Walt Disney’s World budgeting and planning have mapped the company as the most competitive media corporation in the world. From previous scenarios, Walt Disney’s budgeting brought them more revenues, especially before the pandemic. According to Khalid (2021), the company budgeted to increase its spending on content to $33 billion in the 2022 fiscal year, budgeting that started on October 1, 2022. The increased budget aims to increase their streaming capabilities to expand Disney Plus and HULU rather than the previous focus on television streaming.

The monstrous spending technique underlines how Disney draws closer to direct-to-consumer content as a high need, growing its interest in streaming. The yearly planning report explains that Disney intends to deliver roughly 50 titles for dramatic and streaming dissemination during the financial year (Khalid, 2021). The organization additionally specifies that its pressed delivery timetable might be influenced by the new targets’ markets (Dybek, 2021). Considering their competition, their investment budget is higher, thus proving to be more powerful. The budgeting plan concerns the rise of streaming competition and the ability to increase their revenues, as observed in previous years.

As Disney moves to a solid spotlight on direct-to-customer plans of action, the organization is moving forward with happy creation and dispatching in all cases to take care of Disney Besides, Hulu, and different stages. The organization’s Overall Amusement Content unit gauges it will deliver approximately 60 unscripted series, 30 drama series, 25 show series, and five made-for-television motion pictures and specials throughout the 2022 financial year (Dybek, 2021). These plans give the company an advantage in the market and ensure continuous engagement with its consumers.

Walt Disney has also increased their budget for the new Chinese and Nigerian markets. The new Walt Disney World in Nigeria opens new opportunities to study and invest more in the new market. Africa is among the continents where media corporations have not established their roots. Most media corporations, such as Netflix Plus, have tried to establish a streaming company in Africa with no returns on investment (Yahoo is part of the Yahoo family of brands, n.d.). But for Disney Walt Word, the plan to slowly capture the market through studying the needs of the consumers is promising.

Company’s Financial Ratios and Industrial Comparison of the Ratios

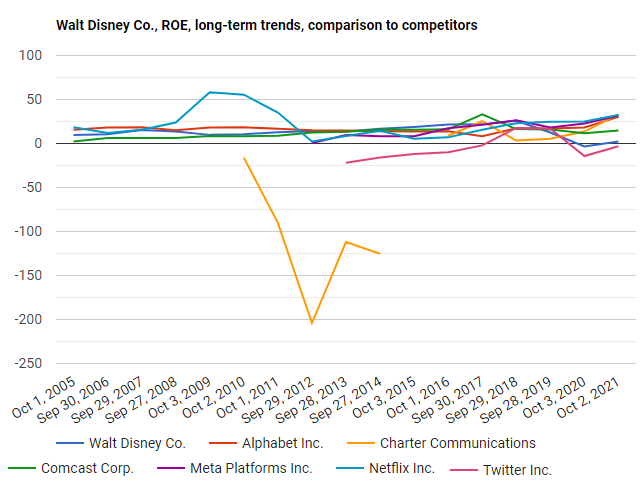

Disney has been heavily affected by the pandemic. Especially concerning the frequency of its parks and shops – directly related to the drop-in tourism. But in the fourth fiscal quarter of 2021, its last balance sheet, Disney had a net income of US$ 159 million, thus reversing the loss of US$ 710 million in the same period of 2020 (Walt Disney Co. – AnnualReports.com, n.d.). Even with the effect, the company has shown resilience with a growing ROE in the past year (Yahoo is part of the Yahoo family of brands, n.d.). The following Figure presents Disney Walt World Growth since 2017.

As observed in Figure 1 above, the company’s gross profit had fallen to less than $ 18 Billion. The company added revenue of $18.5 billion in the three months ended October 2, up from $14.7 billion in the same period in 2020 (The complete toolbox for investors | finbox.com, n.d.). From May 2021, the company graph movement is positive, with a promising growth to up to $ 25 Billion by May 2022 (The complete toolbox for investors | finbox.com, n.d.). Generally, Walt Disney’s ROE has experienced recessions and peaks for the past few years.

In comparison with its competitors, Walt Disney World has also been competitive, considering they have a substantial unutilized market. Walt Disney has been competitive and able to increase its ROE over the past year. It was more affected by the pandemic since it relied on tourism and physical studios (Walt Disney Co. – AnnualReports.com, n.d.). But with increased investment in the streaming business and the blooming tourism market, Walt Disney World has seen more growth in its ROE. Figure 2 below shows a comparison between Walt Disney and its competitors.

