Introduction

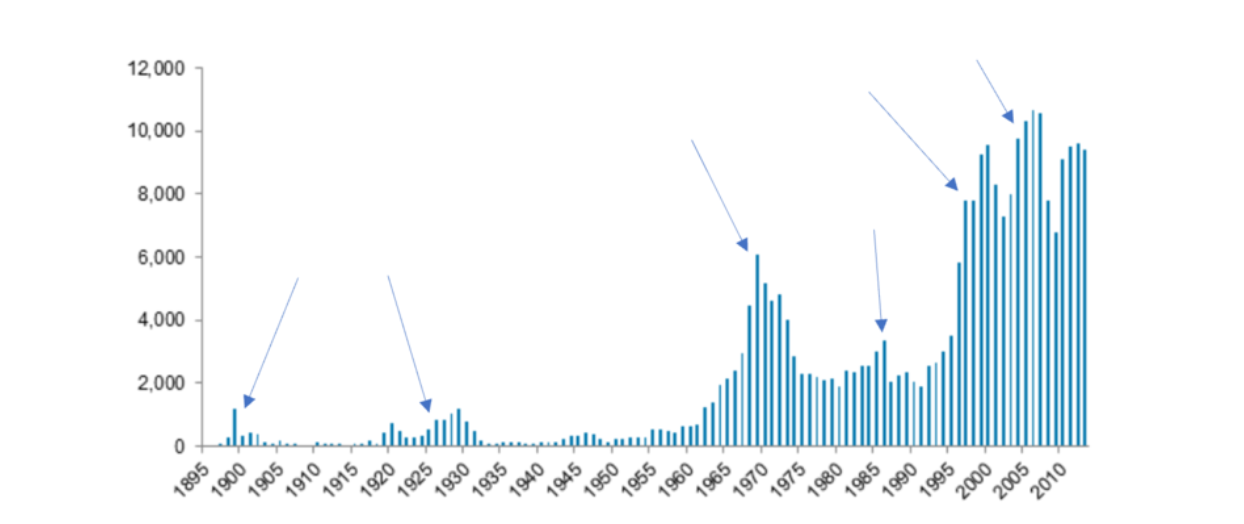

Mergers and acquisitions (M&As) are cyclic and resemble waves-like features. A significant part of mergers is correlated with various factors such as increased share price ratios. Mergers have been a topic of discussion globally for at least a century. Since 1895 there have been more than five mergers in the world, most of which have occurred in the 20th century. While analyzing the occurrence of merger waves, three significant drivers considered include favorable stock market conditions, technological advancement, and overcapacity (Cho & Chung, 2022). Despite much research done to understand the causes and the nature of mergers, only a few try to internalize their wave nature. However, in this essay, we use the natural way and apply several neoclassical and behavioral theories that account for the conspicuous nature of mergers.

Brief History as Context of M&A activity

Traditionally, M&As are periodically driven by significant shifts in industries, the economic scale, regulations, and shakeouts, more so in fragmented industries. For instance, the upward aptitude merger between 1995-2000 was attributed to massive innovation around the world, technological advancement, commercialization, and the real estate business emergence (Li et al., 2021). Analogously, the downward merge of 2000-2003 was triggered by the stock market crash and market disruptions resulting from national security. Furthermore, there was a shift in the cycle between 2003-2007 due to increased global liquidity and reservations about foreign exchange (Cho & Chung, 2022). Conversely, between 2007 and 2009, the cycle reversed due to heightened financial regulations that reshaped financial services. The market remained weak in the recovery years between 2009-2013. Many companies concentrated on rebuilding balance sheets and their core businesses during this period. In 2014, there were signs of economic improvement, with the United States of America being the leader (Sha et al., 2020). Companies regained their confidence and fully began making deals, utilizing their fixed flat sheets and favorable funding conditions.

