Introduction

Barclays bank is a UK-based Multinational Corporation headquartered in London and operates in the financial niche. The universal bank was established in 1860 in London as a goldsmith’s lending business offering people loans and saving options. The bank’s resilience in the corporate domain made it navigate all the challenges, and it still operates to date. Barclays bank remains relevant in the financial industry because it analyses societal trends and changes its operations to suit human needs. At the height of feminism in the 1950s, it became the first bank to appoint a female manager in 1958, Hilda Harding, who served the bank until her superannuation in 1970. The bank has more than 4750 branches located in different parts of the world in 55 countries. However, 1600 of the branches are located in the UK. Barclays bank has thrived in finance because it leverages technology, social listening, and adopting an effective leadership structure.

Description of the Organization

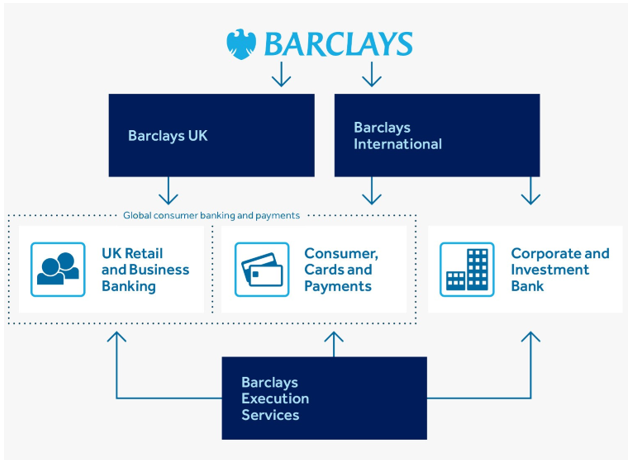

The bank operates in two distinct divisions for efficiency, Barclays UK and Barclays International, all of which are supported by the Barclays executive Services. The bank’s standard services include wealth management, investment, retail, and commercial banking. The bank boasts of having employed over 83,500 members of staff to ensure the smooth delivery of services to the organisation (Haralayya and Aithal, 2021).

Although the business started as a partnership between James Barclays and other goldsmiths, the state of ownership has changed over the year to remain in tandem with the practices and regulations affecting the people. In 1981, it changed its entity and re-registered as a public limited company (Vakhrusheva et al., 2021). The state of ownership allows members of the public to purchase shares. Some of the most significant shareholders in the company include Raymond James, Natixis advisors, and Cambiar Investors LLC. In 2021, the bank generated a total profit of 5.75 billion sterling pounds (Barnes and Newton, 2022). The bank uses strategic management options and cultural competence to thrive in different regions with different cultures.

Description of the Organization’s Structure

Barclays bank is a British universal bank owned by shareholders. Since it is a limited liability company, the shareholder’s property cannot be sold when the bank fails to pay its debts (Vakhrusheva et al., 2021). The principal shareholders of Barclays Bank include Qatar investment authority, Dodge and cox, BlackRock fund advisors, and the Vanguard Group Inc. The organisational hierarchy is headed by the Barclays execution services (BX), which manages the two main groups, Barclays international and Barclays UK. The CEO further appoints directors to every functional area of the bank to make it work efficiently (Barnes and Newton, 2022). The bank’s primary business model is sales and trading, where the sales agents solicit ideas and opportunities from prospects. At the same time, traders advise clients and execute orders to ensure the client’s goals are attained (Schachter, 2018). It is imperative to note that the organisation’s leadership structure allows for a closed feedback loop.

The chief operations officer (COO) and execution services are virtual offices that coordinate and evaluate all operations. Mark Ashton is the current position holder and coordinates Barclays UK and Barclays International (Schachter, 2018). The COO receives reports from the management committee, which comprises the CEO, Coimbatore Sundararajan, the chairman of the board and the different directors for crucial operations. Specialisation and division of labour are encouraged as each exceptional service, such as investment banking, wealth management, and compliance, requires a director who concentrates on the assignment.

All the directors report to the executive committee to grant better services in the long run. Barclay’s organisational structure promotes specialisation and division of labour (Bari and Syazwani, 2018). Closed loop reporting and a feedback mechanism designed through the structure make the universal bank thrive despite the turbulence in the banking sector. Contemporary companies must learn from Barclay’s organisational structure for effective communication, feedback, and decision-making.

Barclay’s Key Management Theory

The leadership style and organisational structure use Fredrick Taylor’s scientific theory. According to the scientific management theory, leaders must break down tasks and allocate them to specialised people other than relying on the employee’s decisions. The approach explains that everyone can be trained to deliver on their speciality. Barclays uses the top COO to supervise and receive information from directors specialising in their field (Schachter, 2018). Barclays benefits from the scientific leadership theory because it increases collaboration and enhances team efficiency and objectivity. When the correct extrinsic and intrinsic motivations are used, the employees are likely to be more creative, motivated, and result oriented to ensure that they deliver positive results (Tahir, 2018). Although the scientific theory of management by Fredrick Taylor is no longer being applied in many businesses today, most of the application principles are evident in Barclay’s structure.

