Introduction to Product Hierarchy Advantage

Product distribution in most cases is influenced by the consumer requirements and such distribution normally takes a defined succession. Customers in most cases tend to have a higher enthusiast for some products as compared to other competitive products. Products with higher demand levels amongst consumers will always attain the top levels of the consumers’ demands thus are placed in the top positions of the hierarchy while the products with lower competitive demands are normally positioned at the lower levels.

The essay will analyze the product hierarchies of Apple, Samsung, Sony, Huawei and Lenovo that deal with mobile and wearable devices in the Dubai market. The first section of the paper will briefly discuss the performance of mobile and wearable products in the Dubai market, followed by a discussion of the positions of the five companies in Dubai city. Furthermore, it will elaborate on a PEST analysis as well as create product hierarchies for the five companies then conduct an analysis of the substitute ability. In the last part of the paper, it will present a discussion of competition levels, elaborate on the BCG matrix for the companies and highlight a sequence of consumer choice. It will then conclude with the evaluation of the future of the products in the UAE.

Performance of Consumer Electronics Industry in Dubai

Globally, the growth of mobile and wearable technology has been in the rise especially in Australia, Canada, Asia, South Africa, the UK, and the US, where consumers are aware of such technology; have above 52% interest in fitness monitors, 46% in smartwatches, and 42% in buying Internet-connected eyeglasses among others (Arora 10). Most multinational companies have been showing interest in penetrating market conditions even in the economic crises such as those exhibited in the year 2008.

Major international brands currently operate in both Abu Dhabi and Dubai markets. This is confirmed by a report by Abdelgalil and Husain (7) who indicates that Dubai is a leading market for consumer electronics, for instance, the popularity of smartphones has ensured that most consumers use them in the fields of imaging and portable, Smartphone, watch, cameras, and other household electrical appliances. According to Arora, smartphones account for about 30% of the retail volume in consumer electronics in 2015 (11). This inclination indicated an increase from 11% share since last year with a rise in sales percentage of 29% CAGR (Euromonitor International 4).

A customer analysis concerning the Dubai and UAE market indicates they have confidence in purchasing and are not much driven by prices of commodities (Arora 12). This situation has been summarized in the below graph.

Performance of the Mobile and Wearable Industry in Dubai

Apple

The Apple Company was opened in Dubai with a view of controlling the mobile and wearable industry in the region. Since then, it has opened several distribution channels in Jebel Ali Free Zone and Emaar Square. Currently, the company runs the world’s largest outlet in Dubai due to the government’s role in issuing 100% trading opportunity for foreign companies to trade in the country. The Apple Company generated revenue of about 63% of the iPhone business in the Dubai market (Hamid 3).

According to research conducted by the Strategic Analytics, the Apple Company is projected to sell about 15.4 million devices by the end of 2015 as compared to the 10 million watches they sold last year by all makers in the Dubai market. The shipment of the smartwatches is estimated to reach $28.1 million at the end of this year, which will be approximately 51.1 percent. It is also posted to the top manufacturer and distributor of smartwatches since it has captured about 55 percent of the global market shares on the mobile and wearable devices industry (Arora 15).

Samsung

Samsung has been known as the global leader in the manufacturing and distribution of consumer electronics, with its expansion to new countries including the Middle East and Africa.

The company first opened its operations in Bawabat Al Sharq Mall in Abu Dhabi operating on smart-phone and tablets. These products were offered at affordable prices to consumers of the UAE, and it occupied 27% market share. By 2012, Samsung Inc. rose beyond the Apple Company in the global smartphone market share with about 30.3% and a profit of 34% in the overall industry. This value was noted to be a greater increase exhibited in 2011. An increase of about 76% in profit was gained by the company due to its strong sales in Galaxy smartphones and tablets (Arora 15).