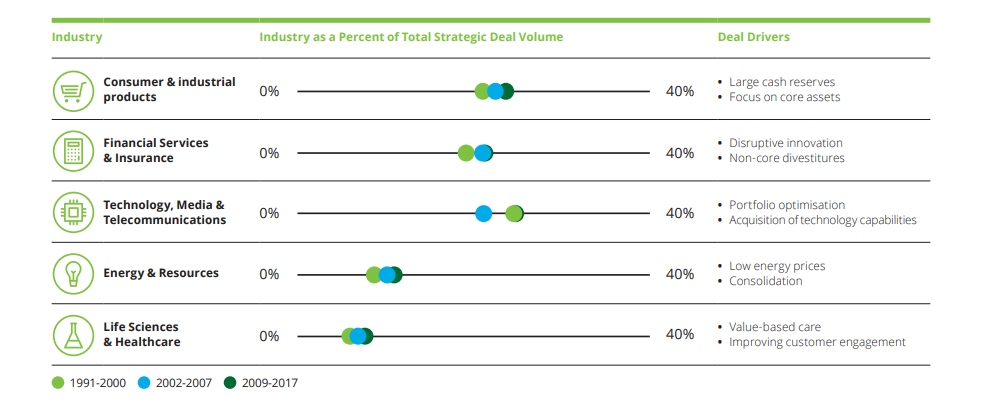

In the current rebound and economic success, strategic buyers have come up and dominated the market place ready to strike deals. The buyers are influenced by the fact that many consumers, financial companies, and energy regulatory boards tend to seek improvement and boost from M&As and portfolio diversification (Zhang et al., 2021). Strategic deals between 2009-2016 represent approximately 80 percent of the total deals and above 85 percent of deal value in the past 25 years. Unfortunately, such vast and great strategic deals only represent a small section in the Energy and Health Care regarding the deal value and volume.

Theories Explaining the Wave-like Nature of M&As

In order to accurately internalize the wave nature of M&As, we will consider some hypotheses developed to explain the merger feature. In addition, we will determine the consistency of the provisions based on the patterns of mergers seen in the above illustrations. We approach the hypotheses by testing them based on the regression results. The theories are neoclassical and behavioral (Cho & Chung, 2022). Under the neoclassical theory, there is, the q-Theory and The Industry shock Theory, whereas, in behavioral theory, there is both The Managerial Discretion Theory and The Overvalued shares theory.

The q-Theory

According to Jovanovic and Rousseau, mergers can be summarized by purchasing already used equipment and plant. The q-theory argues that the existing gap between qs of the potential acquiring the equipment is not always constant. Instead, it increases at particular points, for instance, in the phase of the stock market boom that creates a vast difference pushing the managers and leaders of organizations to favor purchasing new firms over the spent capital, thus creating either a downward or upward merger. According to the q-theory of investment, when an organization’s returns on its capital exceed the cost of capital, there is an expansion of the capital stock.

Alternatively, an organization can still expand by acquiring more equipment and assets. Instead, it can expand profitably when well managed. In other words, a firm’s expansion does not necessarily depend on the quality of its assets, but instead, it is dependent on its management. It can be concluded that the talents of managers solely determine the rate of the stock market boom (Cho & Chung, 2022). Jovanovic and Rousseau further provide insights about the causes of change in beliefs about managers on the market that led to merger waves. The dual claims that the stock market booms depend on technological advances, such as the automobile. As earlier, the late 1990s merger resulted from innovations and technological advancement. It led to opportunities supporting profitable mergers.

The Industry Shocks Theory

According to Harford’s Shocks Theory, different shocks exist that cut across various causes, such as technological and regulatory. These forms, at particular times, tend to buffet several industries such that the simultaneous process within firms produces features similar to waves (mergers) throughout the economy (Wang, 2021). This neoclassical explanation of the wave-like nature of mergers has some potential vulnerabilities with criticism as those of q-theory that the identified shocks should produce effects on both the listed and unlisted industries with the same magnitude across both types of industries.

