Introduction

The expected situation when marketing goods and services is that changes in buying and selling behavior will quite often dictate economics. Most importantly, competition dictates price of commodities and services being offered. On the same note, changes in demand and supply will also respond in the same way. However, monopoly has become an influential concept in determining the direction of market economics. Professor Baumol and professor Blinder (2007, p.218) define monopoly as a situation that is controlled by one player. In economics, monopoly prevails when there is only one market player who dictates demand and supply. However, this term may also refer to a situation whereby a few of market players influence the changes in demand and supply of goods, and essentially, the prices of the commodity. For example, if some industries have outstanding competitive edges, they can influence a lot on how other non influential industries charge customers. These industries seek to gain total control and offer direction in market competition, demand, supply as well as prices of goods and services.

Finch and Orillard (2005, p.117) equate market monopoly to heterodox economics. It is a form of capitalism which goes parallel and in opposite direction to fair market approach. Heterodox economics follow the antics of Keynes, Schumpeter and Marx who were always after dynamics analysis and disequilibrium (Finch & Orillard, 2005, p.117). However, Baumol and Blinder (2007, p.219) are of the view that it is not everything that is bad about pure monopoly. To some extent, it is a stepping stone to the right and realistic direction and good model to be remunerated. But Baumol and Blinder (2007, p.219) argue out that this model of economics has some negative attributes in the competitive market. The mainstream monopoly in Austria is marked by antitrust regulations and this is all in the sense of pursuing ideal and perfect market. However, as Horwitz (2000, p.110) documents, this ideology has been hurting marketing competition and destroying the concept of liberalized market.

Monopolistic market may not be convenient for any country and economy. It has a huge cost that can drive any economy, and indeed the whole world in a downward trend. As Djolov (2006, p.20) observes, there are some social costs that are accrued when an economy is monopolistic. For example, there would be homogenous goods where customers are not allowed to choose from wide variety. The consumer has no or little say in the movement of prices of essential commodities. It is also possible that the overall country’s economy would be hurt and some companies or economic players would be making monopolistic and unrealistic profits (Djolov, 2006, p.20). Ludwig Von Mises Academy is an internet based educational service founded in 2010 design for all students, and is a subset of Ludwig von Mises Institute. This academy has a major focus on teaching various disciplines, and the most important of all being economics. This paper presents a critique of this mainstream monopoly and draws the argument from Ludwig Von Mises Academy which has a school of thought that Intellectual monopoly is not a desirable element in any economy.

The Austrian perspective of monopolistic economy

Austria has a long-standing monopoly theory which has become very controversial. In actual sense, there are some leading Austrians who believe that the directions that have been taken by mainstream economists as a way of developing the country are wrong. According to Wohlgemuth (2002, pp. 223-246), minorities have little say when it comes to developing the Austrian economy. In fact, it is the political knowledge that seems to take control critical decision making processes. The fallible individual knowledge, renowned entrepreneurs and the dissenting minorities have a small role, and this role is confined to developing little circles of economy surrounding the individuals. The bulk work is a preserve of the highly ranked individuals in the country. Prof. Block Walter (1997, pp. 271-279) notes that the kind of monopolistic policy that exist in the country is one where the government decides on the industry that it would control; for example, electricity, water, agriculture and stock exchange.

