Introduction

Yahoo! Inc. has placed itself in the top spot among Internet portals, by attracting approximately 232 million visitors each month worldwide. It not only offers a directory and search engine, but also features a collection of communications, commerce, and content services with over 25 international sites in 13 languages.

Yahoo! produces much of its revenue from banner advertising and sponsorship ads, while also obtaining fees through subscription and business services, such as SBC Yahoo! DSL and Dial, Yahoo! Personals, Small Business Services, Yahoo! Mail, and Yahoo! Enterprise Solutions. Moreover, many customers paying fees rose to 8.4 million, from 4.9 million the previous year, reflecting enlargement in these services.

According to the expert analysis Yahoo! is the number one Internet brand internationally and reaches the main audience universally. Furthermore, the service more than 232 million people each month universal. Yahoo! is global Internet communications, commerce, and Media Company that helps Internet users navigate the World Wide Web. Yahoo! has the main worldwide audience. No doubt, they also have the most breadth of wireless products and services of any web supplier. Yahoo! offers a broad array of communications, commerce, and content services that lead consumers to make them their homes on the Internet. (Chang, 2002)

Background

If we analyze then we come to know that Yahoo! was founded by David Filo and Jerry Yang in 1994. Filo and Yang in progress they’re directed to keep a list of their attention on the Internet. As their list grows they would break them into subcategories. This is the basic core concept behind Yahoo. As word spread about their site more and more people started using their site. In the fall of 1994, the site celebrated its first million-hit day.

In March of 1995 Yahoo! was integrated. In April 1995 they received an investment from Sequoia Capital. Realizing that their company could produce rapidly they looked for a management team. Tim Koogle was employed as chief decision-making officer and Jeffrey Mallett was hired as leader operating officer. In April 1996, Yahoo! opened a highly-winning IPO. In May of 1999 Yahoo! was reincorporated.

Throughout the past decade, the Internet has grown necessary for approximately all people. Some of Yahoo’s closest competitors are Google, Excite, MSN, Earthlink, and American Online. Due to Yahoo being so wide and offering a broad range of Internet and technology products, Yahoo also has to vie not directly with companies such as Microsoft. When it comes to Internet providers and search and marketplace, Yahoo ranks in the middle of the top.

Revenues for the fiscal year broken 12/31/2006 totaled $3.57 billion as Net profits totaled $839.6 million. Google’s revenues for the fiscal year ended 12/31/2006 totaled 3.19 billion; comparable to Yahoo’s, but the Net income was nowhere near Yahoo’s at $399.1 million. Earthlink, Inc, another Internet service provider, shows considerably fewer revenues and net income for the fiscal year ended 12/31/2006. Microsoft, a much larger company shows revenues of $38.47 billion and net income of $10.00 billion for the fiscal year ended 12/31/2006. Overall, Yahoo is competing with a variety of players in the computer service industry.

Porter’s Analysis of the Industry

It is crucial for a strategic business manager to obtain a clear comprehension of the industry that Yahoo functions in to get an edge over competitors. There are a large number of competitors presenting similar services like Yahoo. Due to the feasibility of similar information, there exists very little diversity between rivals. Because of this, competition is usually primarily based on brand name and brand equity. Michael Porter developed a scheme explaining the five forces that influence how an industry operates.

Barriers to Entry/Threats of New Entrants

The threat of new entrants restricts the whole profit possible in the industry since new entrants bring new abilities and they seek market split, pushing down margins. But in the real world, a variety of industries effort to guard their firms’ high-profit height and restrict additional rivals from entering the market. These barriers to entry exist in the market to prevent potential rivals from entering in.

In the computer services industry, in which Yahoo functions, is extremely hard for new rivals to enter the market. One of the reasons for the low threat of novel entrants is since of the high economies of level and knowledge curves in this business. Yahoo was able to capture these economies of scale by creating geographical-specific sites and expanding its operations. New entrants would find it difficult to capture the economies of scale. Furthermore, the fact that Yahoo offers free services eliminates the idea of switching costs. In addition, rivals would have a hard time competing with Yahoo’s successful brand identity and brand equity.

Bargaining Power of Suppliers

Suppliers can apply their bargaining power in an industry by threatening to either increase prices or reduce the quality of products or services. Yahoo’s suppliers have somewhat low bargaining power. There are plenty of suppliers in the market so the influence of such suppliers is not as notable. Besides, there are numerous sources that would be willing to provide information to Yahoo.

Bargaining Power of Customers

Buyers are able to compete in the industry by driving down prices and demanding higher quality or better services. Individual end-users have high bargaining power because of the number of various portals providing the same service as Yahoo provides. On top of that, it doesn’t cost them to switch over to another information provider. This makes it necessary for Yahoo to exemplify their services to their customers in order that they are satisfied.

The Threat of Substitute Products

When substitutes are available in the market, profitability in an industry is limited.

The threat of substitute products is high for Yahoo in the computer services industry. The pricing for Yahoo’s services and its competitors provides very little difference. Advertisers and end-users find it very easy to switch service providers because of the vast availability.

Industry Supply and Demand

The Internet is considered to be the fastest-growing communication medium in the history of the world. It continues to grow at an incredibly fast rate increasing the demand for service providers such as Yahoo. This number may increase to 2007, according to IDC.

With the prices of computers falling, more and more customers are now able to afford personal computers. Whether users are utilizing Internet resources for online shopping, education, business, email, etc, the world has definitely seen a dramatic increase in the number of users.

