Introduction

Inflation and unemployment analysis in UAE and GCC is subjected to different tendencies and principles. This is explained by the fact that UAE is less dependent on oil trade, hence, the inflation and unemployment rate in the UAE is lower in comparison with the countries of GCC.

Statistics

By the study by Baghestani and Abual-Foul (105), the UAE is regarded as a highly developed, and steadily improving state. The economic system of the UAE is diversifying rapidly, and it should be emphasized that the economic development of the UAE is the third among the Middle East countries. Even though the UAE is becoming less dependent on natural resources, exports still play an important role in its economy and help to keep the inflation rate stable (1.5%)

The low inflation rate is explained by the high economic diversification. As it is stated by Mckee and Garner (56):

Inflation in the UAE is expected to reduce because of the diversification of economic activities. It is expected to fall since the UAE is not as dependent on oil as other GCC’s. It was noted that the consumer price inflation shot up by 10.1% in 2010 in comparison to 7.8% in 2009. The increase was due to the increase in prices of non-oil imported goods priced in Euro that resulted in an increase in household demand pressures. On the other hand, high oil revenues, cheap credit and liquidity in 2009-2010 led to a heave in asset and consumer prices.

In the light of this statement, it should be emphasized that the actual value of the inflation rate is explained as the economic development indicator. Considering the rate of the GCC, the UAE parameters are often regarded as the key influence factor.

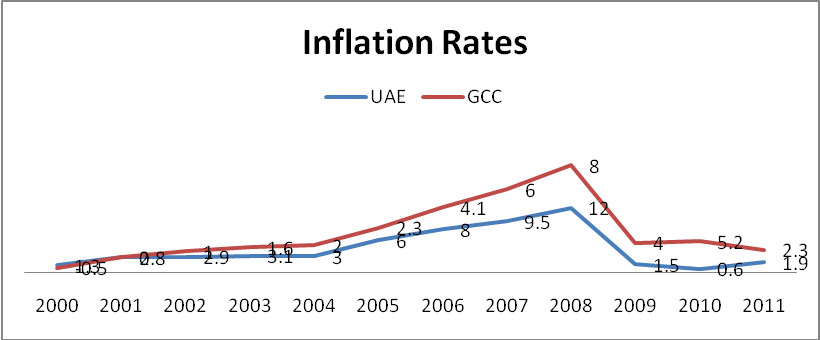

The inflation rates of the UAE and GCC are given on the graph below:

Considering the analysis of economic parameters provided by Zembowicz (124), it should be emphasized that inflation in the countries of GCC is caused by the increase of prices for consumer goods. Jointly with the high domestic demand that was caused by the economic growth in numerous sectors.

As for the unemployment rate, UAE and GCC are highly dependable on the expatriates. On the one hand, this emphasizes the fact that the region is featured with a sufficient amount of working places, on the other hand, this may be regarded as a crisis of the employment system. Hence, as is stated by Caplin (287), Saudi Arabia is featured with the highest unemployment level (8.5%). The problems of unemployment in the GCC are mainly explained by the fact that these countries prefer expatriating workers from Asia. Hence, the domestic population is not involved in numerous jobs, which causes a high unemployment rate.

The 2007-2009 period is featured with the highest unemployment rate among UAE citizens. The reasons for these rates are given above, and it should be emphasized that these rates and values presuppose that the UAE and GCC are featured with the high economic rates that are the merit of expatriate workers. (Khalam, 205)

Conclusion

The unemployment and inflation rate in the GCC and the UAE reveal the fact that this region is developing steadily. Because the main part of the working force in the UAE is expatriate, the high unemployment level among the domestic population is compensated by high tempos of economic diversification that stabilizes the economy and attracts an additional workforce.

Works Cited

Al-Haj, Abdullah Juma. “The Politics of Participation in the Gulf Cooperation Council States: the Omani Consutative Council.” The Middle East Journal 50.4 (2009): 559.

Anthony, John Duke. “Special Report: Consultation and Consensus in Kuwait: The 18th GCC Summit.” Middle East Policy 1.1 (2009): 137-156.

Hamid, and Bassam Abual-Foul. “Evidence on Forecasting Inflation under Asymmetric Loss.” American Economist 54.1 (2010): 105.

Jessica. “Mirage in the Desert Oasis: Forced Labor in Dubai and the United Arab Emirates.” Harvard International Review 30.4 (2010): 287.

Anthony H. Bahrain, Oman, Qatar, and the UAE: Challenges of Security. Boulder, CO: Westview Press, 2010.

Abdul “Feature Article: Rising Oil Prices & Their Impact on the Emergers.” Emerging Markets Economic Outlook Summer 2006: 6.

Zabir. “Gulf Cooperation Council – Plus-two Ministerial Joint Settlement.” DISAM Journal of International Security Assistance Management 2007: 125.

David L., Don E. Garner,. Offshore Financial Centers, Accounting Services, and the Global Economy. Westport, CT: Quorum Books, 2010.

McLaurin, James Reagan. “A Review of the Financial Markets in the Gulf Cooperation Council (Gcc) Countries.” Journal of International Business Research 6.1 (2007): 150-165.

Kevin. “Saudi Arabia and the GCC: Exploring for Growth in a Troubled Global Economy.” Middle East Policy 6.2 (1998): 29-35.

Filip. “Remodeling Dubai: The Emirate’s Housing Market.” Harvard International Review 30.4 (2009): 124.