Huawei

Huawei Investment Holding is known for its good connections with customers through cloud connectivity. The industry operates competitively on elements such as prices, functionality, quality, and timing of new products. Furthermore, the company has ventured into smartphones and tablets under the Media Pad brands. It is further known for services such as network integration and end-to-end delivery technology among other services. Its shares in the Middle East have tremendously increased with full-year global sales revenue of $ 7.5 billion, which is 10% increase from the previous year while its shipment was about 127 million in the global market (Arora 14).

Lenovo

Lenovo Company has been performing well in the global market with a $ 10.7 billion in revenue accounting for 3 percent with 10% increase year-over-year. It has recently faced a decline in the PC and tablet markets and slower growth due to increased competition. Despite such hitches, it has been performing better with a record of 20.6 percent in the PC business. The gross profit of the company in the first fiscal quarter of 2015 increased by 22 percent to $1.6 billion with a gross margin of 15.4 percent. Its operating profit was $96 million, which was a decline (Arora 14).

Sony Corporation

Dubai was the first underwater outlet of Sony products in the UAE region. Te company sold a total of 10689 in 2009 with the LCD TV electronics capturing 10% market share, 14,751 units FPTV (more than 12% market share), 15,948 units CTV TTL (near 8% market share). The sale revenue has also been increasing by 11% through a drop in sales of its products is predicted to occur.

PEST Analysis

Political Factors

Dubai has been experiencing political stability that has ensured good operations in businesses. Most multinational companies are investing in the country due to the attractive market. The country’s political goodwill driven by good governance has favored business operations with a vast economic environment worldwide. The UAE indicated a GDP of $348 billion in 2012 according to the World Bank and aging trend of 231 times by 2013.This trend is expected to continue as more businesses and investments find their route to the region (Arora 10).

The government has guaranteed the protection of consumers since the social environment in the region has been rated to be 93% in terms of the rights it provides to their healthcare and rights while it provides 85% right to life. Workers have also been protected and have been provided with better living standards. Such conditions have led to the confidence of consumers to purchase mobile and wearable products due to the further boost in technology in the country.

Economic Factors

Economic factors that influence business operations in Dubai surrounds issues relating to the inflation rate, high interest rate, global financial downturn, new fiscal policies, high taxation, and quotas that sometimes hinder the mobile and wearable industry in Dubai (Stephens 62). Furthermore, there has been dwindling and slow growth of the economy in the global interface. This situation has led to a reduction in business operations due to minimal capital and decline in demand among others.

It is expected that a reduction in spending in the mobile and wearable devices companies in hardware in the coming years for some time. However, there was a slow increase in the sales of such devices. The decline was noted in market values. It was distinguished that companies such as Samsung, Apple, Sony, Huawei, and Lenovo were affected due to their vast retail chains in different parts of the world. The factor considered in these regions is the change in value for the currency due to its strength and/or weakness of the US dollar (Stephens 67). For example, a hitch of the economic recession that occurred between 2008 and 2009 hit the UAE led to a decline in its overall business operations, especially in its industrial sectors. The hit further led to the invention of other forms of business dealings through the government’s initiative of ensuring that proper economic reforms existed. Such activities included the regulation of laws governing direct investments and export revenues, which had proven advantageous to the mobile and wearable industry in the region (Arora 10).

Lastly, the income levels among different consumers also determine the ability to purchase a mobile and wearable gadget or not. Most companies that take into consideration such factors are currently commanding the mobile and wearable market. An example is the Apple Company that has ventured in implementing a strategy of premium pricing thereby commanding a larger market share as compared to other mobile companies such as Lenovo and Samsung (Arora 10).

Socio-cultural Factors

Most of the consumers are falling in the upper class; hence, they conform to the purchasing trends on luxurious products. It can be noted that the region has enjoyed a 20-year luxurious power in purchase. Furthermore, social status has played a major role in luxury purchasing with the kinds of lavish goods reflecting one as outstanding in the society. Such products enable them have a reflection of their contentment, happiness, and their path to social class (Arora 10).