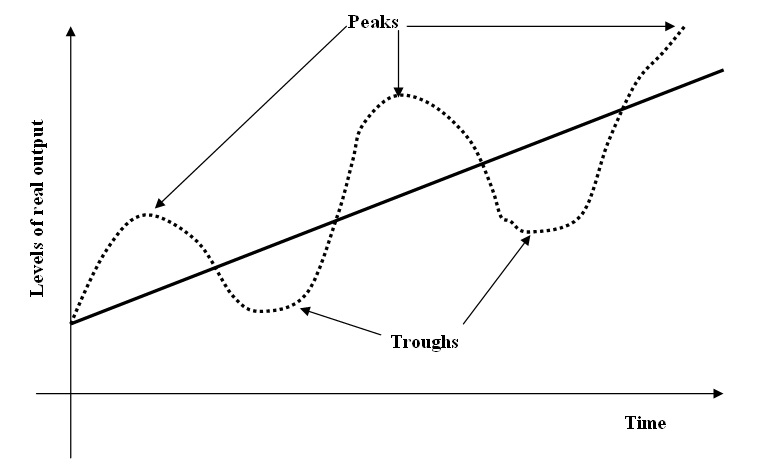

Business Cycle: The Austrian theory

In this country, money as a resource in creating an economy is created from thin air. It is then put in the banking system which in turn increases the supply of funds to be loaned to individuals. This in turn causes artificial fall especially in the interest rates. All this is done without a rise in the pool of savings for the economy. Keeler (2001, p. 331-351) qualifies this and notes that the kind of business cycle that exist in Austria brings in monetary shock that essentially disturbs relative prices. For example, the terms put in interest rates are exploitive and there are deliberate methods that are used to alter profits of selected economic sectors. This is pure monopoly in running of a country’s economy and which only benefits certain areas of the economy. The business cycle in Austria has information distorted, especially the information that is conveyed by the market prices. For example, interest rates that are lower incentivize investments into projects that are financed in the longer term and those that are capitally intensive (Tempelman, 2010, p. 3-15).

The monopolistic nature of Austrian economy is controlled from the central bank of the country. The bank manipulates interest rates especially in fooling the bankers and the investors into believing that there would be an increase in real supply of loans for capital investments (Carilli & Dempster, 2001, p. 319-330). The bank is seen to rely heavily on ignorance or foolishness of investors and bankers. Carilli and Dempster (2001, p. 319-330) call these investors and bankers as prisoners. However, the most important thing is that while the bank puts the investors and the bankers into these problems, it is the country that gets hurt in the long run. The kind of business cycle that Austria’s economists have adopted can be equated to the Keynes business cycle. The following is a representation of Keynes business cycle as applicable to Austria.

