- Introduction and benefit of product hierarchy

- Performance of Consumer Electronics Industry in Dubai

- PEST Analysis

- Product Hierarchy

- Substitute Ability

- The Level of Competition in Dubai

- BCG Matrix for Apple, Samsung, Sony, LG, and Toshiba in Dubai

- Future in UAE with correlation to consumer acceptance and cultural adaptability

- Works Cited

Introduction and benefit of product hierarchy

In most cases, the product distribution of a business occurs in a defined succession that the company has designed by considering the customer requirements; therefore, the product hierarchy (which is affected frequently by competitive rivalry) extends from the fundamental necessities to the specific products that fulfill the consumer requirements. This means that the products that have a high level of demand amongst the customers will have the opportunity to attain the top positions in the hierarchy, whereas the products with comparatively low demands will be positioned at lower levels.

The aim of this paper is to analyze the product hierarchies of the five companies in the consumer electronics market in Dubai, and these companies are Apple, Samsung, Sony, LG, and Toshiba. In order to do so, this paper would assess the performance of the consumer electronics market in Dubai, briefly discuss the position of the five companies in Dubai, form a PEST analysis, create product hierarchies for the companies, and analyze the substitute ability. In addition, this study will also examine the level of competition, elaborate a BCG matrix for the companies, create a sequence of consumer choice, and evaluate the future of the product in UAE.

Performance of Consumer Electronics Industry in Dubai

Chahine and Heberto (2) Consumer Electronics Industry stated has boosted in spite of the global financial crisis in 2008 and multinational companies had shown their interest to penetrate this market under adverse economic situation; however, Estimated industry size is about US$3 billion. Most international brands have already started their operation in both Abu Dhabi and Dubai markets; according to the report of Abdelgalil and Natasha (7), Dubai is a leading market for consumer electronics, for instance, TV, smartphones, watch, cameras, and other household electrical appliances.

There are many factors that influenced the players of this industry to enter this market, such as, the rapid growth of the consumer electronics market, population and economic growth rate, high purchasing power of the customers, diversification strategy and so on. Customers of UAE are not price-sensitive and a consumer confidence score is high; however, the following figure shows more details in this regard-

On the other hand, local companies have to meet substantial domestic demand for electronics products and started to enter a new market, for instance, East African nations are the prospective market for exporting local electronics appliances. Local companies have generated high-profit margins in Dubai Shopping Festival and Eid festive season since companies offered a discount, and sales commission and wholesalers dropped prices; however, retail sales increased by 30% to 50% of different companies.

Apple

According to the report of Hamid (1), this company opened an office in Dubai with the intent to control the business of MINA region from Dubai; furthermore, it has established distribution channel in Jebel Ali Free Zone and opened a new office in Emaar Square in the first quarter of 2014. It has recruited efficient, talent and qualified employees to operate a business in UAE; at the same time, the CEO of this company visited UAE to assess market opportunity; thus, he decided to open world’s largest outlet (near 50,000 square feet of space) in Dubai (Hamid 1). However, Martin (1) stated that the government of this country gives the opportunity to the foreign companies 100% ownership; moreover, Dubai is a potential market for this company since 63% revenue of the iPhone business generated from this market.

Samsung

This South Korean company established in 1938, and entered the electronics market in the 1960s and experienced outstanding success within 10 years; at present, it is the world’s largest cell phone manufactures, which expands business in 60 countries. As part of its expansion strategy, it started business operation from Bawabat Al Sharq Mall in Abu Dhabi; initially, it started with the limited product line, such as smart-phone and tablets were the key products for this new market; it offered the cheap and best price for the customers of UAE and it occupied 27% market share.

Sony Corporation

Sony considered UAE one of the potential places for business; thus, this company started the world’s first underwater outlet in Dubai. In 2009, it had sold total 10689 units LCD TV (10% market share), 14,751 units FPTV (more than 12% market share), 15,948 units CTV TTL (near 8% market share); however, sales revenue of this company increased by 11% though it was predicted sales drop due to financial downturn.

LG Electronics

LG entered the Dubai market in 2002 and it tried to develop market share; however, it positioned itself in the sixth position in the smart-phone market by 2 years; however, it charged competitive price for the latest technology and best quality products. In 2009, it sold 10689 units LCD TV (10% market share), 13,092 units FPTV (11% market share), 15,948 units CTV TTL (about 8% market share); however, this company faced intense competition in the UAE market as Japanese and South Korean competitors captured large market share.

Toshiba

Toshiba founded in 1875 and it created a global network and generated more than US$61 billion sales revenue; in 1997, this company started operation in Dubai to control business in Gulf region and it opened with wide-range of products and it experienced significant positive growth. It operated and controlled through Dubai-based Dhaher Al Muhairi Company from 1999 and it planed to establish new UAE-based subsidiary; however, it has more than 300 employees in UAE who managed the company and completed a mega-project (Davids 1).

PEST Analysis

Political Factors

The political atmosphere of Dubai is quite stable and business friendly, and as a result, the international giants of the consumer electronics industries find the Dubai market quite attractive to carry out their trading activities. However, certain risk factors still exist because sudden political unrests or unavoidable circumstances may hamper the business atmosphere in various ways. It is notable that in the past decade, there has been no trace of such political unrests, which significantly hampered the business environment of the electronics market.