The Overvalued Shares Theory

According to this theory, neoclassical assumptions still assume managers can increase the shareholder’s wealth and reduce the assumptions that mergers and the efficiency of the capital market create wealth. In the phase of stock market booms, firms’ share prices are overvalued. The managers of the firms are always aware of the overvaluing process, and they, therefore, move ahead and protect their shareholders from losses due to decreased markets below the appropriate levels. Managers protect the shareholders by exchanging the overvalued shares for other assets from other firms. In the process, merger waves are birthed due to the growth rate in overvalued companies in the phase of the stock market boom. In addition, during stock market booms, there is optimism in the market that makes it difficult for managers to predict the nature of the price of the bidder’s shares or whether the price reflects synergies from M&As. Managers end up being partners without their consent, and they end up becoming victims of failed mergers that do not generate the synergies they anticipated.

Test of the Theories

Behavioral theories are built on assumptions of either optimism or over-optimism within the stock market. These theories make predictions based on distinct merger patterns for firms listed on stock exchanges and those not listed. The above-analyzed theories need a shred of backup evidence by estimation of assets acquired by firms. The key prediction is that the acquired assets by various listed firms are more sensitive to the aggregate P/E ratio. The aggregate P/E in this section acts as a measuring tool of optimism degree in the stock exchange market.

Firstly, under the managerial discretion theory, as discussed above, the Anglo-Saxon institutional structure is assumed to exist. An increase in mergers is attributed to increasing shares owned by the largest shareholders. This theory predicts a negative relationship between the number of shares owned by the largest shareholders versus the intensity of assets acquired by a firm (Wang, 2021). Secondly, the overvaluation theory, on the other hand, develops an opposite direction. The theory claims that the number of shares owned by the largest shareholder, especially for an overvalued firm, is directly proportional to personal gain from exchanging assets from another firm. Overvaluation predicts a positive coefficient for firms with the largest shareholders.

Why Firms Choose M&As

Multiple rationales exist for M&As, most of which lack categorizing specific intentions that can be considered rational. The three main reasons why firms choose M&As include; the quest for expansion and pressure to grow, consolidation factors, testimonials, and success manifestation from other firms. Firstly, the primary motivation why firms opt for M&As is the quest for growth. When internal growth within a firm is not achieved and does not add up, and organic growth options are depleted, M&As prove to be the only solution where growth can be achieved (Wang et al., 2020). Consequently, external pressure, for instance, the demand for more profits and growth from investors, may force managers to initiate M&A transactions. Only internal efforts cannot solve external pressure for firms listed on the stock exchange market. Instead, M&A transactions have to intervene.

Testimonials, success testaments, and evidence provided during conferences on social media platforms prove that M&A transactions have enormous success. Manager firms get the perception of winning and develop motivation from such testimonials. Conversely, the success stories differ from one firm to the following. Transactional factors are different, for instance, the company’s life cycle, among other differences. Accepting testimonials with questionable validity may wreak havoc for many firms (Gadegaard & Knudsen, 2021). Lastly, consolidation and competition with market position challenges often create fear within a company of being overtaken or left behind. The only option to keep up with the speed and competition is to engage in M&As transactions.

Reasons for Failures for M&As Transactions

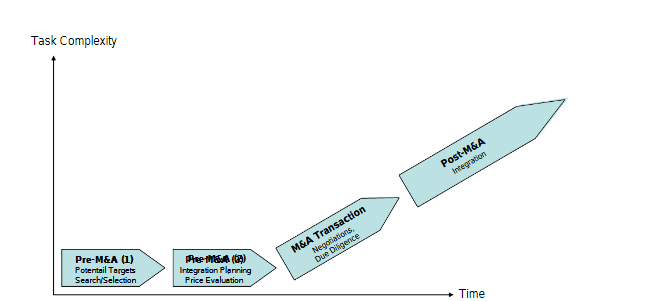

There are manifold reasons why M&As fail, despite the methodology having various success factors. Various impediments play vital roles in most firms’ failures of these seamless success avenues. They include; unrealistic expectations, distrust, the existence of dynamic groups, and overconfidence. Beginning with unrealistic expectations are the main reason for failure among various firms (Mihaiu et al., 2021). Manager underestimation of the required efforts and tasks to successfully transact the M&A is unseen until the results are evident.