The neo-classical monopoly ideology in Austria

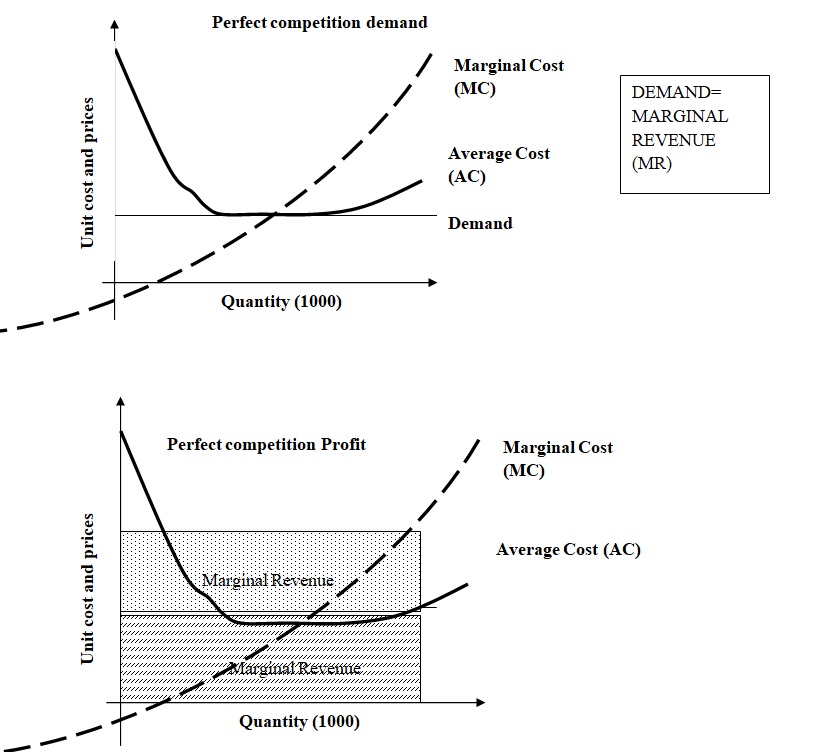

The neoclassical perspective of monopoly is where the market structure assumptions of perfect competition are not the case (Block, 1977, pp.271-279). According to Nijkamp (2010, p. 345), such a market has dominant industries and they remain mainstream for long. A neoclassical monopolistic firm is a kind of firm or industry that has or faces the entire demand. It produces an output with marginal revenue being associated with what was sold as the last unit; and which is equal to marginal costs that are associated with selling the final unit. The Ludwig Von Mises Institute presents this as a big problem in Austria. In the case of Austria, the government prohibits competitive entry, and then there is a pure recognition of the source of monopoly. This method has become popular in Austrian market as a non legal barrier to entry of some industries. The barriers include among others, putting impediments to entry of new firms that are likely to cause or overcome existing industries successfully in terms of competition (Block, 1977, pp 271-279).

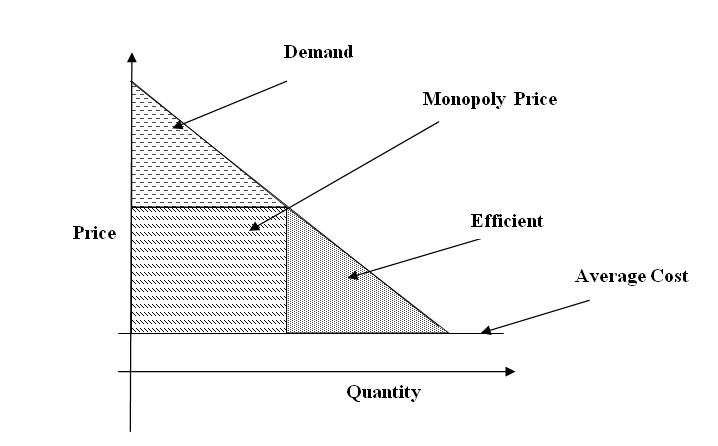

Monopoly prices in Austria

Whenever there is a monopolistic economy, prices are affected. These occur when one or a few of firms become determinants in the competitive market. For example, if it is only one company that is producing certain goods, it is possible that this company will be deciding on the prices of essential goods (Glatzer, Gnan & Valderrama, 2005, pp 24-48). Monopoly prices are consequential because they come as the result of conduct of business from firms that assume some sort of supremacy. The consumers usually do not have a say on the kind of prices that would be charged on a particular commodity. However, when the market has many players, it is possible that the behaviors of a consumer would significantly control the prices of commodities. This is because the consumer of goods has an option of where to buy his or her goods, and consequently, the market players compete to attract consumers by lowering the prices (Glatzer, Gnan & Valderrama, 2006, pp. 24-48). Here then, the prices in Austria are not realistic, and this is because the determinants of prices are not many. Below is a representation of the influences of monopoly on the prices.

Critique of mainstream monopoly in Austria

Monopoly tends to go against the normative form of general economics; where, all parties involved have a role in determining the outcomes of the market. For example, if the demand is high and the supply is low, the expected outcome in such a market is that the prices would go high. On the other hand, if the supply is high and the demand is low, the expected outcome is that the prices would be low (Sugden, 2004, pp. 1014-1033). Consumers too should be involved in determining competition in the market. However, when there is a pure monopoly as is advocated in Austria economy, the possibility is that the government and the monopolistic firms determine the direction of the economy. This paper presents a critique of the mainstream monopoly as is the practice in Austria.

What is wrong with mainstream monopoly?

Powell (2004) points out that the big problem with monopoly is that it denies market players an opportunity to play their part. The monopolistic game misrepresents how an ideal or actual market should operate. Powell (2004, p. 68) notes that in a situation whereby a farmer is engaged in farming, the entrepreneurs and the capitalists are not allowed to determine the directions of their produce. The concept of free market demands that there should be no external influences, rather, the players and the changing times should be allowed to determine the stability of the market. Callahan (2002, p. 71) explains this by noting that if there is equal valuation during the time of exchange, then there is no business, and there is no value added. If a farmer does not have a say when it comes to the value of his or her produce, then, this kind of exchange is unwelcome and does not add any value. That represents how bad monopoly is and should not be allowed to operate in any economy.