Economic Factors

Economic factors play a great role in the consumer electronics industries in Dubai because the market is very susceptible to fiscal alterations. Factors such as high inflation rate, high interest rate, global financial downturn, new fiscal policies, high taxation, and quotas occasionally hinder the consumer electronics industries in Dubai. It is important to note that the demands and overall turnover of this industry suffered a great deal of turmoil during the global financial crisis of 2008. However, at present times, the economy of Dubai recovered significantly and as a result, the sales of the companies like Apple, Samsung, Sony, LG, and Toshiba are thriving.

Socio-cultural Factors

The players of these industries are very cautious about the socio-cultural factors in Dubai because the social and cultural framework of Dubai is quite different the Western countries. As a result, the companies remain careful while they generate the advertisements and other public relation activities because the local people are quite conservative and religious.

Technological Factors

The consumer electronics industries are fully dependant on technology; consequently, the companies operating in Dubai need to stay up to date at all times. Due to high level of competition in the Dubai market, the companies continue to contend between themselves to deliver the most modern and most efficient technologies to the people in Dubai. Consequently, the local communities in Dubai are able to grab the most wonderful gadgets instantaneously.

Product Hierarchy

Table 1: Product Hierarchy. Source: self generated.

Substitute Ability

Economic growth in the UAE is steady since this country is the world’s eighth largest oil producer; at present, it changes macro-economic policy and concentrates on diversification on economy to generate 69% GDP from non-oil sectors; thus, it develops tourism, transport and trade sectors. It ensures a free-market economy for which consumer electronics industry is expanding with multinational companies; thus, these companies introduce products considering social and cultural factors, strategic geographical position, customers’ confidence, trend of the customers, UAE Commercial Agencies Law, and so on. The customers of Dubai consumer electronics market focus on mainly quality, price, guarantee, and after-sale-service accordingly; however, customers of Dubai get chance to choose their electronics items from wide collection of local and foreign models and product features; multinational companies charged lower price. The main factors include-

- Due to open market economy, foreign consumer electronics producers can easily enter Dubai, UAE market and captured market share, for example, LG entered Dubai market in 2002, but it holds large share;

- The consumer electronics industry in Dubai provides a greater opportunity to the purchasers to select their brand from large rage of product line and feature of the products; in addition, they can easily switch off one company to another (Abdelgalil and Natasha 7)

- Apple product items like iPad Air and iPad Mini, MacBook, Apple Watch, iPhone 7, iPhone 6s, and iMac are expensive products, and popular to the customers; however, substitute of these products are also available in UAE market;

- Samsung and Sony offer some common item, for instance, washing machines, cameras, accessories, air conditioners, printer, mobile devices, vacuum cleaners, monitor, tablets, TV, etc; however, market share of Samsung is outstanding the UAE market;

- The players consumer electronics industry always try to make substitute products with extra facilities, for example, laptop and interactive models of TV replace traditional TV, mobile replace cameras and watches;

- In UAE, most of the employees are expatriate who come from Indian sub-continent and they seek product with cheapest price; however, market share of Samsung increased rapidly for offering suitable pricing strategy.

The Level of Competition in Dubai

Apple, Samsung, Sony, LG, and Toshiba face high level of competition in Dubai because many global and local players are also offering their products and services in the Dubai market. As a result, the consumers have high bargaining power because of the huge number similar items present in the market and due to the competitive pricing structures created by the concerned companies. Very diverse ranges of companies are present in the Dubai market that are constantly creating new types of gadgets and constructing very low pricing strategy to reach even the middle class customers. In addition, the global players like Lenovo, Dell, Hewlett Packard, Acer, HCL, Panasonic, Nokia, and Motorola are also importing a huge number of diverse products and gadgets in the Dubai market, further boosting the market competition.

On the other hand, UAE also has a number of local producers of tech gadgets who strengthen the rivalry to lower the market shares of the global players by lowering their sales. However, the rate at which new entrants penetrate the Dubai market is quite sluggish because new entrants face many problems like lack of funds, high level of rivalry, and aggressive pricing strategy, for which they find it difficult to sustain. In addition, the new players also have lack of experience, low funds, poor cash flows, low sales, and lack of trust from the customers, for which the competition from new entrants in the consumer electronics market is quite low.

