For many people, college is often the very first step into adulthood. During this time, we gain new concerns – our studies, homework, or relationships with peers and tutors. Managing all of these alongside everyday chores and a part-time job may sound like mission impossible.

Besides these essential responsibilities, another central aspect of student life that often goes forgotten – personal security. This is where insurance comes in.

Insurance is a necessary precaution, particularly for college students. It protects you in the case of an emergency and saves you plenty of stress and money when something does go wrong.

In this article, our team has prepared for you everything you need to know about insurance as a college student. We start by explaining the basics and the importance of coverage. Then, we give a straightforward explanation of how it works and disprove some of the most popular insurance myths. You will learn which plan or policy is appropriate for your unique situation. We also advise you on purchasing different insurances and other related issues. Finally, we will tell you how to stay safe on campus.

Ready? Let’s begin!

💯 Student Insurance 101

From early childhood, a lot of us have developed the habit of thinking that insurance is a very “adult” concept. It is something to do with luxury cars, medicine, and businesses. We don’t concern ourselves with these things, completely certain that our parents will keep an eye on these things. However, once a person enters adulthood and starts living on their own, they have to take responsibility for their safety.

If you have never previously concerned yourself with insurance and are now realizing that you have no idea where to start, don’t panic. In this section, we will start at the very beginning – the definitions. Afterward, we explain why insurance is important for college students and which risks you may face during your studies. And if you want to learn even more, we have an extensive free essay database that displays papers on this topic.

What Is Insurance?

Insurance is an agreement protecting people in the event of loss, damage, or injury. It distributes the risk across a pool of people who buy the policy. Insurance can protect you from a predictable event that unexpectedly arises. For instance, you might predict that burglars or fire could destroy your home, but you do not expect either of these events to actually happen. That’s why you pay premiums to your insurance agent (and thousands of other people do the same). The money you give will be distributed to those whose properties do get damaged.

So why did we refer to insurance as “an agreement”? That is because when the insured event occurs, you will receive only the amount you have agreed on with your agent – no more, no less.

Why Do I Need Insurance?

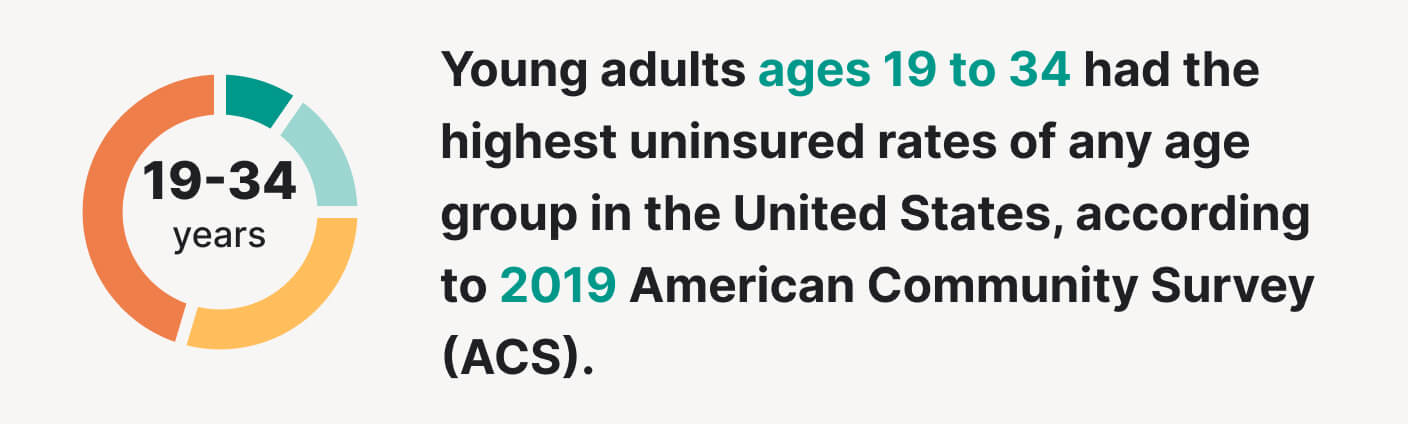

A lot of students don’t know or care enough about insurance. In fact, the 2019 American Community Survey has shown that very few young adults invest in insurance policies. However, knowing that you and your loved ones are secure from unforeseen situations is priceless. Incidents in life can happen at any moment. No one can predict an unfortunate death, medical emergency, or damage to property. The financial impact of such situations can devastate you and eat into your life savings.