External Influences That Might Impact Barclays Growth

A strategic SWOT analysis is conducted on a business to determine its strengths, weaknesses, opportunity and threats. The strengths and opportunities eliminate the organisation’s weaknesses and threats (Bari and Syazwani, 2018). Similarly, the PESTLE analysis determines the political, economic, social, technological, and legal factors likely to affect an organisation or determine whether the business would fail. The political environment is an external factor which can help favour the organization when the law supports profitability. Social factors include the demographics and characteristics which make people seek services from the organisation (Tahir, 2018). The three critical external areas that Barclays should focus on include social, political, and economic factors. Although the factors are beyond the organisation’s sphere of influence, the management can take them into account and work with the relevant external stakeholders to improve its performance.

Social Factors

The social factors in an organisational analysis include society, culture, and how it affects people in the long run. The banking industry can only thrive when people in society are successful in their economic endeavours. For example, when the demographics have a small number of people with formal training, unemployment will be high, and the business will not have potential customers (Bari and Syazwani, 2018).

Further, gender stereotyping and lack of entrepreneurial spirit may negatively affect the business as society members will lack economic empowerment. Barclays can leverage social factors to empower people to be financially independent in the community. Investing in corporate social responsibility by offering entrepreneurial training, giving people loans to develop themselves, and increasing their saving capacity makes Barclays an economic jump starter in society. Consequently, the bank will get customers, and it may thrive in the long run. However, corporate social responsibility must be implemented strategically to add organisational value.

Political Factors

Political factors play a significant role in the operations of banks. Political instability, unfavourable taxes, corruptions, and pricing regulations are part of the external environment that may hinder a company’s growth (Haralayya and Aithal, 2021). Although the factors are out of Barclay’s control, it can partner with other relevant organisations to lobby the government for changes in policies to make them favourable such as reducing the minimum wage and setting an interest rate that guarantees profits (Ozili, 2022). Further, having new rules on mandatory employee savings will increase the revenue for the bank. The bank must therefore hire a legal director to monitor and evaluate political regulations and lobby for rates and regulations that favour the bank.

Economic Factors

When conducting the PESTLE analysis, Barclay’s bank should consider the economic factors that may lead to poor organisational performance. The economic system in which a country operates must be considered to ensure the operations are in tandem with the economic system being operated in the country (Purshouse, 2020). For example, if a country it operates in has a socialist economic system, it should design its operations to meet the expectation of the people. Further, the level of government invention in strengthening the economy must be analysed and understood to ensure that Barclays benefit from any governmental interventions. The inflation, interest, and unemployment rates must be considered before investing in programs relating to the affected population (Haralayya and Aithal, 2021). Barclays must therefore hire an economist always to analyse the economic situation to avoid making bad decisions.

Conclusion

Barclays bank is a thriving organisation that started in the UK and spread to other parts of the world. The organisation started as a goldsmith lending enterprise, then a partnership and finally became a limited liability company. The ownership status in such an entity is through the shareholders, and public members are always welcome to buy shares. The company has numerous motivated workers who are willing to perform better. The organisational structure depicts bureaucratic relationships and division of labour as per Taylor’s theory. The PESTEL analysis is an essential tool used to determine whether or not an organisation can thrive. Barclays must consider the political, social, and economic factors to blossom.

Reference List

Bari, A. and Syazwani, N.A., (2018). ‘Bank specific and macroeconomics determinants of profitability in Barclays Bank PLC, United Kingdom’. Web.

Barnes, V. and Newton, L., (2022). ‘Women, uniforms and brand identity in Barclays Bank’. Business History, 64(4), pp.801–830. Web.

Haralayya, B. and Aithal, P.S., (2021). ‘Interbank analysis of cost efficiency using mean’. International Journal of Innovative Research in Science, Engineering and Technology (IJIRSET), 10(6), pp.6391-6397. Web.

Ozili, P.K., (2022). ‘Bank income smoothing during the COVID-19 pandemic: evidence from UK Banks’, In Grima, S., Özen, E. and Boz, H. (eds.) The new digital era: other emerging risks and opportunities (Contemporary Studies in Economic and Financial Analysis, Vol. 109B). Emerald Publishing Limited, pp. 127-139.

Purshouse, C. (2020). ‘Halting the vicarious liability juggernaut: Barclays Bank PLC v various claimants’. Medical Law Review, 28(4), pp.794–803. Web.

Schachter, H.L., (2018). ‘Labour at the Taylor Society: Scientific management and a proactive approach to increase diversity for effective problem-solving’. Journal of Management History. Web.

Tahir, A. (2018). Consumer-based brand equity in the retail banking industry: a cross-analysis of a domestic and global bank operating in the UK (HSBC vs Barclays). (PhD Thesis, Anglia Ruskin University). Web.

Vakhrusheva, M.Y., Khaliev, M.S. and Pokhomchikova, E.O., (2021). ‘Barclays’ application of information systems in the manufacturing process’. Journal of Physics: Conference Series, 2032, 1, p. 012129. Web.