The industry is liberalized with several electricity firms operating freely in the market. Companies acquire one another without restrictions with the aim of improving their market share. Others merge with the same objective. Maybe the only tough government regulation is the EU legislations on the environment. There are many methods of generating electricity i.e. power stations, nuclear, coal and renewable. Coal is one method that is not environmentally friends and the companies have been warned against emitting harmful emissions to the environment.

British energy is largest producer or generator of electricity with over five thousand trained and skilled professionals. They own and run nuclear stations, coal power stations, gas-fire stations and other small projects. They have their headquarters in Livingstone Scotland and branches in barnwood, Paddington, east bilbride and Reinfrew

British energy involved a major corporate restructuring of two public utility enterprises, the nuclear electric and Scottish energy. According to Mclaney (2006) corporate restructuring is pursued for the purpose of maximizing shareholders wealth and for providing a dynamic and flexible economic environment. Further it brings a greater achievement in corporate governance issues of the companies in the conduct of the reorganized business. In this case the reorganization in UK electricity industry, to produce British Energy acquisitions fell into three categories. These are the horizontal structures, vertical structures and mixed structures.

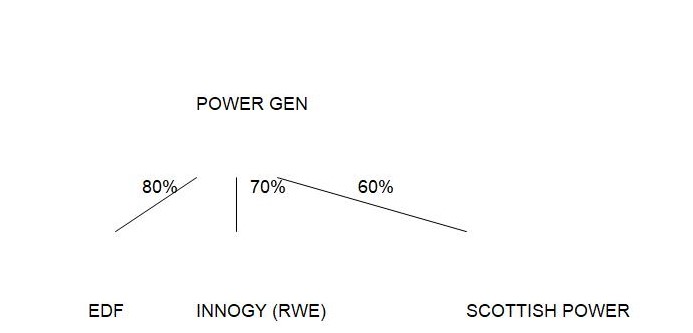

The horizontal structure is where one electricity firm owns directly controlling interest in more that one subsidiary. This may be illustrated as follows for illustrative purposes only.

Interpreted, it would mean that power Gen has acquired 80% of the controlling interest in EDF, 70%in innogy (RWE) and 60% in Scottish power.

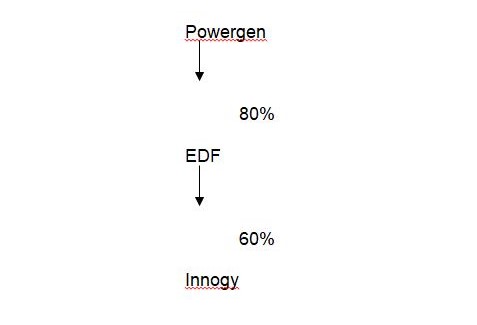

The vertical structure is where a parent company owns directly controlling interest in a subsidiary, which in turn owns directly controlling in another company. Assume that powergen acquired 80% of the shares in EDF. EDF also acquired 60% of the shares in innogy. This scenario can well be illustrated as follows:

Powergen would have a direct controlling interest in EDF of 80% and has an indirect arithmetic interest of 48% in innogy (i.e. 80% of 60%). Even though the arithmetic interest of powergen in innogy is less that 50%, innogy is a sub- subsidiary of powergen. This is because powergen control EDF and EDF control innogy and therefore by extension, powergen controls Innogy.

When a company acquires part of the shareholding of another, the other part is taken by the minority group and is referred to as minority interest. It is called minority interest because their holding is usually less than 50% shares of the company that has been acquired. As the net assets of a company are financed by share capital and reserves so the proportion of the ordinary shares, preference shares and reserves attributable to outsiders is calculated, and is shown as ‘minority interest on the liabilities side of the balance sheet of the holding company.

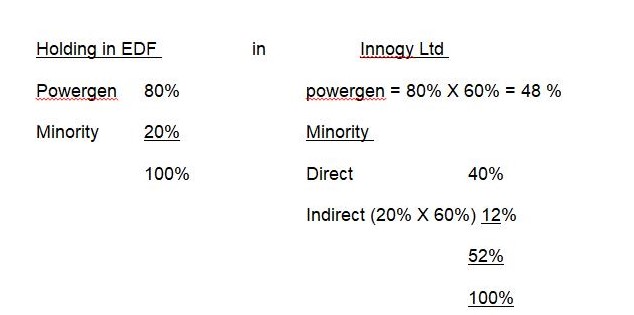

One of the challenges of accounting for acquisitions is on the calculation of minority interest. To obtain the minority interest in EDF and innogy the proportion of ordinary shares and that those of preference shares held by the minority will first be established. The amounts are then added. Then the minority’s share of each reserve (i.e. capital and revenue reserves) in the subsidiary company is calculated. As for the reserves belong to equity shareholders so the minority’s share of each reserve depends on the percentage of ordinary shares held. The minority interest is calculated by adding up the amounts of share capital and reserves attributable to the outsiders.