Insurance provides financial coverage for risks to your life, health, or property. In other cases, it can also support you in certain specific incidences. For example, child insurance plans accumulate your funds until the child reaches a certain age. This money can even pay for their college.

How Insurance Works

To become insured, you should buy a policy by making regular payments (“premiums”) to the insurer. If the insured event occurs, you submit a claim to your agent. After a review, they will be obliged to pay out the agreed amount for the loss or damage. You won’t get your money if you do not claim or if your application contains untruthful or misleading information.

The amount you receive as an insurance payment can be hundreds of times bigger than the amount you have given to the insurance company as premiums. This is possible because the insurance payout is taken from the pool of premiums provided by other policyholders.

Importance of Insurance for College Students

There are plenty of reasons why insurance is essential for students.

- Coverage for education interruption. The insurer will cover your expenses if your studies come to an abrupt end. For example, this may happen if a student discontinues college due to the death of a close family member or hospitalization.

- Liability assurance. Insurance can cover your legal responsibilities if you happen to cause accidental injury or property damage to another person.

- Future planning. Insurance can also become a tool for creating long-term wealth. Choosing a money-back policy plan allows you to receive a certain amount after the expiration of the policy term.

- Tax benefits. Did you know you can claim income tax deductions when you start earning? Thus, your taxable income becomes lower. This can be of considerable benefit while starting a career with a small salary.

- Coverage for unforeseen circumstances. For instance, they can fall under the category of travel-related expenses. International students appreciate this insurance if they lose their passport, driving license, or checked-in baggage.

Typical Risks Faced by College Students

In the section below, you will find a list of some of the common risks college students might face in the course of their studies.

- Physical health issues. An insurance policy can cover your medical costs. Health coverage is the most popular kind of policy, as treating injuries or other conditions can be costly.

- Mental health issues. You can be careful and avoid injuries, but stress is often a huge part of the college experience. There are ways to reduce it, but there will always be something to worry about. When issues pile on, being insured can help you reduce the strain of stressful situations on your mental health.

- Accidents. Imagine you’ve accidentally caused a fire in your dorm. Now, think of all the consequences. Hopefully, no one gets hurt – but the renovations would surely cost you a fortune!

- Theft. The more people you are around, the higher your risk of theft. Any educational institution is a densely populated establishment, so watch out. If you have something valuable (a laptop or smartphone), get insurance.

🔍 Popular Insurance Myths

There are plenty of misleading myths about insurance out there in the world. We could have heard false rumors and thought they were true or just made some false assumptions based on incomplete information. Below, we have disproven some of the more popular insurance myths out there.

Insurance Myth #1

I don’t need insurance because nothing bad will happen to me.

FACT: You may have a perfectly healthy lifestyle – however, injuries, illnesses, and accidents can happen to anyone at any time. Healthcare bills in the US can add up to thousands of dollars. So, if you don’t have insurance, you can go bankrupt just because of a broken leg.

Insurance Myth #2

If something does happen, I can just get insurance then.

FACT: Insurance protects you from unforeseen events in the future. Only the accidents that happen to you after the insurance policy’s effective date will be covered. For example, your insurance agent will inspect your car before signing the agreement so that you can’t claim compensation for previous damage.

Insurance Myth #3

All insurance is the same, so I’ll get whichever is the cheapest.

FACT: On the contrary, all insurance plans are different. Don’t lose coverage in the pursuit of a cheaper policy. The best kind of insurance would cover sports, mental health, maternity, medical evacuation, and repatriation (for international students).

Insurance Myth #4

If I get insurance, I’m completely covered and won’t need to worry about anything.

FACT: Any policy has a list of exclusions. These might be something like dentist consultations, plastic surgery, or accidents that happened while intoxicated or practicing sport. And don’t forget about out-of-pocket expenses that are never covered. Reading your insurance plan can save you a lot of stress later on.

❓ What Insurance Do I Need?

Once you’ve learned what insurance is and why it is necessary, we can go into further detail. Apart from various insurance types, this financial instrument can vary from policy to policy. Unfortunately, it is challenging to determine which plan is the best for you. Let’s check out some essential information below that can help you get started.

Health Insurance

What Is Health Insurance?

Health insurance is often a prerequisite for university admission. The reason is that students without it usually avoid seeking timely medical help. As a result, they drop out in the middle of the semester.

Student health insurance is similar to a warranty for a new product. If it stops working as it should, you can have it repaired for free (or almost for free). If your health “breaks down,” your policy will pay for medication and treatment.

