Background of the Company

Al Hilal Bank (AHB) is a government-owned provider of integrated Islamic financial services in the UAE. It was established in 2008 in Abu Dhabi by the Emirati authorities to offer a broad range of innovative Islamic banking solutions in three areas, namely, commercial banking, investment banking, and asset management for corporate and commercial clients (Zawya para. 2). The company’s primary industry of operation is financial services. However, AHB also offers Islamic insurance products through the Al Hilal Takaful, Al Hilal Auto, and Al Hilal Kazakhstan (Ahlibank par. 6). The bank has its head office in Abu Dhabi but operates 25 other branches and 115 ATMs spread across the UAE (Ahlibank par. 4). Locally, its staff population is about 1,500 employees. Internationally, the bank operates two subsidiaries in Kazakhstan.

Competition in the UAE banking industry is stiff. Besides banks, other players include “credit unions, brokerage companies, mortgage providers, and credit card issuers”, among others (MarketLine par. 12). The industry also attracts foreign players that compete with UAE banks in Dubai and Abu Dhabi. In the Islamic banking segment, six other Islamic financial institutions compete with AHB. These include the “Abu Dhabi Islamic Bank, the Dubai Bank, Dubai Islamic Bank, Sharjah Islamic Bank, Emirates Islamic Bank, and Noor Islamic bank” (Siddiqi 171). AHB competes through product differentiation, geographical diversification, and the provision of innovative solutions that improve customer service. It offers the ‘Qibla Card’ that gives holders the directions to the Qibla, the RFID identification technology and Grab, among others. Since its establishment, AHB has experienced steady growth in its market share to become the third-largest bank in the Islamic banking segment by asset value (AED 28.3bn) (Siddiqi 41).

Strategy of the Company

AHB’s mission is “To contribute to the UAE’s national growth and prosperity, whilst raising the positive profile of Islamic Banking globally and therefore creating value to all stakeholders” (Ahlibank para. 2). The company utilizes a differentiation strategy to realize its mission. Its financial services fall into three main categories, namely, banking (commercial and Islamic banking), asset management (Islamic), and investment banking (advisory and Islamic). Its products range from credit cards, ‘Takaful’, motor vehicle insurance (Al Hilal Auto), and investments. The company deploys several technologies to improve the quality of customer care, including the RFID enabled, digital, and scented cards (Ahlibank par. 12). The Takaful product encompasses insurance cover for property, health, air transport, and maritime travel (Ahlibank par. 8). Unlike in conventional insurance, Takaful policyholders receive annual dividends from the bank. It is clear that by offering a full range of products and services, AHB can appeal to multiple customer segments.

AHB has a workforce of about 1,500 employees and agents. The company uses various methods to measure the productivity of its workers. It has deployed the service monitor program to track the “service performance level” of the staff and sales agents (Ahlibank para. 6). The company relies on customer feedback and audio recordings of client calls to assess staff and management performance. The overall productivity is measured using indicators such as customer deposits, assets, and profitability, which grew by 42% between 2012 and 2013. Over the same period, customer deposits into the bank rose by 13% (Islam 47). Productivity in the financial services industry is not difficult to evaluate because the growth in output, i.e., assets or interest from loans can be measured. These indicators are associated with improved workplace efficiency or technology deployment.

Forecasting

Firms use a variety of forecasting techniques to predict future market trends. The main approaches include qualitative, time series analysis, causal relationship, and simulation (Arrif and Iqbal 57). Qualitative methods rely on the judgments and opinions of the staff that interacts with customers or a panel of experts. Customer surveys can also generate information for qualitative forecasting. Time series analysis is based on the notion that past performance can foretell future growth. Time series can be “stationary, trend-based, or seasonal” (Arrif and Iqbal 61). Analysts can use regression or the moving average method when forecasting with time series. The causal relationship seeks to determine any cause/effect correlation between a factor and future market demand. In contrast, the simulation method utilizes a dynamic programming model to test various scenarios using the identified variables (Arrif and Iqbal 72).

AHB uses various forecasting techniques to determine customer needs and market demand. For example, the company operates the Al Hilal Customer Experience Index (ACE) that records user suggestions and thoughts for benchmarking purposes. This qualitative approach enables the bank to come up with innovative solutions that improve customer service. Much of the information about AHB’s forecasting approaches are confidential. I would suggest that AHB uses a time series approach to forecast changes in its cash assets and credit market. Market indicators show that the Islamic banking industry will grow to a value of $1,052bn in assets by 2019 (Mohieldin 88). Using this information and the bank’s 5-year performance report, AHB can forecast its compounded annual growth rate (CAGR) for the next three years. Also, credit metric forecasts can indicate the company’s revenue growth trajectory. The approach should include external variables, including political factors and regulatory policies that may affect performance.

