Introduction

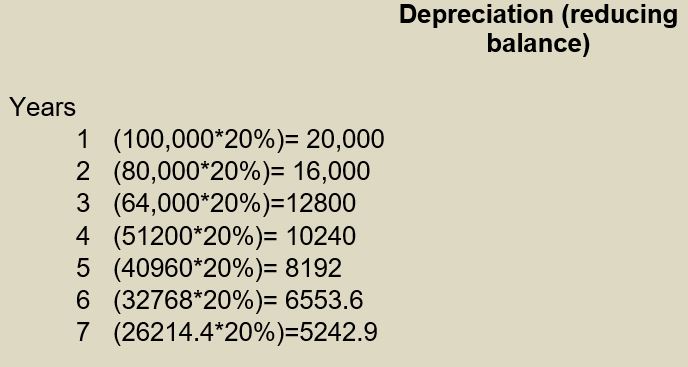

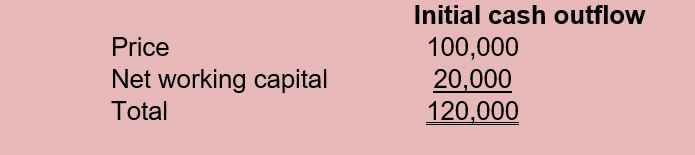

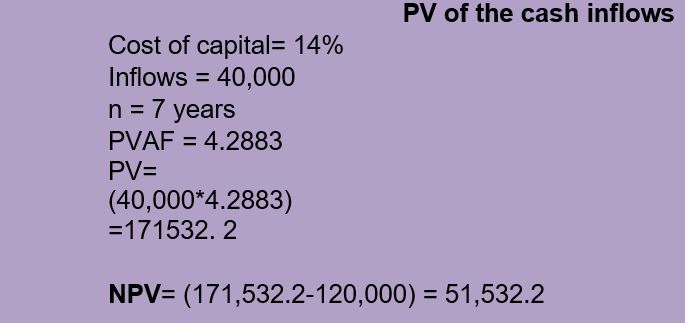

This assessment seeks to relay to you an evaluation of an investment decision to be made by Computer incorporation. The company has planned to purchase a new machine with the following details. Amount to be invested = $ 100,000. The machine will be assigned to CCA class 8 and will be depreciated on a declining balance basis at a rate of 20% per year. After seven years, the machine has no salvage value. The machine is estimated to provide incremental after-tax cash inflows of $ 40,000 per year for seven years. The cost of capital is estimated at 14% and additional working capital is required. The corporate tax rate is at 40%. The company seeks an expert judgment on whether to purchase the machine or not. Below are two approaches to help the company make the investment decision. The first approach is the use of Net present value and the second approach is the use of the payback period. Below are the evaluations to help make the decision.

Payback period of the investment

(120,000/40,000) = 3

The payback period is three years. This means that it would take the company three years to fully recover the initial investment (initial cash outflow).

The rationale for the above computations

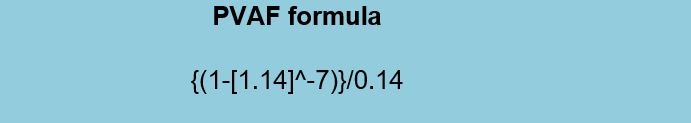

The above initial cash outflow is arrived at by adding the price of the new machine and the additional working capital requirement. The rationale for that is because the working is required purposely to facilitate the operations of the new machine therefore, it forms part of the initial cash outflow. Since the annual inflows as measured by after-tax inflows are constant, the present value annuity factor is suitable for computing the present values of the stated cash inflows as done above. The net present value method is that which takes into account discounting factor or cost of capital and the respective cash flows. Both cash inflows and outflows are discounted to reflect their period of earnings. The initial investment is therefore subtracted from the sum of the discounted inflows. On the other hand, when calculating the payback period, the main idea is to find how long it will take the company to recover the whole initial investment. If the payback period is within the acceptable duration, an investment is accepted.

Recommendation

When using the NPV rule to make the decision, Computer incorporation should purchase the new machine. The NPV rule states that if an investment venture has a positive NPV, that is, NPV >_0, then it should be accepted. The above-calculated NPV is a positive figure (51,532.2) and that means that the purchase of the new machine by Computer incorporation is a good venture. The company should purchase the new machine because the move will boost its cash inflows. A company derives its wealth from positive cash inflows. According to the above payback period, it would take the Company three years to recover the total amount invested. The period is less than the useful life of the machine and therefore, there is a high possibility of making profits out of the investment.