Health insurance for college students is one of the most affordable insurance plans. It is designed to meet student needs and is often adjusted to your particular situation.

Health Insurance Guide

- School Plan. Some colleges offer and even provide funding for insurance plans to their students.

- What It Covers: The coverage varies – you can include the premiums in your student loan. Your eligibility depends on the number of credits you are enrolled in.

- Where to Get It: School’s health center.

- Parent Health Plan. Students can remain on their parents’ insurance until they are 26. Marriage or graduation does not interfere with this.

- What It Covers: The coverage depends on the parents’ insurance plan. You remain on the policy if you have been included before admission.

- Where to Get It: From your parents.

- Catastrophic Plan. This is designed to protect you against large-scale unforeseen medical expenses. People under 30 who cannot afford other insurance plans often apply for this kind of coverage.

- What It Covers: Coverage is limited to several doctor appointments and a few types of preventive care.

- Where to Get It: HealthCare.gov

Life Insurance

What Is Life Insurance?

Few people think something irreparable can happen to them. Why should they worry when life has just begun? Still, a life insurance plan can literally save your family in case of an accident, as most parents co-sign their student loans.

Many people mistakenly think that the absence of dependents makes life insurance unnecessary. While the outstanding balance on federal student loans automatically cancels in case of death, private loans must be paid regardless of whether the education is completed. You don’t want to pass this debt on to your loved ones.

Life Insurance Guide

- Whole Life Insurance. It lasts for your entire life or as long as you pay premiums. Be careful when choosing your insurance company, as it is a permanent (and expensive) choice.

- Term Life Insurance. It lasts for a specific term (1 to 30 years) and could be a better option for young people.

- What They Cover: These insurance plans cover your outstanding liabilities and funeral costs.

- Where to Get Them: You will be subject to a medical examination. The insurance company will make sure you are in good health. Most reputable insurance companies provide both options.

Tuition Insurance

What Is Tuition Insurance?

Tuition insurance refunds a portion of your education expenses if you have to suspend or terminate studies due to an injury or illness. Many colleges have their own leave policies, which are often cheaper than those offered by private insurance companies. However, they don’t cover everything. For instance, additional tuition insurance is a better choice if you have a mental health condition.

In addition to unforeseen health issues, a tuition refund policy may also cover preexisting chronic conditions. And in the wake of the COVID-19 pandemic, many insurers offer epidemic-related coverage. In any case, you must demonstrate a documented medical cause for the withdrawal.

Tuition Insurance Guide

- Tuition insurance policy.

- Covers whatever the school did not reimburse as a part of its refund policy.

- The reimbursed percentage is 75% to 100%, regardless of the withdrawal time.

- The refunded amount depends on what the insurance agreement says, not on the student’s finances or health condition.

- It may be a good solution for people with chronic health conditions (although some insurers exclude preexisting diseases from coverage).

- School refund policy.

- It reimburses your course fees on a declining scale.

- The amount is higher at an early request.

- If you claim the refund after the first month of a semester, you won’t be reimbursed in most cases.

- It may have exceptions for specific medical or mental health problems.

- The refunded amount depends on the student’s financial and medical situation.

Renters Insurance

What Is Renters Insurance?

Renters insurance protects your belongings from fire, vandalism, theft, or vehicle damage. The policy also covers personal liability. For instance, if a friend trips over your cat while at your place and breaks their leg, renters insurance will back you up.

According to the Insurance Information Institute, only 57% of tenants have renters insurance in the US. People mistakenly think that the policy covers only the apartment, not the things inside. However, insurance has multiple hidden benefits, particularly for students.

Renters Insurance Guide

- Parents’ homeowners policy

- It does not cover graduate students.

- It reimburses your possessions in any school-affiliated housing.

- It may not cover off-campus rented apartments.

- It does not cover personal liability to someone injuring themselves in your dorm room.

- Renters insurance policy

- The landlord’s policy covers only the building, not your possessions. Thus, most landlords will ask you to get renters insurance.

- It covers your belongings wherever you live and regardless of your study level.

- Travelers’ renters insurance protects your things around the world.

- It pays for your liabilities if someone injures themselves at your place.

- It provides emergency housing if you need to relocate during repairs

Auto Insurance

What is Auto Insurance?

We recommend you stay on your parents’ auto insurance plan for as long as you can. Sharing one policy is more affordable, and you are still covered when you return home for the summer or winter holidays.