Technological Factors

The mobile and wearable industry is based on the technological advancement that constantly changes. Companies have strived to be up to date in terms of technology to ensure their competitiveness in the Dubai market. The most modern technology is currently embraced by the companies such as Apple, Samsung, Huawei, Lenovo and Sony (Arora 18). Dubai, being the favorite for the mobile and wearable devices industry, provides many opportunities with its magnificent infrastructure, development, and improved technology. The technology of the UAE is product, manufacturing, and management inclusive thus, every aspect that leads to quality product and services are captured (Stephens 65).

Product Hierarchy

Table 1: Product Hierarchy. Source: self-generated.

Substitute Ability

The current economic growth in the UAE stable and steadily growing. This has been indicated by the Euromonitor that ranked it as the eighth largest oil producer. The economy is currently diversified to cover areas of natural resources, tourism, transportation, and trade sectors. These activities have since generated a GDP of 69% especially in the non-oil sectors. The economy exhibit a free a market where mobile and wearable industry steadily expands with increased foreign companies investing in the region.

Various products offered by the mobile and wearable companies are influenced by consumers’ social and cultural factors such as choices, their luxurious lifestyles, prices, quality and services. The mobile phone companies such as Apple, Samsung, Lenovo, Sony and Huawei provide a wider collection of models and features and at lucrative prices. Besides, the companies give greater opportunity for the consumers to select their preferred brands and can switch from one company to another (Abdelgalil and Husain 7).

Products that are offered at higher prices have their substitutes. For example, Apple products such as the iPad Air and iPad Mini, MacBook, Apple Watch, iPhone 7, iPhone 6s, and iMac are expensive products, but popular to customers. The products can be substituted by others from the rival companies such as Samsung, Huawei, Lenovo, and Sony. These companies hire experts and personnel who are conversant with marketing strategies such as price-based from other countries such as India and China. As a result, they tend to define their market share besides offering good prices. For example, Samsung currently has a good market share compared to the other companies, and they offer good prices to their mobile phones.

Level of Competition

A competitive rivalry among Apple, Samsung, Sony, Huawei, and Lenovo is currently rising due to pricing, presence of global and local players that offer their products and services in the Dubai market, the introduction of new products, advertisement, and improved quality service delivery among others.

On pricing strategy, some companies have to follow a criterion of balancing capacity and demand so that their prices remain at the same level for longer time (Münstermann, Eckhardt, and Weitzel 29). Under such situations, customers have been having bargaining power due to the numerous similar mobile products. The new entrants in the Dubai market have been at a slower rate due to high competitions, pricing aggressive strategies that are unsustainable among other problems. The establish enterprises such as the Apple Company have gained customer loyalty thus they perform well in competitive environment (Arora 23).

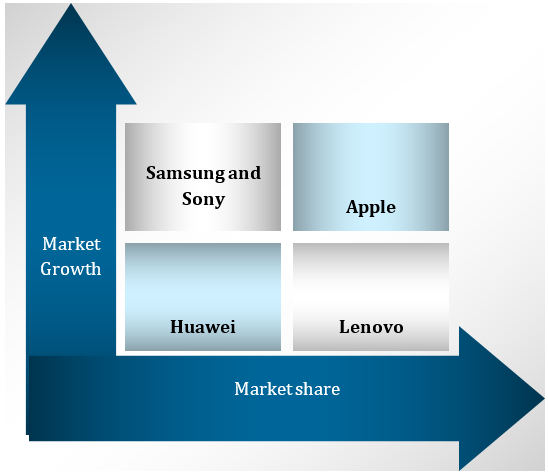

BCG Matrix for Apple, Samsung, Sony, Huawei, and Lenovo in Dubai

The Apple Company commands highest growth and market share due to its numerous stores and gained customer loyalty. Samsung commands the moderately high market growth with lower market share. Such similar result is also seen in the case of the Sony Corporation. On the other hand, Huawei has been indicated to have a low market growth with relative market share while Lenovo has relative high market share with lower market growth.