Capacity Planning

AHB manages its capacity through technology infrastructure, staff skills, and geographical expansion. The infrastructure aims to improve customer care and operational capacity. AHB successfully deployed the RFID technology to support its customer relations management. The tool boosts the bank’s infrastructural capacity to identify customers entering its premises, enable clients to interact with preferred staff, and facilitate contact-free transactions (Ahlibank para. 15). The bank also has a large branch network (25 branches) across the UAE. The service monitor program enhances AHB’s capacity to track the performance of the staff and management at the branch level. The rapid expansion of the bank since its launch in 2008 indicates that it has enough management capacity to utilize the infrastructure and resources to achieve the set objectives. The institution has recorded steady growth in customer deposits and profitability. These indicators suggest strong leadership and management capacity that drives organizational performance forward.

AHB also manages its capacity through organizational learning. It promotes adaptive capacity by absorbing innovative technologies that appeal to changing customer needs. The institution is renowned for its pioneering technologies on its credit cards. The Qibla Card stands out as a unique offering that contains a navigational tool to allow Muslim customers to locate the Qibla (Ahlibank para. 12).

AHB has sufficient capacity in the areas of management, staff skills, and infrastructure/technology. However, more capacity is required in the areas of strategic alliances. Mergers and acquisitions constitute one way a bank can increase its capital base to compete in new locations. For instance, the merger between the Emirates Bank and the National bank of Dubai formed the ENBD (Siddiqi 172). Improving the capacity to collaborate would reinforce AHB’s international expansion plans.

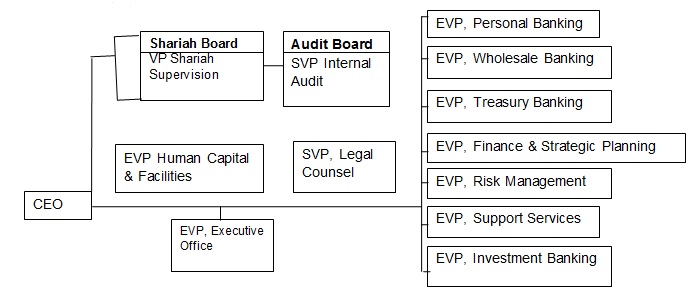

Process Selection and Facility Layout

The processes shown fall into three categories, namely, primary, support, and management. The wholesale, personal, treasury, finance, risk management, and investment banking units perform the primary or essential processes of AHB. The respective executive vice presidents make corporate decisions. The support services department performs functions that support the primary processes. On the other hand, the management processes involve the CEO, the Shariah and audit boards, and the executive vice president.

The layout of an organization is the way the departments are organized to enhance efficiency in business processes (Ahlibank par. 4). AHB’s head office is located in Maryah Island in Abu Dhabi. The bank has a process layout, i.e., the facility houses various offices under one roof. The staff works in various departments, such as personal finance, wholesale banking, and treasury banking, among others, with shared support services. Customer care and IT infrastructure are shared between the offices.

In my view, the facility layout facilitates a smooth workflow in the bank. Customers entering the facility are identified using the RFID-enabled card they hold. They are then directed to a particular department where they can be assisted. They can move between offices within the building without backtracking. Thus, the layout does not lead to customer confusion. It also enhances efficiency because employees can refer customers to specific offices for assistance.

Product and Service Design

AHB offers a range of products and services to customers. It issues credit cards to customers to facilitate transactions via ATM outlets. The RFID-enabled credit card is an innovative product that the bank issues to customers. RFID cards contain a unique tag or number linked to the cardholder’s account number (Ahlibank par. 6). The aim of issuing these cards is to enhance customer service by reducing transaction time. Loyal clients receive RFID cards upon registering with the bank. The tag on the card notifies a particular staff member when the cardholder enters the facility, allowing them to receive preferential treatment. The employee uses the RFID code to obtain client information from the AHB’s “T24 Islamic Bank Model via the ESB messaging system” in advance (Ahlibank par. 7). In this way, the customer’s transactions can be completed with no delay.

In my opinion, this product could be improved to provide personalized services to customers. In addition to customer recognition, features that reward the customers can enhance loyalty to the bank. I would suggest a credit card that rewards loyal customers with points redeemable for cash. Moreover, creating a program around personalized experiences can support product differentiation, resulting in a strong competitive advantage.

The RFID-enabled cards have significant legal implications. The technology is similar to a tracking system that allows employees to recognize and serve customers. However, technology can compromise individual privacy and security. The RFID card supports a range of personalized services that can enable AHB to achieve sustainable competitive advantage. The technology saves the company resources required to manage customer relations, including file records and time. Therefore, it is consistent with the principle of reducing, reuse, and recycle.

Location

AHB head office is located in the Maryah Island of the Emirate of Abu Dhabi, UAE (Ahlibank par. 1). The company has 25 branches spread across different emirates, which includes two-branched in Dubai. It also has two subsidiaries in Kazakhstan that offer Islamic banking solutions. The Abu Dhabi location is strategic in many ways. The decision to establish the headquarters in Abu Dhabi was influenced by strategic reasons. First, the Abu Dhabi government established the bank in 2008 to support the economic development of the region and reduce oil dependence. Second, the choice of the location was strategic to provide funding for the emerging real estate market. Abu Dhabi real estate sector required funding, which forced the Abu Dhabi government to start the bank with a capital of AED 4bn.