Getting your own car insurance is better if you permanently move out of your parents’ home or don’t use their car anymore.

Auto Insurance Guide

Parents’ auto insurance

- It applies if:

- You co-own your parents’ car;

- You live with your parents and use their car;

- You drive their car during vacations;

- You have moved out but live in an apartment rented or owned by your parents.

- It is cheaper than an independent policy;

- It provides you access to Good Student and Multi-Driver discounts.

Your auto insurance

- It applies if:

- You own the car.

- You don’t live with your parents or at a property owned by your parents.

- Young drivers’ insurance is usually more expensive since you generally don’t have as much driving experience.

- It can be a financial burden for your parents if you are not financially independent.

🔒 How to Stay Safe at College

Below, you’ll find several tips on how to avoid unpleasant situations during your college years.

- Always lock your room.

You may know everyone who lives on your floor in your dorm building. They may even be your good friends. But if something valuable gets lost, you will suspect everyone. In addition to lost possessions, you might also lose relationships. The same applies to an off-campus apartment, where the risk of theft is much higher. Besides, keeping a home inventory will contribute to your peace of mind. - Don’t drink in excess.

We recommend drinking in moderation and only if you are of legal drinking age. After all, severe intoxication will make you more susceptible to injuries and accidents. Watch your alcohol intake and call a taxi or ask someone to pick you up after you drink outside. - Don’t walk alone after dark.

Stay away from poorly-lit pathways and areas. Try not to walk home late at night on your own – befriend someone from your dorm to have company on your way from a party. You can also check if your college has a campus escort shuttle. - Be alert.

Stay aware of what is happening around you. Use only one headphone and keep your phone in your pocket while walking alone late at night. Be wary of scammers, con artists, and other individuals that may try to take advantage of you. - Tell someone where you are going.

Let a friend know when and where you plan to spend the night, just in case. This is especially important if you are going to a party or meeting up with someone you don’t know very well. Have a trusted person on speed dial in case you need them to come and pick you up. - Carry pepper spray.

Put it in your pocket and keep it there in all instances. You never know when it may become necessary. According to the US Department of Justice, pepper spray is the safest and the most effective self-defense measure. It doesn’t cause severe injuries to the perpetrator, while using bladed weapons or firearms for self-defense can have severe consequences. - Know where to seek help.

Who will you contact if someone needs help? Find the campus health center, security service, and police station. Enter their contacts into your phonebook for easy access in an emergency situation. - Check your social media settings.

Don’t forget about your cybersecurity. It is better to disable your geolocation on Facebook and other public networks. Make sure to always report any suspicious online activity. - Think of fire hazards.

Never leave your domestic appliances switched on while you are out. A simple toaster can ruin your life and the lives of many other people if left unattended. Double-check that all possible fire hazards are switched off whenever you leave the house. - Walk away from situations that make you feel uncomfortable.

You are never obliged to remain in a setting that makes you feel pressured or threatened. On the contrary, if you are uncomfortable, these are red flags that your subconscious is sending your way. Use any excuse you can think of to leave. For example, you might need to take care of a friend or relative, make an urgent phone call, or have health issues.

You are welcome to share this article with anyone who doesn’t have an insurance plan yet. Knowing you’ve saved someone from serious troubles is a great feeling. Stay safe!

🔗 References

- In school? Student Health Plans & Other Options – HealthCare.gov

- Health Insurance Coverage Among Young Adults Aged 19 to 34: 2018 and 2019 – Douglas Conway, American Community Survey Briefs

- Student Health Insurance Guide – Laila Abdalla, Best Colleges

- A Student’s Guide to the Best Insurance Deals – Patrick Collinson, The Guardian

- The Ultimate Student Insurance Guide – Endsleigh Insurance

- Student Health Plans – U.S. Centers for Medicare & Medicaid Services

- Tuition Insurance – GradGuard

- Tuition Insurance May Help Cover Costs If a Student Withdraws from College – Jessica Dickler, CNBC

- Student: Tenant’s Liability Insurance – Cover4Insurance

- Do College Students Need Renters Insurance? – Allstate Insurance Company

- Car Insurance for Students Taking Their Car to University – Tom Martin, USwitch

- Three Reasons to Consider Life Insurance for College Students – Nationwide

![Social Media Learning Platforms: Are They Underestimated? [2026 Guide]](https://ivypanda.com/blog/wp-content/uploads/2022/05/hands-with-laptop-virtual-world-map-309x208.jpg)