Risks that Wellfleet Bank Faces

- Leveraged loans that the bank extended to companies that already have a considerable amount of debt.

- Syndicated loans allowing small banks to participate in large transactions.

- Notably, these loans tend to carry a high risk of default.

- The bank also faces the risk of concentration on its Corporate Banking Group.

- Operational risk due to disagreements at the leadership level regarding the proposal to chose.

- Large scale credit applications from the mega deals can create a huge credit and regulatory risk.

- Risk of over-dependency on its internal credit risk evaluation model.

- Regulatory risk.

- Market risk as the bank focuses on development opportunities in new markets, which might cause less liquidity, poor corporate governance, and lax insider trading policies.

- Compliance risk due to a possible inability to comply with regulations, practices, and norms of emerging markets.

Decision Regarding the Two Proposals

Proposal one, Ashar Industries, is the most effective because of the following reasons:

- A high acquisitive background.

- It has a steady and healthy growth.

- Displays consistent Compound Annual Growth Rate of 74.48 percent demonstrating a stable development trend.

- Net Income of more than 17.68 percent.

- The net income and revenue grows consistently over the years.

- The company has the best practices to minimize the level of debt by selling one’s assets.

- Furthermore, it has 5A credit rate, which is higher than its competitors.

However, proposal two, Gatwick Gold Corporation is not preferable because of the following shortcomings:

- An inconsistent CAGR standing at 12.48 percent.

- Negative growth.

- Negative ROI.

- Lack of ability to clear its debt.

- The employment of a new management team, which exposes it to high business and operational risks due to neglection of its initial company model.

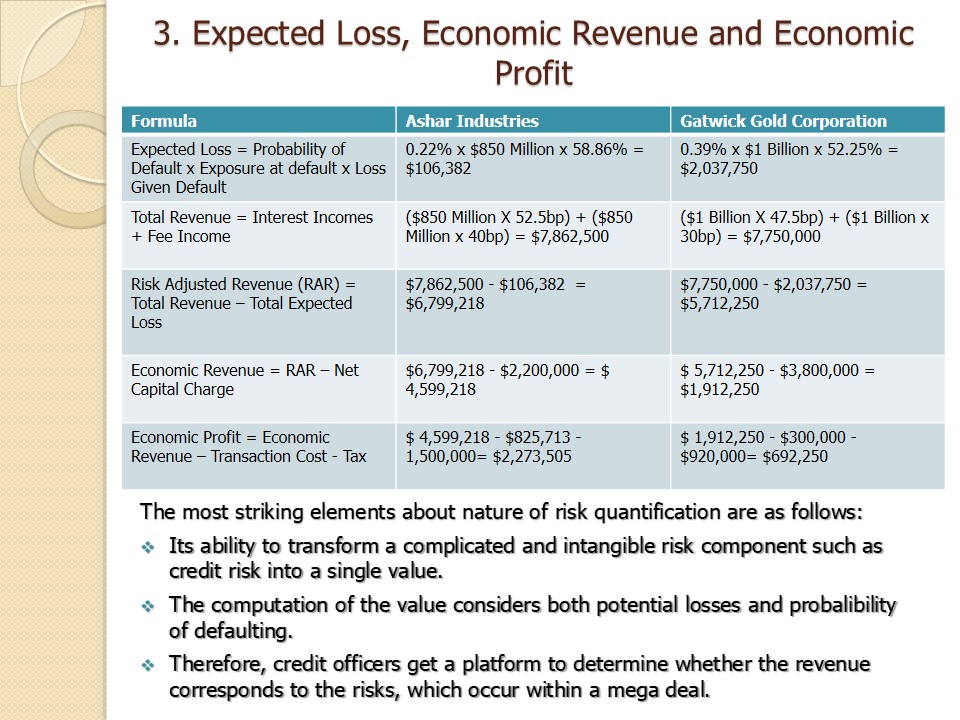

Expected Loss, Economic Revenue and Economic Profit

The most striking elements about nature of risk quantification are as follows:

- Its ability to transform a complicated and intangible risk component such as credit risk into a single value.

- The computation of the value considers both potential losses and probalibility of defaulting.

- Therefore, credit officers get a platform to determine whether the revenue corresponds to the risks, which occur within a mega deal.

Risk Management Process and Suggestions for CEO

- For the bank to lead in investment banking, it made notable recruitments.

- Relationship managers from leading investment bank.

- Senior risk officer.

- Process includes the assessment, evaluation, and management of the risks.

- Committee makes decision on credit risk, returns, and market.

Suggestions for the CEO include the following:

- Bank should have a sound credit granting process.

- It must perform continuous measurement and monitoring of risk to remain competitive in the market.

- Credit risk is not an isolated one, banks should consider its relationship with other risks.

- The bank needs to invest more funds to improve the efficiency of the risk management through reduction of total flow time for approving mega deals.

- Wellfleet firm should eliminate the current form of risk groups and committees and create others for diverse deals.

Calculative Culture and Its Implication for Risk Management Process and Tools

- The apparent culture for the bank is calculative pragmatism.

- Most senior executive committee members caution the bank against over-dependency on risk models.

- Incorporates the board of directors further divided into Audit and Risk Committee and Group Risk Committee.

- Under Group Risk Committee, the company further delegates duties to: reputational, country, operational, group credit, market risk, business risk, and business risk committees.

The calculative culture impacts the risk management process in the following ways:

- Promotes the utilization of complex and robust risk-management process to reduce over-dependency on risk-management tools.

- Facilitates integration of risk with target companies.

- Streamlines the complex debt structure.

- Ensuring productivity investment begins to pay dividends.

- Managing mining-cost inflation by minimizing energy price increase.

Summary

- Wellfleet Bank should follow Basel Norms and make sure that capital adequacy norms ratio should not be lower than 8%.

- Risk management committee should consider 5 C’s of Credit – Character, Capacity, Capital , Collateral, Condition.

- As Credit risk is one of the leading problems faced by banks world-wide, Risk Management Team must learn from past experiences.

- It is important for the bank to have a sound credit granting process, continuous risk evaluation to have a competitive edge in the market.

- Banks should consider the relationship between credit risk with others since it is not an isolated risk.

- Wellfleet bank has an opportunity to adjust risk position to facilitates its complacency with the rapid transforming social environment.