Future Prospects of the Company

Disney will be one of the most powerful and riches multimedia corporations in the future. One major promising factor is the growth of their consumer base and the chance to reach even more consumers. The Disney+ platform has surpassed 118 million subscriptions in more than a year, far exceeding the company’s expectations (Dybek, 2021). When the platform was announced in 2019, Disney estimated it would have between 60 million and 90 million subscribers by 2024. In other words, the five-year goal was reached in a few months (Dybek, 2021). Even Netflix CEO Reed Hastings, the brand’s competitor in streaming, called the feat “surprising” (Khalid, 2021). Through this, Walt Disney has parks and all its stories, characters, and franchises, bringing more profits. They are the attractions in the theme parks, the cruises with characters, toys, costumes, and video games that will continue to grow their revenue in the future.

Analysts now project a new goal for Disney’s streaming: to reach 158 million subscribers in five years. With the closing of movie theatres in the pandemic, Disney postponed part of the productions and anticipated the launch on streaming – in some cases, for an additional price. The strategy can now be adopted permanently, with shorter viewing time in movie theatres and faster availability of titles online. Dybek (2021) highlighted a 60% year-on-year growth in the subscriber base of its leading streaming service, Disney+, a Walt Disney World channel, which reached 118.1 million customers.

In terms of planning, Walt Disney has acquisitions that continue to generate value. Acquisitions are where Disney+ is inserted, Disney’s lucrative bet to compete with the big players in streaming. Disney+ works all the Disney character hall, including the entire Marvel universe, Star Wars and other great films, which competitors don’t have, making its future growth impressive (Dybek, 2021). Through these and other diverse business areas, the company produces and acquires a series of types of films, such as acting, animations, musicals, and plays.

Type of Stock Recommendations

From my viewpoint, I recommend a hold type of stock for Walt Disney. The advantage of holding a stock with Disney is that there are prospects that the profit margin will increase, as depicted by the ROE. Investors should understand that increase in ROE is proportional to an increase in the gains if they sell the stocks at a future date. Additionally, holding stocks limits charges that might be incurred during the selling and buying processes. In my case, I would prefer investing in this company as its future performance and productivity appear promising based on its financial ratios, such as the ROE.

Several aspects must be considered when thinking about investing in Disney Walt. Currently, the trade recommendation is to buy stocks in Walt Disney World. Buying is the perfect stock recommendation with the prospects and growth points at expected future growth. Disney offers a winning combination for long-term investors. Its core business, including theme parks and movie theatres, is growing again, while the streaming unit is becoming a powerful contender in the post-pandemic world (Dybek, 2021). This potency is one of the assets that has drawn much attention from investors since the Walt Disney Company is a company that operates in several segments, showing a great capacity for growth.

As the economy reopens and consumers are eager to return to their everyday lives following mass vaccination efforts in the US and other parts of the world, there are signs of the growth in the number of streaming users, and an essential engine of paper propulsion is losing some of its strength. This bearish cycle, in our view, offers a good entry point for long-term investors as the nearly century-old Disney enters yet another intense growth phase, thanks to its traditional businesses, including theme parks and the direct-to-consumer streaming service (Dybek, 2021). There may be some obstacles to this recovery trajectory, but Disney’s business diversification has everything to allow for a full recovery.

Disney is a company with a long history and has been undergoing constant development, being close to completing its centenary foundation. However, the entertainment company’s prominence exceeds its market longevity. One of the strengths presented is the variety of fronts in which it operates, which attracts investors. The financial market indicates that the diversity of sectors of the company provides more security to those who invest in it since the company has different sources of revenue. The stock managed a remarkable recovery since, more precisely, until the close of trading, the stock had reached more than $134 (Dybek, 2021). It is not surprising that a new record can be beaten coming soon, when the company resumes activities and businesses disrupted by the crisis, releasing new movies and reopening its theme parks.

References

Dybek, M. (2021). Walt Disney Co. (NYSE: DIS) | Return on equity (ROE) since 2005. Stock Analysis on Net.

Khalid, F. (2021). Netflix’s CEO says it has to catch up with Disney+ on animated family hits like ‘Soul.’Business Insider.

The complete toolbox for investors | finbox.com. (n.d.). Finbox.

Walt Disney Co. – AnnualReports.com. (n.d.). AnnualReports.Com.

Yahoo is part of the Yahoo family of brands. (n.d.). Yahoo Finance.