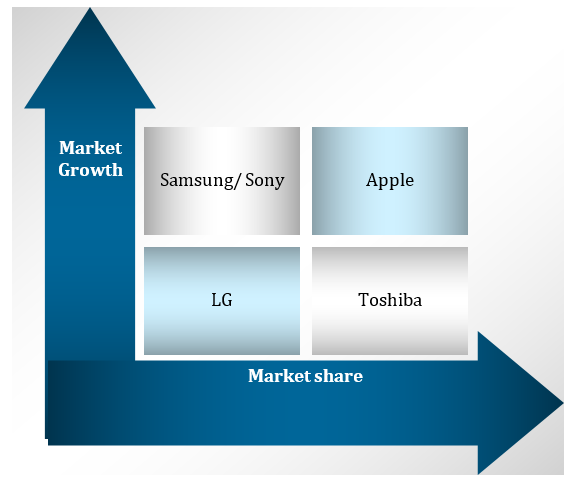

BCG Matrix for Apple, Samsung, Sony, LG, and Toshiba in Dubai

It is notable that in Dubai, Apple has the highest market growth and market share, Samsung and Sony has high market growth but relatively low market share, LG has low market growth and low market share, and Toshiba has low market growth, but relatively high market share. This trend between the competitors of the consumer electronics market of Dubai has been illustrated in the BCG matrix diagram below:

Future in UAE with correlation to consumer acceptance and cultural adaptability

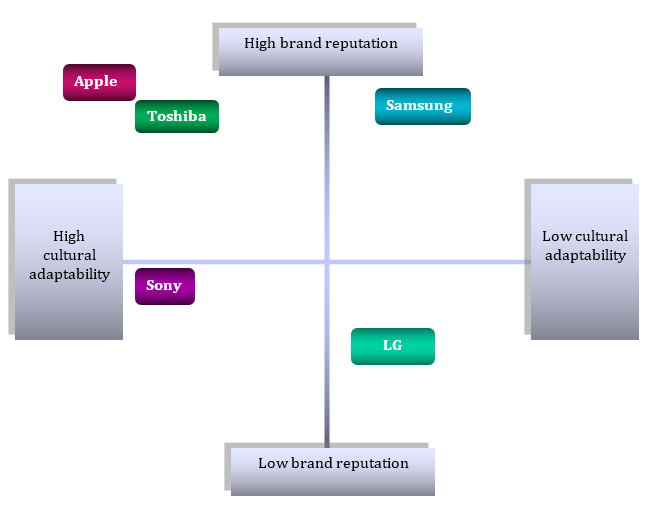

At this stage of the study, it is highly important to discuss the future of the product in the UAE market in correlation to the consumer acceptance and the cultural adaptability in Dubai. It is necessary to argue that from the perspective of the consumer acceptance and the cultural adaptability in Dubai, the future prospect of consumer electronics seem to be quite dominant. It has been suggested that most of the young consumers in Dubai accept the international brands like Apple, Samsung, Sony, LG, Toshiba, Lenovo, Dell, Hewlett Packard, Acer, HCL, and Panasonic very enthusiastically and they familiarize themselves with the new hi-tech and composite gadgets very quickly.

The international brands on the other hand, are very clever in marketing their items in the Middle East and they are quite experienced about the way in which they should advertise and promote their products to help the customers from the Islamic cultural background to adapt to their items rather swiftly. It can be perceived from the performance of the five companies that in future, Apple and Toshiba will have high brand reputation and high cultural adaptability, Sony will have low brand reputation and high cultural adaptability, Samsung will have high brand reputation and low cultural adaptability, and LG will have low brand reputation and low cultural adaptability:

Sequence of Consumer Choice

Sequence of Consumer Choice in the electronic alliance market of UAE has deeply concerned with a large variety of branded products and complex process of customers’ decision-making linked with demand, available information, substitutes, comparison among the alternatives, as well as influence to motivate the customers. In the UAE consumer electronics market, there are some authorized bodies for Conformity Assessment Scheme to ensure the products in accordance with Emirates Standards while cost, durability, and assurance of luxury are the most influencing factors to motivate the individuals decision making process.

The most imperative consumer electronics marketing channels like Carrefour and Lulu in the UAE are representing wide range of electronic appliance and providing specialist advice to the customers along with price comparison with attractive features of products while Hypermarkets along with local e-commerce sites are competing to offer the large variety of electronics with most attractive prices through social media.

Future of the Consumer Electronics in UAE

The Euromonitor reported that consumer electronics market in the UAE has demonstrated significant growth in the current year by breaking the vicious circle of less spending for such product line due to economic downturn and most remarkably, tourism shopping brought this success (“Consumer Electronics in the United Arab Emirates” par. 1). By analyzing the future trend of consumer electronics market in the UAE, it is also identified that-

- The market highly aligned for compact and multifunctional products along with the Internet connectivity and

- To addresses such market needs, most of the players like Samsung and Sony diversified LCD TV, Smartphone, and tablets along with competitive offering ranked at the top while Apple with its multifunctional iPad Mini 4 and i-phone 6 raked at the second position.

Works Cited

Abdelgalil, Eisa and Natasha Husain 2006, Dubai Electronics Market. Web.

Chahine, Garibal and Heberto Molina 2014, Succeeding in the MENA Region with Consumer Products A Market-Focused, Consumer-Driven Approach to Sustained Profitability. Web.

Consumer Electronics in the United Arab Emirates. 2015. Web.

Davids, Gavin. Toshiba Elevators launches UAE-based subsidiary. 2012. Web.

Hamid, Triska. Apple opens secret office in Dubai to serve as Middle East. 2014. Web.

Martin, Matthew. Apple Said to Plan Dubai Stores After Winning Exemptions. 2015. Web.