What to do? Introduce non-controlled competition

In the argument, it has been noted that mainstream monopoly in Austria is as a result of controlled influences from the government. Some firms are allowed to operate freely and get support from the government. Albarran (2009, p. 36) writes that in a command economy or where everything is controlled from the top, all important aspect of the economy are not free. The probability of collapse in such a case is very high. However, when the situation is that the demand and supply are the main determinants of the economy, competition will increase and so will the economy improve. The government in Austria even determines the amount of goods and services to circulate in the market. If some technocrats misbehaves and control such a supply, then, free market would be destabilized. The loser in such a case is the real producer, the capitalist, the entrepreneur and essentially the consumer. Michael and Stephen (2009, p. 23) notes that if the government is to control some elements of the economy, it should be the elements that come into the market to influence demand and supply.

Remove intellectual monopolistic economists

Bernstein (2010, p. 92) puts it clearly that intellectuals are very important when it comes to developing any country. However, some of these intellectual lead the economy in a bad direction for their own selfish gain. In Australia, it is the intellectual monopolistic economists in the government and other controlling agencies that have led the country’s economy in the wrong direction.

Give consumers sovereignty in the market

Consumer sovereignty has been touted as the best in determining the fairness of the market. In essence, the direction of any economic affairs in the market is always a task for the consumers of the product (Sugden, 2004, pp. 1014-1033). The proposal for Austria is that there should be normative economics that have a formula in which the consumers have independence. Since the country is interested in developing nationally, there should be no particular economic player to be controlled or allowed to dominate. If the consumers have the right to decide on what to buy or consume, then, the other players would regulate themselves to fit in the demands of the consumer. This way, there would be intense competition which will then lead to increased levels of production and value addition for the products. In actual sense, Korthals (2001, p. 201-215) notes that many governments, producers and trade organizations across the world have developed an idea that when consumers have the right to control what to buy and what to reject, profits are maximized. However, Hodgson (2001, p. 153) points that it is not always that giving consumer sovereignty would rectify the problem.

Expected results of fair and free market (perfect market)

A perfect market is dictated by non controlled competition (Hoag, 2006, p.153). There are expected results of having a perfect market. There would be increased competition, and above all, there would be value addition to the goods and services; plus improved economy. This therefore forms the basis of a proposal to have Austria come with a policy that will enhance perfect market as its major economic driver. The following is a representation of how a perfect market can result to.

Conclusion

An economy is built by a number of factors. The government is always a critical player especially when it comes to regulations and enforcing legal issues. The producers and companies selling the products are also critical players who can never be ignored. However, it is realized that consumers are the main determinants of economic improvement. This is because, if they fail to buy products and services that are intended by the sellers, there cannot be any economic improvement. For this therefore, it is important for governments to look for ways to develop a level playing field for all market players without any form of favoritism.

The concept of a free market dictates that all players have a level playing field. That is, the government should only play its part while others such as the consumers, the producers, entrepreneurs and the selling companies should be allowed to be controlled by natural market factors. For example, if there is a huge supply from the producers and the consumers are not buying, it should be normal that the prices would go down. On the other hand, if the producers fail to give enough supply of goods and services, and the consumers are demanding for the products, the outcome is expected to have prices shooting up. The government should only intervene when the producers and sellers/wholesalers hold the products and services for the purposes of raising the prices.

Some governments such as Austria have tended to have huge influences when it comes to market economy. The government’s economists have a monopolistic idea of market development; where, some players are assisted by the government so as to control the trends of the market. This is negative in the sense that other market players are disadvantaged. This should be discouraged as it is possible that it can hurt the general economy. Monopolistic economy is a draw back to the gains that have come with increased levels of production, evolvement of technology and intellectual capability of human resource. It is important to abide with changing times, and it can only be recommended that Austria need to tow with the line others have taken.