A summary of competitor trend on mobile and wearable companies is illustrated in the below BCG matrix:

Future of the product in the UAE

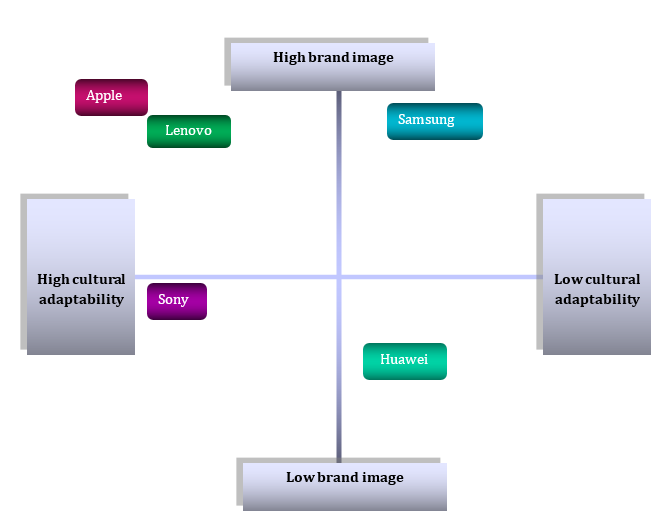

The future in the UAE is being analyzed based on the relationships that exist between consumer acceptance and their cultural adaptability in Dubai. Considering the cultural background, the people of these regions are known for their great love for luxurious items. The future prospect of mobile and wearable computing items will dominate. Customers especially young people are fond of international brands such as Apple, Samsung, Sony, Huawei, Lenovo, Dell, Hewlett Packard, Acer, among others. These gadgets are perceived to be very enthusiastic (Euromonitor International 1).The younger generations are familiar with the new hi-tech and composite gadgets produced by such companies. So the spending of such consumers is expected to be more on these luxurious products.

More brands of mobile phones and wearable computing gadgets will feature in the Dubai market due to the types of advertisement and promotions conducted to suit their culture and social life. It can be perceived that the Apple Company will still win market share due to brand image thus customer loyalty will further be captured. Companies such as Sony and Samsung will have a low brand reputation and cultural adaptability respectively. Lenovo will tend to capture a high brand image and high cultural adaptability.

Sequence of Consumer Choice

Consumer choices in the mobile and wearable communication gadgets in the UAE market are normally influenced by various products and factors influencing decisions of the consumers. Most consumers in the region are greatly motivated to decide on the purchase of such goods by appearances, cost, variety, durability, and assurance of luxury of such items. The various companies’ stalls also provide experts that give advice on prices and quality on both face-to-face communication or online social sites thus influence their choices.

Future of the Mobile and Wearable Market in the UAE

There has been some consistency in the overall growth of mobile and wearable computing products in the UAE as indicated by the Euromonitors. A change in economy of the country has ensured more spending on luxurious products due to tourism shopping thus alignment of the market towards luxurious and multifunctional products such as smartphones and wearable computing gadgets is expected in the future (“Consumer Electronics in the United Arab Emirates” par. 1). Most of the companies especially Samsung, Apple, Huawei have currently majored on diversification to in the competitive market to enhe provision of diversified products.

Work Cited

Abdelgalil, Eisa and Natasha Husain. Dubai Electronics Market, 2006. Web.

Arora, Soma. “Micromax Informatics Ltd: Marketing strategy for emerging markets.” Emerald Emerging Markets Case Studies 5.5 (2015): 1-30. Print.

Euromonitor International. Consumer Electronics in the United Arab Emirates, 2015. Web.

Hamid, Triska. Apple opens secret office in Dubai to serve as Middle East, 2014. Web.

Münstermann, Björn, Andreas Eckhardt and Tim Weitzel. “The performance impact of business process standardization: An empirical evaluation of the recruitment process.” Business Process Management Journal 16.1 (2010): 29-56. Print.

Stephens, Melodena. “Dubai-a star in the east: A case study in strategic destination branding.” Journal of Place Management and Development 1.1 (2008): 62-91. Print.