Tobit model. The first is that if the disturbance term εi is normal or Heteroskedastic, the resulting estimates will be inconsistent. Secondly, it is assumed that the channel in which data is generated, resulting in censorship is the same channel determining the resultant variable (Tobin, 1958, p34).

Application of the Tobit Model

The model is applicable to a very wide variety of areas. The most important element of the model is its ability to solve problems of imperfect data used in the analysis. It improves the results obtained from the regression analysis hence enhances the establishment of accurate relationships between variables of concern.

Clearly, any empirical economic analysis involving establishing relationships can be aided by the powerful Tobit models. To date, the model has been successfully used to talk problems related to data in a bid to get the most representative estimates of the entire population (Moffitt, 1982, p122).

Kim and Maddala (1992) applied the model in estimating and specifying models of dividend behavior based on censored Panel Data. In addition, Akinola (1985) applied the model in assessing the adoption of innovation processes among cocoa farmers in Nigeria. Moffitt (1982), on the other hand, applied the model in analyzing the labor dynamics involving work hours and constrains in institutions. Clearly, the model can be applied in a very wide area of economic analysis (Kim & Maddala, 1994, par4).

Advantages of the model

The most important advantage in the application of Tobit models is the fact that they enable effective analysis of economic data even in cases where the sample data may not be fully representative of the entire population due to different reasons such as data availability and nature of the analysis. Secondly, and more importantly, the model pioneered the areas involving semicontinous data in the analysis. This is an important addition to the models of economic analysis. In addition, the model is highly stable and has been known to be highly reliable in estimations.

In addition, the model provides results similar to the OLS results in a factor that helps in establishing comparability and consistency of results. Finally, the model is applicable in a wide range of analyses ranging from simple time series analysis to heavy panel data analysis.

Disadvantages of the model

The model is definitely complex in application. It requires an extensive understanding of the concepts involved in the preparation of data as well as interpretation of the results. In addition, the application of the models is highly subjective. In the above analysis, there are instances where the decision on which expected value or marginal value of the analysis should be reported is left to the person conducting the analysis who is supposed to be informed by the nature of the analysis he/she is conducting. This being the case, there are gaping loopholes in the application and interpretation of the model. These inconsistencies put to question the exactness of the model as it is not clear, which are the most important considerations in determining which outcomes are suitable.

Example

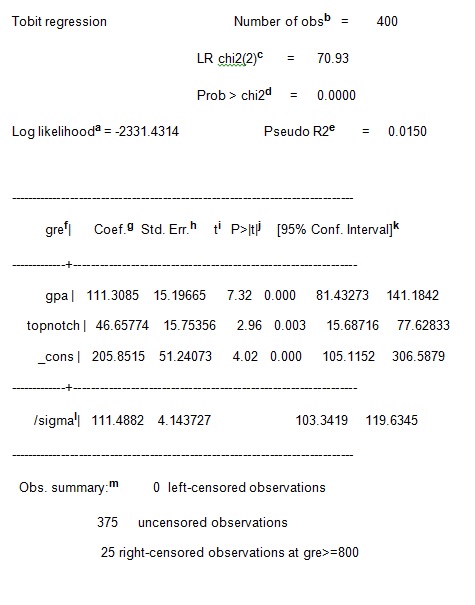

In an analysis involving a students’ test performance, it is possible to have a dataset that is censored. A range of scores from 200-800 implies that results will be censored on both sides as there could be scores below 200 and above 800. A Tobit regression is useful in an attempt to come up with a model that can help predict outcomes in a specified range.

To predict the student score then it is important to first define the score as an outcome as below

Reference List

Greene, William. 2003. Econometric Analysis. New Jersey: Prentice Hall.

Kim, B. & Maddala, G. 1994. Estimation and Specification Analysis of Models of Dividend Behavior Based on Censored Panel Data.

Long, J. Scott. 1997. Regression Models for Categorical and Limited Dependent Variables. London: Sage Publications.

Moffitt, R. 1982. The Tobit Model, Hours of Work and Institutional Constraints.The Review of Economics and Statistics, Vol. 64(3). Web.

Romano, J.P. and Siegel, A. 1986. Counter Examples in Probability and Statistics. Monterey, CA Wadsworth.

Schervish, M.J. (1995). Theory of Statistics. New York: Springer Verlag.

Sheather, S. and Jones, M.1991. A reliable data-based bandwidth selection method for kernel density estimation. Journal of the Royal Statistical Society Series B Vol53.

Sigelman, Lee & Langche Zeng. 1999. “Analyzing Censored and Sample-Selected Data with Tobin, J. (1958). Estimation of relationships for limited dependent variables. Econometrica 26, 24–36.

Tobit and Heckit Models.” Political Analysis 8:167–182.

Wooldridge, J. 2002. Econometric Analysis of Cross Section and Panel Data. Cambridge: MIT Press.