This paper proposes some measures that should be taken into consideration when changing the means of economic development in Austria. First of all, it is important that Austria government look for ways to add sovereignty of the consumers. As well, it is important that the government introduce a non-controlled competition in the general market.

Recommendations

Monopolistic management of economy belongs to the past, and specifically classical and neo-classical times. The modern forms of economic development have embraced technology and high intellectual capability in human resource. Essentially, it is important for economic development to be a preserve of everyone in the country. That is, there should be no particular individual, group of persons or companies who fully control any given economy. The government’s hands should also be loose when it comes to the control of economic performance of a country. As such, it should only intervene when some players introduce unfair competition practices. Hence, it is recommended that Austrian government should permit a liberalized market by allowing every interested party to partake in a fair manner. In particular, consumers should be given sovereignty to dictate pricing of goods and services. Additionally, entrepreneurs should have a free field to determine the quality of the products and services being sold. There should never be intellectual monopolistic and all possible cautions should be taken against such practices.

References

Albarran, A.B. 2009. The media economy. New York: Taylor & Francis Inc.

Baumol, W.J. & Blinder, A.S. 2005. Microeconomics: Principles and Policy, Belmont: CengageBrain Learning.

Bernstein, W. 2010. The birth of plenty: How the prosperity of the modern World was created. New York: McGraw-Hill Professional.

Block, W. 1997. Austrian monopoly theory: A critique, Journal of Libertarian studies, 1(4), 271-279.

Callahan, G. 2002. Economics for Real People: An Introduction to the Austrian School, The Mises Review, 8(3), 1-349.

Carilli, A.M. & Dempster, G.M. 2001. Expectations in Austrian business cycle theory: An application of the prisoner’s Dilemma. Journal of Business and Economics, 14(4), 319-330.

Djolov, G. 2006. The economics of competition: The race to monopoly. New York: The Haworth Press Inc.

Finch, J.H. & Orillard, M. 2005. Complexity and the economy: Implications for economic policy, Cheltenham: Edward Elgar Publishing.

Glazer, E, Gnan, E & Valderrama, M. T. 2005. Globalizaion, Import prices and producer prices in Austria. Journal of Monetary Policy & The Economy, 3(6), 24-48.

Hoag, A. J. 2006. Introductory Economics. Singapore: World Scientific Publishing Co. Pte. Ltd.

Hodgson, G.M. 2001. How Economics Forgot History: The Problem of Historical Specificity in Social Science. London: Routledge publisher.

Horwitz, S. 2000. Micro foundations and macroeconomics: An Austrian perspective, London: Routledge.

Keeler, J.P. 2001. Empirical evidence on the Austrian business cycle theory. Journal of Business and Economics, 14(4), 331-351.

Korthals, M. 2001. Taking consumers seriously: Two concepts of consumer sovereignty. Journal of Agricultural and Environmental Ethics, 14(2), 201-215.

Michael, T. & Stephen, S. 2009. Economic Development. Edition (9th ed.), Ontario: Addison- Wesley publisher.

Nijkamp, P. 2010. Innovation, growth and competitiveness: Dynamic regions in the knowledge based world economy. Berlin: Spring Verlag.

Petroff, J. 2002. Perfect competition. Journal of Microeconomics, 1(1), 3-20.

Powell, B. 2004. What’s wrong with monopoly (The game)? Mises Daily: Ludwig Von Mises Institute.

Prateek, G, 2000. Corruption: theory and evidence through economies in transition. International Journal of Social Economics, 27 (12),1180 – 1204.

Skidelsky, L.R. 2009.This present crisis is a crisis of systemic ignorance not asymmetric information, The Economist Print.

Sugden, R. 2004. The opportunity criterion: Consumer sovereignty without the assumption of coherent preferences. The American Economic Review, 94(4), 1014-1033.

Tempelman, J.H. 2010. Australian business cycle theory and the global financial crisis: Confessions of a mainstream economist, Quarterly Journal of Austrian Economics, 13(1), 3-15.

Wohlgemuth, M. 2002. Democracy and opinion falsification: Towards a new Australian political economy. Journal of Humanities, social science and law, 13(3), 223-246.