But in the simple illustration above the holdings of both the parent energy company (powergen) on the subsidiaries, EDF and innogy would be: –

The effective interest of powergen in innogy is 60%. The last form of structure of a group.

Corporate restructuring involved in the case involved merging the two companies, that is, by combining the operations of nuclear energy and Scottish energy. A merger involves where two businesses of similar size and /or management agree to combine depending on the desirability of the outcome ( Mclaney (2006). The key to privatization of government companies is to put them on a competitive edge with other companies a part from providing the government with revenue from selling its stake.

Mclaney (2006) argues that such combinations of operations allows the companies to eliminate and/or reduce competition amongst themselves and also safeguards sources of supply and/or sales outlets where as equally allowing the spread of risks and reduction of risks through diversification and development of strategic capability towards underutilized target resources to developing economies of scale in their operations which benefits the shareholders and other stakeholders.

The first financial effect associated with acquisitions is the change in the preparation of financial statements. The group would now prepare its accounts on a consolidation basis i.e. a consolidated profit and loss account and a consolidated balance sheet. For example (RWE) acquired Innogys in 2002.During the same year, the company acquired Transgas. As from that year (2002) the group will be preparing consolidated financial statements. Another issue is whether the company acquired is a subsidiary or an associate. Innogy and transgas are subsidiaries of RWE because RWE acquired more than 50% of their shares. Goodwill arising an acquisition must be calculated. Comparing the price at which RWE purchased the subsidiaries and the nominal value of their shares. This is possible by preparing a cost of control account also referred to as a capital reserve.

Acquisitions require very huge initial cash outlays. When RWE was acquiring the subsidiaries it spent billions of dollars for the purchase. Acquisitions have led to expansion of customer base in addition to the production of more energy. This was evident when shanks’ UK landfill was acquired in 2003. Its combination with waste recycling group led to the saving of operational costs. It also pushed the group to the top as one of the highest energy producing company in Europe.

Consequently when an electricity firm is deemed as not well performing, the Par lent Company can decide to dispose it. It can also be as a result of pursuing waste disposal contracts. This was the case when shanks wanted to dispose UK landfill in 2004. However any disposal must get the approval of the shareholders. The financial issue related to disposal of subsidiaries is on how to consolidate the disposal in the final accounts. What is more important is the percentage so disposed and date of disposal.

Like disposals, it is also important to note the date a company was acquired and the percentage of acquisition and whether the acquisition gave rise to a subsidiary or associate. It is worth interesting that the position of a single entity can change from that of associates to subsidiary and vice-versa. For instance RWE acquired 75% of tapada in December 2000. This led to an increase of the percentage holding from 25%. The financial implication here is that W.e.f December 2000; RWE should prepare the accounts of Tapada as by the regulations governing subsidiaries and not associates. The consolidation must incorporate the minority interest of 25% (100%-75% in the shares of Tapada. It must be noted that minority interest in the profits and other reserves in the subsidiary is based on the profits as at the end of the accounting period. But the interest of the members of the group is based on the date that the company acquired the subsidiary. This is because, this was the date Tapada became a member of the group. A distinction should also be made between pre-and post acquisition profits. It is only the pre-acquisition profits that the holding company is entitled to.

The treatments of dividends pose a great problem when dealing with acquisitions. Dividends may be received by a holding company from its subsidiary company out of the pre-acquisitions profits or post acquisitions profits. This does not pose any financial problem. A financial problem arises of the dividends came from pre-acquisition profits. If this is the case, they are credited to investment in shares of the subsidiary Account thereby reducing the cost of control or increasing capital reserve. If the dividends declared are partly of pre-acquisition and post acquisition profits then the dividend received is divided into two parts in proportion to its declaration out of pre-acquisition and post- acquisition profits. The dividends relating to pre-acquisition profits is credited to investments account but the dividends relating to the post acquisition profits is credited to profit and loss Account.

The major income streams for the British Energy company involved the issue of shares at 100p which formed the base of the company’s capital which led to the company’s capitalization at 1400 million pounds. Share capitalization is the cheapest means of financing the operations and particularly when the finances are required for long term financing (Pandey, 2005).