Abu Dhabi, besides Dubai, is a favorite destination for expatriates. The Al Maryah Island projects itself as a business and entertainment center in the UAE. The island is home to high-end hotels, commercial buildings, and residential homes and has a well-established transport infrastructure. Therefore, the choice of this location might have been strategic to reach the corporate and individual customers from suburban Abu Dhabi.

In my opinion, Al Maryah Island is a good location for three reasons. First, the major infrastructural projects taking place in Abu Dhabi requires funding. The demand for mortgages and investment banking is high in this Emirate due to the construction projects. Second, Abu Dhabi attracts many visitors. Therefore, the travel and tourism industry requires financing to stimulate local economic growth. Third, the demand for Islamic banking is growing in the UAE. The government-ownership model ensures sustainability; hence, more Islamic banking products can be rolled out.

Quality Management

AHB offers Islamic insurance or ‘Takaful’ to cover property, health, and automotive sectors (Ahlibank par. 16). The Takaful product is based on the principle of cooperation and distinguishes deposits from the shareholder activities (Arrif and Iqbal 44). It considers the premiums from customers to be voluntary gifts (Takaful fund) that are the source of the compensations paid out to customers. Annually, after deducting operational charges, any unclaimed sum is paid back to the customer as dividends (Arrif and Iqbal 47). Therefore, the determinants of quality of Takaful may include operational design, ease of use, after-sale evaluation, and Shariah compliance.

The bank runs an inspection program to evaluate the quality of its services at the branch level. The inspection involves monitoring services at each branch for one week (Ahlibank par. 10). The aim is to identify service deficiencies and improvements during the inspection. The audit team engages the staff and management to identify areas that need improvement.

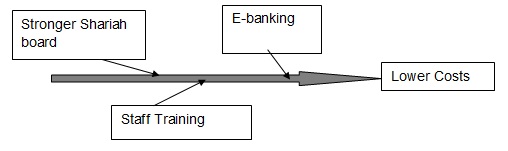

A cause and effect diagram can help identify the issues related to the Islamic finance product and ways of solving them. Islamic banking models are associated with high costs. According to Islam, Islamic banks often report lower revenues than other financial institutions because of high operational expenses (52). Stronger Shariah boards, technology (e-banking), and staff training can reduce these costs. A cause/effect diagram would appear as follows:

I would recommend a program that assesses the user-friendliness of AHB’s products and services. The approach will rely on customer feedback for continuous quality improvement. If I were to benchmark the company, I would base it on customer numbers and strategic goals. The number of customers is a good indicator of performance. On the other hand, the extent to which strategic goals are met over a period determines managerial efficiency.

Conclusions

The Islamic banking industry is growing rapidly in the UAE due to the high demand for such services. AHB has experienced steady growth in customer deposits, branch network, and profits since its establishment in 2008. The bank’s internal capabilities lie in its focus on customer service through unique technologies. AHB’s plan is to become a leading provider of innovative Islamic banking solutions in the Gulf region and globally. It has expanded its operations to Kazakhstan where it runs two branches.

AHB is following its strategy of customer focus as the source of competitive edge. The company runs a range of customer programs to seek feedback for product/service improvement. Examples include the customer voice program, the callback program, and the customer experience index (ACE). Additionally, AHB has a complaint management program to address issues related to customer service and user-friendliness of its products. The bank also deploys technologies, such as RFID and Qibla cards, to improve customer experience.

I would suggest that AHB considers strategic alliances with other financial institutions, including foreign banks, to increase the global reach of its Islamic banking services. The approach is a low-cost strategy of expanding to underserved markets that need Shariah-compliant finance. I would recommend collaboration with smaller banks in Muslim countries to provide the products and services. The demand for Islamic banking is rising, as the population of Muslims is increasing globally. Therefore, diversifying into these markets will allow AHB to tap into new opportunities to increase its market share. I would also recommend collaboration with mobile service providers to allow customers to transact via their phones. This approach could also be useful in customer relationship management.

Works Cited

Ahlibank. Alhilal Islamic Banking. 2016. Web.

Arrif, Mohamed, and Munawar Iqbal. The foundation of Islamic Banking Theory, Practice, and Education. Chelten UK: Edward Elgar, 2011. Print.

Islam, Mazhar. “Development and Performance of Domestic and Foreign Banks in GCC Countries.” Managerial Finance 29.3 (2003): 42-73. Print.

MarketLine. Industry Profile: Banks in United Arab Emirates. 2015. Web.

Mohieldin, Mahmoud. Realizing the Potential of Islamic Finance, Poverty Reduction and Economic Management. Washington DC: The World Bank, 2014. Print.

Siddiqi, Moin. Banking Report: Strong Regional Economy Sees Banking Profits Soar. New York: Cengage Learning, 2013. Print.