The chronological process of developing the transaction gets more complicated as the hierarchy increases. The initial stages of searching and acquisition are relatively simple, but at later stages, the realities of the M&A transactional process hits. Resistance of organizations and consumers comes along the way as, from inertia, it is evident that resistance builds up slowly. Integration into a complete operational merger and acquisition firm is time-consuming and requires extra effort that is painstaking (Kumar, 2019). Predictions towards this process often claim that integration is easier and faster than reality. Profound changes required for a successful implementation are more complex and resource-consuming than thought. The initial stages of post-merger integration are a smaller percentage of the required effort.

Among the characteristics of a good entrepreneur is risk-taking; M&A transactions are not an exemption. Confidence is essential in making M&A deals and achieving its goals, among other things. Confident managers are likely to be hardworking and put in some effort to actualize their confidence. Combined with characters of hope, optimism, and positive beliefs, confidence can yield some positive effects on the success of M&A transactions. However, certain levels of optimism can be toxic and costly (Renneboog & Vansteenkiste, 2019). To some degree, confidence applied to achieve the impossible is overconfidence which is catastrophic more so to businesses, as it may lead to significant losses. For instance, applying confidence to unrealistic expectations, which may be due to a lack of knowledge of financial assets and managerial capacities, may result in overlooking difficulties in tasks beyond an individual’s capabilities. Overconfidence is likely to cause an illusion of control, especially in managerial positions; this may lead to the execution of premature solutions without proper evaluation and consideration of some minimum integration issues.

Finally, distrust among the employees is the grass root and fundamental factor for the success of any organization or company. A counter state of attitudes and moods between the manager and employees is a red flag for the business. For instance, distrust is born when employees are not on good terms with the manager due to overconfidence or lack of in-depth evaluation before integration (Kumar & Sharma, 2019). When employees of a firm lack confidence and do not trust the manager, the execution of duties will not be efficient, leading to the failure of the entire business. Most often, employees lack confidence in M&A transactions because of the unseen uncertainties and dangers posed ahead.

Conclusion

M&As tend to occur in waves for various reasons, among them being the overvaluation of shares. For instance, if a firm’s shares cost way above their value, the option left for the manager is capitalizing the price by acquisition through which they purchase targets with the overvalued shares. In addition, they appear to be periodic due to economic and demographic shocks. M&As are significant and are, in fact, saviors to some firms that are on the verge of closure; better use of mergers rewards such firms greatly. Even though M&As are of great use, some of them tend to fail due to unforeseen issues. It is advisable for managers to carefully evaluate both the positive and negative impacts of M&As before engaging in the transactions.

References

Cho, S., & Chung, C. Y. (2022). Review of the Literature on Merger Waves. Journal of Risk and Financial Management, 15(10), 432.

Gadegaard, M. C., & Knudsen, M. (2021). What Drives Mergers and Acquisitions? [Master’s Thesis]. Copenhagen Business School.

Kumar, B. R. (2019). Mergers and Acquisitions. In Wealth Creation in the World’s Largest Mergers and Acquisitions (pp. 1-15). Springer, Cham.

Kumar, V., & Sharma, P. (2019). Why do Mergers and Acquisitions Fail? In An Insight into Mergers and Acquisitions (pp. 183-195). Palgrave Macmillan, Singapore.

Li, F., Liang, T., & Zhang, H. (2021). Does economic policy uncertainty affect cross-border M&As? ——a data analysis based on Chinese multinational enterprises. International Review of Financial Analysis, 73, 101631.

Mihaiu, D. M., Șerban, R.-A., Opreana, A., Țichindelean, M., Brătian, V., & Barbu, L. (2021). The impact of mergers and acquisitions and sustainability on company performance in the pharmaceutical sector. Sustainability, 13(12), 6525. Web.

Renneboog, L., & Vansteenkiste, C. (2019). Failure and success in mergers and acquisitions. Journal of Corporate Finance, 58, 650-699.

Sha, Y., Kang, C., & Wang, Z. (2020). Economic policy uncertainty and mergers and acquisitions: Evidence from China. Economic Modelling, 89, 590-600.

Wang, F. (2021). M&A Waves in China: A Survey from the Government Behavior Perspective. In M&A and Corporate Consolidation (pp. 73-174). Palgrave Macmillan, Singapore.