Share issue, when it involves an issue for the first time, that is, initial public offering (IPO) requires authorization from the capital market authorities. However, a company wishing to be listed is required to fulfill stringent scrutiny procedures to establish soundness of its financial, managerial and ability to build, uphold, & demonstrate corporate governance matters among others.

Another, income stream is the sale of electricity to be generated by the amalgamated Companies. This will form the core of competition with other enterprises. The essence of any business enterprises is to achieve a competitive edge through providing unique and differential products and services they produce and/or distribute. The success of the operations of the company saw the market value of the shares grow from 100P to 815P in two years. This was attributed to attractive price earning ratio. Block & Hirt says the price earning ratio is influenced by the earnings and sales growth of the firm.

Also, at the verge of collapse rather bankruptcy the company received support from the Government 650M pounds. The purpose of this was to allow for the reorganization of the Company and plan for reemergence (Mclaney, 2006).

The bankruptcy of the company can be attributed to the exercise of a constant dividend Payout policy. However, in times of losses such as it occurred in the British energy, the company will often begin to pay dividends to help stabilize the company’s stock. Many investors consider these dividends as a sign of safety and financial conservatism.

However, during profit making period companies should strive to reinvest all of the company’s available resources into growing the value of the underlying business (Kennon, 2007).

The period under which the companies were merged, that is, the Scottish Energy & Nuclear Electric in the 1990’s, many companies owned by the government were being privatized. Guislain (1997) attributes privatization to the ways governments seek to become more efficient in running enterprises, both in terms of cost and quality of services by better allocating risk and absorbing untapped sources of private capital, technology, and know-how. He continues to argue that Privatization covers a wide range of approaches, that is, from asset sales to initial public offerings (IPO’s) and requires technical expertise to determine and implement the method most suited to the particular transaction. Successful privatization programs require strong political leadership, clear policies with robust institutions, decision-making frameworks to give legal authority to those responsible for privatization implementation, and delegation to appropriate levels of government. In essence, therefore, privatization is majorily influenced by the political will of the relevant government in power.

Also, the general trends in the environment can be a major factor leading to privatization of public enterprises, notably, globalization. Globalization brings and enhances competition in the global arena hence may threaten the existence of an organization especially in the government which are rampant with buaeractic and red tape systems of decision making.

The support from John Major’s government at the time of privatization, the support received through the demand for energy ,made it possible for the shares to increase in value over the period. This was coupled with strong leadership in management as provided by the executive chairman, Robin Jeffrey.

Stakeholders in the British energy are many. Stakeholders was first defined by Freeman R. E,, in his book 1984, Strategic management: A stakeholder Approach as “any group or individual who can affect or is affected by the achievement of the organization’s objectives”.

He further argued that “a stronger your relationship with external parties, the easier you will meet your corporate business objectives , the worse your relationships with stakeholders, the harder it will be. Strong relationships with stakeholders are those based on trust, respect and cooperation.

Stakeholders will include shareholders, employees, customers and suppliers. It is difficult identify others because there is no clear formulae for defining stakeholders (Wilson, 2003). According to Ross et al (98). Stakeholders are those other than the stockholders or creditors who have a claim on the cash flows of the firm. Further, Nuseibeh and Easterbrook, (2000) define Stakeholders as “individuals or organizations who stand to gain or lose from the success or failure of a system” These have profound effect on the operations of enterprises.

These stakeholders include the government. The government provides a conducive environment for doing business through providing incentives and forums for further investments through market research and generally on giving advice on favorable.

The government also develops partnerships to foster healthy competition in the market.

Also, the financial services authority, which is UK’s Capital market regulator provides the market supervision and guidance on those firms that would want to participate by promoting, regulating and facilitating the development of an orderly, fair and efficient conduct of business. This includes the raising of capital in the primary and secondary market. Equally, shareholders who are the equity or stockholders form the owners of the of the company. After the shares were floated the subscribers of the 1400 millions Pound shillings become the owners of the company. The interest of the shareholders is to see their wealth increase through increase in value of shares in the stock market. This is ascertained by considering the price earning ratio of the firm overtime. A stronger price earning ratio will make the value of shares in the stock market increase.

Other stakeholders are the bondholders who in addition to receiving regular incomes are secured to receive the principal back. These are used to finance organization when major capital requirements arise.