Competition

Yahoo!’s most significant competitors are Time Warner and Microsoft. Time Warner is an integrated media and communications company engaged in online services. It has a large customer base through AOL. Microsoft is the largest software company in the world and it provides numerous Internet products and services. They can sell software through online subscriptions. (Angel, 2002)

Weaknesses

Yahoo! needs to expend important interior engineering resources and obtain other technologies and companies to give or enhance their ability. They need to work on their piece of the international section. They need to get additional information concerning other countries. In international markets, they face considerable competition from Internet Service Providers that offer their possess navigational services.

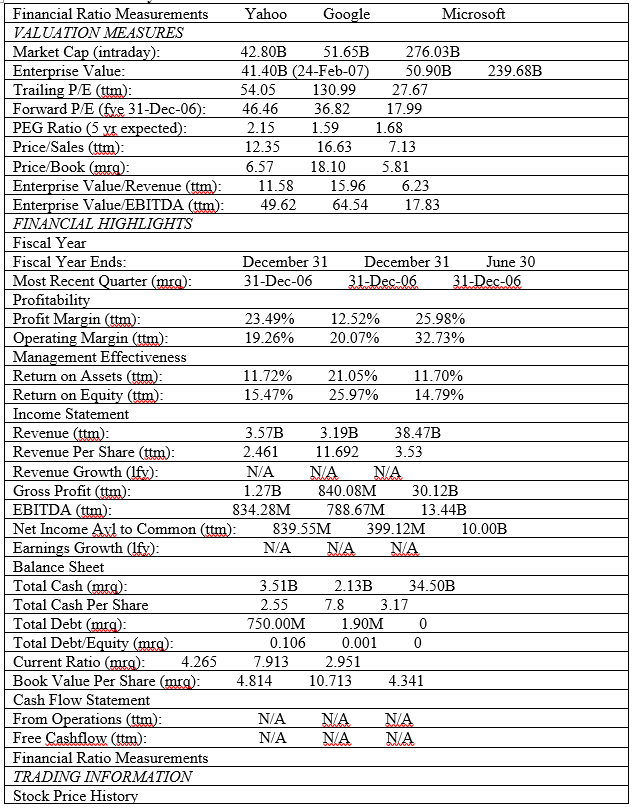

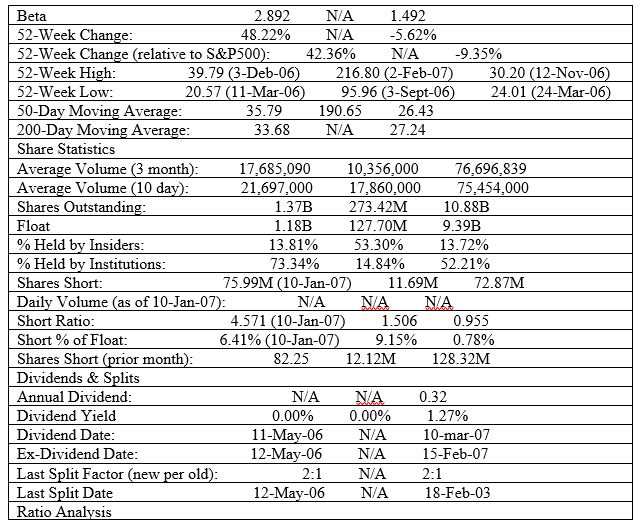

Ratios

Ratios such as current ratio, debt to equity, ROE, and ROA indicate Yahoo is a financially strong company and consistent with its competitors. The current ratio indicates the company is liquid (more so than competitors) which should be valuable to shareholders by reducing risk and shows the company can take on more risk as well. Debt to equity is also a strong indication of its ability to handle more risk. (Turek, 2004) These ratios are also a reflection of the stability of the stock.

Profit Margins

Profit margins for Yahoo indicate consistency with its top competitors.

Growth

All the variables indicate that Yahoo’s growth exceeds competitors.

My investment of $ 1000 will return me profit with consistency. It is safe to invest in Yahoo.

Conclusion

Based on our research of stock price analysis, our recommendation is to BUY. Projected net sales continue to grow for Yahoo! and it has plenty of room for further steady growth. The higher income in addition reflects on improved operating margin.

The 52-week high was priced at $39.14, while the 52-week low was $25.26. The current price as of 5/2/07 was $43.29. The expected baseline price in our estimation was $46.32.

This recommendation is based on our assumption that the long-term growth rate for the firm will be 7% using the Corporate Valuation Model and 9% using the Discount Dividend Model.

References

Angel, Karen. Inside Yahoo! Reinvention and the Road Ahead. New York: Wiley, 2002.

Chang, Jennifer C. “In Search of Fair Housing in Cyberspace: The Implications of the Communications Decency Act for Fair Housing on the Internet.” Stanford Law Review 55.3 (2002): 969+.

Cowan, Douglas E. Cyberhenge: Modern Pagans on the Internet. New York: Rutledge, 2004.

Hogge, Becky. “Cyber Dissidents: A Long Blog to Freedom.” New Statesman. 2007: 18. Web.

Palser, Barb. “Is It Journalism? Yahoo! News Attracts a Large Audience but Does No Original Reporting.” American Journalism Review 2002: 62.

Turek, Melanie. “Instant Messaging: Time for IT to Pay Attention.” Business Communications Review. 2004: 50+.

Reuters, Yahoo! Inc YHOO.O (NASDAQ). Web.

The New York Times, Business; Yahoo Inc, 2007. Web.