The management led by the chairman, Mr. Robin Jeffrey who runs the day to today operations of the company, nevertheless, form the core of the existence. The ability to produce results for any organization through prudent management is essential. Any capable management should the core managerial abilities of decision making based on technical skills, interpersonal and human resource skills.

However, in the case of British energy the stakeholders include the community, environment, European union, united nations, united nations security council and the world at large.

The European Union Commission forms unavoidable stakeholder. They ensure unfair competition is countered and proper and standard product and services are delivered to the customers.

The two companies that were merged, that is, the Scottish Energy and British Energy were the core stakeholders. By merging they provided the synergy and the competitive advantage to edge against their competitors.

In any organization where two or more individuals or organizations are involved there occurs divergent interests this may not relate to the core purpose of the organization hence conflict of interest. Conflicts of interest are undesirable as often they create and escalate costs. These costs are referred as representation or agency costs.

At the British energy, the possible conflicts that may arise include that between management and the stockholders. Management would wish to pursue their own interests which are detriment to the main goal of going into business, that is, profit.

Equally, the government which would be having a stake may also conflict with the management through setting policies and regulation or laws which may not be consistent with the management’s aspirations. Moreover, the European Union Competition Commission’s may be perceived as curtailing the ability of the firm to operate to making more profits and expanding.

The regulatory bodies include the Financial Services Authority, the European Union Competition Commission , the Government united nations security council, united nations. The financial services authority being the Capital Market regulator has the power and to direct the market functions and provides prudent direction in terms of corporate governance including signaling when the company was underperforming and recommend recovery. This however, did not happen, after successful trading from 1996 to 2002 when it made a huge loss of 493 million Pounds, the FSA, should have the trend and advised recovery before the shares would have significantly drop from 815p to 55p and eventually 14.6P when it was de-listed, the synopsis here therefore indicates dismal performance.

Equally, the government which is the major stakeholder before merging and privatization came in to support the company when it was in a financial crisis. This is a positive assistance for economic growth and prosperity of the whole economy.

The European Union Competition Commission completed its mandate by ensuring there was no unwanted monopoly. Monopolies affect the competition which spills down to customers through pricing.

Many lessons are learnt from the case of British energy. A company which public held with political influence can not be allowed to go under; the government can intervene in case of failure. After a promise from the chairman that company in sound financial position and two weeks later the company nearly collapsed but still man remains in the company shows that strict regulation rules followed. In the case strictly private company the chairman was to be shown the door.

British Energy Company was not an investment where ordinary people invested. Therefore, the activities of the company should have been monitored by the investors. This shows investors should not rely solely on the regulation bodies to take care of their investment, they also be part of the monitoring team through appointment and dismissal.

There are many implication of financing regarding the case of British energy. In the international arena we can consider the case of Enron. Unlike British energy Enron went under. Both companies experienced similar financial crisis although the case of Enron there was allot of financial misstatement and many scandals. The government of USA did not intervene to save the company unlike the UK case

References

British energy website.

Block & Hirt (1987), Financial management for Corporate.

Department of Trade and Industry, Government of UK.

Dubash Navroz and Singh Daljit (2005) ‘Of Rocks and Hard Places: A Critical Overview of Recent Global Experience with Electricity Restructuring’, Economic and Political Weekly, Vol XL No 50.

Elkington J., The Chrysalis Economy, Capstone, oxford, 2001.

Ernst & Young Report on Electricity Market to the Department of Trade and Industry.

Freeman R. E., strategic management, pitman books, Boston, Mass, 1984.

Hillman A.J. Keim G.D.

Shareholders Value, Stakeholders management, and social issues: what is the bottom line? Strategic management journal 2001.

House Of Common, Report of British Energy report.

Michael P, Competitive Strategy.

Mclaney (2006) , Corporate finance.

Newbery, David M and Michael G Pollitt (1997): ‘The Restructuring and Privatization of the UK Electricity Supply-Was it Worth It?’, Public Policy for the Private Sector, No 124, World Bank.

Oliveira D, Ricardo Gorini and Mauricio Timono Tolmasquim (2004): ‘Regulatory Performance Analysis Case Study: Britain’s Electricity Industry’, Energy Policy, Vol 32, No 11, pp 1261-76.

Pandey I.M. , financial management (2005).

Stephen T (2005) ‘British Experience of Electricity Liberalization: A Model for India?, Economic and Political Weekly, Vol XL No 50, 2005.

Wilson M., Corporate Sustainability: what is it and where does it come from? , Ivey Management Services, 2003.

Kennon (2007).

Guislain (1997).